FibDay by CLKEN: It determines the fibonacci levels based on the high and low price of the previous day. You can track daily.

TR: Bir önceki günün en yüksek ve en düşük fiyatına göre fibonacci seviyelerini belirler. Gün içi takibi yapabilirsiniz.

Fibonaccianalysis

v2.3 Weekly Fibo Candle Middle LineThis is a real time tools assisting traders in monitoring the Fibonacci Retracement Levels while the range is extending in real time run. I have simply marked the three most important Fibonacci retracement level, namely 38.2%, 50%, 61.8% which are colored and marked as blue Fibo_up, red Fibo_mid and blue Fibo_low. Should you have any idea in trading with other Fibonacci levels, please send me your feedback for improvement and sharing.

Fibonacci Zone Oscillator With MACD HistogramThe columns

After I found a way to calculate a price as a percent of the middle line of the KeltCOG Channel in the KCGmut indicator (published), I got the idea to use the same trick in the Fbonacci Zone Channel (also published), thus creating an oscillator.

I plot the percent’s as columns with the color of the KeltCOG Channel. Because the channels I created and published (i.e. Fibonacci Zone, Donchian Fibonacci Trading Tool, Keltner Fibzones, and KeltCOG) all use Fibonacci zones, this indicator also reports the position of the close in their zones.

Strategy and Use:

Blue column: Close in uptrend area, 4 supports, 0 resistance, ready to rally up.

Green column: Close in buyers area, 3 supports, 1 resistance, looking up.

Gray column: Close in center area 2 supports, 2 resistances, undecided.

Yellow column: Close in sellers area 1 support, 3 resistances, looking down.

Red column: Close in downtrend area, 0 support, 4 resistances, ready to rally down.

I use this indicator in a layout with three timeframes which I use for stock picking, I pick all stocks with a blue column in every timeframe, the indicator is so clear that I can flip through the 50 charts of my universe of high liquid European blue chips in 15 minutes to make a list of these stocks.

Because I use it in conjunction with KeltCOG I also gave it a ‘script sets lookback’ option which can be checked with a feedback label and switched off in the inputs.

The MACD histogram

I admire the MACD because it is spot on when predicting tops and bottoms. It is also the most sexy indictor in TA. Actually just the histogram is needed, so I don’t show the macd-line and the signal line. I use the same lookback for the slow-ma as for the columns, set the fast-ma to half and the signal-line to a third of the general lookback. Therefore I gave the lookback a minimum value of 6, so the signal gets at least a lookback of 2.

The histogram is plotted three times, first as a whitish area to provide a background, then the colums of the Fibzone Oscillator are plotted, then the histogram as a purple line, which contrasts nicely and then as a hardly visible brown histogram.

The input settings give the option to show columns and histogram separate or together.

Strategy and use:

I think about the columns as showing a ‘longer term chosen momentum’ and about the histogram as a ‘short term power momentum’. I use it as additional information.

Enjoy, Eykpunter.

Sholi Auto Levels◾️ Auto levels are calculated for each timeframe separately. The script builds fibonacci levels once in a certain period for each of the timeframes. With the help of previously found support and resistance levels, high and low values, the indicator determines the most accurate distribution of fibonacci levels.

Extremely convenient for use in Technical Analysis. You can define rise or fall correction levels by the specified levels.

◾️ How to use?

Blue levels - support. Red - resistance. If you hover over the pointer near the level, you can see detailed information.

As a rule, the price moves at the indicated levels. It lingers on them and tries to break through or find support.

◾️ What is useful for you?

You will be able to build your own analytics based on clear levels that ideally determine the potential for movement in the market.

LA_Periodic_Fibonacci LevelsThis indicator is used to plot the previous high and low of the chosen timeframe along with the Fibonacci levels of 0.50, +/- 0.618 and +/- 0.786.

Provision is given to plot levels for three different time frames at a time.

Options are given to select/unselect the levels as per the user requirement. For plotting the Fibonacci levels of a specific period, user has to select the option "TF1_Fib" or "TF2_Fib" or "TF3_Fib" along with the respective levels (50, +/- 0.618, +/- 0.786).

User has to add different time frames in their layout which can then be used in the drop down menu. By default, daily, weekly and monthly time frames are given.

Indicator is plotted as the candle progresses and not plotted for future time frames in advance.

Below are few examples on larger timeframes.

BTCUSD on 1 min TF (timeframe)

BTCUSD on Daily TF

DJI on Daily TF

GBTT Premarket Fib ZonesOverview:

This is a daily pre market fib tool. Basically, it looks at your premarket price action and generates a set of fibs. From there, it cross references bearish vs bullish fibs, creates a bear and bull zone to watch for during the day. Finally it draws associated fib levels in each direction are plotted/shaded to represent possible price levels for the day.

The lines will redraw/update every day at open, 930 est and then be there on the chart all day until the following open. These zones are meant to be a reference point for the current trading day only.

Intended use:

To provide educational content about the short term movement of an asset. Can be used on any time frame. But remember, it updates at 930 at open for each day and is only applicable to the current trading day.

Disclaimer:

NOT intended to be a sole source of Technical Analysis or anything more than an educational tool!

MTF previous high and low quarter levelsDescription

An experimental script that prints quarter levels of the previous timeframe's high and low to the current timeframe. The idea is quite simple and is basically the Fibonacci pivoted on the previous high and low with quarter level settings (0,0.25,0.5,0.75,1 etc). The default setting is the previous daily high and low but can be customized on user discretion.

