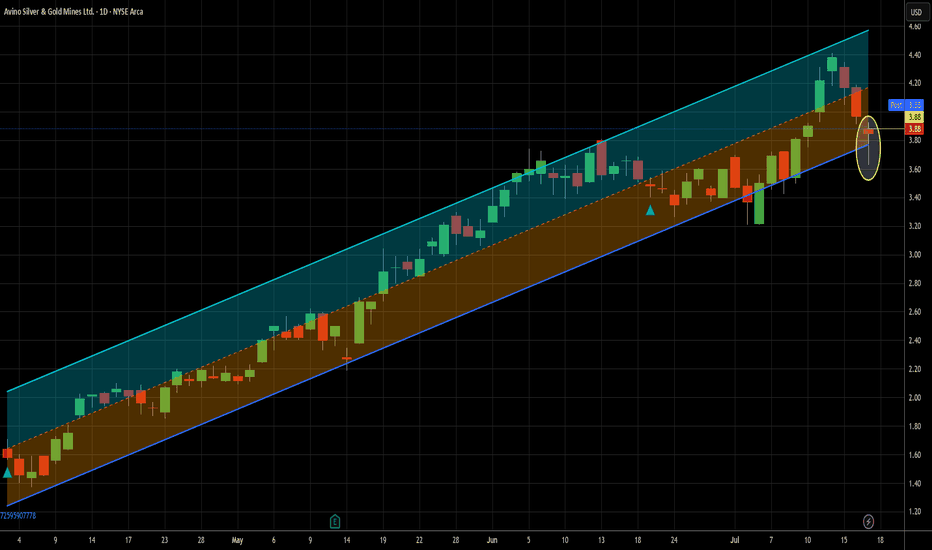

I'm just going to keep putting the hammer down - Long at 3.88I've done two other ideas for ASM in the last 3-1/2 months, so I'm not gonna rehash all those details here. If you are new to me or to my ideas for this ticker, just look at those. In them, I make a fairly compelling argument for short term trading this name. I'll sum it up quickly here - it's been extremely profitable. I'm expecting no different this time.

Since my last idea on June 20th, there has been only one buy signal on this name until this week, but that one paid 9.5% in two trading days. Today's signal is actually the 3rd in a row (not uncommon for this ticker) and full disclosure, I traded the other two so I'm in this already. That said, today's signal is extra spicy, thanks to that pretty little hammer of a candlestick that printed today. For those unfamiliar, it is often a sign of a bullish reversal. It requires confirmation, but given the perfect record my signals have provided to this point on ASM, I can justify not waiting for that confirmation as it can cause missed trades if the stock jumps 4 or 5% the next day, as it is fond of doing. But if someone were to jump in on this trade but wanted to wait for confirmation, I believe that the move here would last more than one day, should it happen.

I also have been increasing my exposure to inflation-related trades lately and why not get that from something that bumps like this does?

The solid uptrend that goes back well farther than this chart shows sweetens the deal even more. Given that my first recent signal clicked at the 4.17 level two days ago, I'm expecting a move to and beyond that level in the relatively near term, though that's obviously not a guarantee. I will likely get out of this leg of the trade before it gets there, unless it does it in one move, which isn't out of the question at all. That's only about 7.5% above the current price and this stock moves that much in a day semi-frequently. Twice in the last 7 trading days, in fact.

So that's my case. If the market stays semi-strong, this will likely stay weak until the market cools off some. This is my second add to my real life position, so I'm certainly not shy about adding more if my signals warrant it.

As always - this is intended as "edutainment" and my perspective on what I am or would be doing, not a recommendation for you to buy or sell. Act accordingly and invest at your own risk. DYOR and only make investments that make good financial sense for you in your current situation.

ASM trade ideas

I'm starting to really like trading this stock - long at 3.47I cheated and bought intraday on this one, because it threw a signal yesterday and I didn't bite then. I couldn't resist today.

You might remember that in my first idea for this stock on April 3, I had some nervousness about this stock. I was happy getting out with a 3.7% gain in four days. What if I told you that was the worst return of the last 7 signals?

