AAVE Daily Chart – Key Buy Zone & Two ScenariosAAVE is currently moving within a well-defined ascending channel on the daily timeframe. The last major bullish leg began from the $120 support and surged nearly +180% to a local high near $330.

Now, after a 25% pullback, price is consolidating around the midline of the channel near $250. More importantly, there’s a strong bullish order block sitting between $220–230, making this a low-risk buy zone with a stop below the order block.

🔸 Scenario 1 (bullish preferred):

Price dips into the $220 OB zone, completes a possible ABC correction, and launches a new bullish leg targeting the channel top above $500.

🔸 Scenario 2 (bearish alternate):

If the $220 order block fails, deeper correction could follow toward the channel bottom near $135.

⏳ This is a critical area to watch for reaction – Smart Money will likely show its hand soon.

🔗 Analysis by CryptoPilot

AAVEUSDT trade ideas

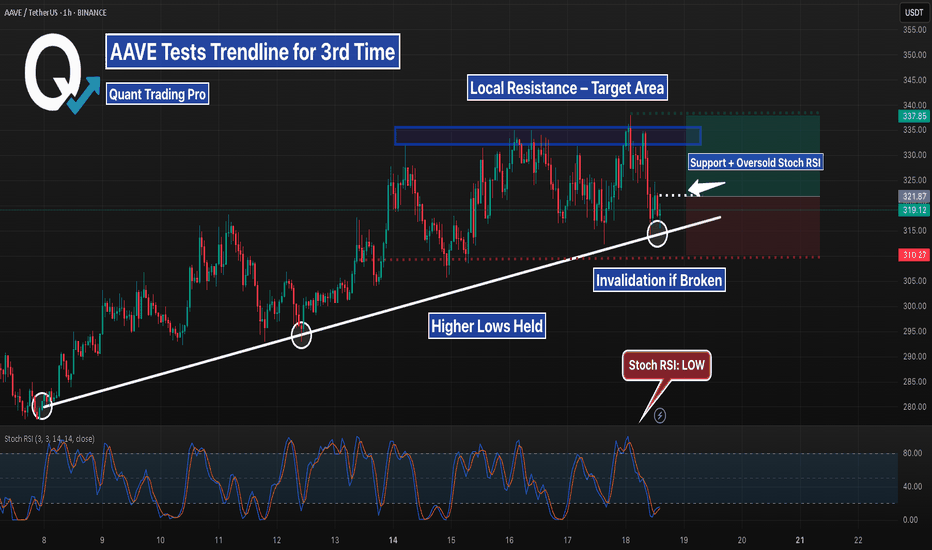

AAVE 1H – Triple Tap Support + Bullish Divergence Incoming?AAVE is painting a compelling reversal setup on the 1H timeframe. After a sharp selloff last week, price has tapped the $278–282 demand zone multiple times — each time printing higher local lows on the Stochastic RSI and showing signs of exhaustion from sellers.

This zone has now been tested three separate times, forming what looks like a triple-bottom structure. During the latest retest, Stochastic RSI is deeply oversold and beginning to curl up — suggesting that momentum may shift in favor of the bulls soon.

We’re also approaching the apex of a descending trendline, meaning compression is reaching its limit. A clean break and reclaim above $290 could be the first real sign of trend reversal, with a potential target near the previous range highs around $335 if momentum follows through.

📊 Why This Setup Matters:

– Strong historical support zone with visible reactions

– Repeated seller failure to break the zone cleanly

– RSI bullish divergence building beneath structure

– Clear invalidation level below support

– Risk-reward skewed in favor of a bounce play

This isn’t confirmation yet — but it’s definitely a chart worth watching closely over the next session. If bulls step in with volume, this could catch momentum fast.