New quarter levels are printed after the close of the previous timeframe and open of the new timeframe (user's timeframe setting)

How To Use

Levels should not be used blindly. Levels can be used as confluence when aligned with high probability supply and demand zones, support, resistance, order blocks, and so on.

Credit to @HeWhoMustNotBeNamed for the Previous High/Low MTF indicator code and @mrbirman for the idea to put this together.

Saty ATR LevelsThis indicator uses the previous period close and +/- 1 ATR to display significant day, multiday, swing, and position trading levels including:

- Trigger clouds for possibly going long/short @ 23.6 fib

- Mid-range level at 61.8 fib

- Full range level at +/- 1 ATR (from previous close)

- Extension level at 161.8 fib

Additionally, a convenient info table is provided that shows trend, range utilization, and numerical long/short values.

This indicator is most beneficial when you combine it with price, volume, and trend analysis. For educational content please check out the indicator website at atrlevels.com.

I am constantly improving this indicator, please use this one if you want to continue to get new features, bug fixes, and support.

Auto Fibonacci From Previous High & Low w/ Percentages & AlertsAUTO FIBONACCI FROM PREVIOUS D/W/M/Q/Y HIGH & LOW WITH PERCENTAGES & ALERTS

This is an auto fibonacci level generating indicator that uses the high and low from the previous day, week, month, quarter or year. It also has a table with real time updates of how far away the nearest fibonacci levels are above and below the current price, represented in percentages. It includes alerts for each level as well if you want to be notified of price crossing fibonacci levels without watching the chart.

***HOW TO USE***

Fibonacci levels are also known as the golden ratio and are popular levels for traders to use as support and resistance levels. Expect price to bounce off of these levels regularly.

The previous high and low are marked as white lines. These are very important levels so make sure to pay attention when price reaches these lines.

Make sure to check out the higher timeframes for major levels.

Each fibonacci line retracement and extension up to the 3.272 level in each direction is displayed as red or green depending on whether price is above or below that level.

The retracement levels used are: previous high, .117, .236, .382, .5, .618, .786, .883, previous low, 1.272, 1.618, 2, 2.272, 2.618, 3 and 3.272.

The extension levels used are: .272, .618, 1, 1.272, 1.618, 2, 2.272, 2.618, 3 and 3.272.

In the indicator settings input tab you can quickly change the timeframe used, turn lines on/off, upper line colors, lower line colors, previous high and low line colors, line width, turn percentage table on/off, change the color of the percentage table and move the percentage table to a different location on the chart.

The indicator includes alerts for each fibonacci level as well, just set your fibonacci timeframe on your favorite ticker and turn on tradingview alerts for alert() calls.

***MARKETS***

This indicator can be used as a signal on all markets, including stocks, crypto, futures and forex.

***TIMEFRAMES***

This auto fibonacci indicator can be used on all timeframes.

***TIPS***

Try using numerous indicators of ours on your chart so you can instantly see the bullish or bearish trend of multiple indicators in real time without having to analyze the data. Some of our favorites are our Buy & Sell Pressure Colored Candles, Directional Movement Index + Fisher Transform, Volume Profile W/ Buy & Sell Pressure Labels, Auto Support And Resistance and Money Flow Index in combination with this Auto Fibonacci. They all have real time Bullish and Bearish labels or percentage gap info as well so you can immediately understand each indicator's trend and how far away major levels are in percentages.

Gann FanHello All,

For long time I have been getting many requests about Gann Fan indicator. now we have linefill() function in Pine Language and I think it's right time to make Gann Fan Indicator. Many Thanks to Pine Team for adding many new features to the Pine Language!

How this indicator works:

- It calculates midline (1/1)

- By using midline it calculates other lines (1/2, 1/3, 1/4...etc)

- It calculates highest/lowest Pivot Points in last 280 bars.( by default it's 280 bars, you can change it and pivot period )

- It checks the location of highest/lowest Pivot Points

- After the calculation of the Gann Fan lines, it draws lines, puts Labels and paints the zones between the lines according to the colors set by the user

Long time ago I created a special algorithm for calculating the line with 45 degree and I used it for "1/1" line. Anybody who needs it can use this algorithm freely ;)

Options:

You can change following items;

- The colors

- Transparency. Possible values for transparency are from 0 (not transparent) to 100 (invisible)

- Line styles

- Loopback Period (by default it's 280)

- Pivot Period (by default it's 5)

- Enable/disable Labels

- Label location (by default it's 50

Tradingview Gann Fan page : The Gann Fan is a technical analysis tool created by WD Gann. The tool is comprised of 9 diagonal lines (extending indefinitely) designed to show different support and resistance levels on a chart. These angles -drawn from main tops and bottoms- divide time and price into proportionate parts and are often used to predict areas of support and resistance, key tops and bottoms and future price moves. Please note that the chart needs to be scaled properly to ensure the market has a square relationship....

Enjoy!

+ Donchian ChannelsThis version of Donchian Channels uses two source options so that one can create a channel using highs and lows rather than one or the other or closes. My thinking was that this would create a more accurate portrayal of price action (or at least contain the greatest scope of it) as seen through the lens of a Donchian Channel. This was actually part of the genesis of my idea around my Ultimate Moving Average.

Besides the single top and bottom plot for the DC's extremities, I've enabled the ability to create outer bands with a variable width that the user can adjust to their preference. I think it's quite nice. I use it in the DC in my other non-overlay indicators.

