CVM- Q1 Data Release and Beautiful Wedge FormingCVM has an update coming up on their drug for head and neck cancer, Multikine. This alone tells you that this is a good stock to own in March. The fact that they are forming a bullish flag formation already is a little surprising, but I will definitely enter this week. Look to hold throughout March and watch out for the press release. Good luck!

CVM trade ideas

Should You Buy This Hot Reddit Stock?After GameStop's spectacular short squeeze, investors are now wondering if other heavily shorted stocks that are popular among contrarian Reddit investors, such as CEL-SCI.

As it turns out, discipline becomes paramount when the value of one's holdings goes up so high and so fast.

CEL-SCI is a development-stage biotech that is seeking to develop a novel immunotherapy treatment, Multikine, for head and neck cancer. Despite its noble goals, the company has its fair share of skeptics: Nearly 30% of its shares are shorted.

Multikine is CEL-SCI's only late-stage candidate. The experimental therapy is going through the final stages of phase 3 data collection and statistical analysis, with results expected any day. Multikine's phase 3 clinical trial has been going on for a decade, even though it was supposed to conclude in December 2015. The discrepancy between the actual and estimated trial completion time has caused CEL-SCI to become a contested stock.

All of this matters because large-cap biotechs can acquire development-stage competitors that successfully bring just one immuno-oncology therapy to market for more than $20 billion. CEL-SCI's market cap is just about $850 million, so the stock would without a doubt become a multi-bagger if it can bring Multikine past the finish line. Likewise, since it only has about $40.5 million in assets and negligible revenue, it will likely trade down to zero if Multikine disappoints.

www.fool.com

CVMThe stock rallied after announcing data lock. It looks ready to move to all-time highs. The 9ema crossed the 20 ema and it appears like we may see a "golden cross" this week. In addition the MACD is rising and yesterday saw the most volume in months.

Continued volume and the imminent release of data should drive the price to the $18.4 range before data release. Good data will bring $80-$100.

CVM 4D:: Best level to BUY // 100%+ SWING trade (STOCKS)Why get subbed to to me on Tradingview?

-TOP author on TradingView

-15+ years experience in markets

-Professional chart break downs

-Supply/Demand Zones

-TD9 counts / combo review

-Key S/R levels

-No junk on my charts

-Frequent updates

-Covering FX/crypto/US stocks

-24/7 uptime so constant updates

CVM 4D:: Best level to BUY // 100%+ SWING trade (STOCKS)

IMPORTANT NOTE: speculative setup. do your own

due dill. use STOP LOSS. don't overleverage.

🔸 Summary and potential trade setup

::: CVM 4days/candle chart chart overview

::: strong bullish chart

::: triangle breakout pending

::: strong recovery in progress

::: measured move TP is 100% gains

::: TP bulls is 26/28+ 100% gains

::: expecting strong gains next few weeks

::: next SWING is going to be 100%+ gains

::: well defined symm trn breakout

::: STRATEGY: BUY/HOLD at market

::: BUY/HOLD swing trade setup / patient traders

::: 100%+ gains on BUY SIDE medium-term

::: good luck traders

🔸 Supply/Demand Zones

::: N/A

::: N/A

🔸 Other noteworthy technicals/fundies

::: TD9/Combo update: N/A

::: Sentiment: BULLS

::: Sentiment outlook short-term: BULLS

CVM About to Start New RallyWeekly Chart :

AMEX:CVM Finished the Major Down Trend on April 2019, and from then is in a solid Secondary Up Trend.

Note 13.50 Historical level, which serve us as a good support to form a trade.

Daily Chart :

Minor Down Trend about to end (Yellow):

Line Chart :

The Trade Plan :

Wait for a Clear Bullish Minor sign -

1. Strong buying Candle on 13.50 Level .

2. Retest of the Orange Trendline and closing above the Yellow Trendline.

Higher Lows, New Highs soonThe recent close above the weekly trendline and the the MACD curling positive leads me to believe that CVM will retest its prior highs. Looking for some consolidation on the uptrend and eventually retest of $17.80 on its way to $23.19 Aside from the recent bear raid this stock has been unfazed by recent market drops and looks strong

$cvm

$CVM Reversal trade in Cel-Sci Corp.The rising trend-line remains strong and volume is promising. There looks to be a very nice reversal trade opportunity setting up and the bollinger bands signal a sizable move.

Very high short interest at 20% which could help fuel a rally.

Company profile

CEL-SCI Corp. is a biotechnology company, which engages in the research, development, and manufacture of investigational immunotherapy products for the treatment of cancer and infectious diseases. Its product pipeline includes Multikine and Ligand Epitope Presentation System (LEAPS). Multikine is an investigational immunotherapy for the potential treatment of head and neck cancers. LEAPS is categorized into LEAPS-H1N1-DC, a product candidate for the treatment of pandemic influenza for hospitalized patients; and CEL-2000 and CEL-4000 which are vaccine candidates for the treatment of rheumatoid arthritis. The company was founded by Maximilian de Clara on March 22, 1983 and is headquartered in Vienna, VA.

