Briz Parabolic SAR Party Indicator A ridiculous amount of parabolic SARs at different locked time frames with moving fast, slow, and med SAR.

SAR

Cradle zone with BBand & SARHi All,

I have combined a number of indicators all into this 1 option.

It has the following:

> The Cradle zone represents a methodology to using the 10 and 20 EMA's at your selected time-frame.

Where the shading between the 10 and 20 EMA is green for an uptrend and red for a downtrend.

Default EMAs

10, 12, 20, and 50

> Those who are familiar using the Cradle method will find this option convenient.

> I have also added the Bollinger Band and Parabolic SAR as additional options to this item, to help give additional information by default.

Good luck with your trading strategy.

Please don't forget to give me a tick\like, as I would appreciate it.

Regards,

S.Sari /CryptoProspa

Grover Llorens Activator [alexgrover & Lucía Llorens] Trailing stops play a key role in technical analysis and are extremely popular trend following indicators. Their main strength lie in their ability to minimize whipsaws while conserving a decent reactivity, the most popular ones include the Supertrend, Parabolic SAR and Gann Hilo activator. However, and like many indicators, most trailing stops assume an infinitely long trend, which penalize their ability to provide early exit points, this isn't the case of the parabolic SAR who take this into account and thus converge toward the price at an increasing speed the longer a trend last.

Today a similar indicator is proposed. From an original idea of alexgrover & Lucía Llorens who wanted to revisit the classic parabolic SAR indicator, the Llorens activator aim to converge toward the price the longer a trend persist, thus allowing for potential early and accurate exit points. The code make use of the idea behind the price curve channel that you can find here :

I tried to make the code as concise as possible.

The Indicator

The indicator posses 2 user settings, length and mult , length control the rate of convergence of the indicator, with higher values of length making the indicator output converge more slowly toward the price. Mult is also related with the rate of convergence, basically once the price cross the trailing stop its value will become equal to the previous trailing stop value plus/minus mult*atr depending on the previous trailing stop value, therefore higher values of mult will require more time for the trailing stop to reach the closing price, use higher values of mult if you want to avoid potential whipsaws.

Above the indicator with slow convergence time (high length) and low mult.

Points with early exit points are highlighted.

Usage For Oscillators

The difference between the closing price and an overlay indicator can provide an oscillator with characteristics depending on the indicators used for differencing, Lucía Llorens stated that we should find indicators for differencing that highlight the cycles in the price, in other terms : Price - Signal , where we want to find Signal such that we maximize the visibility of the cycles, it can be demonstrated that in the case where the closing price is an additive model : Trend + Cycles + Noise , the zero lag estimation of the Trend component can allow for the conservation of the cycle and noise component, that is : Price - Estimate(Trend) , for example the difference between the price and moving average isn't optimal because of the moving average lag, instead the use of zero lag moving averages is more suitable, however the proposed indicator allow for a surprisingly good representation of the cycles when using differencing.

The normalization of this oscillator (via the RSI) allow to make the peak amplitude of the cycles more constant. Note however that such method can return an output with a sign inverse to the one of the original cycle component.

Conclusion

We proposed an indicator which share the logic of the SAR indicator, that is using convergence toward the price in order to provide early exit points detection. We have seen that this indicator can be used to highlight cycles when used for differencing and i don't exclude publishing more indicators based on this method.

Lucía Llorens has been a great person to work with, and provided enormous feedback and support while i was coding the indicator, this is why i include her in the indicator name as well as copyright notice. I hope we can make more indicators togethers in the future.

(altho i was against using buy/sells labels xD !)

Thanks for reading !

$ SuPeR-RePaNoCHa $ [Alerts]Script for automatic trading (Alerts). This is the second part of the previous RePanoCHa script but with Take Profit.

It Use 6 indicators + volume:

-JURIK MOVING AVERAGE

-RANGE FILTER (DONOVAN WALL)

-ADX (ORIGINAL VERSION)

-PARABOLIC SAR

-RSI + VOLUME WEIGHTED (LAZYBEAR)

-MACD

-VOLUME

To close the position you can choose between Take Profit only, Trailing Stop only or both at the same time.

