Hello!

This script serves to distinguish volume delta for any asset and open interest delta for Binance perpetual futures.

The image above provides further explanation of functionality and color correspondence.

The image above shows the indicator calculating volume at each tick level and displaying the metric.

The label color outline (neon effect) is configurable; the image above is absent the feature.

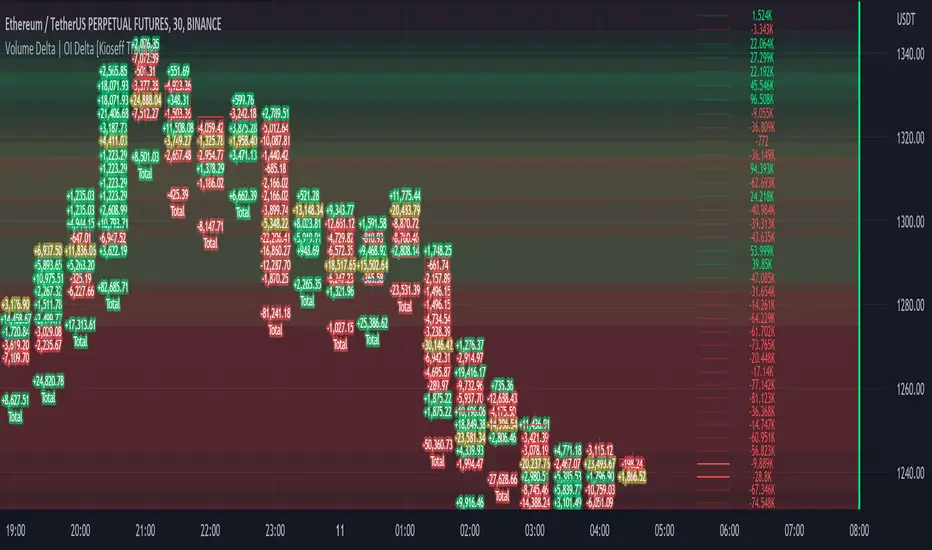

The image above shows Open Interest (OI) Delta calculated - similar to how the script calculates volume delta - for a Binance Perpetual Future pair.

This feature only works for Binance Futures pairs; the script will not load when trying to calculate OI Delta on other assets.

Additionally, a heatmap is displayable should you configure the indicator to calculate it.

The image above shows a heatmap using volume delta calculations.

The image above shows a heatmap using OI delta calculations.

Of course, these calculations - when absent requisite data - require some assumptions to better replicate calculations with access to requisite data.

The indicator assumes a 60/40 split when a tick level is traded at and only one metric - "buy volume" or "sell volume" is recorded. This means there shouldn't be any levels recorded where "buy volume" is greater than 0 and "sell volume" equals 0 and vice versa. While this assumption was performed arbitrarily, it may help better replicate volume delta and OI delta calculations seen on other charting platforms.

This option is configurable; you can select to have the script not assume a 60/40 split and instead record volume "as is" at the corresponding tick level.

The script also divides volume and open interest if a one-minute bar violates multiple tick levels. The volume or open interest generated on the one-minute bar will be divided by the number of tick levels it exceeds. The results are, subsequently, appended to the violated tick levels.

Further, the script can be set to recalculate after a user-defined time threshold is exceeded. You can also define the percentage or tick distance between levels.

Also, it'd be great if this indicator can nicely replicate volume delta indicators on other charting platforms. If you've any ideas on how price action can be used to better assume volume at the corresponding price area please let me know!

Thank you (:

This script serves to distinguish volume delta for any asset and open interest delta for Binance perpetual futures.

The image above provides further explanation of functionality and color correspondence.

The image above shows the indicator calculating volume at each tick level and displaying the metric.

The label color outline (neon effect) is configurable; the image above is absent the feature.

The image above shows Open Interest (OI) Delta calculated - similar to how the script calculates volume delta - for a Binance Perpetual Future pair.

This feature only works for Binance Futures pairs; the script will not load when trying to calculate OI Delta on other assets.

Additionally, a heatmap is displayable should you configure the indicator to calculate it.

The image above shows a heatmap using volume delta calculations.

The image above shows a heatmap using OI delta calculations.

Of course, these calculations - when absent requisite data - require some assumptions to better replicate calculations with access to requisite data.

The indicator assumes a 60/40 split when a tick level is traded at and only one metric - "buy volume" or "sell volume" is recorded. This means there shouldn't be any levels recorded where "buy volume" is greater than 0 and "sell volume" equals 0 and vice versa. While this assumption was performed arbitrarily, it may help better replicate volume delta and OI delta calculations seen on other charting platforms.

This option is configurable; you can select to have the script not assume a 60/40 split and instead record volume "as is" at the corresponding tick level.

The script also divides volume and open interest if a one-minute bar violates multiple tick levels. The volume or open interest generated on the one-minute bar will be divided by the number of tick levels it exceeds. The results are, subsequently, appended to the violated tick levels.

Further, the script can be set to recalculate after a user-defined time threshold is exceeded. You can also define the percentage or tick distance between levels.

Also, it'd be great if this indicator can nicely replicate volume delta indicators on other charting platforms. If you've any ideas on how price action can be used to better assume volume at the corresponding price area please let me know!

Thank you (:

Release Notes

Last change for night; improved efficiency. Release Notes

Small update to classic look & efficiency!Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

•Access to Next-Gen Optimization Tools: tradingiq.io

•Discord Server: discord.gg/aKWPuM4HPy

•Discord Server: discord.gg/aKWPuM4HPy

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

•Access to Next-Gen Optimization Tools: tradingiq.io

•Discord Server: discord.gg/aKWPuM4HPy

•Discord Server: discord.gg/aKWPuM4HPy

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.