Renko Bars for Forex by Darkoexe (no repainting)This indicator achieves plotting Renko bars with no repainting by resetting the open of the first Renko bar every market open after the FOREX market close. The indicator displays Renko bars for a timeframe chart which means multiple Renko bars can appear in the same timeframe as a single chart candle. This is because Renko bars aren't time bound, they are formed based on price movement. Whenever multiple Renko bars would appear in the timeframe of a single chart candle, the Renko bars will be displayed in a stacked manner meaning the Renko bars will be stacked on top of each other. If the Renko bars stacked are green, the top Renko bar close is the Renko close price of the timeframe. Whenever there's no Renko price movement for a specific candles timeframe, there will be a shadow of the color of the previous Renko bar displayed. These shadows can go on for a while if there's no significant price movement or if the Renko brick size input parameter is set too high.

There's 2 ways to calculate the size of each Renko bar. The first way (the default way) uses a fixed fixed brick size where you can choose the size of each brick. The second way uses a dynamic brick size which just uses the ATR with whatever length you would like to determine the brick size for each Renko bar. The dynamic option also has a factor input which would be multiplied with the calculated ATR to determine the brick size. To use the dynamic option, just check the box in the inputs section labeled "Dynamic Renko Box Size (uses the ATR for renko box size)".

Enjoy!!!

Renkobars

Protervus RenkoWelcome to Protervus Renko!

After over two years of research and development, I'm thrilled to present you with my take on Renko in overlay mode.

Key features

Four Renko Types: Classic, Median, Geometric, Turbo

Brick size methods: Traditional, Percentage, ATR

Renko Wicks

Higher Time-Frame selection

No repainting, all data is consolidated and obtained from regular candles

Output mode: pass Protervus Renko data to other indicators

Built-in settings validator

Renko Statistics

Bricks reversal

Complete style and color customization

Tooltips in the settings panel explaining available options

Alerts

Renko Types: Classic, Median, Geometric, Turbo

Show Candles, Levels, or Both - along with Wicks

Note: when levels are disabled Wicks are shown on the actual Renko bricks, while when enabled they are shown in the middle of the Renko level.

Understanding Renko Output

In Real Mode, the output only contains data on the Renko brick, while in Normalized mode the values are repeated for the whole Renko level.

Example with Bollinger Bands:

In Real Mode, Bollinger Bands will be calculated exclusively on the Renko Bricks. Had we used Normalized Mode instead, the output wouldn't make sense as the values are carried over on each candle.

Other indicators (like RSI, for example) would work better with Normalized output though:

Automatic settings validation

Note: if settings are Unreliable, the script will not show any Renko candles or levels. The Output can still be used on external indicators, if needed (e.g. for a more granular RSI output).

Renko Data Panel

Data Panel shows two types of statistics: Rolling and Barset. Rolling data is referring to "last X time" and can be defined in the indicator's settings (in this example it's set to one week) while "Total Bricks" are considered over the whole available barset (since the beginning of the chart).

Besides seeing Renko Bricks trends at a glance, it's also possible to spot interesting areas when Rolling bricks are coming close to either the Total Average or Total Maximum Bricks, signaling a possible reversal or continuation.

Bricks Reversal

Show reversals: configure how many opposite bricks are needed to trigger a reversal, as well as limiting their number to avoid strong opposite movements.

Tip: more conservative Traders might want to receive a signal if the minimum is close to the Average Bricks Trend, but not over the Maximum Bricks Trend.

Moving the Indicator to a separate pane and overlay price

Credits

yatrader2 (lengths in time or bars function), allanster (Heikin Ashi function)

Special thanks go to PineCoders community for their incredible efforts and learning material to help mastering PineScript!

