Markets in Focus: FTSE 100As global stock markets remain under pressure, we’re taking a close look at the FTSE 100 this morning.

The index continues to trend lower and is now approaching key long-term support levels:

🔹 200-week moving average: 7,671

🔹 55-month moving average: 7,510

Typically, these levels might offer a platform for stabilisation — but the technical damage is evident. The five-year uptrend from the 2020 low has been decisively broken, with former support around 8,200 likely to act as a formidable resistance on any rebound.

The pace of recent sell-offs adds to the concern. While we’ll be watching closely to see if buyers defend these key levels, I’m not overly optimistic given current momentum.

Disclaimer:

The information posted on Trading View is for informative purposes and is not intended to constitute advice in any form, including but not limited to investment, accounting, tax, legal or regulatory advice. The information therefore has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Opinions expressed are our current opinions as of the date appearing on Trading View only. All illustrations, forecasts or hypothetical data are for illustrative purposes only. The Society of Technical Analysts Ltd does not make representation that the information provided is appropriate for use in all jurisdictions or by all Investors or other potential Investors. Parties are therefore responsible for compliance with applicable local laws and regulations. The Society of Technical Analysts will not be held liable for any loss or damage resulting directly or indirectly from the use of any information on this site.

UK100 trade ideas

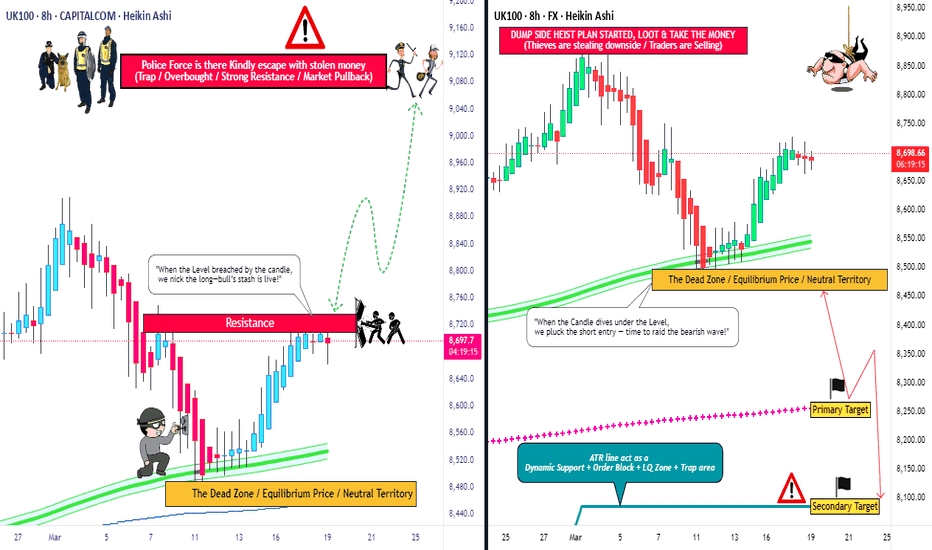

UK100 "FTSE 100 INDEX CASH" Heist Plan (Swing Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the UK100 "FTSE 100 INDEX CASH" market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry and short entry. 🏆💸"Take profit and treat yourself, traders. You deserve it!"💪🏆🎉

Entry 📈 :

"The loot's within reach! Wait for the breakout, then grab your share - whether you're a Bullish thief or a Bearish bandit!"

🏁Buy entry above 8760

🏁Sell Entry below 8450

📌However, I recommended to place buy stop for bullish side and sell stop for bearish side.