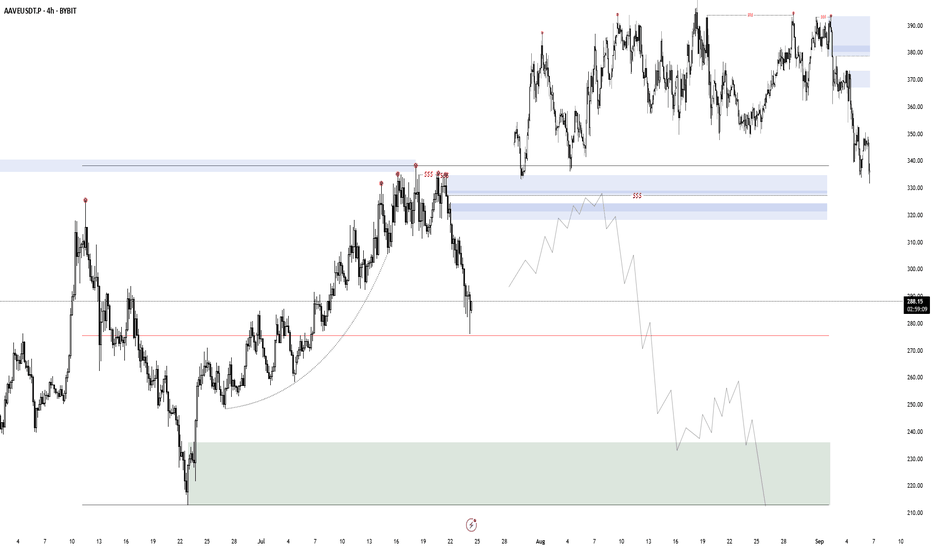

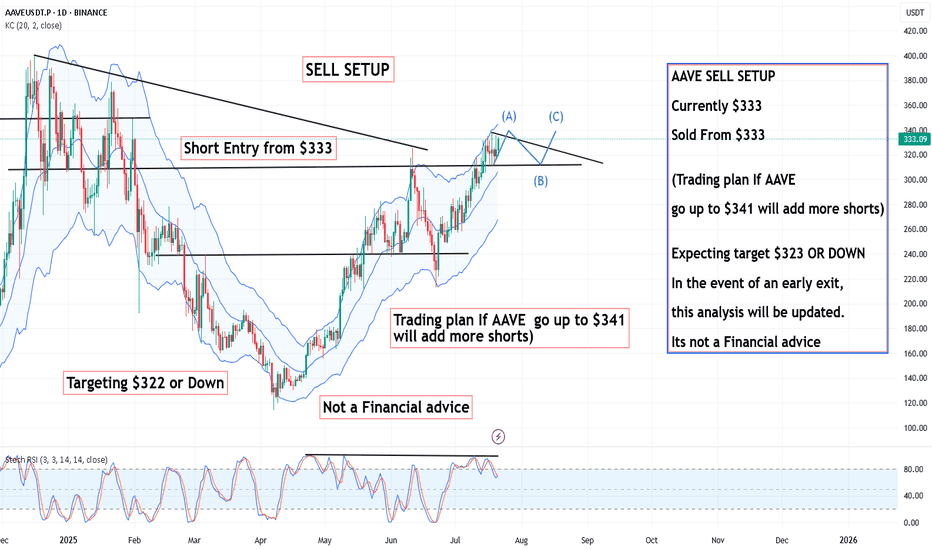

Aave (AAVE): Sellers Taking Over | Looking For Bearish CME FillAave caught our attention with current sell-side dominance, which might lead to a breakdown from the local neckline zone, which then again will lead the price towards the bearish CME gap (to fill it).

What we are looking here is a proper breakdown; after that, we want to see steep movement to lower zones and then a proper MSB to form (which would give us a buy entry)

