Cocoa's Future: Sweet Commodity or Bitter Harvest?The global cocoa market faces significant turbulence, driven by a complex interplay of environmental, political, and economic factors threatening price stability and future supply. Climate change presents a major challenge, with unpredictable weather patterns in West Africa increasing disease risk a

LONG FUTURE CACAO Hello everyone, today I’m sharing my analysis on cocoa futures, as I see an interesting opportunity for an upward move. Below, I’ll break down the reasons behind my bullish bias and my entry strategy. Let’s get into the details!

Why I’m Bullish on Cocoa Futures

Institutional and Retail Activity

My

Cocoa Short: Completed wave 2 (or B) rallyI've previously publish an idea for Cocoa long because of ending diagonal. But it should be clear to an EWer that the down move was a 5-wave structure and thus the long idea was a wave 2 or B idea. Now that we have completed 3-waves up for Cocoa, I think it's time that Cocoa resumes it's down move a

The Cocoa Code - Smart Money is Preparing for a Bullish MoveCocoa is setting up for a long trade upon a confirmed daily bullish trend change.

The fundamentals underlying this market suggest a bullish move of some significance is brewing, and would confirm if we see a daily bullish entry trigger.

Commercials at extreme in long positioning relative to last

Long Idea on CC1! (Cocoa)1)Climate change is having a significant impact on cocoa production in West and Central Africa, according to a study by Wageningen University & Research (WUR). The region accounts for more than 70% of global cocoa production. Changes in temperature and rainfall are making some areas less suitable fo

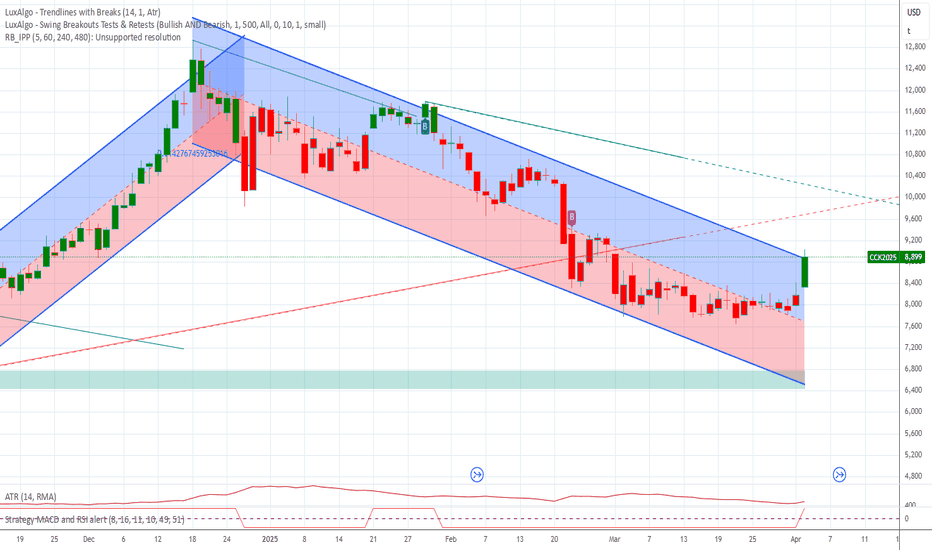

Falling Wedge Pattern: Cocoa FuturesThis is the map of how to trade this rare chart pattern.

This is a textbook sample of Falling Wedge continuation pattern that played out with impressive accuracy.

We have a strong uptrend in 2024 that has been changed

by a large consolidation that took place for the rest of 2024

as it has built the

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.

Related commodities

Frequently Asked Questions

The nearest expiration date for Cocoa CFD is Jun 23, 2025.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell Cocoa CFD before Jun 23, 2025.