preparing for lift-off with Bullish flag formation on SPACE42? Traders, take a look at this beauty unfolding on SPACE42's daily chart 👀

After a powerful upward thrust — a textbook "flagpole" — price action has been gently coiling down within a tight parallel channel. This classic **bull flag** pattern suggests we might just be seeing a pause before the next big move. 🏁

Key Highlights:

* Sharp rally → momentum confirmed ✅

* Flag consolidation → decreasing volume 💤

* Breakout potential → waiting on the edge 🚀

What to watch:

* A strong close above the upper trendline with volume could ignite the next leg up 🔥

* Target projection? Classic bull flag logic says: measure the pole, add it to the breakout 💡

Not a recommendation — just a chart talking loud and clear! 🎯

Let’s see if SPACE42 honors the pattern... or fakes out. Stay nimble, stay sharp ⚡

#SPACE42 #BullFlag #ChartPatterns #TechnicalAnalysis #PriceAction

SPACE42 trade ideas

Wedge Watch: SPACE42 Poised for Liftoff from Falling Orbit?

➤ 📈 RECOMMENDATION: BUY (Speculative)

➤ 🔍 REASONING:

📉 Chart Pattern: This is a falling wedge — a classic bullish pattern often seen at the end of a downtrend.

🚀 Bullish Signal: A breakout above the upper wedge line 📈 typically signals the start of an **uptrend**.

📊 Volume: Look for increasing volume** on the breakout 🔊 — this confirms momentum.

📐 Trend Structure: The narrowing price range with higher lows = buyers are stepping in gradually 💪.

🛠️ Action Strategy:

🟢 Entry: Buy on breakout above the upper trendline.

🛡️ Stop-loss: Just below the recent swing low inside the wedge.

🎯 Target: Take the height of the wedge and project it upward from the breakout level.

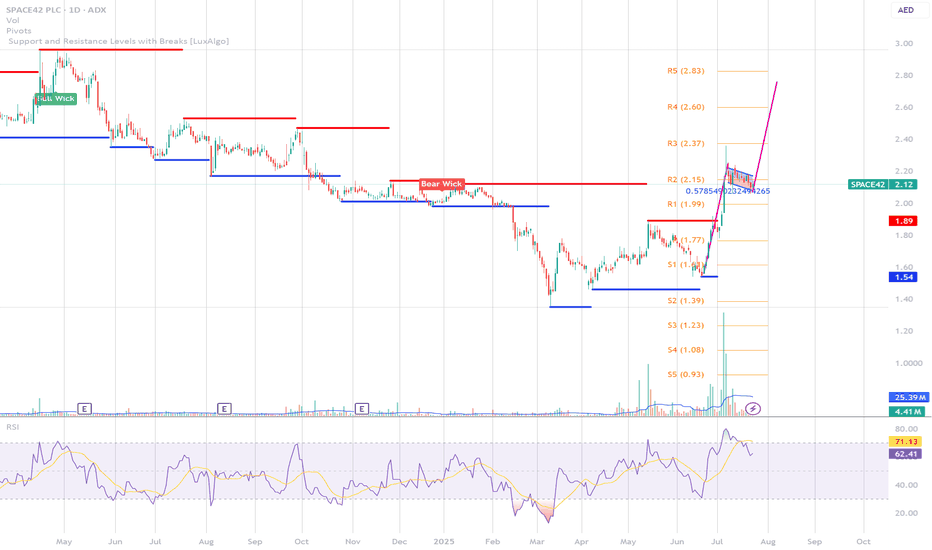

Updated Technical Analysis: Space42 PLC Daily CharThe daily chart of Space42 PLC is showing a strong bullish breakout from a long-term downtrend.

Key Observations:

Price Breakout: The price has decisively broken above the resistance at 1.78 AED, which was a key ceiling for several months.

Retest and Confirmation: There was a brief throwback to retest the 1.78 AED level, which successfully held as support, confirming the breakout.

Next Resistance : The immediate resistance is now located at 2.40 AED, which is the next technical target suggested by the breakout structure.

Support Levels:

Primary support: 1.78 AED (previous resistance, now confirmed support)

Secondary support: 1.60 AED (lower support zone within the previous consolidation range)

Indicators:

RSI: Currently at **80.77**, indicating strong momentum but also nearing overbought territory. Price may consolidate or pull back in the short term before further continuation.

Volume: A significant spike in volume accompanies the breakout, adding credibility to the move.

Commodity Trend Reactor: Displays positive strength and aligns with bullish momentum.

What to Watch:

Holding 1.78 AED Support: If the price remains above this level, the bullish structure is intact.

Approach to 2.40 AED Resistance: Look for signs of continuation (strong bullish candles and sustained volume) or potential rejection.

Pullback Behavior: A controlled retracement to 1.78 AED with low volume would be healthy and could provide a continuation setup.

Volume and RSI: Watch for decreasing volume on pullbacks and RSI behavior near current levels for potential cooling before a next leg higher.

Key Levels:

Support: 1.78 AED, 1.60 AED

Resistance: 2.40 AED

The current price action suggests bullish momentum, but traders should closely monitor how the stock behaves around these critical levels for confirmation of further movement.