There have been 6 signals since my last idea. These are the returns (shown on the chart with white arrows):

+11.22% in 3 days

+12.95% in 2 days

+10.33% in 6 days

+17.11% in 2 days

+6.71% in 2 days

+4.02% in 3 days

Obviously not a guarantee, but those are numbers that make me a lot less nervous about this trade than the first one. Obviously, buying and holding since my last trade would have been a far better idea (+112% in 10 weeks), but that's not what I do, and few stocks do what this one has done since then. So this time, I'm not just coloring outside the lines, I'm scribbling. Hopefully, this one will be a big winner. Fingers crossed.

I could enter additional lots if it throws signals before it pays and this may or may not be a FPC trade, depending on the circumstances.

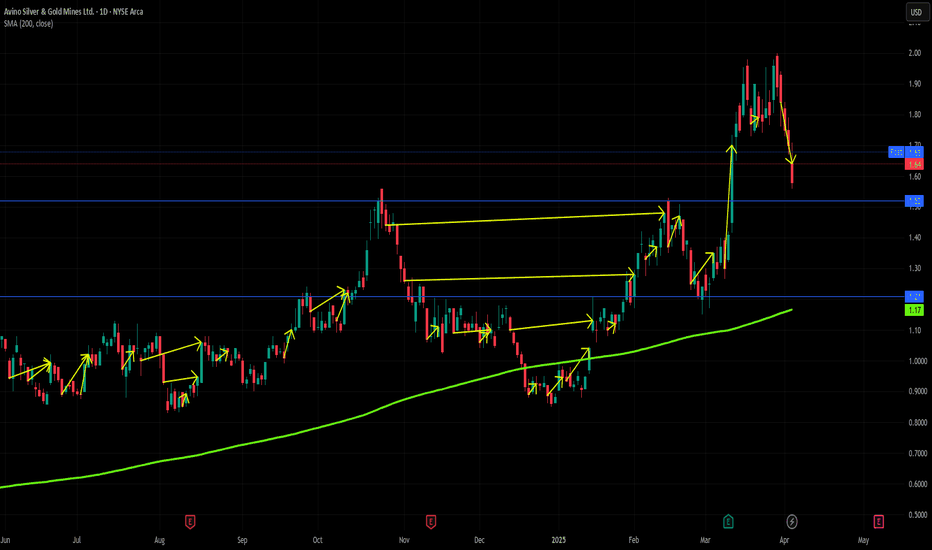

I'm coloring outside the lines today - Long at 1.64In times of duress (and we can all agree this qualifies, I think), go back to a classic - the 200d MA. Not many stocks these days are trading above their 200d MA. Fewer still are in a business that is a built in hedge for inflation. I think these tariffs will be even more inflationary than they are recessionary and gold itself isn't quite a buy, so it's this small miner I'm trading today. I don't intend to hold it very long, but it's always nice to have a reason besides technicals in your back pocket in a trading environment like this one. There is some support nearby and the 200d MA as well.

As an added bonus, low priced stocks tend to generate outsized moves. I don't know about your portfolio, but after today, mine could use an outsized move in the upward direction. 5 down days in a row improves the odds as well. Now for the juicy part.

This is a new method I've been working on for the past few months and it has done PRETTY well in all environments, at least relative to buy and hold. It isn't foolproof and if a stock goes straight down it can be a way to amass a handful of garbage (see 10/25 - 12/5 on the chart).

Overall, though, it does extremely well, as you can see from the yellow arrows on the chart, representing past trade setups with this stock.

28 trades: 27 wins, 1 open - the most recent one.

-Average gain = +6.01%

-Average hold period = 10.3 trading days

-Average gain/lot/day held = +0.58% (roughly 13x the average long term daily return of the S&P)

Depending on the market conditions and what the stock does, I MAY do a FPC close, I may not. I will add as necessary, but hopefully this will be a one and done trade.

As always - this is intended as "edutainment" and my perspective on what I am or would be doing, not a recommendation for you to buy or sell. Act accordingly and invest at your own risk. DYOR and only make investments that make good financial sense for you in your current situation.

ASM – Buying in the StormThis is a bad time for the long term. The macroeconomic scenario is challenging, and indices like the S&P 500 and Nasdaq seem to be at the end of a bullish cycle.