Besides this additional functionality, the indicator has options to plot lines between the basis and the upper and lower bands, so, basically, splitting the upper and lower channel in half.

There is no magic number to the lookback. I chose 233 as default because it's a fibonacci sequence number and I'm more interested in using the DC like a very long period bias indicator, and the longer lookback gives a much wider window (because highs and lows are so spread apart) with which other faster indicators (supertrend, shorter period moving averages, etc.) can work without making the screen a clutter.

The color of the basis may also be made relevant to higher timeframe information. What I mean by this is that you can set it so that the basis of the current timeframe is colored based on the candle close of the higher timeframe of your choosing. If you're looking at an hourly chart, and you set the color to Daily, the basis will be colored based on the candle close (above or below the basis) of the previous day. If the previous daily close was above the basis, that positive color will be reflected in the basis, even if the current hourly candle closes are below the hourly basis. This could potentially be useful for setting a higher timeframe directional bias and reacting off price crossing the lower timeframe basis (or whatever your trigger for entering a trade might be). This is also optional in my Ultimate Moving Average indicator.

You can also set the entire indicator to whatever time frame you want if you want to see where the actual basis, or other levels are on that higher timeframe.

Further additions include fibonacci retracement levels. These are calculated off the high and the low of the Donchian Channels themselves.

You will see that there are only three retracement levels (.786, .705, .382), one of which is not a fib level, but what some people call the 'OTE,' or optimal trade entry. If you want more info on the OTE just web search it. So, why no .618 or .236? Reason being that the .618 overlaps the .382, and the .236 is extremely close to the .786. This sounds confusing, but the retracement levels I'm using are derived from the high and low, so it was unnecessary to have all five levels from each. I could have just calculated from the high, or just from the low, and used all the levels, but I chose to just calculate three levels from the high and three from the low because that gives a sort of mirror image balance, and that appeals to me, and the utility of the indicator is the same.

The plot lines are all colored, and I've filled certain zones between them. There is a center zone filled between both .382 levels, and an upper and lower zone filled between the .786 and either the high or the low.

If you like the colored zones, but don't like the plots because they cause screen compression, turn off the plots under the "style" tab.

There are alerts for candle closes across every line.

I should state that, regarding the fibs, obviously the length of the Channels is going to affect to what levels price retraces to. A shorter lookback means you will see more changes in highs and lows, and therefore retraces are often going to be full retraces within the bands unless price is trending hard. A longer lookback means you will see smaller retraces. Using this in conjunction with key high timeframe levels and/or a moving average can give great confidence in a trade entry. Additionally, if you have a short bias it may help in finding levels or entering a trade on a pullback. It could also be good for trade targets. But again, the lookback you choose for this indicator is going to dictate its use in the system you're building or already have. A 9 EMA and a 200 EMA, while fundamentally the same, are going to be used somewhat differently while doing your chart analysis.

Additional images below.

Same image as main, but with supertrend and my +UMA to help with chart analysis.

Image with the fib stuff turned on.

Zoomed out image with the same.

Shorter lookback period.

Zoomed in image of shorter lookback.

Martyv Technical Analysis KitThis indicator is being developed as a tool hopefully suited to both the beginner/amateur/hobbyist and possibly also the professional analyst/trader. The idea is that it would be a tool that can give you an instant ‘overview’ of a few different schools of measurement on any measurable asset. Makes for great training wheels or a primer for further analysis.

Out of the box settings will give you an AutoFib for the most recent low and high (with extension targets), a pair of commonly-used moving averages (50 SMA and 200 SMA), RSI (and/or many other) divergences on the chart, and candles colored according to current trend (Blue = Bullish Control, Purple = Neutral/Coasting, Red = Bearish Control) and intensity according to volume (Darker = High Volume/Increasing, Lighter = Low Volume/Decreasing). For more advanced traders/analysts, almost all settings can be customized, with multiple options and additional features.

*There are a lot of settings. Shrug. Wink. I tried to bundle them together, however there are a few that I use quite often and placed them at the top for easy access. If you have any suggestions as to what's super useful in the top area, lmk. Happy trading! -E

AutoFib

-Places an AutoFib for the most recent low and high (with extension targets)

-You can choose to "contain price action" inside a 0-1 fib retrace, or allow extension targets to automatically be used (potentially useful within Harmonic Trading among other things)

-Uses the Fast/Medium/Slow (Default) global inputs for fib lookback period (Defaults to 8/21/34 at the time of this writing, can be changed in settings)

-Customizable fib levels, colors, and styles

-Can choose between AutoFib with manually defined levels or SmartFib with levels automatically calculated, including extensions as needed

--Choose between only using the most recent confirmed fib retrace, or the currently developing (non-confirmed) fib retrace - this will also contain price action within a 0-1 fib

--Adds fib extensions as needed, you can define extension levels

-Can change the lookback period and turn the visible Zig Zag and/or AutoFib on/off

-Can turn Logarithmic on/off in settings

Divergence

-Can identify and mark divergences (regular and hidden) for MACD, MACD Histogram, RSI (Default), Stochastic (Default), CCI, Momentum, OBV, Diosc, VWmacd, and Chaikin Money Flow

-Can turn divergences on/off individually

-Can choose to show hidden divergence

-Uses the Fast/Medium/Slow global inputs (Defaults to 8/21/34 at the time of this writing, can be changed in settings)

Trend Channels

-Uses a Zig-Zag with a specified lookback period (can be changed in settings)

-Setting AutoFIb to a different lookback than Trend Channels yields interesting results imo

-Can turn channels on/off

-Can change the lookback period and turn the Zig Zag and/or Channels on/off

Trend Ribbon

-Uses the John F. Ehlers Supersmooth method on a specified lookback period (Default 14)

-Checks the current price action against the lookback period trend and if the Supersmooth signal aligns with the trend direction, it gives a strong signal (Bull/Bear). A continuation signal (Neutral) is given if these two don’t match, and often indicates trend continuation or trend reversal.

