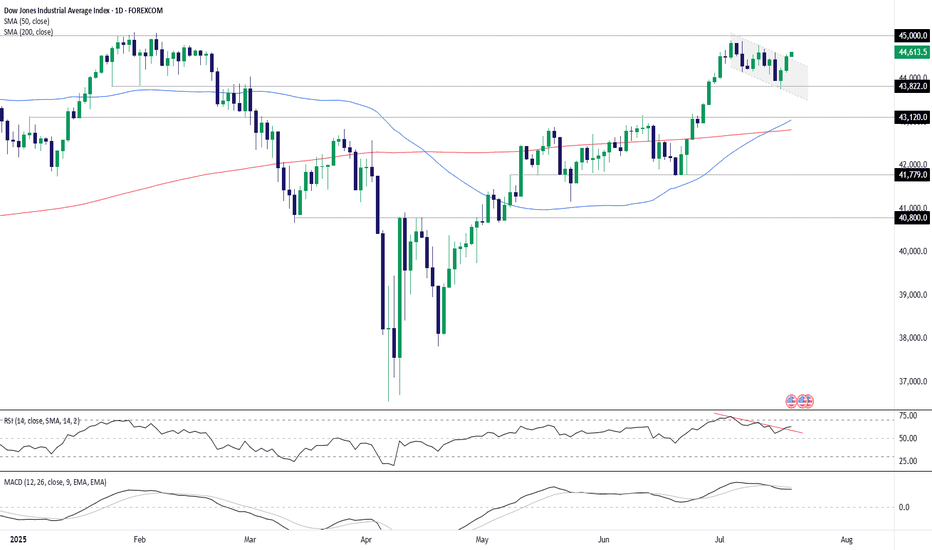

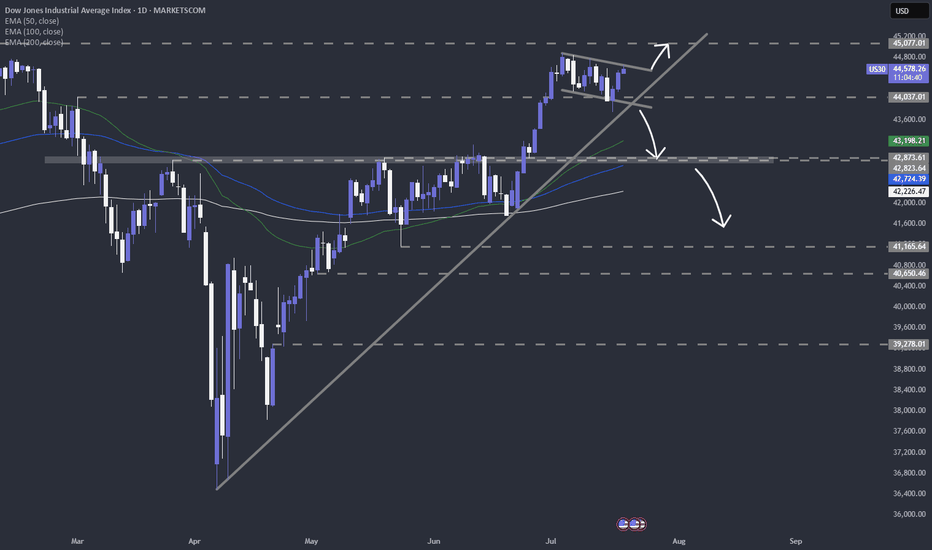

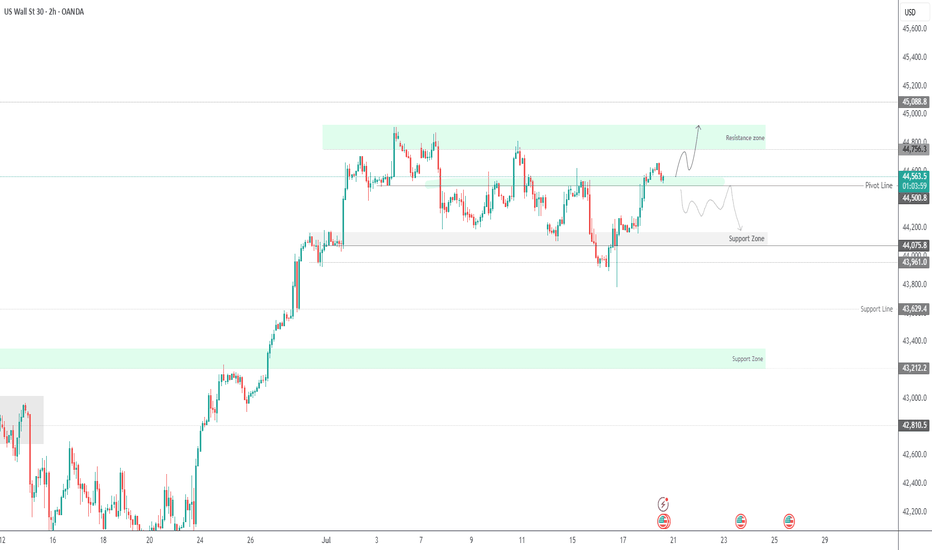

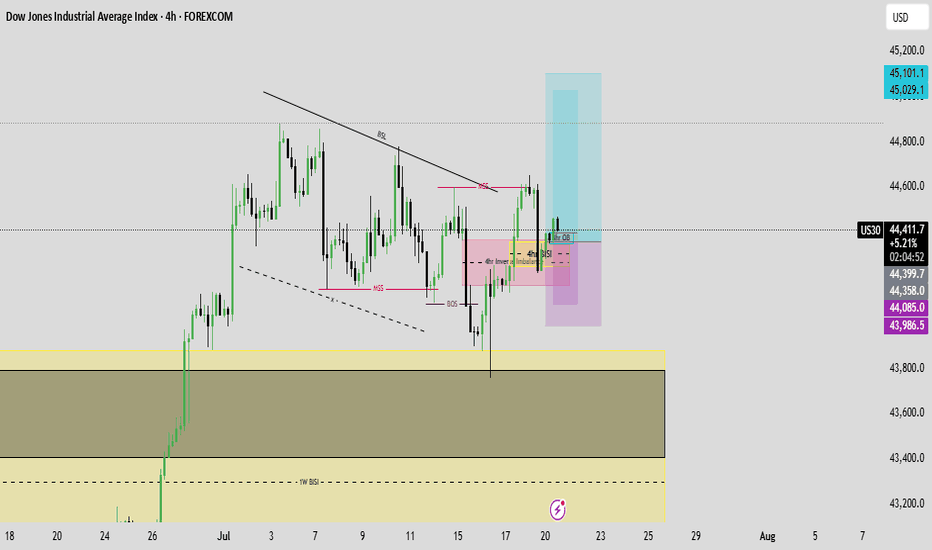

Dow Eyes 45000 After Bullish BreakoutThe U.S. 30 contract has broken topside from a short-term bull flag, reinforcing the broader uptrend and putting 45000 resistance back in focus.

Traders looking to play a continuation can consider longs with a tight stop beneath for protection. A break of 45000 may trigger a fresh burst of upside momentum, putting big figures above in play.

Bullish price momentum is also building again, adding to the case for upside.

Good luck!

DS

USAIND trade ideas

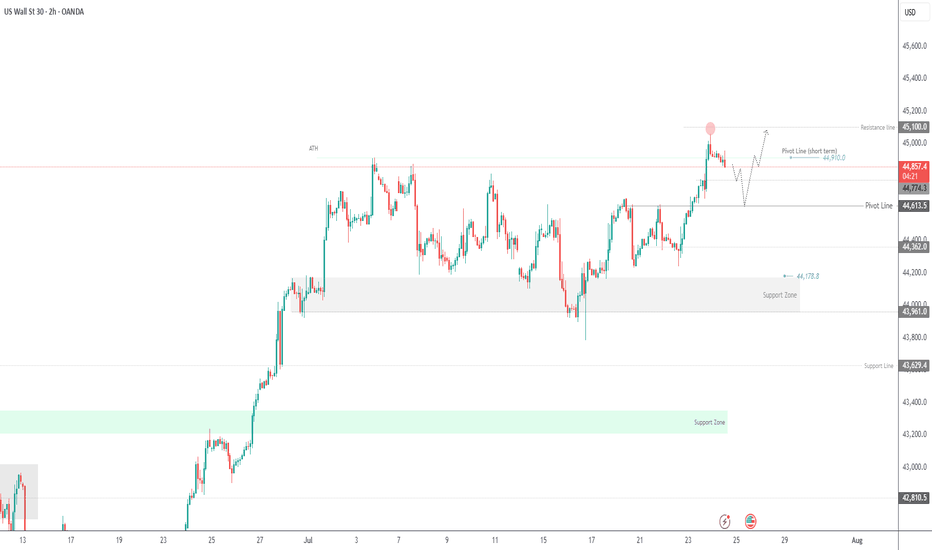

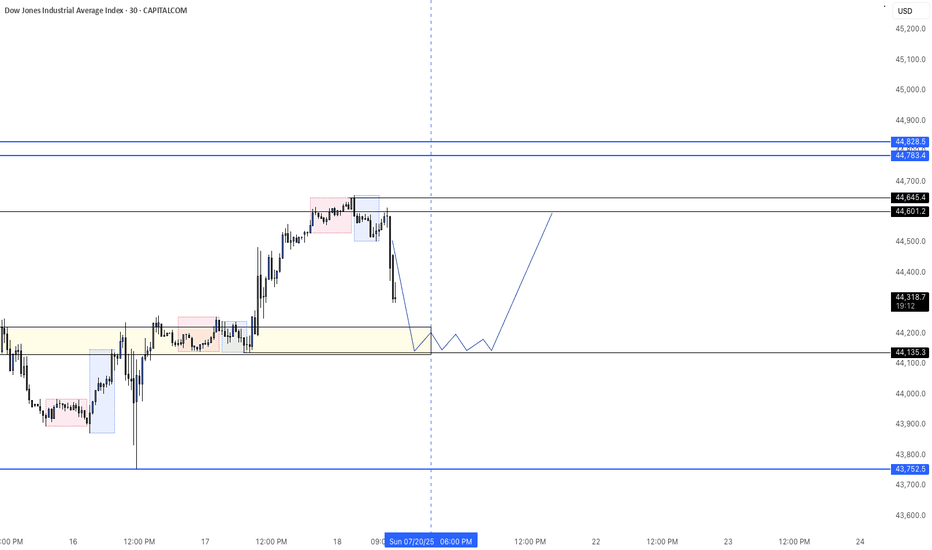

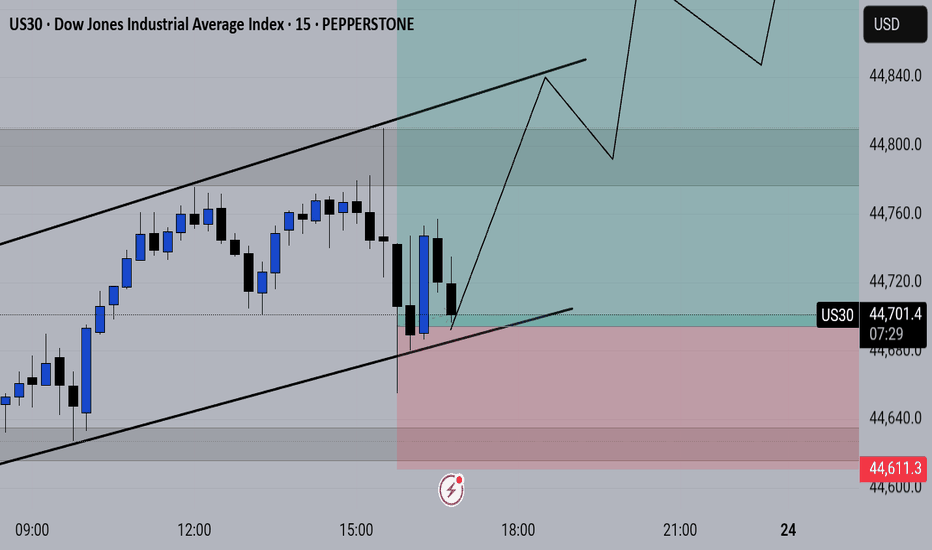

US30 Hits New All-Time High – What’s Next?US30 | OVERVIEW

The price has printed a new all-time high, exactly reaching our target at 45,090, as previously anticipated.

