Corn Futures ( ZC1!), H4 Potential for Bearish MomentumTitle: Corn Futures ( ZC1! ), H4 Potential for Bearish Momentum

Type: Bearish Momentum

Resistance: 699.50

Pivot: 706.50

Support: 675.00

Preferred case: On the H4 chart, we have a bearish bias. To add confluence to this, price is under the Ichimoku cloud which indicates a bearish market. Overnight price had bearish momentum downwards with price currently trading at 682.75 at time of writing. If this bearish momentum continues, expect price to possibly head towards the support line at 675.00 where the 78.6% Fibonacci projection line and 0% Fibonacci lines are located.

Alternative scenario: Price may go back up and head towards the 1st resistance at 699.50 where the 78.6% and 23.6% Fibonacci lines are located.

Fundamentals: There are no major news.

CORNU2025 trade ideas

Corn Futures ( ZC1!), H4 Potential for Bearish Momentum Title: Corn Futures ( ZC1!), H4 Potential for Bearish Momentum

Type: Bearish Momentum

Resistance: 699.50

Pivot: 706.50

Support: 675.00

Preferred case: On the H4 chart, we have a bearish bias. To add confluence to this, price is under the Ichimoku cloud which indicates a bearish market. Overnight price had bearish momentum downwards with price currently trading at 682.75 at time of writing. If this bearish momentum continues, expect price to possibly head towards the support line at 675.00 where the 78.6% Fibonacci projection line and 0% Fibonacci lines are located.

Alternative scenario: Price may go back up and head towards the 1st resistance at 699.50 where the 78.6% and 23.6% Fibonacci lines are located.

Fundamentals: There are no major news.

Corn Futures ( ZC1!), H4 Potential for Bullish MomentumTitle: Corn Futures ( ZC1! ), H4 Potential for Bullish Momentum

Type: Bullish Momentum

Resistance: 715.25

Pivot: 706.50

Support: 675.00

Preferred case: On the H4 chart, we have a bullish bias. To add confluence to this, price is above the Ichimoku cloud which indicates a bullish market. Overnight price had bullish momentum upwards with price currently trading at 693.2 at time of writing. If this bullish momentum continues, expect price to possibly head towards the Pivot line at 706.4 where the previous high and 100% Fibonacci line are located.

Alternative scenario: Price may go back down to retest the support line at 675.00, where the 100% and 0% Fibonacci lines are located.

Fundamentals: There are no major news.

Corn Futures ( ZC1!), H4 Potential for Bullish Momentum Title: Corn Futures ( ZC1!), H4 Potential for Bullish Momentum

Type: Bullish Momentum

Resistance: 715.25

Pivot: 706.50

Support: 675.00

Preferred case: On the H4 chart, we have a bullish bias. To add confluence to this, price is above the Ichimoku cloud which indicates a bullish market. Overnight price had bullish momentum upwards with price currently trading at 693.2 at time of writing. If this bullish momentum continues, expect price to possibly head towards the Pivot line at 706.4 where the previous high and 100% Fibonacci line are located.

Alternative scenario: Price may go back down to retest the support line at 675.00, where the 100% and 0% Fibonacci lines are located.

Fundamentals: There are no major news.

Corn Futures ( ZC1!), H4 Potential for Bearish Momentum Title: Corn Futures ( ZC1!), H4 Potential for Bearish Momentum

Type: Bearish Momentum

Resistance: 680.25

Pivot: 661.20

Support: 674.00

Preferred case: On the H4 chart, we have a bearish bias. To add confirmation to this bias, price is under the ichimoku cloud which indicates a bearish market. Overnight price had a bearish momentum downwards and closed below the 1st resistance line at 680.25 where the 50% and 38.2% Fibonacci lines are located. Expecting price to continue bearish and head towards the 1st support at 674.00 where the 38.2% Fibonacci line is located.

Alternative scenario: Price may go back up to retest the 1st resistance level

Fundamentals: There are no major news.

Corn Futures ( ZC1! ), H4 Potential for Bullish MomentumTitle: Corn Futures ( ZC1! ), H4 Potential for Bullish Momentum

Type: Bullish Momentum

Resistance: 698.50

Pivot: 661.20

Support: 680.25

Preferred case: On the H4 chart, we have a bullish bias. Overnight price had a small bearish retracement downwards. However, if this overall bullish momentum continues, expect price to continue bullish and head towards the 1st resistance at 698.50 where the previous high and 2 x 100% Fibonacci lines are located.

Alternative scenario: Price may go back down and close below the 1st support line at 680.25 where the 50% and 38.2% Fibonacci lines are located, and head towards the pivot at 661.50, where the previous swing low is located.

