keep your eyes on AAVE Hello Traders 🐺

In this idea, I want to talk about AAVE’s price, because in my opinion, there's already a very good buy opportunity in the market. Want to know why?

Stick with me until the end—I promise it’s worth it! 🔥

As you can see, AAVE is already inside a gigantic triangle pattern, which means it’s currently accumulating more and more liquidity for the upcoming Altcoin Season.

Now I know... everyone’s saying:

“There’s no Altcoin Season. We’re still in a bear market. Maybe for another 4 years!”

Come on! 😅

If you understand market psychology and know how the crypto market cycles work, you probably know that we go through 3 major phases.

Let me break it down for you—then I’ll talk about the AAVE price target.

Because if I start with the target now, and you don’t understand where we are in the cycle, you won’t be able to feel the actual conviction to buy or even trade it.

🔄 Phase One: BTC Dominance Rises, BTC Takes the Spotlight

In this phase, everything except BTC suffers. Why?

Because money flows out of other coins and into BTC. That’s why BTC.D goes up sharply.

🔁 Phase Two: BTC.D Corrects, Alts Take the Lead

ETH and Altcoins begin to outperform BTC, at least for 4–5 months in a row.

This is the phase we’re still waiting for… and it's inevitable.

After every downtrend, there’s an uptrend—that’s just how markets work.

Altcoins are heavily undervalued right now, and once BTC.D starts correcting (because it can’t go up forever)—we’ll witness a massive Altcoin Season.

🧠 Phase Three: The Final Pump Before the Bear Market

Everything becomes overbought, and smart money starts distributing before the actual bear market begins.

They sell overvalued assets to non-professional traders and investors.

Brutal? Yes. But real.

To take profit, someone else has to take the loss.

80% of people lose money—but you’re here because you want to be in the top 20%.

And thanks to all of you, we’re building a very strong community. 💪🐺

📉 Now Back to AAVE...

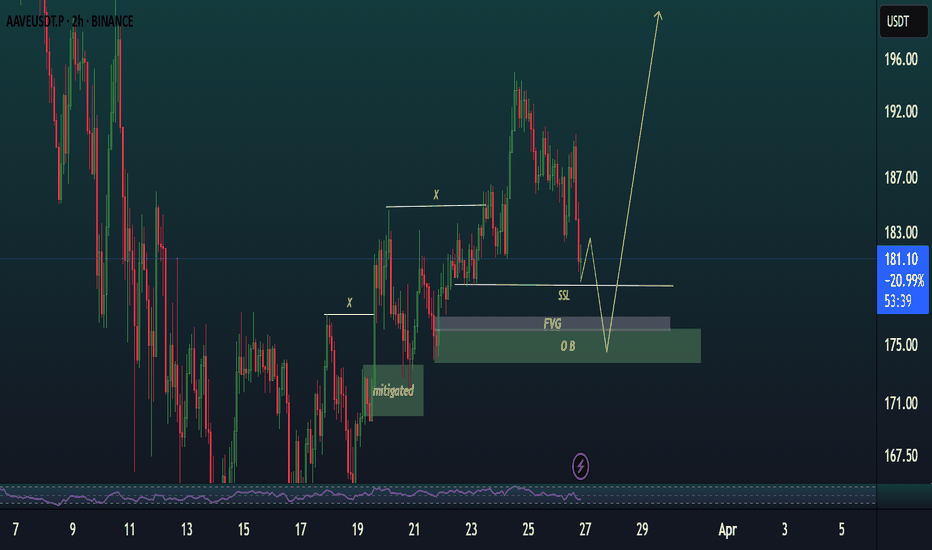

Currently, AAVE is trading inside a falling wedge pattern, which is a bullish setup.

We still haven’t had a lower low, so we can stay bullish and start accumulating AAVE at these levels.

Even if the price dips further, the maximum pain would be around 30%, which is nothing compared to the potential upside.

From here, the market can only go up, and you can hold your AAVE until BTC.D reaches at least 40%, which in my opinion is a good zone to take partial profit. 🎯

Thanks for reading my idea, I hope you enjoyed it—and as always:

🐺 Discipline is rarely enjoyable, but almost always profitable 🐺

🐺 KIU_COIN 🐺

AAVEUSDT trade ideas

Aave Technical AnalyzeTrend: Aave is also following an ascending channel, with the price approaching the lower support.

Support: The green support zone at 150–175 is key. A breakdown could lead to further downside.

Resistance: The resistance at 465–490 is the next major barrier.

Volume: Volume is gradually decreasing, which could signal a pause before a breakout or breakdown.

