Lines, Boxes etc that fade out by distanceIt would be cool to have drawing Elements that fade out by a distance. Like trend lines that last just a few days. Zones with a gradient fade out in one direction, like up or down. Especially horizontal lines could have a center point, from where they fade in both directions.

LEU trade ideas

Safe Entry LEUStock Movement Ranging.

Current 1H Green Zone is Safe Entry, wait for confirmation for entry since the Zone been Tested before which means its weaker but since it has strong buying power i believe its safe.

Note: 1- Potentional of Strong Buying Zone:

We have two scenarios must happen at The Mentioned Zone:

Scenarios One: strong buying volume with reversal Candle.

Scenarios Two: Fake Break-Out of The Buying Zone.

Both indicate buyers stepping in strongly. NEVER Join in unless one showed up.

2- How to Buy Stock (safe way):

On 1H TF when Marubozu/Doji Candle show up which indicate strong buyers stepping-in.

Buy on 0.5 Fibo Level of the Marubozu/Doji Candle, because price will always and always re-test the

Safe Entry Line LEUSafe Entry 135.5$ Price Level.

LEU Target 315$ Price Level.

Note: 1- Potentional of Strong Buying:

We have two scenarios must happen at The Mentioned Line:

Scenarios One: strong buying volume with reversal Candle.

Scenarios Two: Fake Break-Out of The Buying Line.

Both indicate buyers stepping in strongly. NEVER Join in unless one showed up.

Leu data i have been watching for Squeeze power

Short Interest: 2.92M shares (18.6% of float)

Days-to-Cover: ~1.7–3.3 days

Borrow Rate (APR): ~0.49%

Put/Call Open Interest Ratio: ~0.88

Volume Put/Call Ratio: ~1.06

30-day Implied Volatility: ~87%

IV Rank: ~61

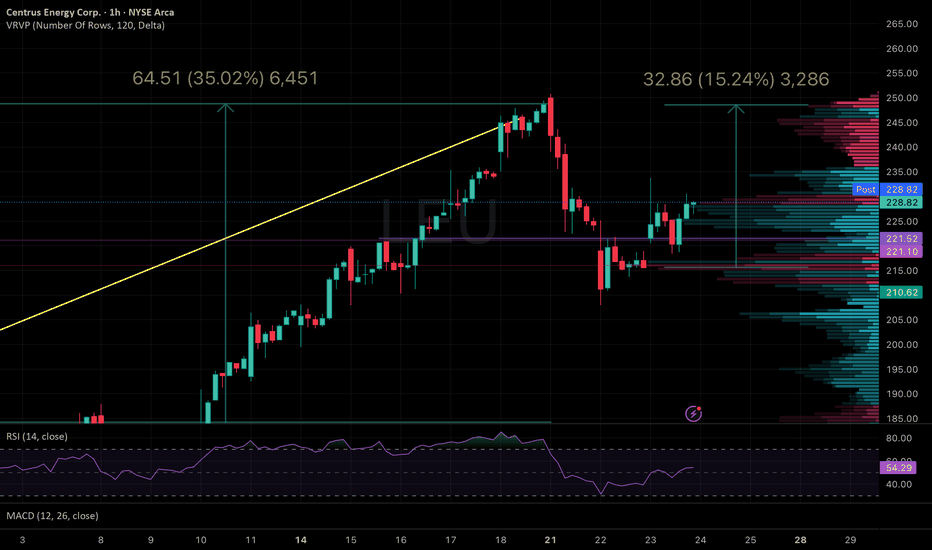

Suggested Re-Entry Zone: $177.00–$180.00 range (near lower trendline and prior support zone)

Short-Term Price Target: $196–$200 retest (lower high)

Breakout Price Target: $210.98+ (previous peak); continuation possible if short covering ignites

Note: The chart shows a descending wedge pattern forming with high volume flushes into support — historically a bullish setup if it reclaims and holds above $185. A strong close above $191.77 can re-ignite momentum.