Today, we may see a correction toward 44,770 and 44,610. If the price stabilizes above these levels, another bullish leg is expected.

On the upside, a break above 44,910 would confirm a bullish continuation toward 45,090 and 45,250.

Key Levels:

Support: 44,770 · 44,610 · 44,370

Resistance: 45,090 · 45,250

previous idea:

Quick take on DJIACurrently, the Dow Jones Industrial Average TVC:DJI is trading within a short-term downside channel. However, could it just be part of a correction, before another possible leg of buying? Let's dig in.

MARKETSCOM:US30

Let us know what you think in the comments below.

Thank you.

75.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

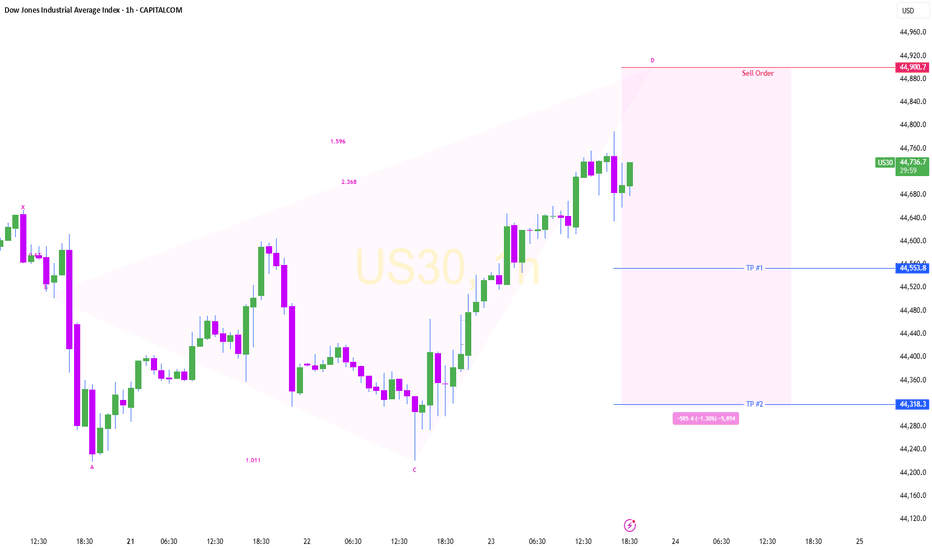

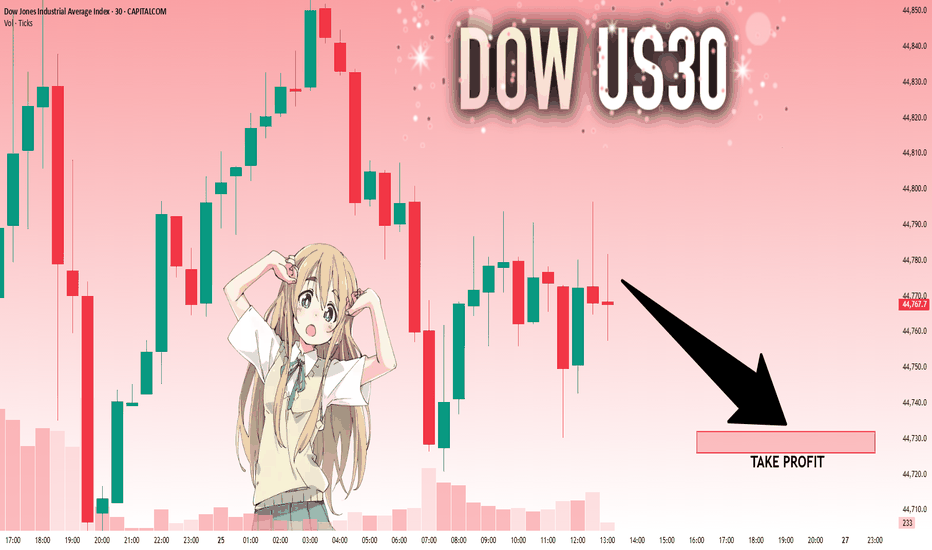

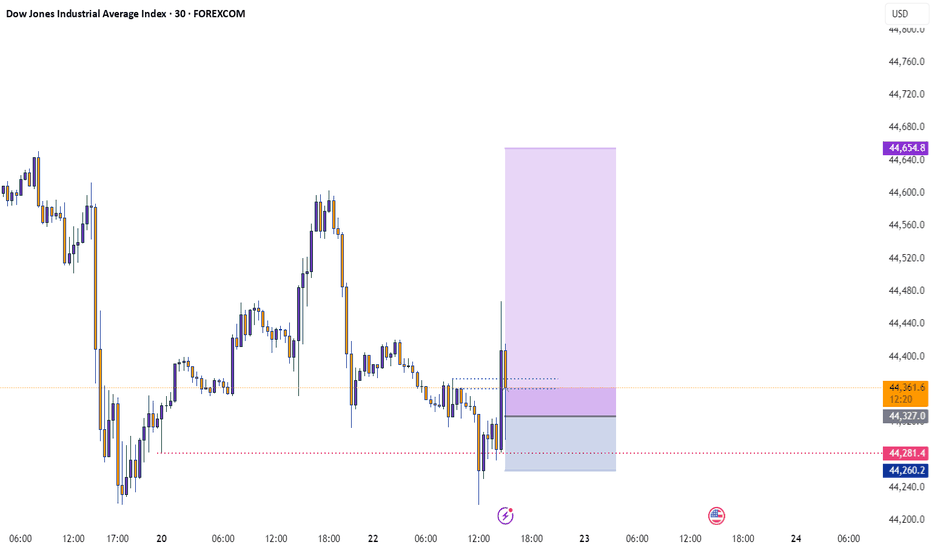

US30: Local Bearish Bias! Short!