Example of bot syntax: (alerts once per bar)

LONG | e=BINANCEFUTURES a=ACCOUNT s=BTCUSDT c=order | delay=1 | e=BINANCEFUTURES a=ACCOUNT s=BTCUSDT c=position b=short t=market ro=1 | delay=1 | e=BINANCEFUTURES a=ACCOUNT s=BTCUSDT b=long q=100% t=market | delay=1 | e=BINANCEFUTURES a=ACCOUNT s=BTCUSDT c=position b=long p=0.7% q=50% t=post ro=1

SHORT | e=BINANCEFUTURES a=ACCOUNT s=BTCUSDT c=order | delay=1 | e=BINANCEFUTURES a=ACCOUNT s=BTCUSDT c=position b=long t=market ro=1 | delay=1 | e=BINANCEFUTURES a=ACCOUNT s=BTCUSDT b=short q=100% t=market | delay=1 | e=BINANCEFUTURES a=ACCOUNT s=BTCUSDT c=position b=short p=-0.7% q=50% t=post ro=1

LONG TP | e=BINANCEFUTURES a=ACCOUNT s=BTCUSDT c=position q=50% t=market ro=1 (if you set the TP from entry this alert is not necessary)

SHORT TP | e=BINANCEFUTURES a=ACCOUNT s=BTCUSDT c=position q=50% t=market ro=1 (if you set the TP from entry this alert is not necessary)

LONG TS | e=BINANCEFUTURES a=ACCOUNT s=BTCUSDT c=position q=10% t=market // (alerts once per minute)

SHORT TS | e=BINANCEFUTURES a=ACCOUNT s=BTCUSDT c=position q=10% t=market // (alerts once per minute)

XLONG/STOP-LOSS | e=BINANCEFUTURES a=ACCOUNT s=BTCUSDT c=order | delay=1 | e=BINANCEFUTURES a=ACCOUNT s=BTCUSDT c=position b=long t=market ro=1

XSHORT/STOP-LOSS | e=BINANCEFUTURES a=ACCOUNT s=BTCUSDT c=order | delay=1 | e=BINANCEFUTURES a=ACCOUNT s=BTCUSDT c=position b=short t=market ro=1

Bundle of various indicators, All-in-oneThis scripts compiles many indicators into one. It comes from many sources and i added all sources i used. If i forgot one, don't hesitate to message me.

This is useful if you need to setup your chart layout fast. The menu makes it easy to configure it.

You can configure and display:

- Various types of moving averages: RMA, SMA , EMA , WMA , VWMA , SMMA , HullMA, LSMA , DEMA , TEMA

- Stochastic RSI crosses from multi-timeframes directly on candle's close (1h, 4h, D, W)

- Bollinger bands with primary and secondary deviation

- SAR

- Color background using difference between Stochastic RSI K and D

- Support and resistance

- Open high low close from higher timeframes (D, W, M)

- Auto fibonacci levels (still a work in progress, i will add logarithmic fibonacci levels too later)

- "Alt season" for crypto users: if BTC dominance cross his SMA , display a pictogram on every chart

Stil working on:

- Auto fibonacci levels: i will add logarithmic fibonacci levels

- Stochastic crosses

- Alt season: use others types of moving averages

If you have any suggestions / improvements, feel free to message me or write it in the comments below.

Peterbolic SAR - ColorbarIndicator with buy/sell alerts for setup/trigger conditions

Built upon Peterbolic SAR current version as of publishing

Peterbolic SARThe Peterbolic SAR indicator is based on Peter Brandt's 3 Day Trailing Stop Rule. The yellow triangles indicate setup candles, and the green and red triangles represent trigger candles to buy and sell, respectively.

Sawcruhteez asked me to create the code for this SAR. Gabriel Harber came up with the name for the SAR. Peter Brandt gave his permission to use his name.

For more information, see Sawcruhteez Streamz: Live Coaching Sessionz with Gabriel Harber - Trading Peterbolic SAR

and Peter Brandt's original description of the 3DTSR

ENVELOPE BOLLINGER KELTN IMPULSE EMA SMA SAFEZONE SAR CHANDELIERALL THIS ALL IN ONE!

there are many options to check or uncheck to show only the tool that you need at that particular moment.