-Can turn supersmooth and/or matching bar repaint on/off

-Can choose between Bull/Bear/Neutral signals and only Bull/Bear signals

-Alerts available for Bullish or Bearish change

-Can choose current timeframe or any timeframe

Bar Repaint

-Candles colored according to current trend (Blue = Bullish Control, Purple = Neutral/Coasting, Red = Bearish Control) and intensity according to volume (Darker = High Volume/Increasing, Lighter = Low Volume/Decreasing). You can set candle color to reflect: Open/Close, Trend (Default), or an RSI Gradient. You can set candle intensity to reflect: Volume (Default), Momentum, RSI, or ADX.

Price Tag

-Price tag that sits neatly between the candles and the fib labels. You can turn this on or off.

Auto Fib Golden Pocket Band - Strategy with Buy Signalsthis strategy is based on the Indicator "Auto Fib Golden Pocket Band - "Autofib Moving Average"

it's the same as the indicator but with:

- the strategy tester included

- several entry Signal filter

- Dynamic SL

Keltner Center Of Gravity Channel ( KeltCOG )I have the ambition to create a ‘landscape’ which enables the user to see the ‘mood’ of the market about the price of an instrument, simply by looking where the candles go. Prices are a simple phenomenon , they go up or down or stay the same. This is represented quite well for the short term by a candle. I recommend to study candle patterns. Prices not only fluctuate but also trend up, down or go sideways. The user should analyze this by determining the COG (Center Of Gravity) and the ‘normal’ current range by using the historical data in a lookback period.

As a COG the center line of a Donchian Channel is often used. I.m.o. a COG should be a zone, in this channel I use the gray zone of my Donchian Fibonacci Channel, The ‘normal’ range is a multiple of Average True Range, as used in a Keltner Channel. Combining the two can give a cumbersome result, as one can see in my Keltner Fibonacci Channel. In this KeltCOG channel I solved this by not using all Fibonacci levels and by making the Keltner lines strictly parallel to the nearest COG line. To do this, I use the fact that the COG lines have horizontal stretches, there I make the Keltner lines horizontal too. Only where the COG lines change value, the Keltner lines are recalculated. This way the channel gets a very regular shape with three clear zones.

Interpretation of a chart by using the KeltCOG channel.

Overbought: If the candles go higher then the blue zone, the market is hyper enthusiast, creating an overbought situation. This is often followed by a reversion to the COG.

Uptrend: If the candles form in the blue zone, the market is enthusiast and willing to pay more.

Hopeful: If the candles form in or near the upper uncolored zone, the market is hopeful and is thinking about paying more. Sometimes prices go a little up.

Content: If the candles form in the gray zone, which represents COG, the market is happy with the current prices, so these move sideways

Disappointed: If the candles form in or near the lower uncolored zone, the market is disappointed and contemplates paying less, sometimes prices go a little down.

Downtrend: If the candles form in red zone, the market doesn’t like the instrument at all, rejects the current price and is only prepared to pay less.

Oversold: If the candles form below the red zone, the market overdoes its disgust, creating an oversold situation, often followed by a reversion to the COG.

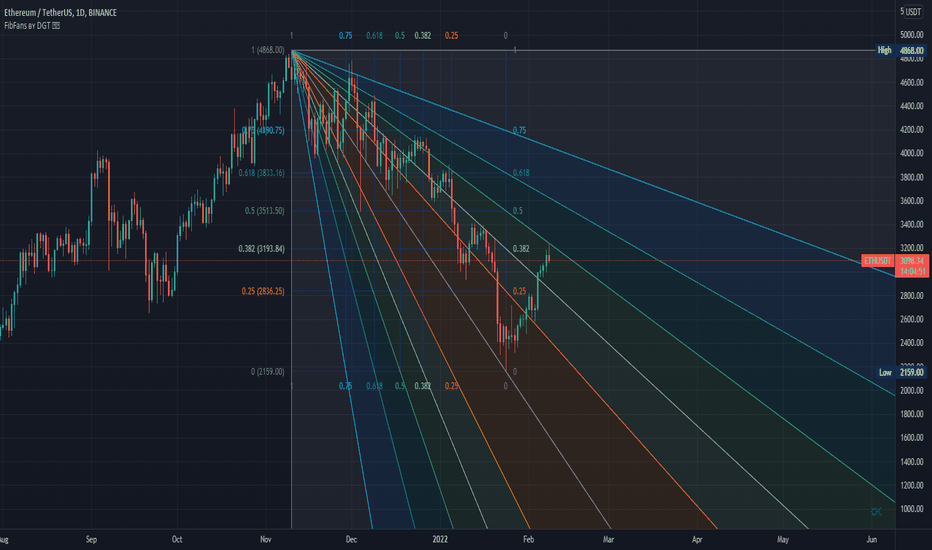

FibFans on Previous HTF HL [FaizanNawaz] by DGTFibonacci Fans application on top of Previous Higher TimeFrame High and Low. Idea owner is @faizannawaz1, special thanks to him for both the idea and tesing the application

WARNING : Study includes plottings in the future, and due to temporal gaps in non 7/24 markets such as weekends, holidays etc plotting of the fans will move to the open session (the effect will be observed on Friday and Monday). With crypto no any side affect will be observed.