Fundamentals: There are no major news.

Corn Futures ( ZC1!), H4 Potential for Bullish MomentumTitle: Corn Futures ( ZC1! ), H4 Potential for Bullish Momentum

Type: Bullish Momentum

Resistance: 698.50

Pivot: 661.20

Support: 680.25

Preferred case: On the H4 chart, we have a bullish bias. Overnight price had a bullish momentum and went above the 1st support line at 680.25 where the 50% and 38.2% Fibonacci lines are located. Expecting price to continue bullish and head towards the 1st resistance at 698.50 where the previous high and 2 x 100% Fibonacci lines are located.

Alternative scenario: Price may go back down and close below the 1st support level and head towards the pivot at 661.50, where the previous swing low is located.

Fundamentals: There are no major news.

Corn Futures ( ZC1!), H4 Potential for Bullish Momentum Title: Corn Futures ( ZC1!), H4 Potential for Bullish Momentum

Type: Bullish Momentum

Resistance: 698.50

Pivot: 661.20

Support: 680.25

Preferred case: On the H4 chart, we have a bullish bias. Overnight price had a bullish momentum and went above the 1st support line at 680.25 where the 50% and 38.2% Fibonacci lines are located. Expecting price to continue bullish and head towards the 1st resistance at 698.50 where the previous high and 2 x 100% Fibonacci lines are located.

Alternative scenario: Price may go back down and close below the 1st support level and head towards the pivot at 661.50, where the previous swing low is located.

Fundamentals: There are no major news.

Corn Futures ( ZC1!), H4 Potential for Bearish MomentumTitle: Corn Futures ( ZC1! ), H4 Potential for Bearish Momentum

Type: Bearish Momentum

Resistance: 680.25

Pivot: 661.20

Support: 654.20

Preferred case: On the H4 chart, we have a bearish bias with price under the Ichimoku cloud which indicates a bearish market, adding confluence to our bias. Price is currently consolidating along the 1st resistance line at 680.25 where the 50% and 38.2% Fibonacci lines are located. Expecting price to continue bearish and head towards the pivot at 661.2 where the previous low, 100% Fibonacci line and 78.6% Fibonacci projection lines are located.

Alternative scenario: Price may go back up and close above the 1st resistance level and head towards the 2nd resistance line where the previous swing high is located.

Fundamentals: There are no major news.

Corn Futures ( ZC1!), H4 Potential for Bearish Momentum Title: Corn Futures ( ZC1!), H4 Potential for Bearish Momentum

Type: Bearish Momentum

Resistance: 680.25

Pivot: 661.20

Support: 654.20

Preferred case: On the H4 chart, we have a bearish bias with price under the Ichimoku cloud which indicates a bearish market, adding confluence to our bias. Price is currently consolidating along the 1st resistance line at 680.25 where the 50% and 38.2% Fibonacci lines are located. Expecting price to continue bearish and head towards the pivot at 661.2 where the previous low, 100% Fibonacci line and 78.6% Fibonacci projection lines are located.

Alternative scenario: Price may go back up and close above the 1st resistance level and head towards the 2nd resistance line where the previous swing high is located.

Fundamentals: There are no major news.

Corn is coiling for a breakout Six weeks of consolidation is setting up Corn futures for a potential breakout. Supply side issues including downgraded USDA data , an even lower crop estimate from the Pro Framer tour , potential lack of storage and barge backups

all point to a bullish explosion to the up side . On the demand side global "demand destruction" rumors abound , global exports being curtailed and a recession on the horizon?? what of the US Dollar? Will Brent Johnson's milkshake theory be proven correct as the US Dollar becomes the safe haven of last resort as the war in Ukraine escalates and thus keep commodity prices in check......somethings gotta give I think we missed selling the iron condor opportunity so proposing buying a 660/650 put 700/710 call iron condor January 2023 expiration then jumping in more aggressively when price breaks out .

Corn Futures ( ZC1!), H4 Potential for Bearish Momentum Title: Corn Futures ( ZC1!), H4 Potential for Bearish Momentum

Type: Bearish Momentum

Resistance: 680.00

Pivot: 661.20

Support: 671.50

Preferred case: On the H4 chart, the overall bias for ZC1!, corn is bearish. To add confluence to this, price is below the Ichimoku cloud which indicates a bearish market. Price has tapped on to the 1st resistance at 680.00 where the 50% and 38.2% Fibonacci lines are located before closing underneath it. Expecting price to continue its bearish momentum towards the support at 671.50, where the 23.6% Fibonacci line is located.