Swallow Academy

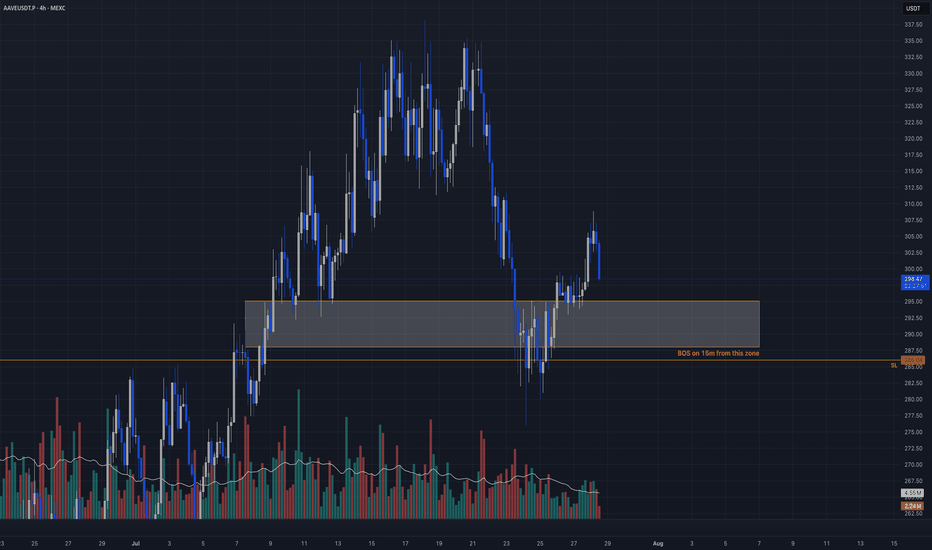

AAVE Reversal + Breaker Block Retest + BOS TriggerCandle Craft fam — we’re watching a sharp reclaim play unfold on AAVEUSDT.P (4H). After a hard drop and sweep of structure, price has returned to a demand zone that’s already printed bullish intent on the lower timeframes.

Now it’s all about precision and confirmation.

⸻

📈 Bias: Long

🧠 Strategy: Reversal + Breaker Block Retest + BOS Trigger

📍 Entry Plan:

▫️ Entry Zone: 288.00 – 294.50 (watch M15 for BOS inside zone)

🛡️ Stop Loss: 286.00

🎯 Take Profits:

• TP1: 305.00

• TP2: 318.00

• TP3: 330.00+

⸻

🧠 Why This Trade?

– BOS confirmed on M15 after reclaim of breaker block

– Price swept structure then bounced — bullish shift

– Demand zone has volume support + previous reaction

– HTF shows reversal potential off strong base

⚠️ Execution note: Wait for M15 confirmation again on re-entry into zone → CHoCH/BOS + volume

⸻

This isn’t the first leg. It’s the reload.

Let structure confirm the story.

—

Candle Craft | Signal. Structure. Execution.

AAVE 4H – Trendline Bounce Into $300 Resistance, Break or RejectAAVE rallied sharply after defending its ascending trendline and key demand zone near $255. Price is now consolidating around the psychological $300 level, which has acted as resistance in the past. Stoch RSI is approaching oversold, hinting that buyers may attempt another push. A breakout above $310 could target $325+, while losing $290 risks a pullback toward the $260–$255 zone.

AAVEUSDTlet see what will happen my expactation it is. it is doing w and high. there is idm level and below of it exist fvg and order block when you check daily and weekly you will see the level which i mention. There is just one thing it they want to decide this pull back into deeply then right side one tool will be active and i expect that it will make new high for aave

AAVE 1H – Trendline Intact, But Will 271 Support Hold?AAVE has been climbing steadily along its ascending trendline, breaking through key resistance levels and tapping 281+. Price is now pulling back toward the 271–272 support zone, which aligns with the first structural retest and sits just above EMA support.

If buyers defend this area, continuation toward the highs remains likely, keeping the uptrend structure intact. A deeper pullback into the 260 zone would still preserve the broader bullish outlook, but could delay momentum.

Key watchpoints:

– Holding 271–272 for immediate continuation

– Trendline + EMA confluence as strong support

– Stoch RSI reset could fuel next bullish leg

Master MACD Histogram + EMA Filter To Filter Out NoiseThe MACD histogram isn’t just noise — it’s a leading signal for momentum shifts when interpreted correctly. On this AAVE 1H chart, a textbook transition plays out:

– Rising histogram fades → crosses below 0

– EMA filter confirms trend shift

– Strategy flips short at the peak, locks in a +10.76% move

The recent long trigger occurs only after the histogram begins rising, crosses above zero, and price breaks back above the 50/9/3 EMA filter.

💡 Histogram Tips:

– Rising bars = bullish momentum building

– Shrinking bars = momentum weakening

– Crossing the zero line = potential trend reversal

– Best results come when histogram + EMAs align

⚙️ Settings Used:

MACD: 25 / 60 / 220

EMA Filter: 50 / 9 / 3

Entry Mode: Both (Histogram + Crossover Confluence)

📈 Use histogram transitions as an early signal — but always confirm with trend filters to avoid fakeouts.