Stop Loss 🛑:

🚩Thief SL placed at 8600 (swing Trade Basis) for Bullish Trade

🚩Thief SL placed at 8700 (swing Trade Basis) for Bearish Trade

Using the 4H period, the recent / swing low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

🏴☠️Bullish Robbers : TP 9080 (or) Escape Before the Target

🏴☠️Bearish Robbers : Primary TP - 8250 (&) Secondary TP - 8100 (or) Escape Before the Target

UK100 "FTSE 100 INDEX CASH" Market Heist Plan is currently experiencing a neutral trend,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets.. go ahead to check 👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

UK100 GOING UP?!Good day traders, my analysis shows that the price will head up but we need some few confirmations first before that

The previous trend was a bearish trend and price failed to create new lower lows and we had our Change of Character/Trend. Price broke above our CHoC giving us a New higher high which shows that buyers are more than sellers, causing price to head up

We broke above the New high and now the price is "Retracing" before it continues it's bullish movement, the best thing to do would be to wait for a bullish candlestick on the Zone(new high) before buying

POTENTIAL SHORT TRADE SET UP FOR UK100Analysis: Utilizing chart patterns, highs & lows, and impulses & corrections, the focus is on identifying a continuation corrective structure following a breakout.

Entry: The price approached the previous upper zone of a HTF ascending structure with an ascending structure on the mid time frame (MTF), then plummeted from the swing high area signaling a bearish shift, and formed another bearish continuation-like pattern on the LTF. We shall be looking for an entry with a small bearish continuation structure here targeting the lower bound of the HTF ascending structure

Expectation: A downward move is anticipated.

⚠️ Reminder: Conduct your own analysis and implement proper risk management, as forex trading carries no guarantees. This is a high-risk endeavor, and past performance does not predict future outcomes. Trade responsibly!

FTSE trend change capped at 8460The FTSE 100 continues to exhibit bearish sentiment, in line with the prevailing downtrend. Recent price action confirms a breakdown below the previous consolidation zone, reinforcing downside pressure.

Key Level: 8460

This level marks the former intraday consolidation area and now acts as critical resistance. A near-term oversold bounce toward this level is possible.

Bearish Scenario:

A rejection from 8460 would confirm resistance and likely resume the downtrend. Downside targets include 8200 as the first support, followed by 8090 and 8000 over the medium to long term.

Bullish Alternative:

A confirmed breakout and daily close above 8460 would shift the outlook to neutral-to-bullish. In that case, upside targets include 8550 and 8600.

Conclusion:

The technical bias remains bearish below 8460. Price action around this level will be key in determining the next directional move. A failure to reclaim 8460 keeps the downside in focus, while a breakout above it would challenge the bearish view.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

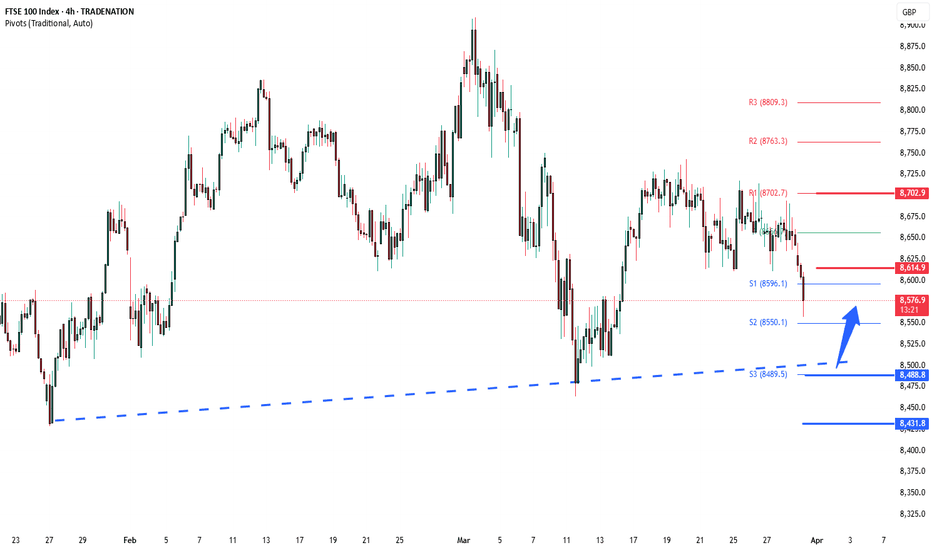

FTSE corrective pullback ahead of tariff announcementTrend Overview:

The FTSE 100 remains in a prevailing uptrend, with recent price action reflecting a corrective pullback towards a previous consolidation zone, now acting as a support level.