MM CHEATCODE V2The Best Renko system out there. The second coming to the original Cheatcode Algo we made

with options to use Tradition point calculations or ATR values for price measurement

- Select up to 3 tp levels

- ATR Risk calculator

- Strategy presets for easy setting selection for certain assets

- A trailing Ma for stint entries filters

- Volatility bands (BB, Kentler,Donchain)

- ATR super trend for added trend & trade filter

- MTF filter (up to 3)

- Added Session display as well as strict filter to only trade during that session(s) selected

- Full signal Alerts (meaning the full signal will send Entry, TP, Sl )

- added MM Capo volatility filter

Also Have Automation Version Available

How to use

You can use a setting preset in for the asset selected and the settings will automatically adjust but won't apply to your setting screen. (Tradingview limitations)

For the most part the buy signal will plot when the ATR moves in up/down direction

Filter your trades with the various trend detections indicators added when they all line up you have the best probability for the trade.

Renko is the best way to trade basic market structure and now with all the confirmation you need.

ALL Links below or PM us for access to this indicator Happy Trading

[blackcat] L5 Renko MasterLevel: 5

Background

Like many people in the Tradingview community, I have been studying how to apply Renko charts to backtesting and live trading for long. However, as we all know, the official Tradingview Renko chart is not recommended for backtesting because it will lead to unrealistic backtesting results. So, I thought about developing a set of customized Renko charts that can be used for backtesting and second-level trading. This "L5 Renko Master" is one of them that I am introducing today.

In fact, this is not a Renko chart based on Tick's principle. It is based on OHLC data, because this kind of chart can be used for reliable backtesting and trading in Tradingview. Therefore, the Renko Master in this script can actually coexist with the standard Japanese candlestick chart, but the trend reversal information it prompts is based on a principle similar to Renko. When the two can coexist and produce trading signals at the same time, this is really a very interesting invention.

Function

First of all, this Renko chart can coexist in the main chart with the Japanese candlestick chart. It can support up to 1 second level of display and trading. By configuring two parameters, you can adapt it to different Time Frames.

Secondly, this Renko chart can be used for backtesting strategies, because it is essentially OHLC data. Although the absolute value of the price cannot correspond to the original OHLC one-to-one, the certainty of the trend reversal is relatively high. It can be compared with Japanese candlesticks on the timeline.

Finally, this Renko chart is embedded with a Renko intrinsic trading strategy, which can be used to locate entry points through red and green labels. This strategy supports Tradingview alerts. You can get "LONG" or "SHORT" trading reminders by creating alerts. In order to obtain a clear market structure, Zen Stroke (Autolength ZigZag) and Zen Kiss (Special Moving Averages) can be checked to be superimposed and displayed on the main chart to facilitate understanding of the temporal and spatial position of prices in the market.

Indicator Set

Renko Master Boxes (砖块图)

Zen Stroke (Auto ZigZag , 自动画缠论笔)

Zen Kiss Moving Averages (缠论均线)

Inputs

Price --> Price source used to produce Renko, close is default.

RefBarBack --> Lookback period length to calculate Renko. The larger value, the less sensitive to price ripples and sideways.

BoxPerc --> Internal box percentage input. The larger value, the less sensitive to price ripples and sideways.

Show Zen Stroke (AutoLen ZigZag)? --> Switch to turn on and off ZigZag.

Shown Renko MA? --> Switch to turn on and off special moving averages.

Key Signal

Bricks

Green bricks for up trend

Red bricks for down trend

Labels

Green labels for buy/long.

Red labels for sell/short.

Zen Stroke (ZigZag)

Green line section for up stroke

Red line section for down stroke

Moving Averages

Yellow for fast line

Fuchsia for slow line

Pros and Cons

Suitable for discretionary trading and bots via alerts. However, only well selected trading pair and time frame can guarantee bot works.

Intuitive and effective, the output signal is more reliable after multi-indicator resonance

Remarks

My third L5 indicator published

Closed-source

Invite-only

Redeem Fee Life Lock Guarantee

Although I take the efforts to inform the script requesters that the best way to promote trading skills is to learn from the open source scripts I released by themself and to improve their PNIE script programming skills, there are still many people asking how to obtain or pay to use BLACKCAT L4/L5 private scripts. In fact, I do not encourage people to use Tradingview Coins ( TVC ) / Cryptocurrency to redeem the right to use BLACKCAT L4/L5 scripts. However, redeeming private script usage rights through TV Coins/ Cryptocurrency may be an effective way to force more people to learn PINE script programming seriously. And then I can concentrate on answering more valuable community questions instead of being overwhelmed by L4/L5 scripting permission reqeusts.