More about Fibonacci Fans, how to apply fibonacci fans and automated fibonacci speed and resistance fans study

Adiitonally the study includes some addons, such as

Central Pivot Range and Traditional Pivot Points

Volume Weighted Colored Bars

Price Range Meter - Horizontal HTF Candle

Disclaimer :

Trading success is all about following your trading strategy and the indicators should fit within your trading strategy, and not to be traded upon solely

The script is for informational and educational purposes only. Use of the script does not constitute professional and/or financial advice. You alone have the sole responsibility of evaluating the script output and risks associated with the use of the script. In exchange for using the script, you agree not to hold dgtrd TradingView user liable for any possible claim for damages arising from any decision you make based on use of the script

Auto PitchFan, Fib Extension/Retracement and ZigZag by DGT Aᴜᴛᴏ PɪᴛᴄʜFᴀɴ, Fɪʙ Exᴛᴇɴꜱɪᴏɴ/Rᴇᴛʀᴀᴄᴇᴍᴇɴᴛ ᴀɴᴅ ZɪɢZᴀɢ

This study aim to automate PitchFan drawing tool and combines it with Fibonacci Extentions/Retracements and ZigZag.

Common setting options, applied to all components of the study

Deviation , is a multiplier that affects how much the price should deviate from the previous pivot in order for the bar to become a new pivot. Increasing its value is one way to get higher timeframe Levels

Depth , affects the minimum number of bars that will be taken into account when building

Historical PitchFan / Fibonacci Levels option will allow plotting of PitchFan / Fibonacci Levels on previous Pivot Highs/Lows

█ PɪᴛᴄʜFᴀɴ — is a set of rays spreading out of the point of a trend's beginning. These rays inclined with the coefficients formed by a Fibonacci number sequence. It is recommended to adjust the Pitchfan plottings to fit after the first wave of the trend has passed and the correction has clearly begun.

PitchFan rays corresponding to Fibonacci levels appear on a chart and represent inclined lines of support and resistance. Price areas near these rays are estimated areas from which the price can turn around or make a significant rebound. The whole logic of working with a pitchfan is based on one simple idea - if the price has bounced off the level, then the correction is likely to end, and the trend will continue. If the price has broken the first resistance, you should wait for the next level test

- Automatically plots PitchFan Rays, based on Pivot Lows/Highs.

- Ability to set ALERTs for each PitchFan Ray Level

- PitchFan Labels displays the price of the line at the last bar, the price value will be recalculated in each new bar

Please check the link provided below with the educational post of how to apply pitchfork, application of pitchfan is same keeping in mind the recommendation stated above

█ Fɪʙ Rᴇᴛʀᴀᴄᴇᴍᴇɴᴛs / Exᴛᴇɴꜱɪᴏɴꜱ

Fibonacci retracements is a popular instrument used by technical analysts to determine support and resistance areas. In technical analysis, this tool is created by taking two extreme points (usually a peak and a trough) on the chart and dividing the vertical distance by the key Fibonacci coefficients equal to 23.6%, 38.2%, 50%, 61.8%, and 100%.

Fibonacci extensions are a tool that traders can use to establish profit targets or estimate how far a price may travel AFTER a retracement/pullback is finished. Extension levels are also possible areas where the price may reverse.

IMPORTANT NOTE: Fibonacci extensions option may require to do further adjustment of the study parameters for proper usage. Extensions are aimed to be used when a trend is present and they aim to measure how far a price may travel AFTER a retracement/pullback. I will strongly suggest users of this study to check the education post for further details where to use extensions and where to use retracements

- Automatically plots possible Support and Resistance levels, based on Pivot Lows/Highs.

- Ability to set ALERTs for each Fibonacci Extension/Retracement Level

- Labels displays the level and the level price

█ Zɪɢ Zᴀɢ — The Zig Zag indicator is used to help identify price trends and changes in price trends. The Zig Zag indicator plots points on a chart whenever prices reverse by a percentage greater than a Deviation variable. Straight lines are then drawn, connecting these points. The Zig Zag indicator serves base for PitchFan and Fibonacci Retracements / Extensions

█ OTHER

PitchFan is often used in combination with the other indicators and/or drawing tools such as Fibonacci Retracement, Fibonacci Channels, Fibonacci Time Zone and others. It allows identify the most powerful areas from which price can turn and to get more accurate trading signal

Andrews’ Pitchfork, how to apply pitchfork and automated pitchfork study

Fibonacci Fans, how to apply fibonacci fans and automated fibonacci speed and resistance fans study

Fibonacci Extension / Retracement, where to use extensions and where to use retracements and automated fibonacci extension / retracement / pivot points study

Others

Fibonacci Channels, how to apply fibonacci channels and automated fibonacci channels study

Linear Regression Channels, , what linear regression channels are? and linear regression channel/curve/slope study

Disclaimer :

Trading success is all about following your trading strategy and the indicators should fit within your trading strategy, and not to be traded upon solely

The script is for informational and educational purposes only. Use of the script does not constitute professional and/or financial advice. You alone have the sole responsibility of evaluating the script output and risks associated with the use of the script. In exchange for using the script, you agree not to hold dgtrd TradingView user liable for any possible claim for damages arising from any decision you make based on use of the script