My dear friends,

Today we will analyse US30 together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding below a key level of 44,774.9 So a bearish continuation seems plausible, targeting the next low. We should enter on confirmation, and place a stop-loss beyond the recent swing level.

❤️Sending you lots of Love and Hugs❤️

Long Position on Dow Jones Industrial Average

Initiating a long position at 44,456, supported by robust economic data and stronger-than-expected corporate earnings. These indicators point to continued resilience in the U.S. economy, potentially allowing the Federal Reserve to consider rate cuts sooner than previously anticipated — a positive catalyst for equities.

📌 Entry: 44,456

🛑 Stop Loss: 44,207

🎯 Take Profit: 44,900

Monitoring price action closely as market sentiment continues to shift in response to macroeconomic developments.

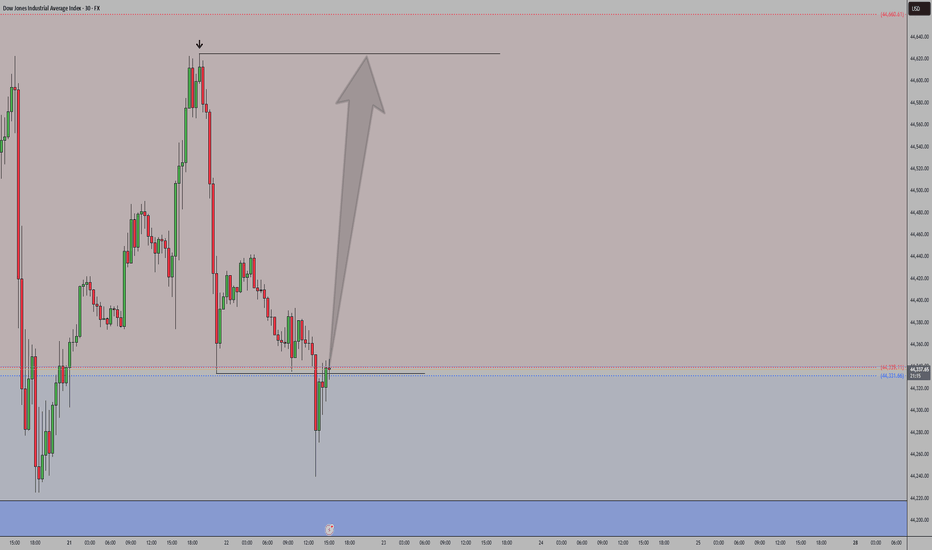

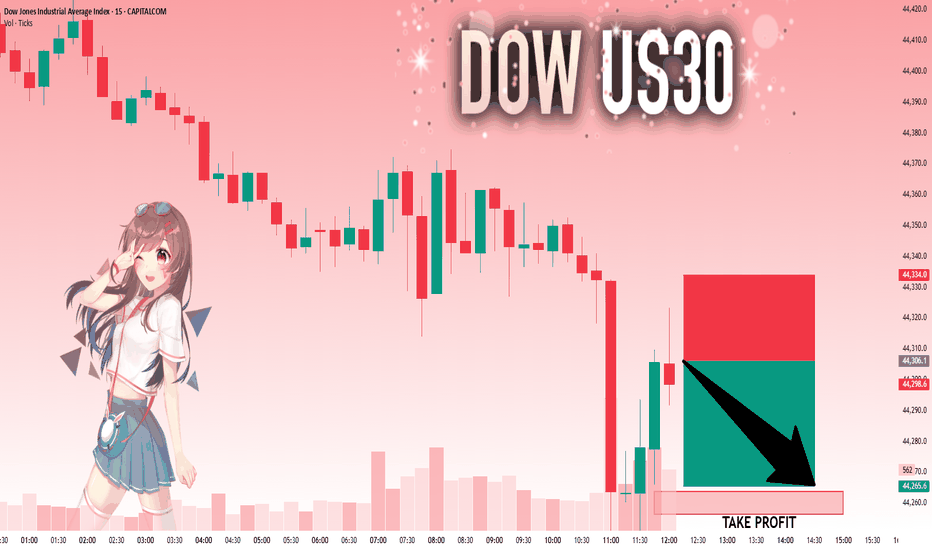

US30: The Market Is Looking Down! Short!

My dear friends,

Today we will analyse US30 together☺️

The recent price action suggests a shift in mid-term momentum. A break below the current local range around 44,306.1 will confirm the new direction downwards with the target being the next key level of 44,263.8..and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️