Still, the temptation to buy can be strong when the setup looks promising.

Technical Factors Supporting the Trade:

Weekly Heiken Ashi breakout confirmed.

Vertical volume well above average.

Exponential moving averages (2 weeks and 1 month) and simple moving averages (3 months and 1 year) all pointing upward.

Breakout of a descending trendline.

A setup like this is hard to ignore.

Entry: $1.66 – even after a 17%+ rally on the day. The ADR justifies the move.

Are you getting on board?

ASM - Strong Case for Reversal The descending curve is a bullish chart pattern called a descending scallop

Higher lows are also present within the triangle I have drawn

The breakout on this would be pretty aggressive and probably reach right back up to its starting point.

Looks like a crypto chart lol.

Weekly Chart.

Avino Silver & Gold (USA: $ASM) Ready For Precious Metal Boom!⛏️Avino Silver & Gold Mines Ltd., together with its subsidiaries, engages in the acquisition, exploration, and advancement of mineral properties in Canada. It primarily explores for silver, gold, and copper deposits. The company owns interests in 42 mineral claims and four leased mineral claims, including Avino mine area property comprises four concessions covering 154.4 hectares, 24 exploitation concessions covering 1,284.7 hectares, and one leased exploitation concession covering 98.83 hectares; Gomez Palacio property consists of nine exploration concessions covering 2,549 hectares; Santiago Papasquiaro property comprising four exploration concessions covering 2,552.6 hectares and one exploitation concession covering 602.9 hectares; and Unification La Platosa properties, which include three leased concessions located in the state of Durango, Mexico. It also owns 100% interests in the Minto, and Olympic-Kelvin properties located in British Columbia, Canada; and 14 quartz leases in Eagle property located in the Mayo Mining Division of Yukon, Canada. The company was incorporated in 1968 and is headquartered in Vancouver, Canada.

$ASM fireworks soonASM is nearing the apex of a symmetrical triangle while holding 10% above its 200 day EMA since January of this year. I see a lack of oversold conditions while the stock is within a consolidation pattern. With precious metals prices resuming their uptrend (or so that is my opinion) the evidence weighs more heavily towards higher prices than lower.

**I am long $ASM**

Super tight rangeBollinger bands are showing volatility has died right off. The last two times this happened were followed by a big pulse up.

Price is still hovering just below 50-day EMA but a break above this level could be enough to set off a nice breakout, but be careful of the fake-out like in May.

cheers!

$ASM Avino silver gold mining stock 1.34-1.84$Buy moment 1.34-1.40$ sell moment 1.78-1.84$. Earnings are coming and due to collaborations between silver and EV battery market I see the target happening well before April. Has already a nice run but still looks stable. I still see a potential gain of 0.40$. Also a very popular one for the SilverSqueeze guys.

Silver Miner’s retail investor-Fueled SurgeSilver-exposed stock $ASM climbed early on Monday, after a surge in retail trading pushed the price of the precious metal to an eight-year high.

Silver has rallied in recent days as some users on social media have seemingly turned their attention to the metal.

“What we don’t know is exactly how this is happening,” said Markets.com analyst Neil Wilson. “Clearing out of shorts by worried hedge funds, retail-driven bid, ETFs flows driving the physical market, smart-money front-running the trade, or a combination of all these,” he added.

The surge came after the dual-listed miner, which has a silver operation in Mexico, disclosed last week plans to sell up to $25 million of newly issued shares into the U.S. market.

Exactly what kinds of investors are behind the current run-up in metal prices and silver-exposed stocks is uncertain, but clearly opportunities have arisen.

A number of posts on the WallStreetBets forum advocated buying silver, while #silversqueeze has also been trending on Twitter. However, many posts also argued against the trade.

“The issuer community will flood the market with capital raises, particularly the U.S.-listed ones who can access the superior liquidity with ‘at the market’ equity issuances,”

www.barrons.com

finance.yahoo.com

$ASM is gonna fall todayPupm&Dump trading strategy idea.

$ASM is rising too much today.

The demand for shares of the company looks lower than the supply.

This and other conditions can cause a fall in the share price today.