Fibonacci Extension / Retracement / Pivot Points by DGTFɪʙᴏɴᴀᴄᴄɪ Exᴛᴇɴᴛɪᴏɴ / Rᴇᴛʀᴀᴄᴍᴇɴᴛ / Pɪᴠᴏᴛ Pᴏɪɴᴛꜱ

This study combines various Fibonacci concepts into one, and some basic volume and volatility indications

█ Pɪᴠᴏᴛ Pᴏɪɴᴛꜱ — is a technical indicator that is used to determine the levels at which price may face support or resistance. The Pivot Points indicator consists of a pivot point (PP) level and several support (S) and resistance (R) levels. PP, resistance and support values are calculated in different ways, depending on the type of the indicator, this study implements Fibonacci Pivot Points

The indicator resolution is set by the input of the Pivot Points TF (Timeframe). If the Pivot Points TF is set to AUTO (the default value), then the increased resolution is determined by the following algorithm:

for intraday resolutions up to and including 5 min, 4HOURS (4H) is used

for intraday resolutions more than 5 min and up to and including 45 min, DAY (1D) is used

for intraday resolutions more than 45 min and up to and including 4 hour, WEEK (1W) is used

for daily resolutions MONTH is used (1M)

for weekly resolutions, 3-MONTH (3M) is used

for monthly resolutions, 12-MONTH (12M) is used

If the Pivot Points TF is set to User Defined, users may choose any higher timeframe of their preference

█ Fɪʙ Rᴇᴛʀᴀᴄᴇᴍᴇɴᴛ — Fibonacci retracements is a popular instrument used by technical analysts to determine support and resistance areas. In technical analysis, this tool is created by taking two extreme points (usually a peak and a trough) on the chart and dividing the vertical distance by the key Fibonacci coefficients equal to 23.6%, 38.2%, 50%, 61.8%, and 100%. This study implements an automated method of identifying the pivot lows/highs and automatically draws horizontal lines that are used to determine possible support and resistance levels

█ Fɪʙᴏɴᴀᴄᴄɪ Exᴛᴇɴꜱɪᴏɴꜱ — Fibonacci extensions are a tool that traders can use to establish profit targets or estimate how far a price may travel AFTER a retracement/pullback is finished. Extension levels are also possible areas where the price may reverse. This study implements an automated method of identifying the pivot lows/highs and automatically draws horizontal lines that are used to determine possible support and resistance levels.

IMPORTANT NOTE: Fibonacci extensions option may require to do further adjustment of the study parameters for proper usage. Extensions are aimed to be used when a trend is present and they aim to measure how far a price may travel AFTER a retracement/pullback. I will strongly suggest users of this study to check the education post for further details, where to use extensions and where to use retracements

Important input options for both Fibonacci Extensions and Retracements

Deviation, is a multiplier that affects how much the price should deviate from the previous pivot in order for the bar to become a new pivot. Increasing its value is one way to get higher timeframe Fib Retracement Levels

Depth, affects the minimum number of bars that will be taken into account when building

█ Volume / Volatility Add-Ons

High Volatile Bar Indication

Volume Spike Bar Indication

Volume Weighted Colored Bars

This study benefits from build-in auto fib retracement tv study and modifications applied to get extentions and also to fit this combo

Disclaimer:

Trading success is all about following your trading strategy and the indicators should fit within your trading strategy, and not to be traded upon solely

The script is for informational and educational purposes only. Use of the script does not constitute professional and/or financial advice. You alone have the sole responsibility of evaluating the script output and risks associated with the use of the script. In exchange for using the script, you agree not to hold dgtrd TradingView user liable for any possible claim for damages arising from any decision you make based on use of the script

[blackcat] L5 Whales Jump Out of Ocean XLevel: 5

Background

I have been working on developing indicators on how to track the banker funds or whales. In my open source indicators published, you can search for the keywords "Banker" or "Whale" to find and use these indicators. After three years of development and hard work, I have perfectly combined the banker fund/whale mathematical model and the unique Fibonacci space-time indicators. This is named as "L5 Whales Jump Out of Ocean X" indicator that I will introduce today.

Function

This indicator introduces three independent judgment standards. They are whales & waves, Fibonacci time windows and dynamic Fibonacci retracement arrows. Whales and waves are banker fund/ whale behavior modeling based on my unique moving average technology. Fibonacci time and space indicators are a unique improvement I made to traditional indicators of the same kind to make them more powerful.

This indicator is basically applicable to all markets, but requires traders to choose the most suitable trading pair to operate. This indicator is used for multiple periods. Because the smaller the period, the more unstable the data, the larger the period, the more stable the Fibonacci space-time indicator. I use this indicator for the operation of cryptocurrency, commodities, forex, local stocks and ETFs. When this indicator is combined with the candle patterns of Japanese candlesticks, it will often produce higher quality signals, so I suggest that people who use this indicator should have the basic knowledge of Japanese candlesticks in order to better use this indicator.

Key Signal

Long Whales / Banker Pump--> fuchsia and red stick bars (Motive waves with fuchsia color; corrective waves with red color)

Short Whales / Banker Dump --> yellow and red green stick bars (Motive waves with yellow color; corrective waves with green color)

Long Waves --> fuchsia and red areas (Motive waves with fuchsia color; corrective waves with red color)

Short Waves --> yellow and red green areas (Motive waves with yellow color; corrective waves with green color)

Fibonacci Top Time Window --> red background color

Fibonacci Bottom Time Window --> green background color

Dynamic Fibonacci Retracement Support Arrows --> green arrows with "SUP" text; the brighter color, the stronger support.