Aave (AAVE): Aiming For $360-$400 Before Bigger Long SqueezeAave coin has had a good upward movement, and now we are inches away from a major resistance zone where we will be expecting to see some kind of big liquidity movement to lower zones.

RSI is overbought so we are already in dangerous zones, but we are pretty sure that before the big dump, we will reach the resistance zone so for now, this is our target area!

Swallow Academy

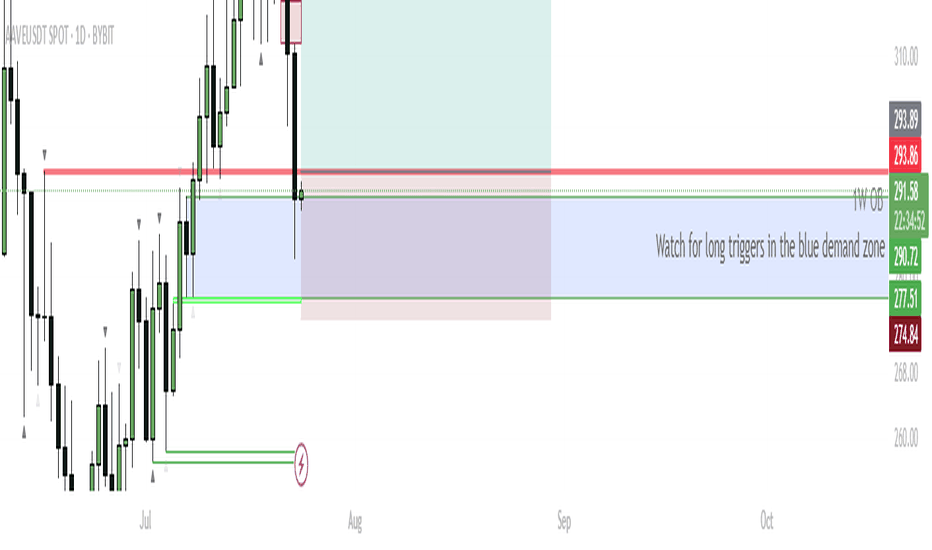

AAVE – Eyeing Reversal From Daily Demand for $400 TargetCurrent Structure:

AAVE recently rejected from 1M S/R at $332.54 and pulled back into a confluence support zone—overlapping 1W order block (OB), 1D OB, and previous resistance now flipped support ($277–$290 zone, marked blue).

Buy Zone:

Watching the blue box area for bullish reversal triggers. This is a high-probability demand zone due to multiple timeframe confluence.

Trigger:

Wait for a bullish reaction/candle confirmation inside the blue zone. Ideal scenario: bullish engulfing, sweep of the low and reclaim, or a strong bounce with rising volume.

Targets:

Primary upside target: retest of the 1M S/R at $332, then continuation toward $400 if momentum sustains.

Invalidation:

If price closes below the 1D OB ($274.84), long setup is invalidated—risk of further downside increases.

AAVE is testing a major support confluence zone, combining weekly and daily order blocks. This area previously acted as resistance and now presents a strong demand zone. If bulls defend this zone and trigger a reversal, there’s a clear runway back to previous highs and potentially $400. This setup offers a favorable risk/reward profile with tight invalidation.

