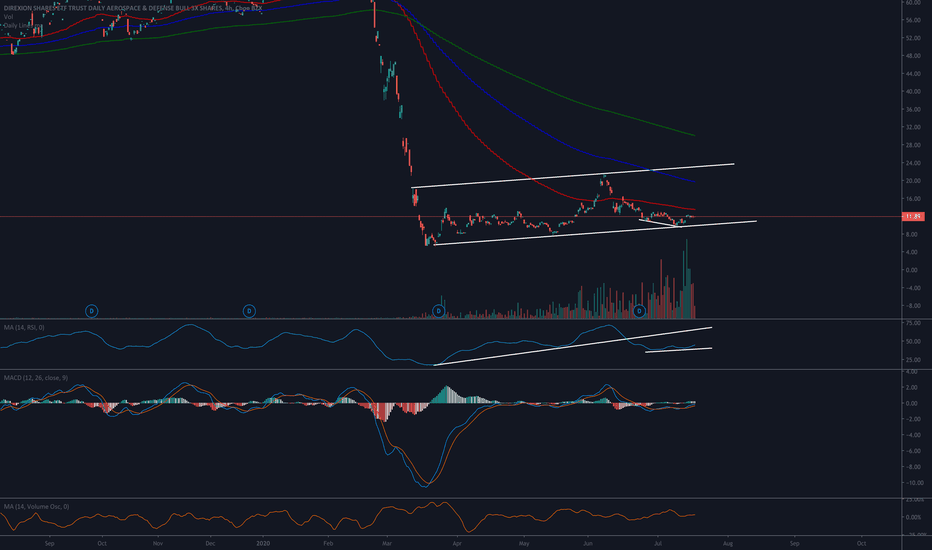

War is a Racket | DFEN | Long at $28.00The war machine keeps turning. Profits will reign. Direxion Aerospace and Defense 3x AMEX:DFEN never fully recovered from pandemic lows, but world peace is (unfortunately) far from reach. The uptrend in the chart has commenced. Personal entry point at $28.00.

Target #1 = $37.00

Target #2 = $50.00

Target #3 = $64.00

DFEN trade ideas

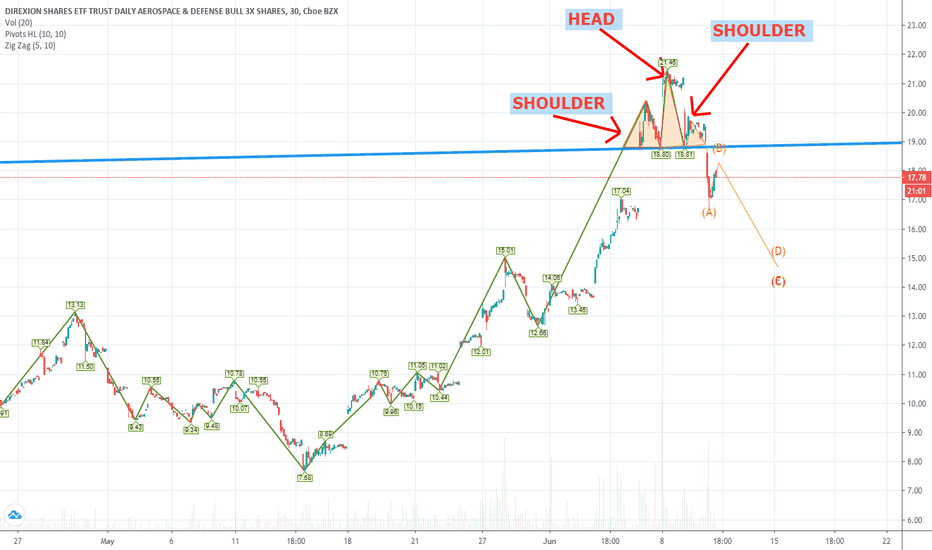

DFEN 11/17 17CAMEX:DFEN has shown a pattern of responding positively to conflict, this combined with an earnings event for NYSE:RTX , $NO and NYSE:BA could prove to bring significant upside. 3 Bearish imbalances that need to be filled, PT1 at $16.82, PT2 at $18.12, OB at $20.11. I am bullish on defense earnings due to the conflict in Ukraine.

thehill.com

Is the DFEN dip buyable?I think that the dip is very buyable. Fundamentally, Russia has made the world more

dangerous. Shipments of weapons to Ukraine have depleted US and European stockpiles.

NATO is in a growth mode as proposed by former president Trump some years ago.

While many would like less defense spending and shift it into social spending or

infrastructure or clean technology government funding. the pragmatics are that

national security is generally higher on the priority list. DFEN just dropped below

the high volume area of the volume profile on the 15 minute chart in a VWAP breakdown.