Dynamic Fibonacci Retracement Resistance Arrows --> red arrows with "RES" text; the brighter color, the stronger resistance.

Ready for Support Cross --> green crosses with "*SUP" text on zero axis.

Ready for Resistance Cross --> red crosses with "*RES" text on zero axis.

Pros and Cons

ONLY suitable for discretionary trading, and does NOT support automatic trading system/bots with alerts.

Intuitive and effective, the output signal is more reliable after multi-indicator resonance

Remarks

My first L5 indicator published

Closed-source

Invite-only

Redeem Fee Life Lock Guarantee

Although I take the efforts to inform the script requesters that the best way to promote trading skills is to learn from the open source scripts I released by themself and to improve their PNIE script programming skills, there are still many people asking how to obtain or pay to use BLACKCAT L4/L5 private scripts. In fact, I do not encourage people to use Tradingview Coins (TVC) / Cryptocurrency to redeem the right to use BLACKCAT L4/L5 scripts. However, redeeming private script usage rights through TV Coins/ Cryptocurrency may be an effective way to force more people to learn PINE script programming seriously. And then I can concentrate on answering more valuable community questions instead of being overwhelmed by L4/L5 scripting permission reqeusts.

I would like to announce a ‘Redeem Fee Lock Guarantee’ program to further simplify the L4/L5 indicator/strategy utility offering and distinguish itself from the competition. ‘Redeem Fee lock guarantee’ is one of the major initiatives by BLACKCAT as a part of overall value packaging designed to guard BLACKCAT’s followers’ against cost-overruns and operational risks usually borne by them when it comes to PINE script innovation ecosystem. The TVCs redeemed for L4/L5 a follower signs up for with BLACKCAT is their guaranteed lifetime locked in TVC Quantity/ cryptocurrency, with no special conditions, exclusions and fine print whatsoever. Based on this scheme, I can constantly refine, expand, upgrade and improve PINE script publishing to ensure the very best experiences for my followers. The 'Redeem Fee Lock Guarantee' is a step in the direction of rewarding the valuable followers. NOTE: Every L4/L5 script redeeming service is ONLY limited to TVC or Cryptocurrency ("Win$ & Donate w/ This" Addresses displayed on script page) redeeming which the 1st signed up TVC Qty/ equivalent cryptocurrency is the lifetime offered TVC Qty/ equivalent crypto.

How to subscrible this indicator?

The script subscription period only has two options of one month or one year, and its price is floating. The latest price of the script subscription is proportional to the number of likes/agrees this script has already received. Therefore, the price of subscribing to this script shows an increasing trend, and the earliest subscribers can enjoy the price of lifetime lock to this script. As the number of likes / agrees of this script increases, the subscription fee for one month and one year will also increase linearly. Whatever, the first subscription price of the use will be locked for life.

Monthly subscription and annual subscription can be done either by tradingview coins (TVC) or by converting into equivalent cryptocurrency at the exchange rate (1TVC=0.01USD) for redeem.

TVC payment needs to pay TVC directly in the comments under this script. Every time I authorize a new user, I will update the latest number of subscribed users and latest price for next subscription under the script comment. If there are any conflicting scenario happened to the rules and my update. My updated price based on the rule will be the final price for next subscription. The following subscribers need to pay the corresponding amount of TVC or cryptocurrency in accordance with the latest number of users and price announced by me in accordance with the rules published.

TVC redemption is the method I strongly recommend, and I hope you can complete the redemption in the comment area of this script. This is like a blockchain structure, each comment is a block, each subscription is a chain, which is conducive to open and transparent publicity and traceability to avoid unnecessary disputes.

Monthly Subscription Charges

500TVC <50 Agrees (A)

50A<850TVC<100A

100A<1000TVC<150A

150A<1350TVC<200A

200A<1500TVC<250A

250A<1850TVC<300A

300A<2000TVC<350A

350A<2350TVC<400A

400A<2500TVC<450A

450A<2850TVC<500A

500A<3000TVC<550A

550A<3350TVC<600A

600A<3500TVC<650A

650A<3850TVC<700A

700A<4000TVC<750A

750A<4350TVC<800A

800A<4500TVC<850A

850A<4850TVC<900A

900A<5000TVC<950A

950A<5350TVC<1000A

1000A<5500TVC<1050A

And so on...

Annual Subscription Charges

5000TVC <50 Agrees (A)

50A<8500TVC<100A

100A<10000TVC<150A

150A<13500TVC<200A

200A<15000TVC<250A

250A<18500TVC<300A

300A<20000TVC<300A

350A<23500TVC<400A

400A<25000TVC<450A

500A<28500TVC<550A

500A<30000TVC<550A

550A<33500TVC<600A

600A<35000TVC<650A

650A<38500TVC<700A

700A<40000TVC<750A

750A<43500TVC<800A

800A<45000TVC<850A

850A<48500TVC<900A

900A<50000TVC<950A

950A<53500TVC<1000A

1000A<55000TVC<1050A

And so on...

Auto Fib Channels by DGTThe Fibonacci Channel is a technical analysis tool that is used to estimate support and resistance levels based on the Fibonacci numbers. It is a variation of the Fibonacci retracement tool, except with the channel the lines run diagonally rather than horizontally.

This study will automatically place the channels where the levels indicate future areas of support and resistance

For further details please refer to education post

Nobody appears to know whether Fibonacci tools work because markets exhibit some form of natural pattern or because many investors use Fibonacci ratios to predict price movements, making them a self-fulfilling prophecy.