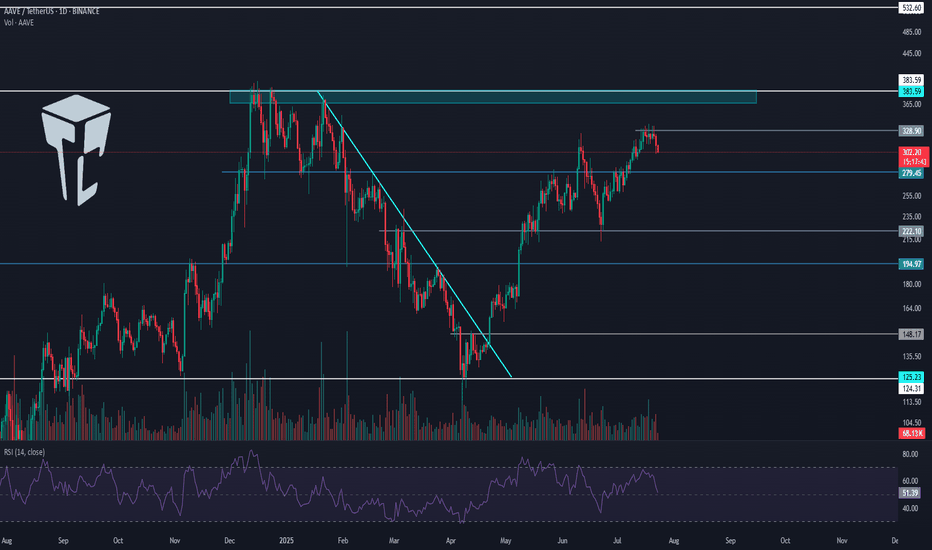

TradeCityPro | AAVE Holds Gains as Altseason Optimism Builds👋 Welcome to TradeCity Pro!

In this analysis, I’m going to review the AAVE coin for you. It’s one of the major DeFi coins active in the lending sector and currently ranks number 1 in terms of TVL.

✔️ The token itself has a market cap of $4.58 billion and is ranked 29 on CoinMarketCap.

📅 Daily Timeframe

On the daily timeframe, since our last analysis, the price has increased by over 100%, and the trigger for long or buy positions was activated.

🔄 There was a descending trendline on this coin, and the trigger for its breakout was 148.17. After breaking that level, we could open a long position.

🚀 However, the main trigger was 194.97, and the primary uptrend started with the break of that level, continuing up to a high of 328.9.

📊 The issue with this current uptrend is that, as you can see in the second leg, there is clear weakness, which is not a good sign for the continuation of this trend.

📈 The current top at 328.9 is not far from the previous high, forming a double top-like structure, leading to a strong bearish divergence in the RSI.

💥 If RSI confirms a breakdown below 50, this divergence will become active and a correction toward 222.10 may occur. A break of that level would be the first signal of a potential trend reversal for AAVE.

⭐ On the other hand, if price wants to continue upward, we have a very important resistance at 383.59.

🔍 Breaking this resistance would initiate an uptrend in higher cycles and could even lead to a new ATH for this coin.

💼 I plan to open a long position if the 328.9 resistance is broken, and for spot purchases, I will wait for a breakout of 383.59.As long as the price remains above 279.45, I am not considering any short positions.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

