SSL Channel w/alertSSL Channel with cross alert when channels cross up or down. Built on ErwinBeckers SSL Channel script.

Cross

Triple eMA cross trackerTracks 3 emas, colorizing background:

Green - 1 on top of 2 on top of 3;

Blue - 1 on top of 3, but 2 below 3;

Red - 1 below 2 below 3;

Orange - 1 below 3, 2 above 3.

Nutshell: allows a quick and always apparent check for strategies like the old 8e, 13e, 21e strategy you see online, customizeable by any emas of your choosing.

MACD Cross MTF Pane [Anan]Hello Friends,

I'm tired opening MTF charts and looking into MACD Cross, So I decide to share this tool with you ;)

Green = Bullish MACD Cross on

Red = Bearish MACD Cross on

Not Green / Not Red = The point of intersection

Fast-Slow MA Cross on custom timeframe (with alerts)A simple script for tracking your moving average crossing with an option for a fixed time frame and a 3 additional MAs for reference.

FUSIONGAPS V4 {50/15-Series}Base on the FUSIONGAPS oscillator series, but Only the 50/15 oscillator is plotted, and with Momentum and Acceleration oscillators added.

The thickest line is the FG oscillator: Red/Green coloring indicates if the market is in a Bearish/Bullish period.

The green colored line is the DFG oscillator (DIFFERENTIAL FUSIONGAPS: Price Momentum)

The red colored line is the D2FG oscillator (DOUBLE-DIFFERENTIAL FUSIONGAPS: Price Acceleration)

Indicators:

DeathCrosses ( DX ) and GoldenCrosses ( GX )

Momentum Reversal indicators (D2FG based filter applied to reduce false-positives, but can be manually disabled.)

~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~

Note:

In no way is this intended as a financial/investment/trading advice. You are responsible for your own investment decisions and trades.

Please exercise your own judgement for your own trades base on your own risk-aversion level and goals as an investor or a trader. The use of OTHER indicators and analysis in conjunction (tailored to your own style of investing/trading) will help improve confidence of your analysis, for you to determine your own trade decisions.

~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~ * ~

Please check out my other indicators sets and series, e.g.

LIVIDITIUM (dynamic levels),

AEONDRIFT (multi-levels standard deviation bands),

FUSIONGAPS (MA based oscillators),

MAJESTIC (Momentum/Acceleration/Jerk Oscillators),

PRISM (pSAR based oscillator, with RSI/StochRSI as well as Momentum/Acceleration/Jerk indicators),

PDF (parabolic SAR /w HighLow Trends Indicator/Bar-color-marking + Dynamic Fib Retrace and Extension Level)

and more to come.

Constructive feedback and suggestions are welcome.

~ JuniAiko

(=^~^=)v~

ADX Di+ Di- [Gu5]Fill indicates Strong Trend

Cross indicates End of Trend

--

El relleno indica una fuerte tendencia cuando el Di supera "Level Trend"

El cruce de Di+ con Di- indica el fin de la tendencia

Cuando el valor del ADX es menor a "Level Range", estamos en Rango

EMA 8/20This is a simple cross over moving avareges

Bu iki basit hareketli ortalamın kesişimini gösteren bir indikatördür

True Golden Cross by -Westy-

The “Golden Cross” of the 50 and 200 day SMA is not the most accurate combination profit-wise.

Testing of 1750 combinations over 300 years of data across 16 global markets revealed that the EMA produces better results than the SMA and the best settings are that of a 13 / 48 EMA Crossover.

Research credit to - etfhq.com

EMAs Alert-This script allows you to show the crossings of the most important emas such as 10, 20, 50 and 200

-You can modify the values of each ema you like

-Bring alerts of the crosses of each ema, which will allow you to activate this function to only the assets you want to track

Golden Cross by -Westy-Quick Guide

- Yellow cross and green MA on top = Potential uptrend

- Yellow cross and red MA on top = Potential downtrend

A simple golden cross indicator of the green 50 and red 200 SMA with a yellow cross for ease of visibility and backtesting.

Generally, longer time frames more powerful signals but are less frequent. I typically use it on the 4 hour, daily and weekly.

Ichimoku Cross Indicator [Mehdihz]This script shows tenken & kijen lines position to better detection of crosses.