█ Study OPTIONS

Auto Fibonacci Channels , the main aim of the study

- Pivot threshold can be adjusted via “Deviation” and “Depth” input options

- Historical Channels / Retracements option will allow plotting of Channels on previous pivot high/lows

- Ability to set ALERTs for the Channel Levels

- Channel Labels displays the price of the line at the last bar, the price value will be updated in each new bar

Auto Fib Retracement – This is the build-in study of TradingView, customized to be in-line with Fibonacci Channels

- Pivot threshold can be adjusted via “Deviation” and “Depth” input options

- Historical Channels / Retracements option will allow plotting of Retracements on previous pivot high/lows

- Ability to set ALERTs for the Retracement Levels

Zig Zag – Derived from build-in Auto Fib Retracement with some customization options.

Disclaimer :

Trading success is all about following your trading strategy and the indicators should fit within your trading strategy, and not to be traded upon solely

The script is for informational and educational purposes only. Use of the script does not constitute professional and/or financial advice. You alone have the sole responsibility of evaluating the script output and risks associated with the use of the script. In exchange for using the script, you agree not to hold dgtrd TradingView user liable for any possible claim for damages arising from any decision you make based on use of the script

Auto Fib Speed Resistance Fans by DGTFibonacci Speed and Resistance Fan is an analytical drawing tool used to indicate the support and resistance levels of an existing trend and the price level at which possible changes in the trend may occur.

A Fibonacci Speed Resistance Fan consists of a trend line drawn between two extreme points - a trough and opposing peak or a peak and opposing trough - on which a set of sequential speed resistance lines are drawn above (which represents time) and below (which represents price). These lines are drawn based on time/price percentages of the distance between the beginning and the end of the trend line.

Speed resistance lines not only help to measure trend corrections but also measure the speed of a trend (the rate at which a trendline ascends or descends)

Traders can use the lines of the Fibonacci Speed and Resistance Fan to predict key points of resistance or support, at which they might expect price trends to reverse. Once a trader identifies patterns within a chart, they can use those patterns to predict future price movements and future levels of support and resistance. Traders use the predictions to time their trades. Key support and resistance levels tend to occur frequently at the 61.8-percent level on both uptrends and downtrends.

Please check for further details in the education post that I will share shortly after this publication :

Nobody appears to know whether Fibonacci tools work because markets exhibit some form of natural pattern or because many investors use Fibonacci ratios to predict price movements, making them a self-fulfilling prophecy.

█ Study OPTIONS

Auto Fibonacci Speed and Resistance Fan , the main aim of the study

- Pivot threshold can be adjusted via “Deviation” and “Depth” input options

- Historical Fans option will allow plotting of Speed and Resistance Fans on previous pivot high/lows

- Ability to set ALERTs for the Speed and Resistance Levels

- Price Grid Lines if extended it will result with Fib Retracement levels

- All lines, line levels are customizable, default values are set exactly to the same with the available Fib Speed and Resistance Fan drawing tool

Zig Zag – Derived from build-in Auto Fib Retracement with some customization options.

Example Usages :

Disclaimer :

Trading success is all about following your trading strategy and the indicators should fit within your trading strategy, and not to be traded upon solely

The script is for informational and educational purposes only. Use of the script does not constitute professional and/or financial advice. You alone have the sole responsibility of evaluating the script output and risks associated with the use of the script. In exchange for using the script, you agree not to hold dgtrd TradingView user liable for any possible claim for damages arising from any decision you make based on use of the script

Auto Fib Retracement (Price Format)This is a modded version of TV builtin "Auto Fib Retracement". This version has the option to format price label. Sometimes when you analyzing e.g. altcoin charts against BTC. They can have more then 2 decimal points and the old version displays 0 when that happens. I also optimized it a little so it should be faster now

Fibonacci Disciples Auto Levels (ES/NQ/GC/NQ WIDE) - APPROVEDPVTEvery Index, every ETF , every sector started somewhere.

That starting point defines Zones that follow that Index, or ETF forever.

What i am saying is - everything you are trading has a pre-defined range of movement that was established when the stock Index became available to the market.

It is this range that defines specific levels that will always play a significant part in the movement of that stock, or Index for its entire lifespan.

This script will automatically multiply that original price range to the stock or index’s current real time value using Fibonacci sequence and a proprietary pre-calculated Fibonacci formula to draw custom Golden Ratios on your chart in real-time. Each gold line represents a new “Golden Ratio” that is, or has already emerged as price moves up and down.

This phenomenon becomes possible by sealing the gaps between Fibonacci Fractal retracements making each gold line a measured .618:1.618 Golden Ratio.

Having these unique Golden Ratios displayed automatically on your chart allows you as the Trader to always have a price target in mind rather than having to guess where price might be headed on a naked chart.

From there you are welcome to add your favorite moving average or any other tool you wish to help determine the overall direction of the trend whilst using these Golden Ratio targets for scalping opportunities. If you do not know how to identify fractal W’s and M’s may I suggest you utilize a public Williams Fractal tool to accompany this indicator script.

Due to the scalping nature of this tool it will be best used on all time frames from 1min up to 4hrs.

Each measured line is customizable to your liking. If you wish to see less you can unclick individual measurements. I suggest leaving the “Baseline” and each “.618%” line active.

You can also change the color of the lines if you wish.

If you would like access to this script you can either DM me on TradingView