Price Action: Watch for price testing the lower support. A bounce could target the upper resistance levels, but if it breaks below the green zone, further declines could occur.

AAVE - Amazing PERFECT Signal/TA YesterdayBOOM. 9 % 👌 🎯

Original TA from yesterday :https://www.tradingview.com/chart/AAVEUSDT.P/M3HGP1df-AAVE-Possible-Good-Short/

Follow for more ideas/Signals. 💲

Look at my other ideas 😉

Just donate some of your profit to Animal rights and rescue or other charity :)✌️

AAVE - Possible Good Short I had drawn my lines and marked the blue trend line and box with yellow mark. But i forgot AAVE. Now it has broken the lines like text book and testing it.

High possible Short right here :)

Follow for more ideas/Signals. 💲

Look at my other ideas 😉

Just donate some of your profit to Animal rights and rescue or other charity :)✌️

#AAVE/USDT#AAVE

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, this support is at 161.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 190

First target: 206

Second target: 218

Third target: 237

Aave Update: All-In, Think Long-TermOur last entry for AAVEUSDT was in November 2024 around the 150$ price range. This zone is about to be activated again. It is not fully certain but if it is indeed activated, clearly shown on the chart, there is an opportunity to go All-In, with a high probability of success.

Aave grew nicely, strongly and hit a top of $400. Going back to $150 is a huge correction that amounts to 62%. The actual correction is already really strong, the low at $167 totaled -58%.

Don't look much further down. Do not pin your hopes on forever down, lower lows. The truth is that a strong rise is balanced out by a correction, but a correction is a correction and nothing more. It tends to end in a higher low.

In this chart, I am showing you the long-term buy and support zone. This is the price at which one should go LONG.

First, start with a small amount of lev. As we get closer to the breakout, go All-In. We are getting closer by the day.

We might have only a few days before the next bullish breakout shows up. While there will still be some sideways and consolidation before the rise, once the bottom is gone, it is gone.

It is time to enter the Cryptocurrency market.

The best time to buy is when prices are low.

When in doubt, trade spot. With spot trading you can never go wrong. All you need to do is to buy and hold. In the worst scenario, think long-term.

If you develop a bias towards a waiting time of 1 year or more on every position you take, you will be a winner in this bull-market.

Thank you for reading.

Namaste.

AAve short down to $190 or lowerI just now opened a short position on aave. I anticipate that the market will start breaking back down soon from current prices based on my DTT strategy

Direction, Target and Timing.

Today is Trump bitcoin conference I think, haven't watched it but the PA suggest that we about to head lower so maybe whats being said or what was said is not pleasing for he market.

If you would like to learn more about my DTT strategy, send me a dm, check out my X profile etc.

AAVE price analysisOn the weekly timeframe, the price of CRYPTOCAP:AAVE is being bought off quite actively, leaving “shadows” below

🔼At the moment, it looks like a “subtle hint” that the OKX:AAVEUSDT price may start the 5th wave of growth in the medium term and reach $570-670

Do you believe in such prospects ?

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

Aave: End Of Correction (Update)Several signals are pointing to the current correction being over or reaching its end. AAVEUSDT peaked 16-December 2024. The action has been bearish for 78 days if we consider yesterday's low.

The action pierced the 0.618 Fib. retracement level in relation to the bullish wave that happened from April through December 2024. This is the main support zone for most strong, long lasting, bullish movements.

Trading volume has been rising. There is strong high buy volume. The RSI shows a good reading as support is hit. More than 40 which supports the correction reaching its end.

The market is never in a hurry when it is about to enter a long lasting phase. While the correction can be ending or is over, some sideways (consolidation) can happen before the next advance takes place. See mid-2024 on the left side of the chart.

First the drop. Then sideways (consolidation), followed by slow and steady growth and finally a strong advance. We are entering the second part of this four steps sequence.

Aave is starting to look good and should look much better in the coming months.

Thanks a lot for your continued support.

Namaste.

AAVE Retests Key Support – Bullish Reversal Ahead?CRYPTOCAP:AAVE is currently retesting a rising support line after breaking through a key resistance zone, which has now turned into support.

This structure suggests that the uptrend remains intact, and the recent dip could be a healthy pullback before a continuation to the upside.

DYOR, NFA

AAVEUSDTSo!

1. SUI almost reached at 2.4 as I said. Of course, my position has been opened, but not for the full movement.

2. Should we wait for a bullish movement? If I find many tokens showing a bullish pattern, then yes!

3. On the first impression, For AAVE, as soon as the consolidation is finished, a bullish movement should begin.

4. AVAX hasn’t reached the goal point