Key Levels:

Support: 8550 (key level), 8490, 8430

Resistance: 8614, 8655, 8700

Bullish Scenario:

A pullback to 8550, followed by a strong bullish reversal, could confirm the support level and signal further upside momentum. A breakout above 8614 may open the way toward 8655 and 8700 in the longer term.

Bearish Scenario:

A daily close below 8550 would weaken the bullish outlook, increasing the likelihood of a retracement towards 8490, with 8430 as the next downside target.

Conclusion:

The FTSE 100 remains bullish above 8550, with potential upside targets at 8614, 8655, and 8700. However, a break below 8550 could shift momentum to the downside, targeting 8490 and 8430. Traders should watch price action near 8550 for confirmation of the next directional move.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

FTSE Forms Bullish Hammer at Mini-Range SupportThe FTSE 100 daily rolling futures formed a bullish hammer candle at the lower edge of its mini-range yesterday. But before the bulls get carried away, there are a few cautionary signals to consider.

FTSE 100 Follows the Price Action Playbook So Far in 2025

The FTSE 100 has been a textbook example of price action trading this year, with breakout moves, clean retests, and trending phases that have given traders plenty to work with. January kicked things off with a breakout from key resistance, quickly followed by a classic retest of the broken level. February saw the bulls take charge, pushing the index higher in a strong trending move.

Then came March, when the rally hit a wall at swing resistance. The failure to break through led to a significant retracement, taking the FTSE back down to the volume-weighted average price (VWAP) anchored to the December lows. This pullback set the stage for the next phase: sideways consolidation, with the index settling into a relatively small ‘mini-range’.

However, this week brought a bit of drama. Yesterday’s price action seemed to have broken the mini-range to the downside as market sentiment soured over Donald Trump’s impending tariff announcement, set for Wednesday. With fears of sweeping trade measures hanging over the market, the FTSE looked poised for a deeper move lower.

A Bullish Rejection—But Bulls Should Stay Cautious

Just when it looked like the bears might take control, the FTSE 100 daily rolling futures made a late-session comeback. During the final two hours of the UK trading session, buyers stepped in and pushed prices back up. The bullish momentum continued during the latter half of the US trading session, allowing the futures to close back within the mini-range and forming a bullish hammer candle in the process.

This bullish hammer is significant for a few reasons. Firstly, it represents a clear rejection of lower prices, suggesting that the market is not ready to break down just yet. Secondly, the location of the candle adds weight to the signal. Not only does it reinforce the integrity of the mini-range, but it also marks yet another bounce from the VWAP anchored to the December lows—a level that has been a key support point throughout the recent consolidation.

However, it’s essential to keep a level head here. One notable point of caution is that the hammer pattern only formed on the FTSE rolling futures, not on the underlying cash market, which closed at 4:30 UK time. This discrepancy raises a question about how much weight to give the signal.

Additionally, the nature of the consolidation itself hints at a potential problem for the bulls. Tests of the bottom of the mini-range have been far more frequent than attempts at the top, hinting at underlying weakness. While the bullish hammer is an encouraging sign, the pattern of repeated downside tests suggests that sellers remain active.

The FTSE 100’s ability to maintain its ground in the face of potential US tariffs will be the key to watch this week. If the hammer candle holds and the bulls can push prices higher, it could signal a more sustained move back towards the range highs. However, if the downside pressure resumes, it may well prove to be a false dawn.

UK100 Daily Candle Chart

Past performance is not a reliable indicator of future results

Disclaimer: This is for information and learning purposes only. The information provided does not constitute investment advice nor take into account the individual financial circumstances or objectives of any investor. Any information that may be provided relating to past performance is not a reliable indicator of future results or performance. Social media channels are not relevant for UK residents.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 83% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