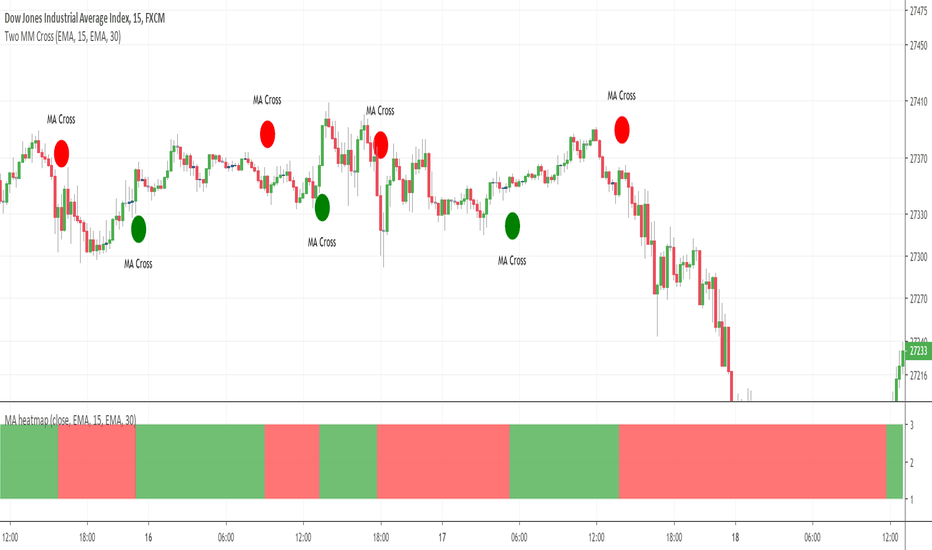

Triple Moving Average HeatmapHi everyone

I didn't publish on Friday because I was working on an Expert Advisor in MT4. The day I don't publish, some scripts spamming guys published many (not useful) scripts the same to kick me out of the TOP #1 ranking.

So what I'm going to do about it? crying or sharing more quality scripts than before? :)

I guess you know the answer :) I'm gonna share a few quality scripts that I have in my library. I noticed that you guys tend to like more the scripts useful for your trading actually making you money rather than a copy-paste (of another copy-paste)

Alright, enough for the trolling now let's introduce the Three MA heatmap which is an upgrade of that script : MA-heatmap-Double-cross-edition/

The challenge was to keep the heatmap not rolling and to make it match with the MA cross. I did it using this

```

since_ma_buy = barssince(macrossover)

since_ma_sell = barssince(macrossunder)

heatmap_color() =>

since_ma_buy < since_ma_sell ? color.new(color.green, 20) : since_ma_buy > since_ma_sell ? color.new(color.red, 20) : na

```

This is a technique that I found after drinking three glasses of red wine (#french) to keep the heatmap stable and not rolling.

To get what I'm saying I invite you to replace the piece of code above by what everyone would normally do

```

heatmap_color() =>

macrossunder() ? color.new(color.green, 20) : macrossover() ? color.new(color.red, 20) : na

```

Ah and I'm not done sharing for the day, a few scripts are coming also after that one and tonight !!!!! I want to live in a world where you guys can enjoy quality scripts (mostly) :)

PS

____________________________________________________________

Feel free to hit the thumbs up as it shows me that I'm not doing this for nothing and will motivate to deliver more quality content in the future.

- I'm an officially approved PineEditor/LUA/MT4 approved mentor on codementor. You can request a coaching with me if you want and I'll teach you how to build kick-ass indicators and strategies

Jump on a 1 to 1 coaching with me

- You can also hire for a custom dev of your indicator/strategy/bot/chrome extension/python

EMA Rainbow v2

EMA Rainbow is Moving Averange indicator .

Contain multiple Ema in one instance, Ema 20/25/30/35/40/45/50/55 and Cross indicator 20 / 55.

Extra, Ema 100,200 end Cross indicator.

You can change colors to what you want and enabled/disabled .

We combined EMA Cross 12/26 with EMA Rainbow

Enjoy.

Bollinger bands/Lagging span crossHello my dear ambitious traders

I'm working hard this week to publish some great indicators this week and open sourced. Hope you'll enjoy, learn and use them.

This will be my greatest reward but comments showing appreciation are also very welcomed (actually likes too) :)

For today, I'll share a simple indicator but it's coming along with some insightful knowledge ^^

Anyway, I'm not here to ask you to this but to share a very cool indicator I made a few months ago and wanted to share for FREE with the community today

The indicator is related to this educational post : What-a-Bollinger-Bands-Lagging-span-cross-can-tell-us/

This trading technique was invented by Robbytrade, a famous french trader twitter.com

I wanted to have those visual signals on the chart so I coded it.

The advantage of being a developer is that you can litteraly code what you miss and get your life better in the process. The one that will find a way to code a new form of money will be rich... wait.... that guy is called Satoshi Nakamoto...

That's all for me today my friends

PS

Trying to update the Trade Manager shared yesterday with some cool features. More to come in the upcoming days

Enjoy

Dave

MA heatmap (Double cross edition)Hello my friends

Sorry yesterday I couldn't post an indicator because I was travelling. So here's the today indicator inspired from that one Moving-Average-Heatmap-Visualization/

This will gives an interesting representation of a Double Moving Average cross

That's all for me

Let's resume the free indicators publishing next Monday with the MA heatmap (Triple cross edition) and then the 4 cross ... until the 100 cross edition .... "wait are you joking sir ?"... Totally YES :)

But the Triple cross edition will be released as it's interesting from a Pine script perspective

Enjoy your weekend and stay safe

Dave

SVAMA - A Non Parametric Adaptive Moving Average Based On VolumeIntroduction

Technical indicators often have parameters settings that the user must enter, those are inconvenient when the user must design a strategy because such settings must be optimized, it must also been noted that the optimal settings at time t could change at time t+n , this is why non parametric indicators are more efficient. Today i propose a moving average adapting to the market volume without using parameters affecting the smoothing.