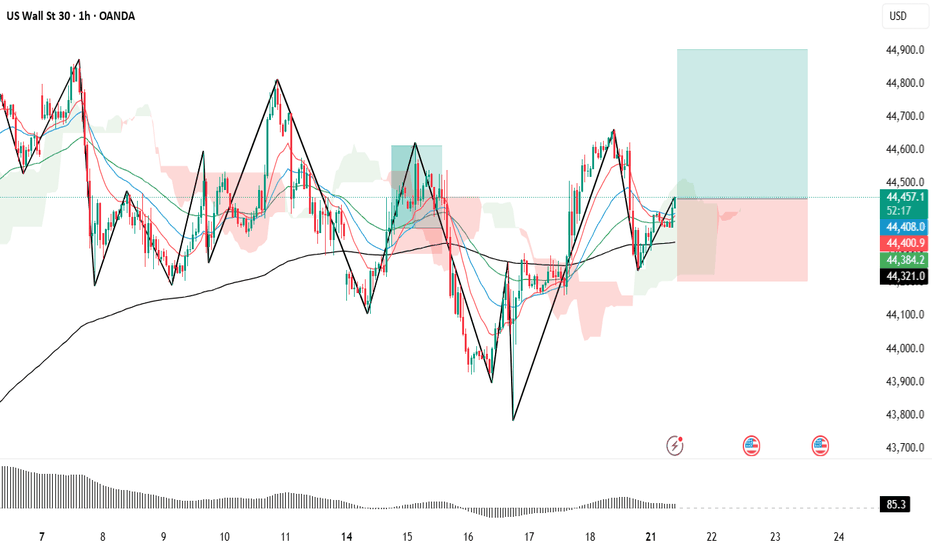

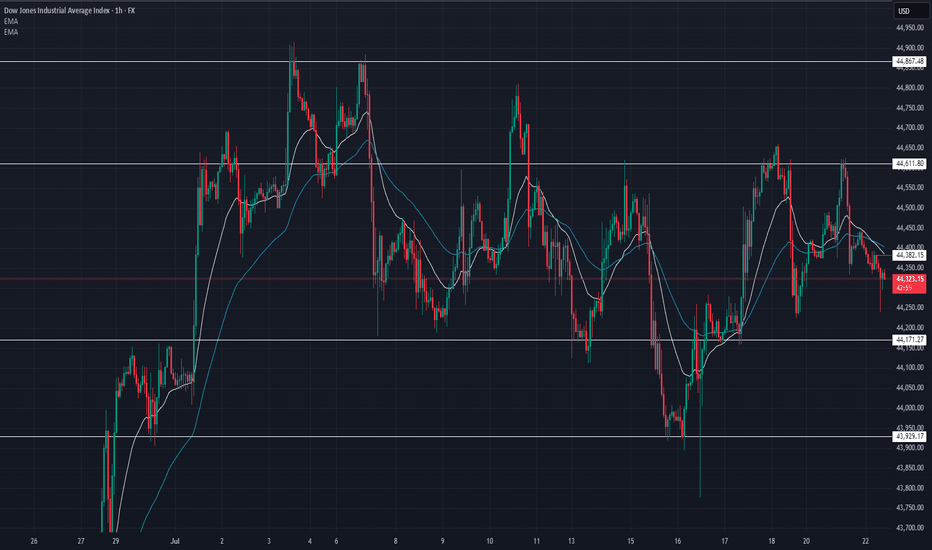

US30 Update – 07/22/2025📍 US30 Update – 07/22/2025

Still trapped in the range chop ⚠️

Price rejected off 44,611 again and is now pulling back toward mid-range. Structure continues to respect key zones, and we now see lower highs forming — early signs of bearish pressure building 🐻

EMA crossover is flipping bearish on the 1H — sellers gaining control short term.

📊 Market Structure:

📉 Lower highs forming below 44,611

📈 Still above demand at 44,171

📉 EMA 9/21 crossover down — bearish tilt

📉 Momentum weak under 44,385

🔑 Key Levels:

🔼 Resistance: 44,611 → 44,867

🔽 Support: 44,171 → 43,929

🧠 Market Bias:

Short-term bearish 🧨

➡️ Clean breakdown of 44,171 = bearish momentum

➡️ Buyers must reclaim 44,385 to shift bias

💡 Trade Scenarios:

📉 Bearish Rejection Play:

Entry: 44,380–44,400

TP1: 44,200

TP2: 44,000

SL: Above 44,430

📈 Demand Bounce (Low-Risk Buy):

Entry: 44,180–44,150

TP1: 44,385

TP2: 44,600

SL: Below 44,100

US30 Holds Above 44500 – Bullish Momentum in PlayUS30 | Technical Overview

The price action continues to reflect a bullish bias, supported by strong earnings reports and solid U.S. economic data. As long as the index trades above 44500, the upward momentum is expected to continue.

Technical Outlook:

Price remains bullish above 44500, with upside targets at 44640 and 44760.

A confirmed 1H close below 44500 would shift momentum to the downside, exposing support levels at 44350 and 44215.

Key Levels:

• Pivot: 44500

• Resistance: 44640 / 44760 / 44920

• Support: 44350 / 44215 / 44075

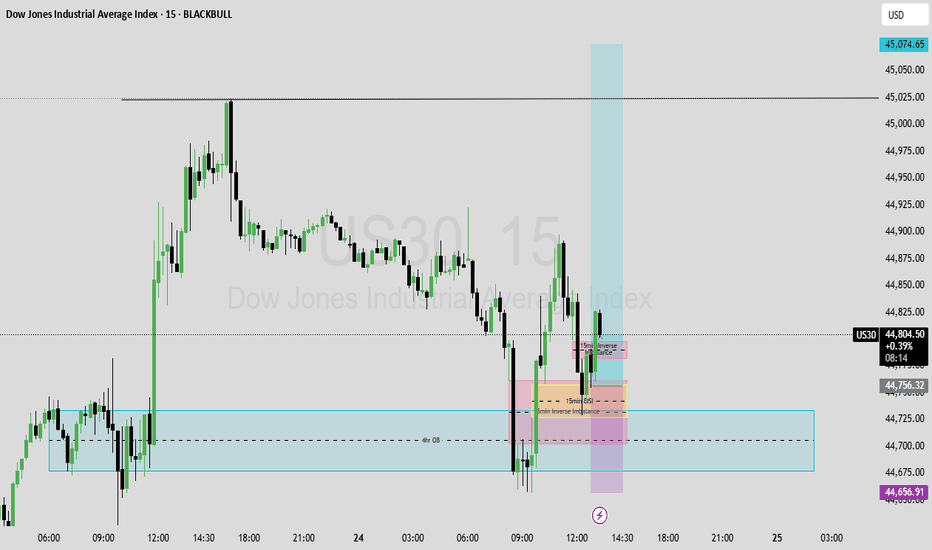

US30 | Inverted Hammer at Key Supply Zone – Reversal or BreakoutUS30 just printed an inverted hammer on the 4H at a major supply zone (44,550–44,600). This is a critical decision point:

✅ Bearish Case:

If price rejects and closes back below 44,530, sellers could take control with targets at 44,380 → 44,180 → 44,020.

