Is it too late to enter China market now ?www.cnbc.com With articles like this, suddenly all those who claims China market was "uninvestable"are sitting up and taking a closer look at this market again.

For those who have followed me, please refer to my past posts on HSI and FXI and various Chinese companies, most listed in HK but some in China as well.

The one sector that I remain bearish is the property market and I have no short to mid term plans to enter into it. There are however many interesting sectors , especially pharmaceutical, healthcare related stocks that I am interested to explore.

Buying into an ETF like FXI gives you a broader exposure to the blue chips companies that are financially stable and diversify into different sectors like automotive, IT, e-commerce, consumer staples, healthcare ,etc. Then, if you are still interested in China related stocks, you can dive into individual company and invest as well. Higher risk higher returns.

As usual, please DYODD

FXI trade ideas

China Market Broder View This analysis is based on FXI ETF the iShares China Large-Cap ETF, which is trades on US stock exchange represents large-capitalization Chinese equities that trade on the Hong Kong ...

largest fall in Chinese market over 60 %, you can see volume-based buying near monthly support area which were represented through circle. I noticed volume following month:

March 2022

Oct. 2024

Jan 2024

Sep 2024

Feb 2025

April 2025

During the Month of September & October a bullish breakout has been appeared with ultra-high volume when FII was Exiting Money from Indian market. that Breakout Failed Due to Trade war tension or anything else whatever the reason, but weakhand brought out by market then market tested again, and we can see ultra-high volume making bullish candle on April 2025 indication of smart money entered. So Bullish Momentum could be seen in upcoming months.

Technical Perception

RSI traded above 50

a bullish crossover of 20&50 Moving average

Price Traded above 20 Moving average

FXI ETF - what's your next move ?First thing first, congratulations to those who bought this ETF at the beginning of 2024. It has since climbed 70% from the bottom to the current price.

Now, we are at an inflection point. With an ambitious 5% GDP target and 2% inflation rate for 2025, the whole world is watching China for more stimulus plans to be released. Property market, once the darling jewel and near exclusive investment for many people , this dream has been dashed. EV market, touted to be the next sector of growth is facing price cutting amongst the local manufacturers. The tariffs imposed by US does not help, making their import price to the overseas buyers higher and squeezing their profit margins.

In a year or two, I expect more consolidation of EV manufacturers where only the top 3 players will survive and holds significant market shares.

From chart, we can see the price action is now at an inflection point. Refer to the chart , Oct 2022, could we see a repeat of this pattern? Possible but imo, quite unlikely. The government is in a catch 22 position, having to defend itself against the never ending US tariffs and a sluggish domestic market that consumers are still reluctant to spend (as much as the government would like them to be).

Thus, I would be monitoring this chart closely, not adding at the moment but definitely not selling any units as well.

Please do your own due diligence.

FXI - Headed to 50As the "Made in America" - "Made in China" battle heats up, FXI projections may indicate that China will made strong advancements in its economy. How tariffs play into the scene is yet unknown, the chart patterns, including the extension formation makes me think that price can target the 2.618 measured move, up to 50.

FXI options expiring on January 17 and February 21, the strategyFXI Technical Analysis: Testing Key Support Before Potential Upward Move on Policy Developments

Description:

In this analysis, we examine FXI (FTSE China 50 Index ETF) and its recent volatility trends between January 17 and February 21, 2025. FXI has seen a significant drop in implied volatility from 117.10% to 37.82%, accompanied by a drastic reduction in open interest from 123,059 to 5,247. This indicates a potential decrease in market uncertainty regarding the Chinese market.

Key Points:

Implied Volatility: Decreased from 117.10% to 37.82%

Open Interest: Decreased from 123,059 to 5,247

Near-term Volatility: 3.10 (>1 abnormal)

Analysis: FXI is likely to test the lower support level around January 17, which also aligns with a critical resistance area. Following this, based on upcoming policy decisions related to Trump’s inauguration and U.S.-China relations, FXI may either move upwards or consolidate sideways. My assessment leans towards a greater potential for an upward movement, driven by positive policy developments.

Trading Strategy:

Support Test: Monitor FXI as it approaches the key support level for potential entry points.

Upward Bias: Look for bullish signals post-support test to capitalize on the anticipated upward move.

Risk Management: Implement stop-loss orders to protect against unexpected downward movements.

Join the Discussion: What are your thoughts on FXI’s potential move? Do you agree with the upward bias based on policy developments? Share your insights in the comments below!

FXI - Solid Pick for 2025Reading about the Chinese auto companies this morning and seeing how their cheaper vehicles are bound to dominate. I spend time in Mexico and see the onslaught of cheap Chinese vehicles selling for $18,000. Seems that almost all articles I read mentioning China, I walk away thinking that China is kicking our butt in business progress. Yet the US stock indices continue to break all time highs, day-by-day, while China's market, albeit having made significant gains since making a double bottom over the past year, is just muddling along.

I see FXI, at a minimum, being at 34 at the end of 2025, based on the current trend line in place. That's a 10% gain plus a 2%+ dividend that meets my 12% annual investment requirement. Currently, the gains have been capped at the .328% Fibonacci retracement level. Bad news if this is merely a corrective wave with lower prices ahead. But even as the US and Europe place tariffs on imports, the rest of the world is jumping at the opportunity to purchase cheaper products in a highly inflated world.

Double bottom target price is up in the mid 40s. I plan to be overweight in FXI in 2025.

FXI to $55.00 someday ?FXI , the most representative ETF of the Chinese stock market, reflects, in our view, a 15-year stagnation that contrasts with the remarkable economic growth China has experienced during the same period.

Since May 2008, the FXI has unsuccessfully attempted to break above the $55.00 level, registering relative highs at the following points:

May 2008: $55.00

April 2015: $52.85

January 2018: $54.00

February 2021: $54.53

At the same time, since October 2008, the ETF appears to have established a support level near $20.00, with notable lows at:

October 2008: $19.35

October 2022: $20.87

January 2024: $20.86

A key level: $33.73

Currently, FXI is attempting to break above $33.73, which corresponds to the 0.382 Fibonacci retracement level. This calculation is based on the relative high of $54.53 (February 2021) and the lows recorded in October 2022 ($20.87) and January 2024 ($20.86).

In October 2024, the price temporarily surpassed this level, driven by high volume, reaching the 0.50 level ($37.70). However, this movement was short-lived and lacked follow-through.

The key question

Will FXI manage to decisively break through the $33.73 (0.382) level in the coming days? And if so, will it reach the following key Fibonacci levels?

$37.70 (0.50)

$41.67 (0.618)

$47.32 (0.786)

$54.53 (1.00)

While FXI is still far from breaking through the $55.00 barrier, a sustained move from the $20.86 lows could signal a historic trend shift, challenging the ceiling that has capped its price for the past 15 years.

Our opinion is for educational purposes only and should not be considered a recommendation to buy or sell. Before making any investment, consult with your financial advisor.

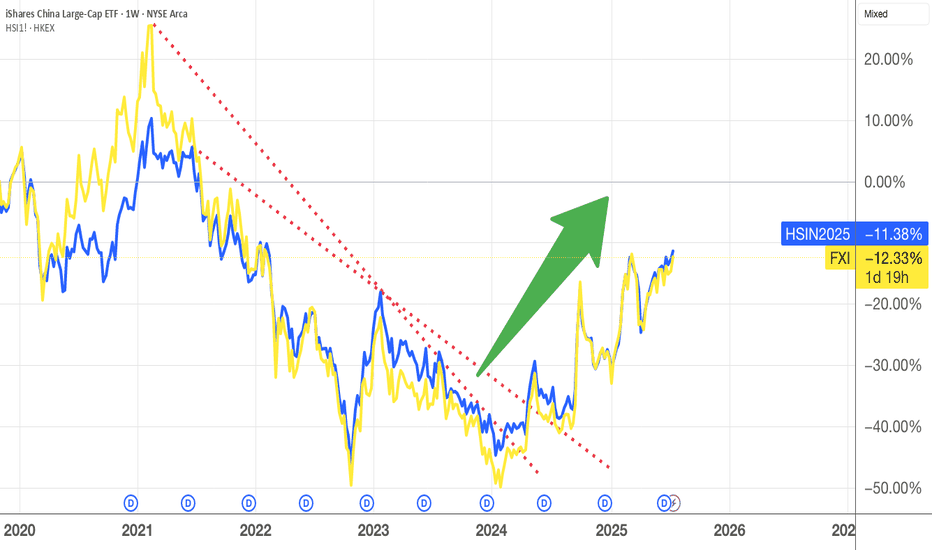

There is hope for China equitiesOne of the most hated market currently and some called it uninvestable, the China market has plunged more than 60% from its peak. We are now at an inflection point again, reaching the upper side of the decreasing channel.

I believe the property market will take some years to recover , with excess supplies to clear and consumers continuing to adopt a wait and see approach in buying as prices continue to fall......

Probably, 2nd to 3rd Quarter of this year , will we be able to see some recovery. Currently , it is still weak although the government has injected billions of dollars to shore up the stock market, clamping down on short sellers, etc.

Prices can continue to tumble even if it breaks out of the channel as the stimulus is not strong to begin with and consumer confidence has not returned to the market. Job market remains soft in China and people are tightening their wallet to spend unnecessarily. With no additional stimulus from the government, people are using their own savings to continue travel and do their shopping but at a more cautious approach.

So long as the US interest rates remain high at 5 over % , the international players would continue to support the US market which makes business sense.

Time is of essence as people who invest in S&P 500 index can easily gain 8-10% profits a year so there is no reason to park funds into China equities even it is undervalued and the downside is very little. Nobody can tell for sure how long this will last as it can go sideways for a long time. Those who knows how to stock pick individual China shares may benefit from certain themes which I have covered some months ago like Travel sectors.

FXI - Wave 5 can push price to 40+A Wave 4 50% indicated price would drop to 31.10. Filled at 31.05. Wave 5 should push prices above Wave 3. While I will take some profits around the $40 level, as I did when price hit $33, my initial target, China will be a force going forward so I will maintain a long-term stock position. Thus far, this has been an exceptional trade after initially highlighting the double bottom at the 22 level.

Buy when there is maximum fear or blood on the streetsBefore, investors were afraid to touch Russia market but then again, other than its ETF, many retail investors in Asia are quite unlikely to be acquainted with this ETF. Now , 2 years have passed and the war is still ongoing but few cares about the outcome and impact (if any) on the stock market.

Now, all eyes are on China, a too big country to miss anyway! We see from the weekly chart that it has reached a triple bottom formation and rebounded nicely upwards. It is still very much undervalued imo and the risk/rewards is tremendous if all things are working nicely for China.

It would not be a straight line up though we had seen very strong upward trajectory in the last 4 weeks in the HSI.

2nd half of this year, I expect more stimulus to come from the Chinese government to continue boost consumer confidence. The faster they put a floor on the property market bottom, solve the unemployment issues , the faster the consumers will return to the stock market. Retail investors are hoarding up cash in the trillions instead of spending after the recent Covid Saga plus the implosion of the property market (many many got burnt)

It will take some time so be patient ....There will be resistance along the ways but knowing the resilience of the Chinese government, I believe the bull market has return and moving forward, it will be better for everyone.

I am vested in this index so please DYODD

Ishares MCSI China: The Sleeping Giants last pushAs you may know, Chinese markets have recently surged following the announcement of a massive 7.5 trillion yuan ($1.07 trillion) stimulus package, equating to roughly 6% of China’s GDP. This package aims to revitalize its struggling economy and promote new growth. Following the news, the Hang Seng Index broke out from a value of 17,369 to an impressive 20,689—a remarkable 25% increase in less than six months.

FXI Still Time to Capitalize on the China Stimulus RallyThe recent surge in Chinese stocks following China’s central bank stimulus announcement signals a promising opportunity for those looking at the iShares China Large-Cap ETF. The stimulus package, part of a series of aggressive moves from Chinese policymakers, reflects a significant shift in their approach to economic management. For years, China hesitated to implement large-scale stimulus measures, fearing the long-term risks. However, the latest actions show that this cautious mindset has been abandoned, with the government now prioritizing immediate economic recovery.

This newfound willingness to deploy powerful monetary tools suggests that China’s central bank is prepared to act decisively to combat the economic pressures the country is facing. With this level of commitment, it’s reasonable to expect that the stimulus will have a meaningful impact, potentially accelerating growth in key sectors. The iShares China Large-Cap ETF, which tracks some of the largest Chinese companies, stands to benefit significantly from this shift. As these companies often reflect the broader health of China’s economy, investors could see strong gains in the near term as the effects of the stimulus ripple through the markets.

Given the central bank's proactive measures and the potential for further interventions, the iShares China Large-Cap ETF presents a compelling opportunity for bullish investors who want to capitalize on China's economic rebound.

Potential Trend Reversal on iShares China Large-Cap ETF (FXI)The FXI (iShares China Large-Cap ETF) chart is signaling a possible shift in trend direction. Following a period of volatility, recent price action suggests the potential for an upward movement. Traders should watch closely for further confirmation of this trend reversal and adjust their strategies accordingly.

Dead cat bouncing ?China unveils fresh stimulus to boost its ailing economy by cutting reserve requirement ratio and lowering interest rate, following the footsteps of Federal Reserve, on Sep 24.

China and Hong Kong market rallied after the announcement. I re-looked at the chart of FXI and contemplated that FXI should be now in the 'b' wave of a larger W-X-Y (double zigzag) pattern as depicted in the chart.

This 'b' wave can be a flat or a double three, but based on its structure, it could most likely turn out to be a contracting triangle. Once this 'b' wave structure is done, FXI should be heading south again to complete the 'Y' wave. Target price : 10 USD.

$FXI / $SPX | You Should Be Tracking ThisWe've been full bull China since early spring of this year and this chart here represents our macro thesis. We've posted about AMEX:FXI before and it's potential swing move of 75-100%...

This chart here is AMEX:FXI vs SP:SPX on macro HTF. We believe this chart represents a macro bottom of china relative US equities.

Last night, China announced a 50 bps rate cut with plans for additional rates cuts in the near future, as well as lowering existing mortgage rates. We've been expecting some govt influence and we finally got it.

HUGE move printing and we think it's just the beginning. We've been big on NYSE:BABA and OTC:PNGAY all year and they've been two of the big winners today.

Currently printing a macro 3M RSI bottom and looking to confirm it after q4 candle print.

This is a move that will likely take the rest of the decade to fully play out.

China's about to fly No more comments needed - weekly double bottomed, broke out of downtrend and retested breakout - I expect FXI > 35 by end of the year

Disclaimer: This idea is not intended as investment advice and should not be interpreted as an offer to sell or a recommendation to purchase any asset. Any decisions made based on the information presented in this idea are the sole responsibility of the individual. All investment decisions should be made independently, taking into account your financial situation and objectives.

FXI - iShares China Large-Cap ETF... FXI stock is a strong buy due to China's rapid economic growth, diverse portfolio of leading companies, and potential for high returns. Investing in FXI offers exposure to China's expanding market.

9988.HK

Alibaba Group Holding Limited 9.72%

0700.HK

Tencent Holdings Limited 8.73%

3690.HK

Meituan 8.09%

00939

00939 7.08%

01398

01398 4.74%

03988

03988 4.26%

9999.HK

NetEase, Inc. 4.00%

1810.HK

Xiaomi Corporation 3.77%

9618.HK

JD.com, Inc. 3.73%

01211

01211 3.51%

FXI stock is a strong buy because while the US and Europe have experienced an incredible bull run, China's market hasn't seen the same gains. This offers a unique opportunity for potential growth and high returns.