ENJOY!

ENVELOPE BOLLINGER KELTNER IMPULSE EMA SMA SAFEZONE SAR CHANDELIER

SmartSARSAR signal filtered by 3 indicators: MACD, AC, RVI.

This combination of trend indicator(SAR), 2 oscillators (MACD, RVI) , and 1 Bill Williams (AC) give us good Enter point.

Recommended timeframes: from 30 min and higher.

RePaNoCHa V4 [Alerts]Script for automatic trading with Alerts.

LG --> Long (green: not confirmed) (lime: confirmed)

ST --> Short (maroon: not confirmed) (red: confirmed)

TS --> Trailing Stop

xL --> Close Long Position

xS --> Close Short Position

SL --> Stop Loss

The trailing stop closes the trade if the price changes direction by a specified percentage or offset. There is no ideal distance because markets and price are always changing and we know that is impossible to exit on the top or bottom. This script interpolate the trailing Stop Offset with profit, higher profit --> higher Trailing Stop Offset. Despite this, it's difficult to catch the price but not impossible. It has a TS delay too. It take a snapshot every X seconds, if the TS is activated the alert is triggered, otherwise the price keeps fluctuating until a new snapshot.

It can be easily converted to Backtest. Just delete "//" on the corresponding part.

Default settings for XBT:USD at 1H.

Lucid SARI wrote this script after having listened to Hyperwave with Sawcruhteez and Tyler Jenks of Lucid Investments Strategies LLC on July 3, 2019. They felt that the existing built-in Parabolic SAR indicator was not doing its calculations properly, and they hoped that someone might help them correct this. So I tried my hand at it, learning Pine Script as I went. I worked on it through the early morning hours and finished it by 4 am on July 4, 2019. I've added a few bits of code since, adding the rule regarding the SAR not advancing beyond the high (low) of the prior two candles during an uptrend (downtrend), but the core script is as it was.

This code is open source under the MIT license. If you have any improvements or corrections to suggest, please send me a pull request via the github repository github.com

For more details on the initial script, see

Sawcruhteez from Lucid Investment Strategies wrote the following description of the Parabolic SAR, where the quotes are from Section II of J. Welles Wilder, Jr.'s book New Concepts in Technical Trading Systems (1978)

--------------------------------------------------------------------------------------------------------------------------

Parabolic SAR

"The Parabolic Time / Price System derives its name from the fact that when charted, the

pattern formed by the stops resembles a parabola, or if you will, a French Curve. The system

allows room for the market to react for the first few days after a trade is initiated and then the

stop begins to move up more rapidly. The stop is not only a function of price but also a function

of time .

"The stop never backs up. It moves an incremental amount each day, only in the direction which

the trade has been initiated."

"The stop is also a function of price because the distance the stop moves up is relative to the

favorable distance the price has moved... specifically, the most favorable price reached since the

trade was initiated."

A. The calculation for a bullish Parabolic SAR is:

Tomorrow’s SAR = Today’s SAR + AF(EP - Today’s SAR)

"Acceleration Factor (AF) is one of a progression of numbers beginning at 0.02 and ending at

0.20. The AF is increased by 0.02 each period that a new high is made" (if long) or new low is

made (if short).

EP is the "Extreme Price Point for the trade made so far. If Long , EP is the extreme high price for

the trade; if Short , EP is the extreme low price for the trade.”

Most websites will provide the above calculation for the Parabolic SAR but almost all of them

leave out this crucial detail:

B. "Never move the SAR into the previous day’s range or today’s range

"1. If Long , never move the SAR for tomorrow above the previous day’s low or

today’s low . If the SAR is calculated to be above the previous day’s low or

today’s low, then use the lower low between today and the previous day as

the new SAR. Make the next days calculations based upon this SAR.

"2. If Short , never move the SAR for tomorrow below the previous day’s high or

today’s high . If the SAR is calculated to be below the previous days’ high or

today’s high, then use the higher high between today and the previous day

as the new SAR. Make the next days calculations based upon this SAR."