The relative strength lines did a bottom bounce on the indicator. I will exploit this

as a long buying opportunity looking to a modest 5% upside target at minimal risk.

DFEN ETF forms bullish "Upside Breakout" chart patternDirexion Daily Aerospace & Defense Bull 3X Shares forms bullish "Upside Breakout" chart pattern

"Upside Breakout" chart pattern formed on Direxion Daily Aerospace & Defense Bull 3X Shares (DFEN:NYSE). This bullish signal indicates that the stock price may rise from the close of $21.91 to the range of $24.60 - $25.20. The pattern formed over 50 days which is roughly the period of time in which the target price range may be achieved, according to standard principles of technical analysis.

Tells Me: The price broke upward out of a trading range suggesting we're entering a new uptrend.

The Upside Breakout pattern represents a trading range in which prices move sideways between two parallel horizontal lines. It's often a pause or congestion area within an existing trend though sometimes the breakout results in a reversal to the prior trend. Either way, an upside breakout through the upper resistance line signals an end to the consolidation period and the start of an uptrend.

Price Target 1: $24

Price Target 2: $26

DFEN - 14.69% Profit Potential Swing Trade Setup - TriangleAscending Triangle formed after a period of correction. The run should resume and price to hit the resistance line.

Keeping the Stop Loss very tight. Consider lowering it to $22.81 if you don't have much risk exposure in your current trading portfolio.

- Target Entry: $23.50

- Target Stop Loss: $23.20

- Target Exit: $26.90

- Risk / Reward Ratio: 11.33

About me

- Note that I tend to adjust stop losses in order to secure profits early and preserve capital. This means that the target price is going to be achieved as long as there are no strong pullbacks that trigger my new adjusted stop loss

Boeing and Lockheed just got a big earnings forecast upgradeFor assessing earnings forecasts, I use the Zacks "Price and Consensus" chart. The charts for Boeing, Lockheed-Martin, and Raytheon all show that they got big upgrades of their earnings forecasts last not. I should caution that I have no idea WHY analysts upgraded these aerospace companies' earnings. Maybe it's related to the Trump space force or geopolitical tensions with Iran. But the stocks are moving today in response to the upgrade, and the upgrade was biggest for Boeing. An ETF like DFEN, with a lot of Boeing exposure, looks like a promising bet after the upgrade. Aerospace stocks have been pretty overvalued overall, so until I understand better why the upgrade happened, I am treating this as a short-term swing trade.

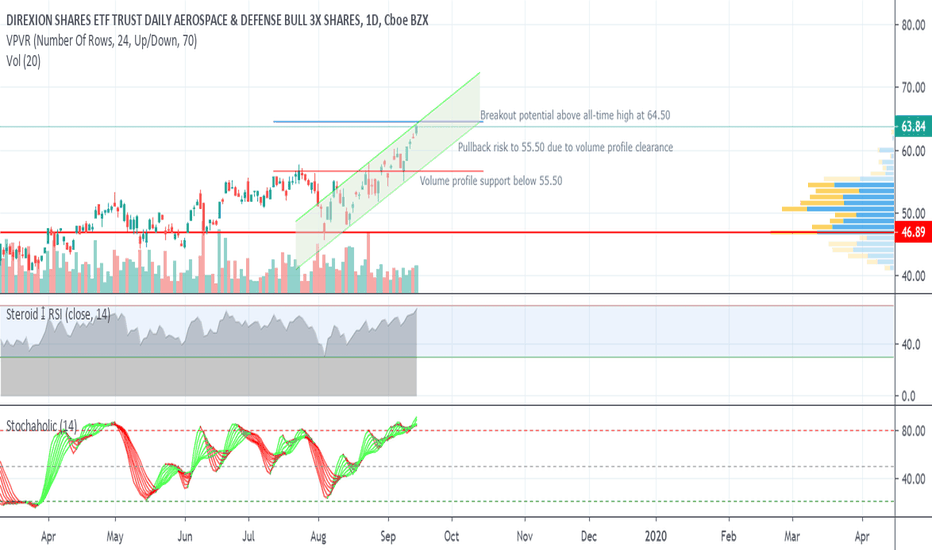

Defense and aerospace stocks could get breakout to new highsOne of the items on my watch list is DFEN, the Direxion Daily Aerospace and Defense Fund. This ETF tracks companies like Boeing that would supply the US government with jets and drones in the event of a war with Iran. I'm not buying the fund yet, because it's at the top of its month-long parallel channel, and it's very close to its all-time high at 64.50, without much support on the volume profile. However, if it does start to look like we're going to war with Iran, I think we may see a breakout. I am watching closely to buy any breakout above either the parallel channel or the all-time high.