✅ Bullish Fakeout:

If price breaks and holds above 44,620, expect a push toward 44,700 and 44,900.

📌 What I’m Watching:

Rejection candle + bearish close → short entries.

Strong breakout candle with retest → long continuation.

Key Levels:

🔴 Resistance: 44,550–44,600

🟢 Support: 44,380 → 44,020

⚠️ Manage risk carefully. Volatility is high and liquidity hunts are common in this zone.

💬 Do you think we reject here or break out higher? Drop your thoughts below!

#US30 #DowJones #PriceAction #SmartMoney #TradingView #TechnicalAnalysis #IndicesTrading

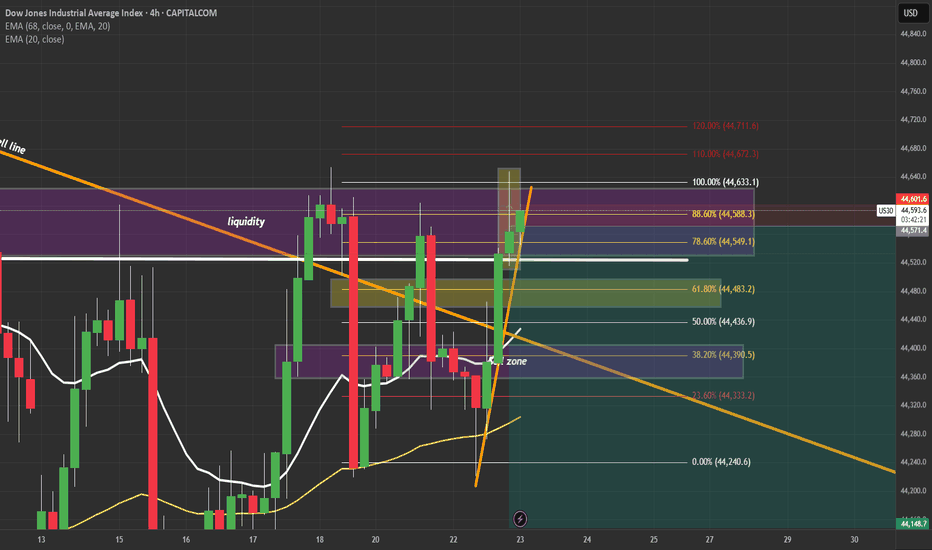

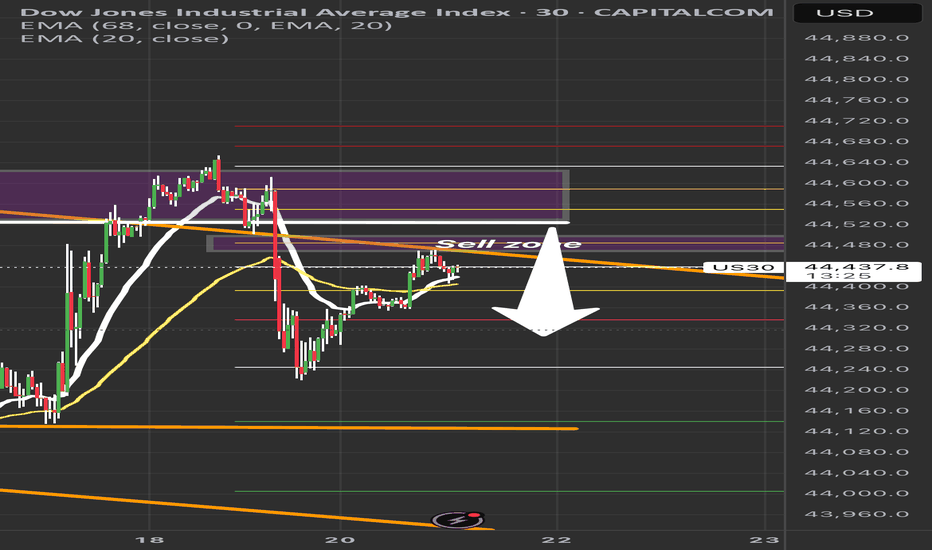

US30 Sell Setup – Watching Key Retracement ZonePrice is pulling back into a key sell zone (44,480–44,550) after a strong bearish move.

✅ Confluences:

• Previous liquidity zone

• 50–61.8% Fib retracement

• EMA rejection overhead

Plan: Waiting for bearish confirmation before short entry.

🎯 Targets:

TP1: 44,300

TP2: 44,150

TP3: 44,000

❌ Invalidation: Break above 44,600.

Patience = Precision. No confirmation, no trade.

#US30 #DowJones #TradingSetup #SmartMoneyConcepts #PriceAction #LiquidityZones #ForexTrading #DayTrading #IndicesTrading #SupplyAndDemand #TechnicalAnalysis #Fibonacci #MarketStructure #ScalpSetup #SwingTrade #RiskManagement #TradingEducation