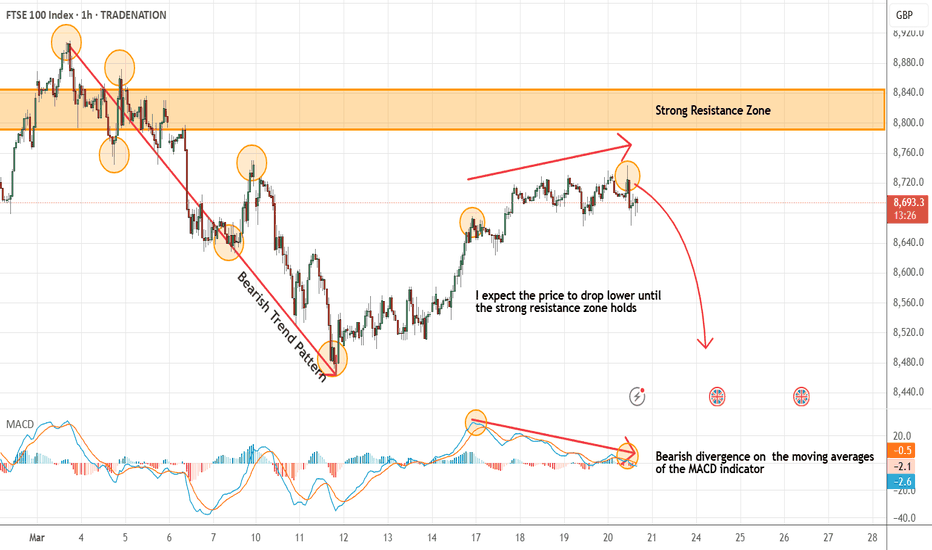

UK100 - Short Term Sell Idea Update!!!Hi Traders, on March 20th I shared this idea "UK100 - Expecting The Price To Drop Lower Further"

I expected the price to drop lower further. You can read the full post using the link above.

Price dropped lower as expected!!!

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

-------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

FTSE100 corrective pullback supported at 8550Trend Overview:

The FTSE 100 remains in a prevailing uptrend, with recent price action reflecting a corrective pullback towards a previous consolidation zone, now acting as a support level.

Key Levels:

Support: 8550 (key level), 8490, 8430

Resistance: 8614, 8655, 8700

Bullish Scenario:

A pullback to 8550, followed by a strong bullish reversal, could confirm the support level and signal further upside momentum. A breakout above 8614 may open the way toward 8655 and 8700 in the longer term.

Bearish Scenario:

A daily close below 8550 would weaken the bullish outlook, increasing the likelihood of a retracement towards 8490, with 8430 as the next downside target.

Conclusion:

The FTSE 100 remains bullish above 8550, with potential upside targets at 8614, 8655, and 8700. However, a break below 8550 could shift momentum to the downside, targeting 8490 and 8430. Traders should watch price action near 8550 for confirmation of the next directional move.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

FTSE100 INTRADAY sideways consolidation supported at 8594The FTSE 100 equity index is exhibiting bullish sentiment, reinforced by the prevailing uptrend. The recent intraday price action appears to be a corrective sideways consolidation, potentially forming a Bullish Flag continuation pattern, which typically precedes a continuation of the upward momentum.

Key Trading Levels:

Support Level: The critical support level to watch is 8,594, marking the previous consolidation price range.

Upside Targets: A corrective pullback from current levels, followed by a bullish bounce from the 8,594 level, could pave the way for an upward move toward the next resistance levels at 8,729, followed by 8,798 and 8,853 over a longer timeframe.

Alternative Bearish Scenario:

A confirmed loss of support at 8,594, with a daily close below this level, would invalidate the bullish outlook. In such a case, the index could experience further retracement, with potential downside targets at 8,539 and 8,465.