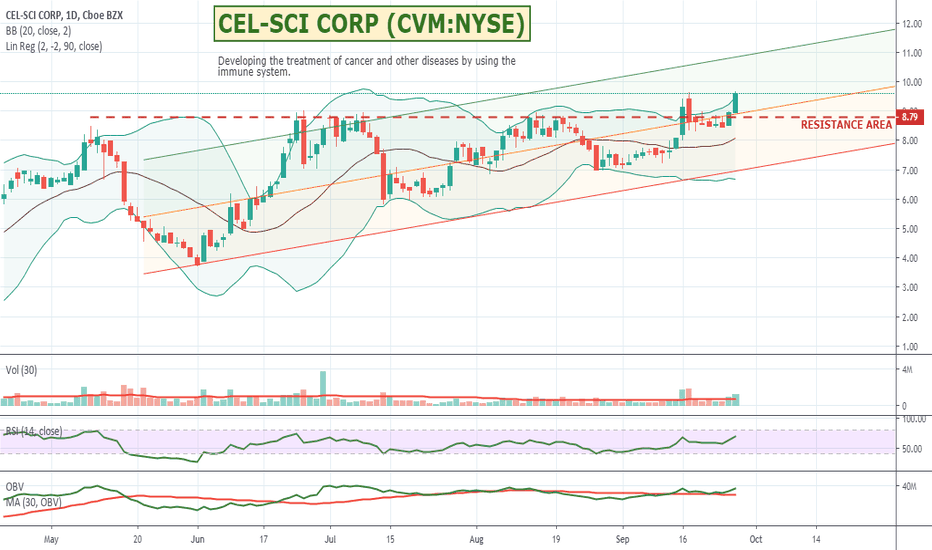

$CVM - CEL-SCI - Using the bodies immune system to fight cancersStill playing around with buying shares directly in Trading View via Trade Station and REALLY liking it so far. Super simple. Took a punt on CVM as it looks to have broken above a multiple resistance area, has broken above its upper bollinger band, has good volume, OBV is up, and the RSI is showing it has demand behind it and is still at fair value.

As for the company itself, I do like the idea of using the bodies own defence systems and turbo boosting them to fight cancers and other diseases. These "discovery" type stocks can however be highly volatile and can rocket or plummet on news.

You can see on the chart in the blue buy box I bought 100 @ $9.09 and they are now at $9.60 - and the green $58.48 in the box is how much I am up for the stock so far. You can also see that I have a sell stop (ie sell at market) if the stock hits $7 or below. This sell stop is easy to drag up and down, so I can have a look each day and very quickly visually check on say the 1 Day and 15 minute charts to see if I want to move it up or down. I can also very quickly flick between my moving averages views and my bollinger band views to see if I want to make it tighter or looser depending one whats happening in the market. Very cool. I like it :)

I don't have a take profit order in but that is also easily set and movable. Sometimes on these speculative type shares I might have a 15% take profit to capture any sudden rises before they pull back. For now I will monitor this one manually and move my stops as it progresses. Note that I will almost never move a stop down. They are there for a reason. Id prefer to take the $5 brokerage hit and get out and buy back in if one of my stops gets taken out.

CVM is also my mothers initials so fingers crossed this one rockets :) (<- Not a buy recommendation by any means :))

CEL-SCI Corporation is engaged in the research and development at developing the treatment of cancer and other diseases by using the immune system. The Company is focused on activating the immune system to fight cancer and infectious diseases. It operates through the segment of research and development of certain drugs and vaccines. It is focused on the development of Multikine (Leukocyte Interleukin, Injection), an investigational immunotherapy under development for treatment of certain head and neck cancers, and anal warts or cervical dysplasia in human immunodeficiency virus and human papillomavirus co-infected patients and Ligand Epitope Antigen Presentation System (L.E.A.P.S.) technology, with over two investigational therapies, LEAPS-H1N1-DC, a product candidate under development for treatment of pandemic influenza in hospitalized patients, and CEL-2000 and CEL-4000, vaccine product candidates under development for treatment of rheumatoid arthritis.

CVM about to breakout above 10This company is currently in Phase 3 of a pre treatment autoimmune therapy drug multikine that is aiming to improve your chances of chemo therapy by 10%. Results are expected within the next 6-12 months. And it could really hit a home run on the back of Phase 3 results. In the short term I expect investors to start taking bets and a test of the 10 level once broken will ultimately lead to a target of 12. Lots of upside. LONG

CVM Break outLast 2 times we had MACD cross on the daily we saw new 52 week highs then a retrace only to rebound even higher days later to the .61 Fib extension levels both times.

This time we have retraced to 5.80 and from there our .61 level is $9.10.

Looks like we are getting that MACD cross on the daily this week and Im damn near certain we see $9 this week.

CVM Just getting startedWatch for a "J Hook" developing on the daily chart and notice the that the .61 FIB was tested 3 times and held in 5 days of heavy volume. Also several higher ups at CVM were awarded options @ $5.65 in lieu of salary. This late in Phase 3 this fact alone makes me super BULLISH.

Looking to retest the $7.50 high and either consolidating for a few days or just blast off to the next fib level of 1.618 @ $10.68 or possibly $11.64

Still looking for $100 by next year #CVMMAFIA

disclosure: Locked and Loaded, super long CVM.

CVM - Morning Panic & BounceCVM is a biotech had news on the 30 of trial underway this is a former spiker that currently has multi green days under its belt current shares short % is 12% this also sitting well above vwap which shows longs are holding over the weekend and with shorts getting paid I will be looking for a morning panic at open for a nice bounce, also observation last panic bounce was on friday and I didnt bounce until around 9:45ish so want a little let it truly panic

Entry mid 4.90s looking for a 10-20% bounce will pla

CVM Imminent Rally Notice CVM tested its upward trend and pulled back @ $3. Also the MACD cross.

This stock has been consolidating since October and is looking ready to break out. Massive bull flag on the daily. Volume has been steadily increasing every day. Also final phase 3 data due anytime. Looking for a break of $3 on 3/8 and potentially up to $3.50 short term. Long term this will be a $100 stock.