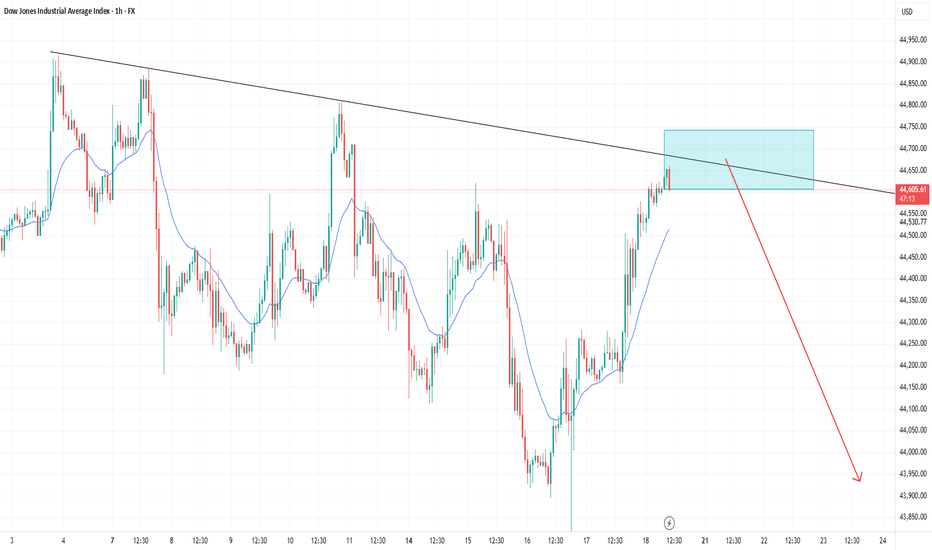

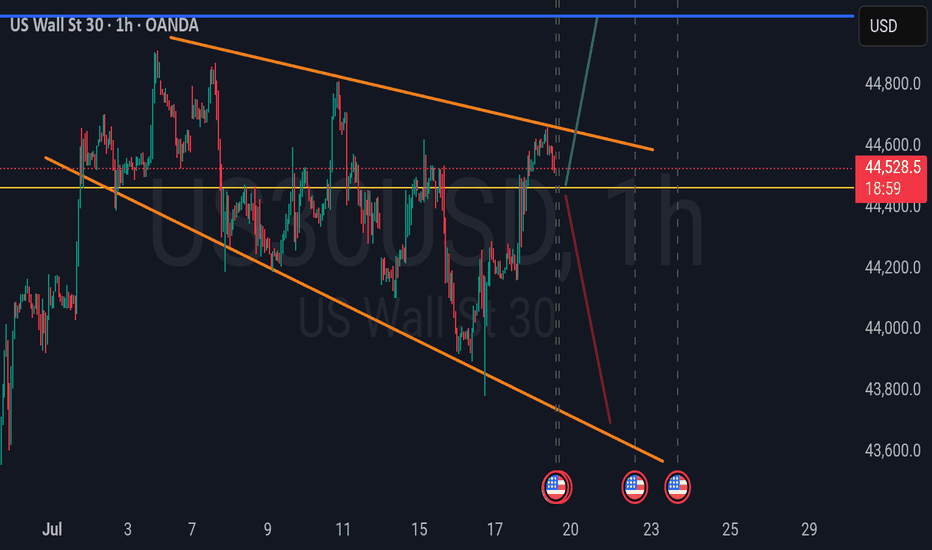

US30 Rejection at Channel Resistance US30 is showing a repeated pattern of rejection at the upper boundary of the descending channel. Price has now tapped this trendline for the fourth time, forming a consistent bearish structure.

Price rejected again at the top of the descending channel (marked by orange circles)

Clear sell setup with stop above the most recent swing high, targeting the lower channel boundary around 44,200, aligning with past demand.

Short below 44,685

Target: 44,200

Stop: Above recent highs near 44,913

Risk/Reward: Favourable if structure holds. If this pattern plays out as before, we can expect another push to the downside within the channel.

A break and retest of the midline could add extra confirmation.

#US30 #DowJones #PriceAction #SellSetup #BearishRejection #ChannelTrading #TechnicalAnalysis

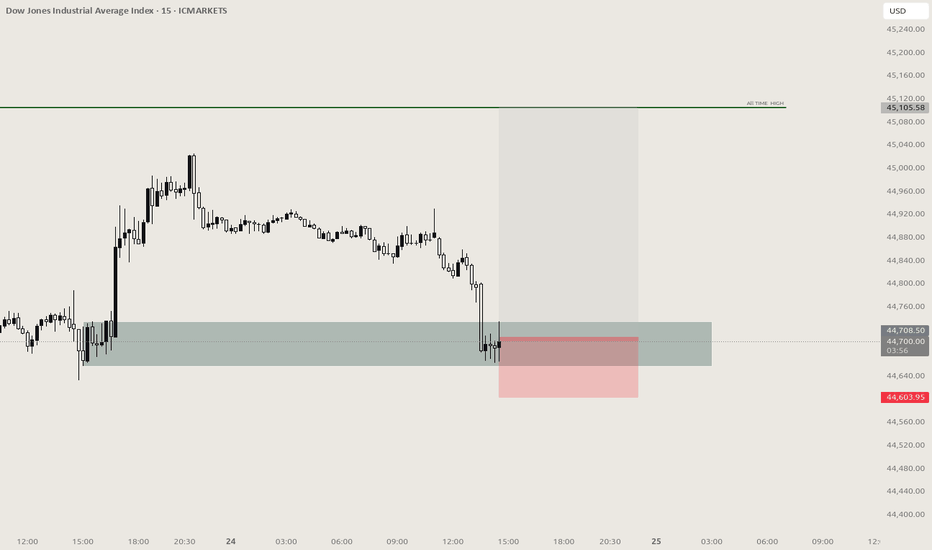

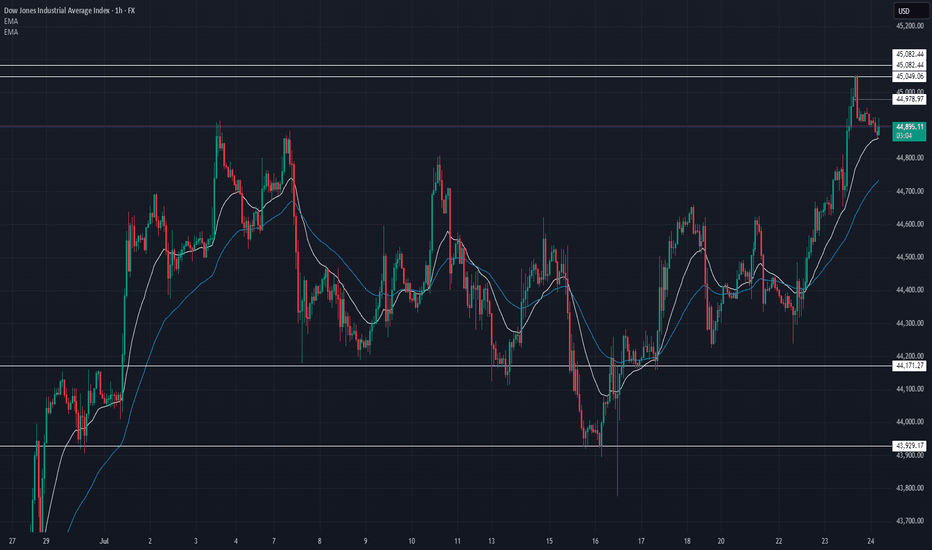

US30 Technical Breakdown – 07/24/2025📍 US30 Technical Breakdown – 07/24/2025

🔥 New highs achieved — bulls pushed straight through the 44,867 ceiling and tagged 45,082 before pulling back slightly. This is a key psychological level, and price is now consolidating just below.