I would like to announce a ‘Redeem Fee Lock Guarantee’ program to further simplify the L4/L5 indicator/strategy utility offering and distinguish itself from the competition. ‘Redeem Fee lock guarantee’ is one of the major initiatives by BLACKCAT as a part of overall value packaging designed to guard BLACKCAT’s followers’ against cost-overruns and operational risks usually borne by them when it comes to PINE script innovation ecosystem. The TVCs redeemed for L4/L5 a follower signs up for with BLACKCAT is their guaranteed lifetime locked in TVC Quantity/ cryptocurrency, with no special conditions, exclusions and fine print whatsoever. Based on this scheme, I can constantly refine, expand, upgrade and improve PINE script publishing to ensure the very best experiences for my followers. The 'Redeem Fee Lock Guarantee' is a step in the direction of rewarding the valuable followers. NOTE: Every L4/L5 script redeeming service is ONLY limited to TVC or Cryptocurrency ("Win$ & Donate w/ This" Addresses displayed on script page) redeeming which the 1st signed up TVC Qty/ equivalent cryptocurrency is the lifetime offered TVC Qty/ equivalent crypto.

How to subscrible this indicator?

The script subscription period only has two options of one month or one year, and its price is floating. The latest price of the script subscription is proportional to the number of likes/agrees this script has already received. Therefore, the price of subscribing to this script shows an increasing trend, and the earliest subscribers can enjoy the price of lifetime lock to this script. As the number of likes / agrees of this script increases, the subscription fee for one month and one year will also increase linearly. Whatever, the first subscription price of the use will be locked for life.

Monthly subscription and annual subscription can be done either by tradingview coins ( TVC ) or by converting into equivalent cryptocurrency at the exchange rate (1TVC=0.01USD) for redeem.

TVC payment needs to pay TVC directly in the comments under this script. Every time I authorize a new user, I will update the latest number of subscribed users and latest price for next subscription under the script comment. If there are any conflicting scenario happened to the rules and my update. My updated price based on the rule will be the final price for next subscription. The following subscribers need to pay the corresponding amount of TVC or cryptocurrency in accordance with the latest number of users and price announced by me in accordance with the rules published.

TVC redemption is the method I strongly recommend, and I hope you can complete the redemption in the comment area of this script. This is like a blockchain structure, each comment is a block, each subscription is a chain, which is conducive to open and transparent publicity and traceability to avoid unnecessary disputes.

Monthly Subscription Charges

500TVC <50 Agrees (A)

50A<850TVC<100A

100A<1000TVC<150A

150A<1350TVC<200A

200A<1500TVC<250A

250A<1850TVC<300A

300A<2000TVC<350A

350A<2350TVC<400A

400A<2500TVC<450A

450A<2850TVC<500A

500A<3000TVC<550A

550A<3350TVC<600A

600A<3500TVC<650A

650A<3850TVC<700A

700A<4000TVC<750A

750A<4350TVC<800A

800A<4500TVC<850A

850A<4850TVC<900A

900A<5000TVC<950A

950A<5350TVC<1000A

1000A<5500TVC<1050A

And so on...

Annual Subscription Charges

5000TVC <50 Agrees (A)

50A<8500TVC<100A

100A<10000TVC<150A

150A<13500TVC<200A

200A<15000TVC<250A

250A<18500TVC<300A

300A<20000TVC<300A

350A<23500TVC<400A

400A<25000TVC<450A

500A<28500TVC<550A

500A<30000TVC<550A

550A<33500TVC<600A

600A<35000TVC<650A

650A<38500TVC<700A

700A<40000TVC<750A

750A<43500TVC<800A

800A<45000TVC<850A

850A<48500TVC<900A

900A<50000TVC<950A

950A<53500TVC<1000A

1000A<55000TVC<1050A

And so on...