Alternative scenario: Price may go back up and close above the 1st resistance level.

Fundamentals: There are no major news.

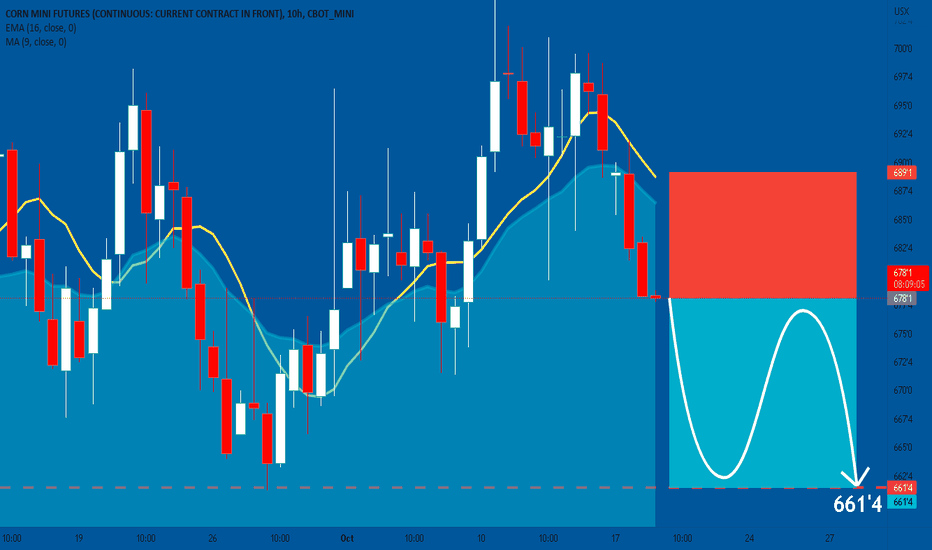

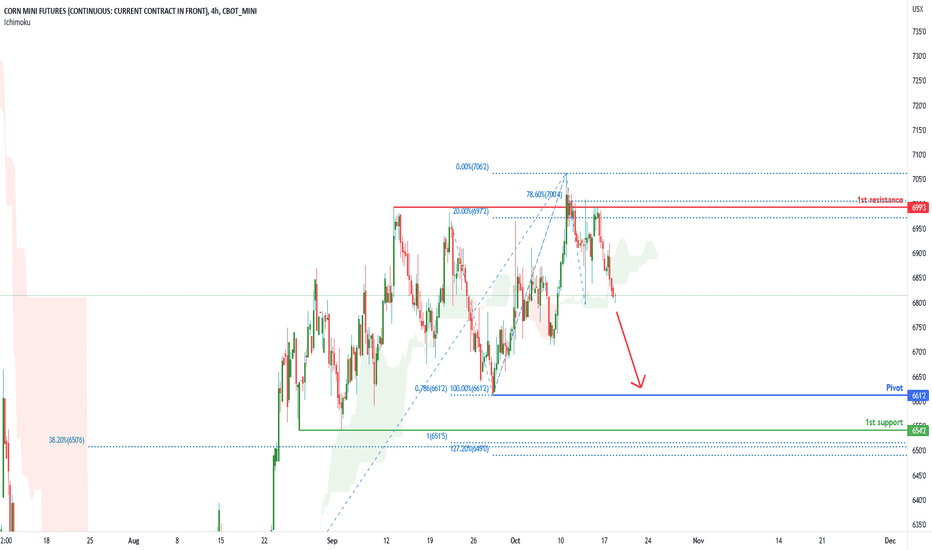

Corn Mini Futures ( XC1!), H4 Potential for Bearish Momentum Title: Corn Mini Futures ( XC1!), H4 Potential for Bearish Momentum

Type: Bearish Momentum

Resistance: 699.3

Pivot: 661.20

Support: 654.20

Preferred case: On the H4 chart, price has tested the 1st resistance line at 699.3 multiple times where the 20% and 78.6% Fibonacci lines are located. Price then retraced downwards with price under the Ichimoku cloud which indicates a bearish market. Expecting price to continue bearish and head towards the pivot at 661.2 where the previous low, 100% Fibonacci line and 78.6% Fibonacci projection lines are located.

Alternative scenario: Price may go back up and close above the 1st resistance level.

Fundamentals: There are no major news.