When a Bullish SAR is broken then it gets placed at the SIP (significant point) of the prior trend.

In otherwords it is placed above the current candle and at the price that was the SIP.

The inverse is true for the first Bullish SAR.

"This system is a true reversal system; that is, every stop point is also a reverse point." If breaking

through a bearish SAR (one above price) that simultaneously signals to close a short and go

long.

Casey's Parabolic SARI whipped together this script after having listened to Hyperwave with Sawcruhteez and Tyler Jenks in the evening on July 3, 2019. They felt that the existing Parabolic SAR was not doing its calculations properly, and they hoped that someone might help them correct this. So I tried my hand at it, learning Pine as I went. I don't know if this script works properly (so don't use it!), but it does show a trend change on the weekly this week as it apparently should. I'm making the script public so that Sawcruhteez and Tyler Jenks can take a look at it.

MIT License

Copyright (c) 2019 Casey Bowman

Permission is hereby granted, free of charge, to any person obtaining a copy

of this software and associated documentation files (the "Software"), to deal

in the Software without restriction, including without limitation the rights

to use, copy, modify, merge, publish, distribute, sublicense, and/or sell

copies of the Software, and to permit persons to whom the Software is

furnished to do so, subject to the following conditions:

The above copyright notice and this permission notice shall be included in all

copies or substantial portions of the Software.

THE SOFTWARE IS PROVIDED "AS IS", WITHOUT WARRANTY OF ANY KIND, EXPRESS OR

IMPLIED, INCLUDING BUT NOT LIMITED TO THE WARRANTIES OF MERCHANTABILITY,

FITNESS FOR A PARTICULAR PURPOSE AND NONINFRINGEMENT. IN NO EVENT SHALL THE

AUTHORS OR COPYRIGHT HOLDERS BE LIABLE FOR ANY CLAIM, DAMAGES OR OTHER

LIABILITY, WHETHER IN AN ACTION OF CONTRACT, TORT OR OTHERWISE, ARISING FROM,

OUT OF OR IN CONNECTION WITH THE SOFTWARE OR THE USE OR OTHER DEALINGS IN THE

SOFTWARE.

SMA/pivot/Bollinger/MACD/RSI en pantalla gráficoMulti-indicador con los indicadores que empleo más pero sin añadir ventanas abajo.

Contiene:

Cruce de 3 medias móviles

La idea es no tenerlas en pantalla, pero están dibujadas también. Yo las dejo ocultas salvo que las quiera mirar para algo.

Lo que presento en pantalla es la media lenta con verde si el cruce de las 3 marca alcista, amarillo si no está claro y rojo si marca bajista.

Pivot

Normalmente los tengo ocultos pero los muestro cuando me interesa. Están todos aunque aparezcan 2 seguidos.

Bandas de Bollinger

No dibujo la línea central porque empleo la media como tal.

Parabollic SAR

Lo empleo para dibujar las ondas de Elliott como postula Matías Menéndez Larre en el capítulo 11 de su libro "Las ondas de Elliott". Así que, aunque se puede mostrar, lo mantengo oculto y lo que muestro es dónde cambia (SAR cambio).

MACD

No está dibujado porque necesitaría sacarlo del gráfico.

Marco en la parte superior cuándo la señal sobrepasa al MACD hacia arriba o hacia abajo con un flecha indicando el sentido de esta señal.

RSI

Similar al MACD pero en la parte inferior.

Probablemente, programe otro indicador para visualizar en una ventanita MACD, RSI y volumen todo junto. El volumen en la principal hay veces que no te permite ver bien alguna sombra y los otros 2 te quitan mucho espacio para graficar si los tienes permanentemente en 2 ventanas separadas.

Parabolic SARThis is a redesign of the built-in Parabolic SAR indicator. I added a proper input system, an option to highlight initial points for both lines and an option to choose points width. So, customize it as you want.

Parabolic SAR was originally developed by J. Welles Wilder and described in his book "New Concepts in Technical Trading Systems" (1978). It is a trend-following indicator that can be used as a trailing stop loss.