Renko Simple OverlaySimple Renko Overlay that attempts to deal with the delay present in the Renko function while still using brick size from the Renko function.

Renko + CandlesThis indicator has been designed to show you both candle chart and Renko chart in one place.

I think most of you are familiar with candle chart which is working with the time and price movements but Renko chart is based on price differences and is not related to the "time" parameter.

so if you see a Renko brick is appear up(or down) to the previous brick it means that a certain and fixed price movement has been occurred (which mostly calculate by ATR). and also this indicator works in any time frame.

Remember because we want both charts we have time parameter in this indicator, and if the price doesn't move up or down a certain percentage from previous bars, it will plot a renko bar beside the previous one.

you can use this indicator to see if the price moves up or down.

Or you can determine the important support and resistances with much less noises.

it can be used as a confirmation for you to keep your positions or exit.

go ahead and discover it...

If you have any questions, don't hesitate! ask in the comments section below.

MTF RenkoThis indicator Should be opened on a 15 min chart

It will display the Renko Highs and lows of:

30 min chart

45 min chart

60 min chart

and

120 min chart

[MACLEN] HODL ZONE RENKO

PLEASE READ!

Trade at your own risk. Please read about renko charts before using this indicator. This indicator is for educational purposes only.

This Indicator is only valid in renko charts with 1 second timeframe. For BTCUSDT . With the traditional method and the size box of 80.

With this indicator we can detect zones of buy and sell. Even that is not recommended to use leverage, I use it to find an entry and use only small leverages. It could be also used to accumulate and HODL bitcoin .

Please, comment anything.

POR FAVOR LEER!

Tradea bajo tu propio riesgo. Por favor lee sobre las graficas renko antes de usar este indicador. Este indicador es solamente con fines educativos.

Este indicador es válido solamente en graficas renko con un timeframe de 1 segundo. Para BTCUSDT . Con cajas del método tradicional de un tamaño de 80.

Con este indicador podemos detectar zonas de compra y venta. A pesar de que no es recomendable usar apalancamiento, yo lo uso para encontrar entradas y solo uso apalancamientos pequeños. También podría usarse para acumular y holdear bitcoin .

Por favor, escríbeme cualquier duda o comentario.

Renko Bar ChangeI realized it's not in the TV Library so I think it's mandatory to add.

If you wish to access and use for yourself contact me - I reply on Average in less than 4 hours on a 60 day period.

---

Renko Bar Change Indicator Documentation:

Renko Parameters:

Set Box Size either via ATR or your own Float-Value after choosing the correct Renko Style-Option.

Both Renko Style Options are self-explanatory.

Alerts and Plots:

1) Green arrow visualizing a green Renko bar after a red Renko bar

2) Red arrow visualizing a red Renko bar after a green Renko bar

3) Alert for green Renko Bar after red Renko Bar

4) Alert for red Renko Bar after green Renko Bar

Flex Renko Emulator Strategy by Zack_The_LegoThe author of the study is Zack_The_Lego but i made it into a strategy because its an awesome study by him.

RENKO Modified (NO REPAINT CODE)I'm releasing this code in public Interest in hope of getting it improved by the community. If someone wants to use this code, then he/she should publish this code in Public Library with Open Source reference.

The code is entirely mine and not anyone else's.

I would love to see some imporvements to this code, so if you have any suggestions then let me know in the comments section and if someone can actually make it better than it would be great.

I'll share the logic for BUY and Sell upon agrreing on mutual terms.

As of this moment, the code simply plots Renko Bars, based on Daily Open.

I have added Daily close as an option in this, just in case someone wants it.

similarly you can call upon High and Low (for Obvious Reasons)

It CAN NOT REPAINT at all!!!!

Renko on CandlesticksThis script drowse renkoboxes on top of candlesticks. This script does not repaint and can be used for alerts generation. If you add Renko to the same chart using security function it won't be the same (which seems to be a bug in TV). To check if my implementation is correct you can open Renko in a separate window and check timestamps.

Unlike standard implementation, when you use ATR based Renko bars, every box can have different size! The current ATR is applied after every bar. The standard implementation takes the current ATR value and applies it to the whole chart, so the chart may look totally different when you reload the page.

Renko channel BREAK (alert)This is the Alert version for Renko channel BREAK.

Please use this script after research the Strategy version!!

Renko Dynamic Index ZonesThe goal of this indicator is to plot the Dynamic Index, Signal, and Histogram values "as if" the chart is a true price action based Renko chart. It can be used on a time series chart or Renko series chart. The Dynamic Index is derived from the raw price action of a time-based chart, where the historic and live price values are clustered into Renko bricks. The Renko brick production algorithm is entirely backed by Renko Overlay Ribbon and thoroughly tested. The Dynamic Index gets its inspiration from the Commodity Channel Index.

The algorithm takes into account rapid brick production within a single time candle and adjusts accordingly. The output may vary slightly between different chart time frames for the same indicator settings, but this is due to the lack of price fluctuation visibility that can occur in higher chart time frames. If the brick tick size is low, an appropriate chart interval should be selected that maximizes the amount of price volatility visible to the indicator. A bad setting would be something like a 1 tick EURUSD Renko setting on an H4 or Day chart, there simply is no way to derive the exact and ordered price fluctuations in a single candle, 1 pip at a time. A more appropriate chart time frame would be 1-5 minutes for this selected Renko brick size.

The difference between this indicator and the companion Renko Dynamic Index oscillator can be understood in the following video. The indicator plots the current Dynamic Index - Signal cross and Dynamic Index - Zero cross thresholds on the chart so that you know exactly where the most important crossing values are at all times. These can be used as a dynamic stop or a dynamic entry location for trades. The overbought and oversold dynamic zones are also plotted on the chart.

If you are interested in the RSI-RENKO DIVINE™ Strategy please have a look here:

Contact me in Trading View or telegram for more information and access instructions.

Renko MACD TrendThe goal of this indicator is to plot the MACD, Signal, and Histogram values "as if" the chart is a true price action based Renko chart. It can be used on a time series chart or Renko series chart. The MACD is derived from the raw price action of a time-based chart, where the historic and live price is clustered into Renko bricks. The Renko brick production algorithm is entirely backed by Renko Overlay Ribbon and thoroughly tested.

The algorithm takes into account rapid brick production within a single time candle and adjusts accordingly. The output may vary slightly between different chart time frames for the same indicator settings, but this is due to the lack of price fluctuation visibility that can occur in higher chart time frames. If the brick tick size is low, an appropriate chart interval should be selected that maximizes the amount of price volatility visible to the indicator. A bad setting would be something like a 1 tick EURUSD Renko setting on an H4 or Day chart, there simply is no way to derive the exact and ordered price fluctuations in a single candle, 1 pip at a time. A more appropriate chart time frame would be 1-5 minutes for this selected Renko brick size.

The difference between this indicator and the companion Renko MACD indicator can be understood in the following video. The indicator plots the current MACD - Signal cross and MACD - Zero cross thresholds on the chart so that you know exactly where the most important crossing values are at all times. This can be used as a dynamic stop or a dynamic entry location for trades.

If you are interested in the RSI-RENKO DIVINE Strategy please have a look here:

Contact me in Trading View or telegram for more information and access instructions.

Telegram: t.me

Daily Edge: www.daily-edge.com

Renko MACDThe goal of this indicator is to plot the MACD, Signal, and Histogram values "as if" the chart is a true price action based Renko chart. It can be used on a time series chart or Renko series chart. The MACD is derived from the raw price action of a time-based chart, where the historic and live price is clustered into Renko bricks. The Renko brick production algorithm is entirely backed by Renko Overlay Ribbon and thoroughly tested.

The algorithm takes into account rapid brick production within a single time candle and adjusts accordingly. The output may vary slightly between different chart time frames for the same indicator settings, but this is due to the lack of price fluctuation visibility that can occur in higher chart time frames. If the brick tick size is low, an appropriate chart interval should be selected that maximizes the amount of price volatility visible to the indicator. A bad setting would be something like a 1 tick EURUSD Renko setting on an H4 or Day chart, there simply is no way to derive the exact and ordered price fluctuations in a single candle, 1 pip at a time. A more appropriate chart time frame would be 1-5 minutes for this selected Renko brick size.

Please find the following video introduction helpful for this indicator and the Renko MACD Trend indicator:

If you are interested in the RSI-RENKO DIVINE Strategy please have a look here:

Contact me in Trading View or telegram for more information and access instructions.

Telegram: t.me

Daily Edge: www.daily-edge.com

Alnami_Quantum_blocks v.11The (Al Nami Quantum Blocks v.11) script is based on Renko chart that is based on % move of the selected symbol. This is different from the traditional or ATR based Renko charts..

box size = user selected percentage x current price

Alnami Quantum Blocks Channel is composed of 5 levels that are calculated based on the box size:

1- Base

2- Green Box High (GBH) = Base + box size

3- Next Green Box trigger (GBN) = base + (box size x 2)

4- Red Box Low ( RBL ) = Base - box size

5- Next Red Box trigger ( RBN ) = base - (box size x 2)

Those levels will appear in the chart with the following order:

------GBN-------

------GBH-------

------BASE------

------RBL-------

------RBN-------

Usually when prices are trending up, the price will stay above the base for most of the time,, when it trending downwards, price stays below base most of the time..

Now how to time your entries based on the channel?

This strategy draws two levels, breakout level (top red line) and stop level (bottom green line).

If the price is above red line, place a buy order

If the price is below the green line, place a sell order

In version 11 of the Quantum blocks, you can choose to make the those two lines drawn using:

recent/near term price actions (less accurate) and fast - set the number of Legs to low value

or

wider term price actions (more accurate) and slow - set the number of Legs to high value

This version also tracks the last three changes for the red and green lines as following:

1- Above, Above, Above = 3

2- Above, Above, Below = 2

3- Above, Below, Below = 1

4- Below, Below, Below = 0

I did run full optimization for the settings of this strategy on Bitcoin (Binance:BTCUSDT) for the following multiple time frames using Amibroker scrips and data downloaded from Binance through a REST API call. The TFs were for 1min, 15min, 30min, 45min, 90min, 120min, 180min, and 240min.

pair Input Settings

btc TF Profit% Sys DD% Trade DD% sharpe% # Trades Win% Wave% # of Legs up lo

1 204 40.16 15.04 1.33 132 40.15 1.5 4 3 3

15 249 35 14.3 2.96 35 51.43 1.8 3 1 3

30 469 28.95 14.04 3.82 34 67.65 1.4 3 1 3

45 712 54.48 23.3 2.49 46 54.35 1.7 3 3 3

90 1114 40.51 21.41 3.3 48 54.17 1.4 2 3 3

120 602 25.32 16.8 2.82 51 43.14 1.2 2 3 3

180 960 35.9 20.09 3.33 42 52.38 0.9 2 2 3

240 819 46.84 28.27 3.48 46 65.22 0.6 2 3 3

I spent a lot of time and resource in providing the above, If this script/back tests helped in making some profits, then kindly express your appreciation and support to this work by sending some altcoins to any of the following wallets, this will encourage me sharing more stuff with the public:

BTC : 15VLCLZRkEhhZn6E4gNjMLVYnmCcUzKvWU

LTC : LN6mE6aZhEqVVfssmaQ3kk8PPspWQ5wToy

ETH : 0x7901035f2b6f334fa404d0ceb187d7bfcfdb72ce

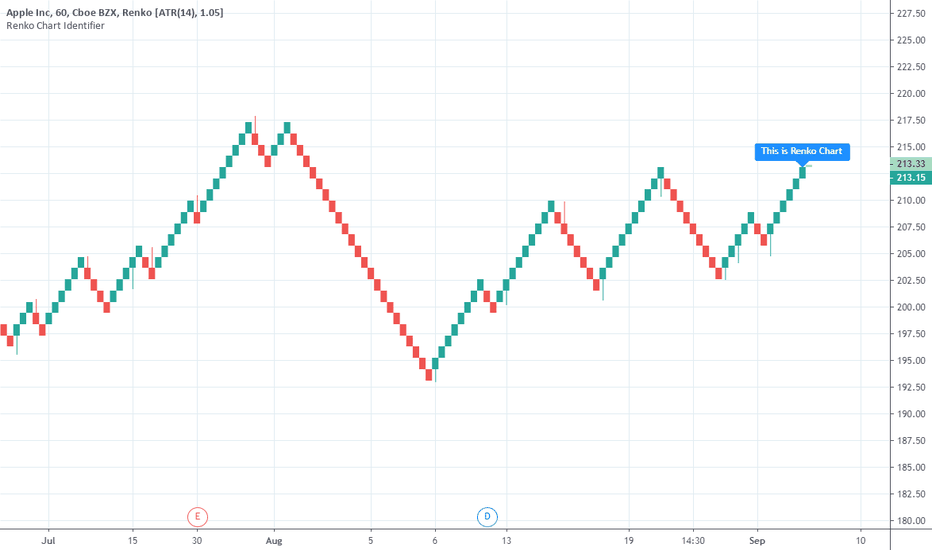

[RESEARCH] Renko Chart IdentifierDespite I am not a big fan of Renko I spent some time to solve a common problem of chart type identification using absolutely obvious technique: Renko bricks have the same size. That's all. Not a cutting-edge maths.

This tool allows to identify:

ATR Renko charts (see ^)

Traditional Renko charts

Here is example for Traditional Renko:

It also works correctly with other chart types:

Classic Candles

Heikin-Ashi

Kagi

PnF

Range Bars

Remember @everget !

And pay attention to the license before use)

Renko Overlay RibbonThis script has been moved to protected from this location

due to mishandling on multiple trading platforms. Since I have proprietary strategies built on this code, it has caused me to make it protected. This is not an Invite Only script anyone can use it, however the source code is no longer visible.

All calculations are performed against calculated Renko bricks form a price chart. The engine that drives this script is complex, but robust. It attempts to garner the order of nested Renko bricks inside a time candle when multiple bricks are produced. I call these "volatile bricks". In a normal Renko chart where tick data is used, this would be displayed as rapid brick production on the screen.

It is important to choose an appropriate time frame when in Traditional mode. Setting the ribbon to 1 pip on EURUSD using a Day chart is not wise, because there is no way to know just how many 1 pip bricks were produced and in which up/down sequence. ATR mode is different because the bricks are constantly changing in size, adapting to the current ATR of the chart time interval.

Please view these old videos taken from the original page for questions on why this indicator was created in the first place:

My strategy built on this indicator can be found here:

Multiple indicators based on renko bricks on time charts can be found here (they also work on renko charts in Trading View). These are special scripts that use this indicator as the engine to generate indicators "as if" you were operating on a Renko chart.

PM for questions, enjoy.

Renko Weis Wave VolumeA volume bulls vs bears power indicator that is based entirely on Wyckoff Weis Wave Volume trends. This indicator is part of my DIVINE series RENKO indicators that run on an engine capable of extracting Renko brick information from a time series. As with the Renko RSI and Renko Trend Momentum indicators, swapping between Renko and time series type charts(bar, candlestick , heikin ashi) is seamless.

The algorithm uses the cumulative volume sum during the lifetime of a Renko brick formation. It tries hard to dissect and distribute volume when multiple bricks are formed during a single time candle (bar, candlestick , heikin ashi). Both positive and negative volume are plotted simultaneously, so that any instance where multiple bricks are created in a single time candle, positive and negative volume will be shown.

4 color themes as with all of the other DIVINE series indicators and strategies.

Shows ares of accumulation, distribution, capitulation. volatility .

Shows volatile brick locations with counts that indicate the number of nested bricks that were contained in a single time based candle.

Works well with Renko Price Bars Overlay script.

Reference to explanation of volatile brick information tips.

All feature requests are welcome. PM for access.

RSI-RENKO Divine StrategyLive, non-repainting strategy using RENKO and RSI mixed together to multiple types of long and short positions.