So I opened a short position from $1,86;

stop-loss — $2,08;

take-profit — $1,42;

Do not view this idea as a recommendation for trading or investing. It is published only to introduce my own vision.

Always do your own analysis before making deals. When you use any materials, do not rely on blind trust.

You should remember that isolated deals do not give systematic profit, so trade/invest using a developed strategy.

If you like my content, you can subscribe to the news and receive my fresh ideas.

Thanks for being with me!

ASM Penny Stock Alert UpdatePENNY STOCK ALERT UPDATE

$ASM - Avino Silver & Gold Mines Ltd. Common Shares (Canada)

Initial Alert Price: $0.94

Price High: $1.25

% Gains/Losses: 32.98%

(+14% More Than Expected)

Potential Stop Loss: $1.1875

#Breakout #Stocks #Trading #Investing #Alerts #StockMarket #Daily #News #Today

ASM Penny Stock Alert UpdatePENNY STOCK ALERT UPDATE

$ASM - Avino Silver & Gold Mines Ltd. Common Shares (Canada)

Initial Alert Price: $0.94

Price High: $1.32

% Gains/Losses: 40.43%

(+21.43% More Than Expected)

Potential Stop Loss: $1.25

Our initial update stated that we were leaning more towards the sell side with ASM, but the stock continued to run another 10% since our last alert update for a total 40% return on investment from our initial alert. The stock is showing some momentum with nothing but buying volume since today's session opened. The stock is currently on track to retest its 52-Wk Highs of $1.49 where currently resistance sits. We would like to notate that the $1.49 was previously the levels of resistance back in 2018, so if the stock can bounce above and find support, then the stock will begin trading back in the $1.50-$3.00 Price Ranges that it once did between 2016 and 2018. #Breakout #Stocks #Trading #Investing #Alerts #StockMarket #Daily #News #Today

Follow for more trade alerts and information & egister your account for Instant Alerts by clicking the link in our signature.

ASM Penny Stock Alert UpdatePENNY STOCK ALERT UPDATE

$ASM - Avino Silver & Gold Mines Ltd. Common Shares (Canada)

Initial Alert Price: $0.94

Price High: $1.14

% Gains/Losses: 21.28%

(21.09% More Than Expected)

Stop Loss Limit: $1.08

Looking for a 15% Swing Trade on ASM after the most recent consolidation has created a Descending Triangle for the 2nd time in the past 60 days. We're hoping to see the stock breakthrough the $1.12 Levels and find levels of support above the current resistance to begin retesting the $1.46 6-Month High. #Breakout #Stocks #Trading #Investing #Alerts #StockMarket #Daily #News #Today

Follow for more trade alerts and information & register your account for Instant Alerts by clicking the link in our signature.

ASM Penny Stock Alert UpdatePENNY STOCK ALERT UPDATE

$ASM - Avino Silver & Gold Mines Ltd. Common Shares (Canada)

Initial Alert Price: $0.94

Price High: $1.14

% Gains/Losses: 21.28%

(21.09% More Than Expected)

Stop Loss Limit: $1.08

Looking for a 15% Swing Trade on ASM after the most recent consolidation has created a Descending Triangle for the 2nd time in the past 60 days. We're hoping to see the stock breakthrough the $1.12 Levels and find levels of support above the current resistance to begin retesting the $1.46 6-Month High. #Breakout #Stocks #Trading #Investing #Alerts #StockMarket #Daily #News #Today

Follow for more trade alerts and information & egister your account for Instant Alerts by clicking the link in our signature.

New CycleThis share has just started a new trading cycle since early this year. Price could rally to the next following four years. However, in long term view this share is a sideway with price whipsaws on weekly view. For short term four years trading cycle, there was significant buy breakout on May, breaking a strong trendline TL1 followed by a Golden Cross in weekly timeframe. Additionally, this share has recently made a strong recovery since August and breaks another strong daily downtrend line this week coincides with a positive divergence sparked on MACD histogram. Holding long may place a trailing stop at 1.05, and a new long position can be executed at current level cautiously with a nearest stop loss level at 1.05. We would be cautious on resistance overhead at 2.2 to 2.5 if the price is unable to penetrate significantly higher.

Disclaimer the content on this analysis is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions.