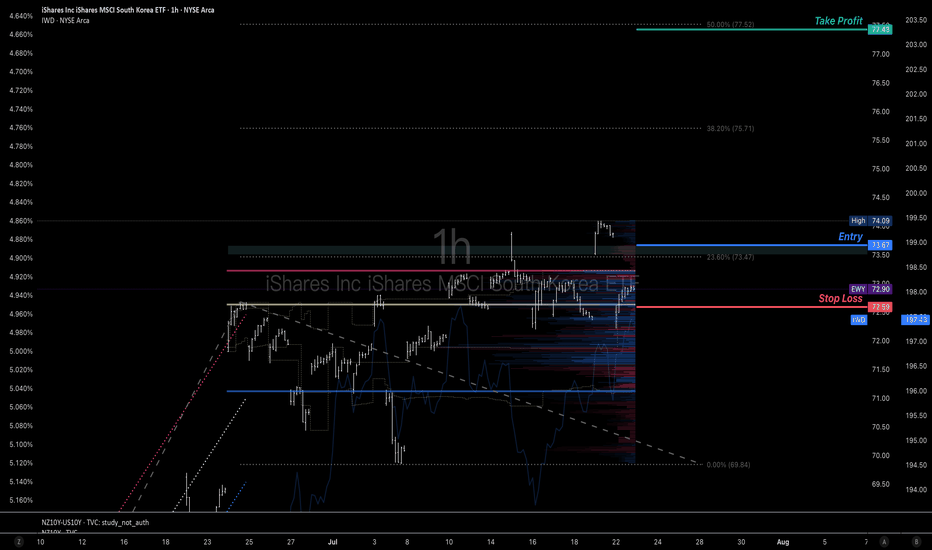

A potential chance to get long position of Korean equity marketsKorean economy and stock market emotion are well boosted by their regulation reform and new president elect. Many global traders miss the previous uptrend and the price is about to test the current resistance again.

Imma use a buy stop order @73.67 to try to get in the train to diverse my long position on equity market.

If you only do swing trades, there's a long swing trade plan on my chart. I may use the latest to take half of profit once the price hit the first or second resistance @77.43 above the current trading area to control the position size that can fit for long term trade.

EWY trade ideas

Opening (IRA): EWY July 18th 35C/February 21st -55C PMCC*... for an 18.17 debit.

Comments: Back into EWY, after missing out on the dividend due to my shares being called away. Since there is no longer a dividend to be had, going with a Poor Man's Covered Call/long call diagonal, buying the longer-dated 90 delta strike and selling a shorter-dated call that pays for all of the extrinsic in the long, resulting in a setup that has a break even slightly below where the underlying is currently trading.

Metrics:

Buying Power Effect: 18.17

Break Even: 53.17

Max Profit: 1.83

ROC at Max: 10.07%

50% Max: .92

ROC at 50% Max: 5.04%

Delta/Theta: 46.50/.751

Will look to money/take/run at 50% max.

Opening (IRA): EWY January 17th 52 Covered Call... for a 51.50 debit.

Comments: Primarily in this for the dividend, since the ROC %-age without it kind of blows chunks. The last four distributions were: .63, 1.68, .70, and 1.65. Would appreciate something in the neighborhood of 1.00 (please and thank you) ... .

Metrics:

Buying Power Effect/Break Even: 51.50/share

Max Profit: .50

ROC at Max (Excluding Dividends): .97%

I generally look to take profit on these at 50% max, but will wait for the dividend to drop to see what's what ... .

Korea bullish trend, buying dipsThesis: South Korea is being considered as an AI startup hub as well as a chip source for AI.

it has a bullish trend. i am waiting for price to reach the lower end of the lower dynamic volatility range to start incrementally building a position in 0.25-0.5 basis points

ETF - Go Long on South Korea! $EWY The ETF on ASX is $IKO South Korea, iShare MSCI South Korea.

This ETF tracks $EWY in the US Market.

I like this wedge chart pattern here, we are still trading sideways since the start of the year.

A breakout is coming,

currently, the price is still above all three moving averages, (21,50,200).

Therefore, it is more likely to break out into the upside.

Buy on a breakout and close above $94.75.

Korean pumptardednessEWY posted the same pattern as it did before the last 2 big drops. Entered into some puts today for next week.

There's still room for it to go hit resistance and ATH, the 2 lines I've drawn. If it goes up from here, look for a similar pattern before shorting.

I'm bearish for Monday, but who knows, they can do another vaccine pump, 3 weeks in a row, lol.

Note, if it tanks on Monday, wait until Tuesday to short, it usually does a 2 step drop with an up day in teh middle.

EWY has confirmed a breakout with lots of room to move higherKorean stocks are attractively priced compared to American equities. Initially a falling dollar benefits American exporters. If the dollar falls too far, it will be bearish for American stocks and we could see International stocks take the lead again. American stocks tend to underperform after a decade of outperformance. The EWY Korean Index is comprised of sectors that are currently the highest performing sectors in America.

Tech: 33.8% (Samsung is the largest holding)

Communication: 11%

Consumer Discretionary: 10.5%

EWY Korean H&S?Out of all major indices, Korea is down the most tonight. I didn't realize that EWY now has weekly options, not as much liquidity as EWW or EWZ, but at least they exist.

In any case, looks like a H&S pattern..... also, note how much bigger the movement compared to SPY. I always tell people teh return is better with foreign index ETFs.

[Long Idea] EWYLooking back over the last few weeks, it's clear that foreign stocks have been the safest, best play to take advantage of looming dollar inflation.

I should have bought and held countries with accelerating growth, like Russia (RSX) and South Korea (EWY).

Hoping at some point in the next month or two I get a good buying opportunity in either one, probably to ride for the rest of 2020. Remember we have elections this year and if the market sniffs out even a chance of a Democrat winning, it may price in MMT and the dollar might weaken even faster. Either way, both parties are full speed on out-of-control spending, deficits, and borrowing. Long Energy, Tech, Gold, Foreign Stocks.

Canary in the coal mine $EWYWhile there are folks that may disagree, i've always looked at the $EWY as an early indicator of possible downside pressure, globally. If you look at this chart, the EWY has been step laddering against the SPX, diverging much more so at the beginning of 2019. While the SPX was making new highs and posed to break out to new levels, the EWY steadily continued its downward move. We are tied globally much more than any other time in history. What affects one market shouldn't be shrugged off as not having an effect on another, especially a country like Korea. As an expat who lives and works in Korea, you can see the economic pressure and slowing down on the ground. Having this spat with Japan in the recent weeks (a spat that goes back to the early 1900's on a much more personal level than economic) is going to accelerate the downturn even further.

Korea now looks like a squeeze setupWith the completion of the elliott pattern on the downside, I am on my toes for a nice squeeze in these markets.

My momentum fractal matcher aligns the 5th of July on the daily, with 8th of February on the hourly. If you look at what happened after 8th of Feb 2018, that was a 10% move up in 5 days. I don't expect this move up to be quite that fast, but I think it will be similar.