Corn Futures ( ZC1! ), H4 Potential for Bullish Momentum Title: Corn Futures ( ZC1! ), H4 Potential for Bullish Momentum

Type: Bullish Momentum

Resistance: 706.50

Pivot: 661.40

Support: 698.50

Preferred case: Corn prices have been rising since September 28, 2022. The price is above the Ichimoku cloud, indicating a bullish market. Price hit and bounced off the second support level at 680.4, which contains the 50%, 38.2%, and 61.8% Fibonacci lines, overnight. Price has now closed above the first support level at 698.50, which contains two 100% Fibonacci lines and one 0% Fibonacci line. If the bullish momentum continues, price may return to the first resistance level at 706.50, where the -27.2% and -20% Fibonacci lines are located.

Alternative scenario: Price may revert to the second support level at 680.50.

Fundamentals: There are no major news.

Corn Futures ( ZC1! ), H4 Potential for Bearish MomentumTitle: Corn Futures ( ZC1! ), H4 Potential for Bearish Momentum

Type: Bearish Momentum

Resistance: 698.4

Pivot: 661. 40

Support: 680. 40

Preferred case: Since September 28, 2022, corn prices have been rising. The price is above the Ichimoku cloud , indicating that the market is bullish . The price moved strongly upwards, approaching the first resistance level at 698.4, which contains two 100% Fibonacci lines. Price then bounced off it and closed below the first resistance level . If this retracement continues, price will fall towards the first support level at 680.4, which contains the 50%, 38.2%, and 61.8% Fibonacci lines.

Alternative scenario: Price may go back up retest the 1st resistance before heading down towards the first support level .

Fundamentals: There are no major news.

Corn Futures ( ZC1! ), H4 Potential for Bearish Momentum Title: Corn Futures ( ZC1! ), H4 Potential for Bearish Momentum

Type: Bearish Momentum

Resistance: 698.4

Pivot: 661.40

Support: 680.40

Preferred case: Since September 28, 2022, corn prices have been rising. The price is above the Ichimoku cloud, indicating that the market is bullish. The price moved strongly upwards, approaching the first resistance level at 698.4, which contains two 100% Fibonacci lines. Price then bounced off it and closed below the first resistance level. If this retracement continues, price will fall towards the first support level at 680.4, which contains the 50%, 38.2%, and 61.8% Fibonacci lines.

Alternative scenario: Price may go back up retest the 1st resistance before heading down towards the first support level.

Fundamentals: There are no major news.

Corn Futures ( ZC1! ), H4 Potential for Bullish Momentum Title: Corn Futures ( ZC1! ), H4 Potential for Bullish Momentum

Type: Bullish Momentum

Resistance: 696.25

Pivot: 661.40

Support: 680.50

Corn prices have been climbing since September 28, 2022. The price is above the Ichimoku cloud, which adds to the market's bullish bias. The price is currently consolidating along the 50% and 38.2% Fibonacci lines, which correspond to the first support level at 680.4. Corn has been rising with a strong bullish trend since last Friday. Corn is now trading at 688.4. If the bullish momentum continues, price will go towards the first resistance level at 696.2, which contains the 0% Fibonacci line and two of the 100% Fibonacci lines.

Alternative scenario: Price may retest the first support and go to the pivot at 661.4, which contains the 100% Fibonacci line and the last swing low.

Fundamentals: There are no major news.

Corn Futures ( ZC1! ), H4 Potential for Bearish MomentumTitle: Corn Futures ( ZC1! ), H4 Potential for Bearish Momentum

Type: Bearish Momentum

Resistance: 680.50

Pivot: 661. 40

Support: 669.50

Preferred Case: Corn fell below the first resistance level at 680.50, where the 50% and 38.2% Fibonacci lines are placed. If the bearish trend continues, price could reach the first support level at 669.4, which is nearby the 78.6% Fibonacci line.

Alternative scenario: Price may retrace back up to the first resistance level at 680.4.

Fundamentals: There are no major news.

Corn Futures ( ZC1! ), H4 Potential for Bearish Momentum Title: Corn Futures ( ZC1! ), H4 Potential for Bearish Momentum

Type: Bearish Momentum

Resistance: 680.50

Pivot: 661.40

Support: 669.50

Preferred Case: Corn fell below the first resistance level at 680.50, where the 50% and 38.2% Fibonacci lines are placed. If the bearish trend continues, price could reach the first support level at 669.4, which is nearby the 78.6% Fibonacci line.

Alternative scenario: Price may retrace back up to the first resistance level at 680.4.

Fundamentals: There are no major news.

Daily ZC analysisDaily ZC analysis

A long position with the target and stop loss as shown in the chart

The trend is up, we may see more upside

All the best, I hope for your participation in the analysis, and for any inquiries, please send in the comments.

He gave a signal from the strongest areas of entry, special recommendations, with a success rate of 95%, for any inquiry or request for analysis, contact me