The Indicator

The volume is rescaled in a range of (1,0) by using max or min normalization. Exponential averaging is used to provide the moving average.

When using max normalization the moving average react faster when the volume is closer to its all time high, when using min normalization the moving average react faster when the volume is closer to its all time low. You can select the method (max or min) from the "Method" parameter.

Volume tend to be higher and more periodic with higher time-frames, this is why lower time-frames might return smoother results when using the Max method. It is recommended to use the Max method when we want a faster moving average while the Min method is more suited to get a slower moving average.

Both methods can provide an interesting MA-Cross system when used on higher time frames.

Conclusion

There should be more non parametric indicators, this would allow for faster and easier optimization processes when creating a strategy, in theory any indicator using a moving average or highest/lowest could be made non parametric by using a running mean or running max/min but the indicator might loose important information.

This is one of my main focus right now since such indicators could also allow for improvements when used with artificial intelligence. I hope you find an use to it, don't hesitate to send me your suggestions.

Thanks for reading !

Strategy Builder Crypto (Single Trend/Plots)Hi everyone

Big program for the daily indicator

This one will be free on trial only for a week because it has an immense value and required quite a lot of work. For more info to use it long-term, please DM me

That out of the way, let's dive right in...

This is a huge upgrade from that script Ultimate-Algorithm-Builder-Single-Trend

The Tradingview non-pro users will appreciate it because it allows to add the selected subsequent indicators as well. The Pro users too will likely like this feature equally, what the H*** I'm saying :)

This indicator will transform you into what I was in the past... into a quant trader. You'll build your own trading algorithm in a few clicks only

Which timeframe and which assets ?

Short answer : ALL and ALL

You'll have to define the configuration of the tool based on your capital, psychology. For custom configuration of the tool, please DM me directly so that we can discuss further

But a few words of advices anyway :

the bigger the timeframe, the lower the inputs (and vice-versa)

Think about how much $$ you want to make per trade and define your entries from there

Think about how much $$ you can afford to lose per trade and define the supertrend from there

...

Your golden configuration might not work for all assets.

You might have to create some tweaks - for instance you found a great config for BTCUSD but it's not working for ETHUSD, then you can create a copy of your BTCUSD chart and set a new config for ETHUSD

What are the indicators inside :

This fantastic tool that I personally use for my trading detects convergence between the following indicators :

Overlay - meaning if the price close above/below a moving average

Trend Signal - to detect if the the DOW law is broken and predict a possible reversal - en.wikipedia.org/wiki/Dow_theory

In other words, it detects if the higher highs or lower lows sequence is broken

MACD or MACD Zero Lag

MA Cross - Cross of moving averages

Ichimoku - if the price closes below/above the cloud

Supertrend - used to detect polarity zones

TSI Shadow -

Pullback

You'll also have the possibility to define a pullback on a given MA. That means basically that you'll get a convergence and it will only display a signal when it will pullback first

This will reduce your losses in case of invalidation and maximize your gains as it will enter the trade in a better position.

You can define your pullback either based an absolute value or based on a percent distance from the MA

+Example:

Pullback value = 100 means I want a 100 pip/USD distance between the MA pullback and the candle

Pullback percent = 2 means I want a 2% distance between the MA pullback and the candle

The percent option is more generic in my opinion but I let the other available for those who might like it

That's it ?

Almost....You can also setup alerts on the indicator signals so that you won't have to stay days in front of the chart to wait for a signal.

You receive the alert, you check real quick if we're not in front of a support/resistance, if no then take the trade. if yes, I advice waiting for a big pullback - better to be safe than sorry in trading

What If you want a custom version ?

Here are a few custom ideas I could add just for you :

re-enter everytime there is a convergence. So far the indicator is only taking the first convergence. This would give more entries

add the resistances/supports (fibo, pivot)

add the take profit targets and trailing stop loss

..

Please hit me up directly so we can discuss further. Any custom dev will require quite some time so it won't be free

Enjoy that one as I really think it will improve your analyst skills and trading and hopefully make you a few gains (which will make me very happy as I want to help most of you to at least not losing your capital)

Dave

Ultimate Algorithm Builder (Single Trend)Hello traders

This is a fantastic tool to detect convergence between the following indicators :

Overlay - meaning if the price close above/below the SMA 50

Trend Signal - to detect if the the DOW law is broken and predict a possible reversal - en.wikipedia.org/wiki/Dow_theory

In other words, it detects if the higher highs or lower lows sequence is broken

MACD or MACD Zero Lag

MM Cross - Cross of moving averages

Ichimoku - if the price closes below/above the cloud

Supertrend - used to detect polarity zones

TSI Shadow - propieraty indicator - URL :

It's ultra flexible as you check which indicator you need in your own strategy. That's why I called it the Ultimate Algorithm Builder

Enjoy

Dave