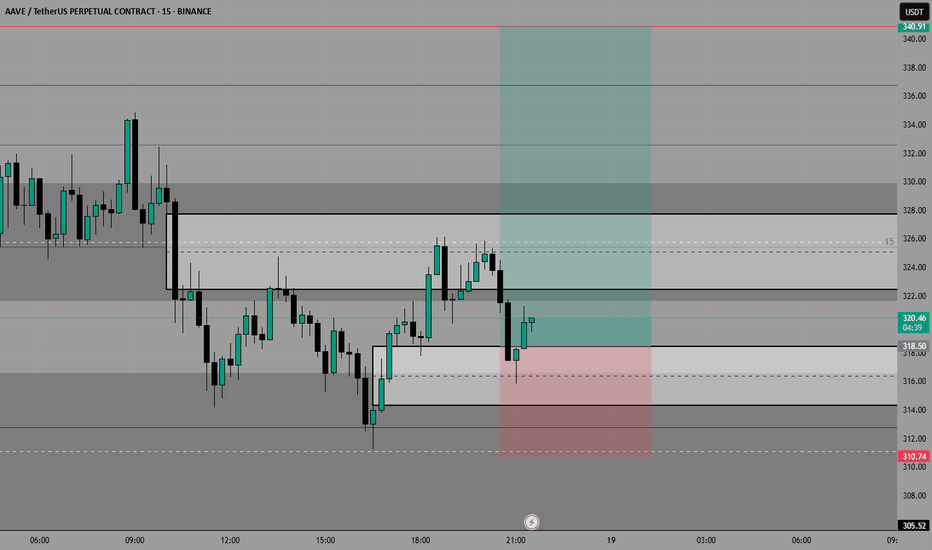

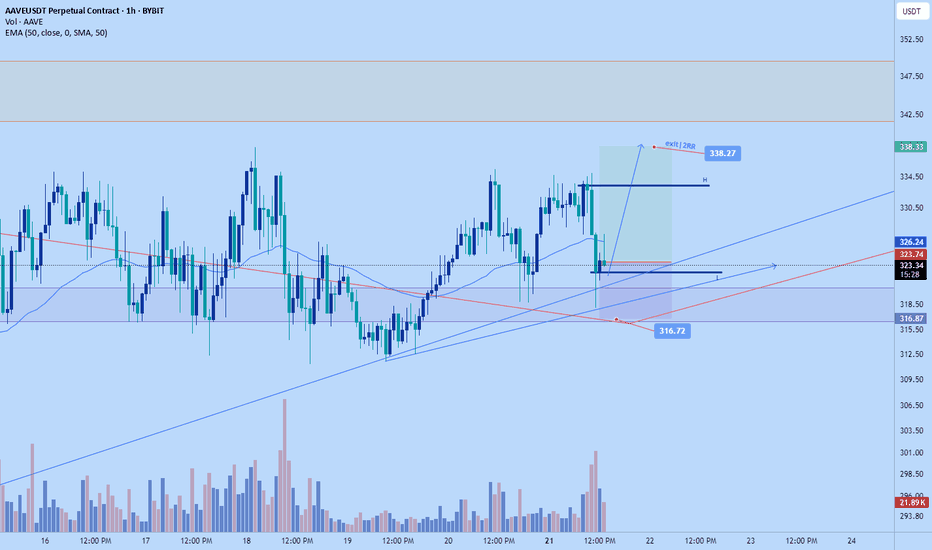

AAve scalp long to $338.27Just now opened a scalp long position on aave. I anticipate that the bulls will attempt to make new highs again soon, we're at at good level and structurally market is likely at a LL point on the hr tf, definitely not a good place to short if I was a bear

Sl: $316.72 good invalidation stop

Roughly 2RR trade.

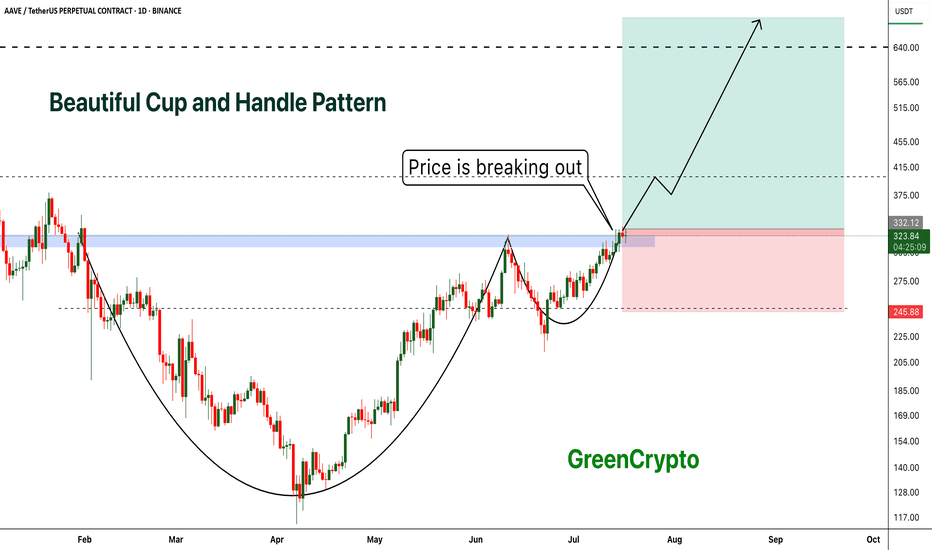

AAVE - Beautiful Cup and Handle Pattern Breakout- AAVE is breaking out from cup and handle pattern finally

- Cup and handle pattern breakout usually results in perfect trend continuation

- A huge long trade opportunity from this

Entry Price: 335 Above

Stop Loss: 245

TP1: 381.89

TP2: 429.16

TP3: 525.94

TP4: 628.78

TP5: 712.89

Max Leverage 5x:

Don't forget to keep stoploss

Cheers

GreenCrypto