Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1.68 AED

16.31 B AED

76.82 B AED

4.88 B

About First Abu Dhabi Bank

Sector

Industry

CEO

Hana Al-Rostamani

Website

Headquarters

Abu Dhabi

Founded

1977

ISIN

AEN000101016

FIGI

BBG000DHGV74

First Abu Dhabi Bank PJSC engages in the provision of banking services. Its services include corporate, investment, and personal banking. The company was founded on February 13, 1968 and is headquarter in Abu Dhabi, United Arab Emirates.

Related stocks

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

FABUF5698856

First Abu Dhabi Bank P.J.S.C. 6.32% 04-APR-2034Yield to maturity

5.72%

Maturity date

Apr 4, 2034

FABUF5847666

First Abu Dhabi Bank P.J.S.C. 5.804% 16-JAN-2035Yield to maturity

5.48%

Maturity date

Jan 16, 2035

FABUF5746612

First Abu Dhabi Bank P.J.S.C. FRN 29-JAN-2029Yield to maturity

5.32%

Maturity date

Jan 29, 2029

FABUF6078594

First Abu Dhabi Bank P.J.S.C. FRN 27-MAY-2030Yield to maturity

5.29%

Maturity date

May 27, 2030

FABUF5995807

First Abu Dhabi Bank P.J.S.C. FRN 22-JAN-2030Yield to maturity

5.23%

Maturity date

Jan 22, 2030

51RM

FIRST ABU DHABI BANK PJSC 0.875% SNR EMTN 09/12/2025Yield to maturity

4.53%

Maturity date

Dec 9, 2025

See all FAB bonds

Frequently Asked Questions

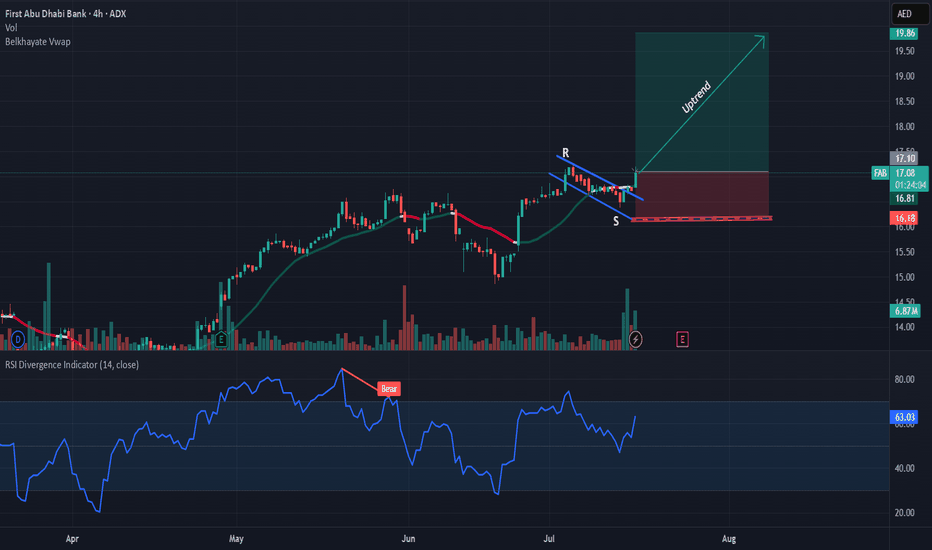

The current price of FAB is 17.70 AED — it has decreased by −1.67% in the past 24 hours. Watch First Abu Dhabi Bank stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on ADX exchange First Abu Dhabi Bank stocks are traded under the ticker FAB.

FAB stock has fallen by −1.23% compared to the previous week, the month change is a 5.73% rise, over the last year First Abu Dhabi Bank has showed a 35.11% increase.

We've gathered analysts' opinions on First Abu Dhabi Bank future price: according to them, FAB price has a max estimate of 21.00 AED and a min estimate of 15.85 AED. Watch FAB chart and read a more detailed First Abu Dhabi Bank stock forecast: see what analysts think of First Abu Dhabi Bank and suggest that you do with its stocks.

FAB stock is 2.38% volatile and has beta coefficient of 1.08. Track First Abu Dhabi Bank stock price on the chart and check out the list of the most volatile stocks — is First Abu Dhabi Bank there?

Today First Abu Dhabi Bank has the market capitalization of 195.54 B, it has increased by 2.26% over the last week.

Yes, you can track First Abu Dhabi Bank financials in yearly and quarterly reports right on TradingView.

First Abu Dhabi Bank is going to release the next earnings report on Oct 23, 2025. Keep track of upcoming events with our Earnings Calendar.

FAB earnings for the last quarter are 0.49 AED per share, whereas the estimation was 0.39 AED resulting in a 25.65% surprise. The estimated earnings for the next quarter are 0.40 AED per share. See more details about First Abu Dhabi Bank earnings.

First Abu Dhabi Bank revenue for the last quarter amounts to 9.49 B AED, despite the estimated figure of 8.37 B AED. In the next quarter, revenue is expected to reach 8.58 B AED.

FAB net income for the last quarter is 5.44 B AED, while the quarter before that showed 4.84 B AED of net income which accounts for 12.48% change. Track more First Abu Dhabi Bank financial stats to get the full picture.

Yes, FAB dividends are paid annually. The last dividend per share was 0.75 AED. As of today, Dividend Yield (TTM)% is 4.24%. Tracking First Abu Dhabi Bank dividends might help you take more informed decisions.

First Abu Dhabi Bank dividend yield was 5.46% in 2024, and payout ratio reached 50.76%. The year before the numbers were 5.09% and 49.77% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

Like other stocks, FAB shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade First Abu Dhabi Bank stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So First Abu Dhabi Bank technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating First Abu Dhabi Bank stock shows the buy signal. See more of First Abu Dhabi Bank technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.