- Features -

Live entry direction with trade warnings and alerts

Live trade building buy and sell limits (for buy/sell limits)

Entry location icons as well as pyramid entries (to add to existing position)

Swing trades that keep you in the trade for the maximum possible profit

1 scalp target based on the RSI settings and entry location

Dynamic trailing stop for swings and scalps

Alert conditions for every update and condition change of the strategy (Provided by indicator study)

4 pre-built color themes, including candlestick coloring

This script is used solely for alerts to the RSI-RENKO Divine Strategy , because Trading View still after 3 years of requesting does not provide the ability to use alert conditions inside a strategy script, only an indicator script. This strategy should be used to backtest your settings. Beyond alerts and strategy inputs, the strategy and indicator are identical.

RSI-RENKO Divine Strategy (Backtesting)Live, non-repainting strategy using RENKO and RSI mixed together to multiple types of long and short positions.

- Features -

Live entry direction with trade warnings and alerts

Live trade building buy and sell limits (for buy/sell limits)

Entry location icons as well as pyramid entries (to add to existing position)

Swing trades that keep you in the trade for the maximum possible profit

1 scalp target based on the RSI settings and entry location

Dynamic trailing stop for swings and scalps

Alert conditions for every update and condition change of the strategy (Provided by indicator study)

4 pre-built color themes, including candlestick coloring

This strategy is best used with the companion indicators: Renko RSI and Renko Trend Momentum using the identical RSI and Trend settings.

The linked script is identical and used solely for alerts, because Trading View still after 3 years of requesting does not provide the ability to use alert conditions inside a strategy script, only an indicator script. This strategy should be used to backtest your settings.

The approach to this strategy uses several parallel trades of different types. In order to generate multiple trade types the "pyramid trades" setting of the strategy (second tab of the settings that lets you adjust the number of pyramid contracts) should be used.

- Trade Types -

Swing: This trade is entered on the solid arrows after the RSI has become oversold or overbought. It is key that all trades wait for some degree of pullback before entering, even after the trend flips between positive and negative. This trade is held until stopped out or an opposite trade is triggered that reverses the position.

Scalp: These trades have a limit buy/sell entry and a target. The initial target is the opposing RSI overbought or oversold level and changes in real time.

Turning on/off the different trade types (strategy only) is simple done by decreasing the number of contracts used for that trade type to zero. When the quantity is set to zero, that trade is not considered.

- Session -

The session filter is used to narrow trade executions by only allowing trades that are inside the session boundaries. This can be used to isolate the London or New York session for example. The default is 24 x 7 which filters no trades (Trading View has a bug when resetting this, so simply reset the indicator to get it back to 24x7).

Please see the following 3 videos introducing the concept of this strategy.

All feature requests or bug reports are welcome either by direct messaging or comments on this page or the linked indicator page.

Please PM for access. Cheers.

Renko RSIThe goal of this indicator is to plot the RSI values "as if" the chart is a true price action based Renko chart. It can be used on a time series chart or Renko series chart. The RSI is derived from the raw price action of a time-based chart, where the historic and live price is clustered into Renko bricks. The Renko brick production algorithm is entirely backed by Renko Price Bars Overlay and thoroughly tested.

The algorithm takes into account rapid brick production within a single time candle and adjusts accordingly. The output may vary slightly between different chart time frames for the same indicator settings, but this is due to the lack of price fluctuation visibility that can occur in higher chart time frames. If the brick tick size is low, an appropriate chart interval should be selected that maximizes the amount of price volatility visible to the indicator. A bad setting would be something like a 1 tick EURUSD Renko setting on an H4 chart, there simply is no way to derive the exact and ordered price fluctuations in a single H4 candle, 1 pip at a time. A more appropriate chart time frame would be 1-3 minutes for this selected Renko brick size.

Plots user specified RSI based on Renko bricks. This would be the same (or very close to) the RSI viewed on a normal Renko chart based on price action alone.

Works well with Renko Price Bars Overlay script.

See also: Renko Trend Momentum