Conclusion:

While the current sentiment remains bullish, traders should closely monitor the 8,594 support level. A successful bounce could reaffirm the bullish momentum, targeting higher resistance levels. Conversely, a break and close below this support would signal a shift in sentiment, suggesting a deeper corrective move.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

FTSE 100: Can April's Seasonal Surge Overcome Fiscal Tightening?🌸 April: A Historically Bullish Month for the FTSE 100 📈

Over the past 25 years, April has consistently been the strongest month for the FTSE 100, delivering an average return of 2.28% and boasting a 76% win rate. 🌟 This seasonal strength is driven by several key factors:

📊 Earnings Season Momentum: April is a pivotal month for corporate earnings, with many FTSE 100 companies benefiting from a post-first-quarter earnings boost. 💼

💷 Fiscal Year-End Flows: UK-based funds often adjust their portfolios at the end of the tax year in early April, leading to a reallocation into equities. 🔄

💸 Dividend Reinvestment: As a high-dividend-yielding index, the FTSE 100 typically experiences dividend reinvestment flows in April, further supporting stock prices. 📈

Despite the challenging macroeconomic environment, these seasonal drivers suggest that the FTSE 100 could maintain its historical trend of strong April performance. Notably, even in years with intra-period declines of up to 6.88%, the index has managed to deliver positive returns during this period. 💪

🇬🇧 UK Fiscal Policy and Market Implications 💡

This year, the bullish seasonal trend for the FTSE 100 coincides with significant fiscal developments. On March 26, UK Chancellor Rachel Reeves delivered the Spring Statement, outlining measures to stabilize public finances amidst mounting economic pressures. 📜 According to the Office for Budget Responsibility (OBR), the UK is at risk of missing key fiscal targets, prompting the government to model spending cuts of up to 11%. Welfare programs and green investments 🌱 are expected to bear the brunt of these reductions.

Additionally, the Bank of England's stance on inflation remains a critical factor. 📉 Persistent inflation risks could lead to a more hawkish monetary policy, potentially weighing on rate-sensitive sectors within the FTSE 100. However, the index's strong seasonal pattern, driven by earnings momentum, fiscal year-end flows, and dividend reinvestments, provides a counterbalance to these headwinds. ⚖️

🔮 Outlook for April 2025 🌟

As of late March 2025, the FTSE 100 has shown resilience, with sectors such as energy ⚡ and homebuilders 🏠 leading gains ahead of the Spring Statement. While fiscal tightening and inflationary pressures present challenges, the historical strength of April, combined with supportive seasonal factors, suggests that the FTSE 100 could still deliver positive returns this month. 📅 Investors will closely monitor the impact of fiscal policy adjustments and the Bank of England's monetary stance as they navigate this critical period. 🧐

Not Financial Advice.

UK100 Technical Analysis 🔹 Trend Overview:

UK100 is currently consolidating between key support and resistance levels, suggesting a potential breakout scenario.

🔹 Key Levels:

📈 Resistance: 8,727 – A breakout above this level could push price toward 8,818.

📉 Support: 8,627 – If broken, price may drop toward 8,475.

🔹 Market Structure:

✅ Price is in a range-bound phase, with a possible breakout in either direction.

🚀 Bullish scenario: Break above 8,727 → Retest → Target 8,818 → 8,912.

⚠️ Bearish scenario: Rejection at 8,727 → Drop to 8,627 → Break → Target 8,475.

🔹 Trade Idea:

Bullish above 8,727 with targets at 8,818 and 8,912.

Bearish below 8,627 with targets at 8,475.

📌 Risk Management: Wait for confirmation of breakout or rejection before entering trades.

FTSE INTRADAY bullish ahead of UK Spring StatementThe FTSE 100 equity index is exhibiting bullish sentiment, reinforced by the prevailing uptrend. The recent intraday price action appears to be a corrective sideways consolidation, potentially forming a Bullish Flag continuation pattern, which typically precedes a continuation of the upward momentum.

Key Trading Levels:

Support Level: The critical support level to watch is 8,594, marking the previous consolidation price range.

Upside Targets: A corrective pullback from current levels, followed by a bullish bounce from the 8,596 level, could pave the way for an upward move toward the next resistance levels at 8,729, followed by 8,798 and 8,853 over a longer timeframe.

Alternative Bearish Scenario:

A confirmed loss of support at 8,594, with a daily close below this level, would invalidate the bullish outlook. In such a case, the index could experience further retracement, with potential downside targets at 8,539 and 8,465.

Conclusion:

While the current sentiment remains bullish, traders should closely monitor the 8,594 support level. A successful bounce could reaffirm the bullish momentum, targeting higher resistance levels. Conversely, a break and close below this support would signal a shift in sentiment, suggesting a deeper corrective move.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

UK Inflation DeclinesUK Inflation Declines

Today, the latest UK Consumer Price Index (CPI) figures were released. According to ForexFactory:

The actual annual CPI came in at 2.8%,

Analysts had expected it to remain at the previous level of 3.0%.

As a result, the British pound weakened, and a slight spike in volatility was observed on the FTSE 100 stock index chart (UK 100 on FXOpen)

Technical Analysis of FTSE 100

In early March, bearish activity (indicated by an arrow) led to a break of the support level around 8757, which then acted as resistance.

However, as soon as bears pushed the price below the February low, bulls stepped in.

Currently, the UK stock index chart is forming a narrowing triangle, which can be interpreted as a sign of equilibrium between supply and demand. However, this pattern will eventually be broken.

It is possible that the release of significant news—such as developments in international trade tariffs—could disrupt the balance of supply and demand, triggering a trend movement for the FTSE 100 index (UK 100 on FXOpen).

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

WHY UK100 might drop for sometimeAs we can see on the MAJOR KEY LEVEL where price formed multiple rejections and reversed, this is a confirmation of selling pressure also price broke out of our Previous support and retested it that gave us a New resistance which shows us that bears/sellers have potential to push it down and we already have multiple confirmations of that along with our Downtrend trendline being respected. If price shows a rejection candlestick on the trend line then that is our confirmation price will go down

what are your views guys?

FTSE100 INTRADAY Bullish Flag continuation pattern supported at The FTSE 100 equity index is exhibiting bullish sentiment, reinforced by the prevailing uptrend. The recent intraday price action appears to be a corrective sideways consolidation, potentially forming a Bullish Flag continuation pattern, which typically precedes a continuation of the upward momentum.

Key Trading Levels:

Support Level: The critical support level to watch is 8,594, marking the previous consolidation price range.

Upside Targets: A corrective pullback from current levels, followed by a bullish bounce from the 8,596 level, could pave the way for an upward move toward the next resistance levels at 8,729, followed by 8,798 and 8,853 over a longer timeframe.

Alternative Bearish Scenario:

A confirmed loss of support at 8,594, with a daily close below this level, would invalidate the bullish outlook. In such a case, the index could experience further retracement, with potential downside targets at 8,539 and 8,465.

Conclusion:

While the current sentiment remains bullish, traders should closely monitor the 8,594 support level. A successful bounce could reaffirm the bullish momentum, targeting higher resistance levels. Conversely, a break and close below this support would signal a shift in sentiment, suggesting a deeper corrective move.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

FTSE100 The Week Ahead 24th March '25FTSE100 bullish & overbought, the key trading level is at 8730

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

UK100 - Expecting The Price To Drop Lower FurtherHi Traders, on March 11th I shared this "UK100 - Looking To Sell Pullbacks In The Short Term"

We expected to see correction prior to the bearish continuation. You can read the full post using the link above.

Price is moving as per the plan!!!

Based on the current scenario my bearish view still remains the same here.

We have bearish divergence in play based on the moving averages of the MACD and I expect the price to drop lower further until the strong resistance zone holds

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

---------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

FTSE INTRADAY awaits BoE MPC The FTSE 100 index could see some volatility today as the Bank of England’s Monetary Policy Committee (MPC) meeting is set for 12:00 London time. The central bank is expected to keep the benchmark rate at 4.50%. Earlier today, UK jobs data showed the ILO Unemployment Rate remained steady at 4.4% for the three months to January.

The FTSE 100 index is currently exhibiting a neutral sentiment, as evidenced by the prevailing sideways consolidation. The primary focus remains on the key resistance level at 8745, which corresponds to the current intraday swing high. Alternatively the downside is supported at 8616. This levels are critical as they determine the next directional move of the index.

Key Support and Resistance Levels

Resistance Level 1: 8745

Resistance Level 2: 8770

Resistance Level 3: 8834 - 8910

Support Level 1: 8616

Support Level 2: 8505

Support Level 3: 8352

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.