We’ve officially shifted into breakout territory. Momentum is strong, and EMAs are fully bullish. But after such a run, we may be due for a retest or short-term correction. Let’s break it down 👇

📊 Current Market Structure:

✅ Series of higher highs & higher lows

✅ EMA 9 > EMA 21 > Price (bullish structure)

✅ Breakout from range: 44,867 → 45,082

🧱 Minor resistance at 45,050–45,082

⚠️ Watch for pullback to 44,750–44,800 zone

🔑 Key Levels:

🔼 Resistance:

45,050 → 45,082 (fresh supply zone)

45,200+ (blue sky if broken)

🔽 Support:

44,867 (former resistance turned support)

44,734 (EMA confluence)

44,450–44,600 (demand zone)

🧠 Market Bias:

📈 Still bullish, but extended.

Above 44,867 = continuation zone

Below 44,734 = momentum shift likely

Rejection at 45,082 could give scalpers a play short 🔄

💡 Potential Trade Setups:

📈 Breakout Buy (Momentum Entry):

Entry: Above 45,100

TP1: 45,200

TP2: 45,300

SL: Below 45,040

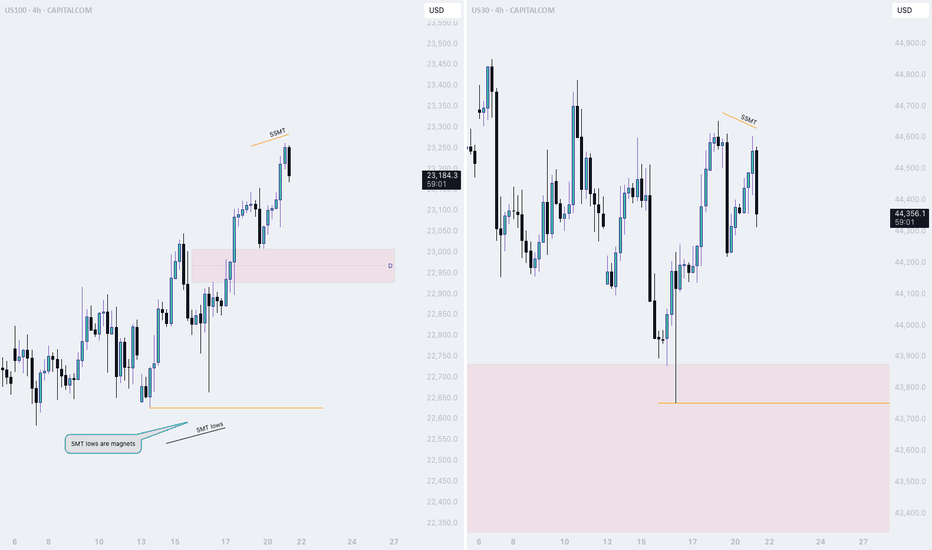

NQ thread: Short ideaMonday started off bullish, but only to drop at the end of the session.

Here is a thread on what is happening and on which narratives I view the market

Starting off with the 4H Time frame, we witnessed NQ and ES taking last weeks high.

YM did not.

This is the first stage of the movement. To find the second stage, we need to dive deeper into the lower timeframes..

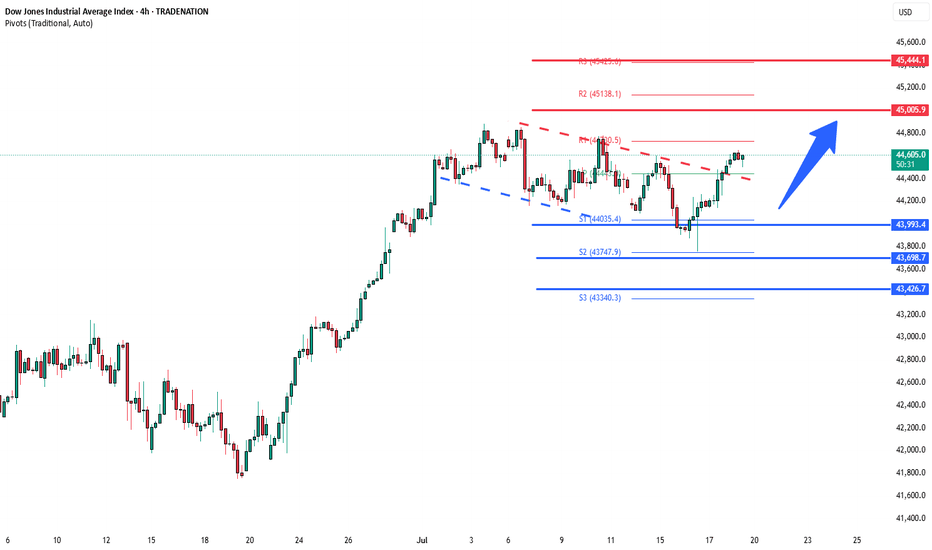

DowJones bullish continuation breakout support at 43990Key Support and Resistance Levels

Resistance Level 1: 45000

Resistance Level 2: 45440

Resistance Level 3: 46000

Support Level 1: 43990

Support Level 2: 43700

Support Level 3: 43420

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.