To know which settings for PSAR are the most profitable on your instrument and timeframe you can use this tool

Profitable Parabolic SAR

LINEdicator - Trendanalysis toolThis indicator creates an trend channel based on an EMA/SMA combo and a Parabolc SAR indicator.

Watch for the peaks and the size of the red/green channel for possible trend change.

Can also be used as an Entry/Exit/Stop-Loss setting tool.

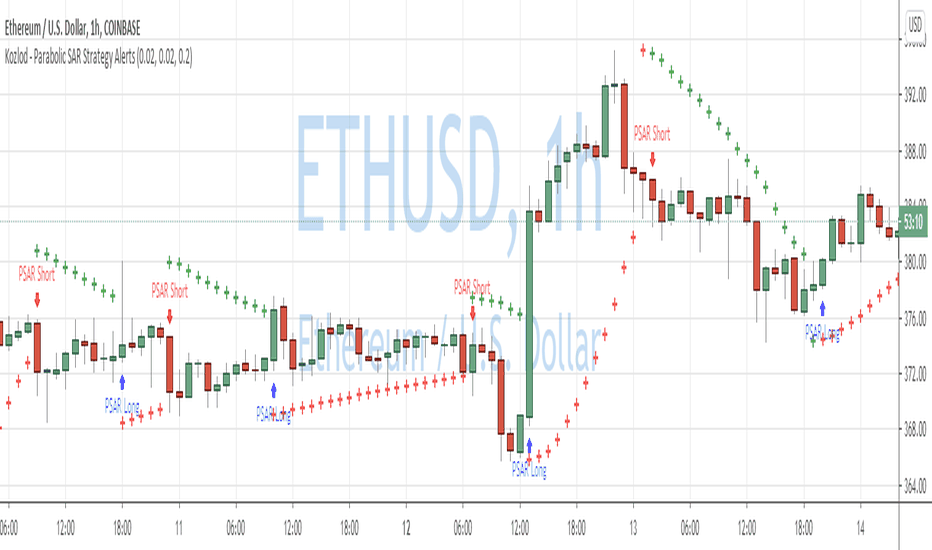

Kozlod - Parabolic SAR Strategy AlertsAlerts for standard Parabolic SAR Strategy.

It works best with "Once per bar" option.

FLT - Fully Loaded TacoThis is a very full indicator.

NOTICE: By default, ALL indicators are turned off in the settings, except for the Bollinger Band, in order to facilitate faster load times.

Features can easily be turned on/off in the settings. You can have as many or as few as you want.

FEATURE LIST:

3 SMAs (Fast, Medium, Slow)

3 EMAs (Fast, Medium, Slow)

Support & Resistance Lines (Lime Color)

Parabolic Support & Resistance (Red dots above, Blue dots below)

Keltner Channel (purple channel lines)

Bollinger Band (Blue Cloud; Center & Borders hidden by default)

TTM Squeeze (Purple Background Color on Chart)

VWAP (Vibrant Blue Glowing Line, Intraday Only)

Fibonacci Retracement (Multicolor, Intraday Only)

Ichimoku Cloud (Standard Colors)

Hull Moving Average + Bollinger BandsThis study make use of Hull Moving Average and Bollinger Bands.

The crosses give signal about HMA and BB crossovers, they are a bit lagging, if you stare well you will spot them a little earlier. It look like a good idea to buy and sell when HMA is near or on the outside of the outer bands.

By default the Bollinger Bands uses Simple Moving Average with 21 periodes, and Hull Moving Average use 9 periodes. You can alter the settings in the format dialog.

Please use as pleased, and if you do something clever with it I'll be happy to know :D

All indicators in one!All indicators in one!

Hull MA (2 colors) + Bollinger Bands + 6 EMA + 50 SMA + 200 SMA + Parabolic SAR + SUPER TREND (2 colors) + Doji signals (yellow)

Analyse Technique Dynamique - All In One - v1.0Based upon "ATD" strategy.

This is just a "all in one" indicator

"SAR" code provided by Chris Moody with adaptations

French resources

www.financegalaxie.fr

www.financegalaxie.fr