Scalp LEU Safe Entry Zone

Scalp Short Term 15M Chart.

Green Zone is Buy.

Take Profit/Red Zone is sell.

Note: 1- Potentional of Strong Buying Zone:

We have two scenarios must happen at The Mentioned Zone:

Scenarios One: strong buying volume with reversal Candle.

Scenarios Two: Fake Break-Out of The Buying Zone.

Both indicate buyers stepping in strongly. NEVER Join in unless one showed up.

2- How to Buy Stock:

On 15M TF when Marubozu Candle show up which indicate strong buyers stepping-in.

Buy on 0.5 Fibo Level of the Marubozu Candle, because price will always and always re-test the imbalance.

Leu Forming a nice Symmetrical Triangle

Exceptionally high shorting—massive squeeze potential

Days‑to‑Cover 1.7–3.4 days (avg ~1.8) Short sellers need multiple days of volume just to cover

Borrow Fee (APR) ~0.52% (intra-day range 0.49–0.52%) Still low—no signs of panicked covering yet

Available Shares to Borrow ~35 K–50 K shares Near zero—utilization is maxed, no fresh shorts allowed

Off‑Exchange Short Volume ~57% of intraday volume Private shorts building pressure to cover fast

Put/Call OI Ratio ~0.88 (put skew) More calls than puts—bullish options flow

Options IV ~86.5% atm, ~78–85% range Elevated but with room to explode on catalyst

LEU in short Squeeze territoryLEU is in short squeeze territory.

Float: ~15.8M shares

Short Interest: ~2.92M shares (~18.5% of float)

Days to Cover: 2.7–3.4 (based on avg. volume)

Cost to Borrow: >12% APR — elevated friction for short holding

Utilization: 100% — all lendable shares are actively short

Off-Exchange Volume: 52.9% of total daily volume

Average DP activity: trending higher last 5 sessions

Interpretation: Consistent dark pool action + volume spikes = institutional movement. Large buys may be being masked to avoid alerting retail and algos.

Call Volume Surge: ~12,380 contracts vs 3K avg

Put/Call Ratio: 0.6 — bullish bias

IV Rank: ~43%

IV Level: ~79.5% (historically high but not dangerous)

Unusual Flow: Deep OTM calls for July and August being loaded — $180, $200, $250

Current Price: $173.66

Today’s High: $175.65

Breakout Zone: $165–168 (just cleared)

Next Resistance: $180.50 → $186 → $195

Support: $167.20 → $161.80

Volume: Over 1.02M — first major 1M+ session since March

RSI: ~86 — hot but normal in short squeeze scenarios

MACD: Just crossed bullishly on daily

Entry: $170–172

Risk: Stop at $163

Target 1: $180

Target 2: $188–190

Stretch Target: $200+ on gamma ramp if momentum holds

Is LEU going to break the next resistance?

The yellow dashed line shows the next resistance level. IMO it shouldn’t be too difficult for LEU to break through this level. The volume profile has been extremely robust, but some corrections may occur along the way.

If there is no aggressive correction and the price moves beyond this yellow line, a true bullish trend may be underway.

Centrus Energy (LEU): Nuclear Energy Expansion ContinuesCentrus Energy Corp. (LEU) is a nuclear fuel supplier focused on providing enriched uranium to power plants worldwide. The company plays a key role in supporting clean energy by ensuring a steady supply of nuclear fuel for electricity generation. With global interest in nuclear energy rising, Centrus is positioned to benefit from increasing demand for low-carbon power solutions.

The stock chart recently showed a confirmation bar with increasing volume, pushing the price into the momentum zone, which occurs when price moves above the 0.236 Fibonacci level. This signals strong investor interest and potential for further gains. A trailing stop can be set using Fibonacci levels with the Fibonacci snap tool, helping traders manage risk while staying in the trend.

Centrus Energy Corp. | Chart & Forecast SummaryKey Indicators on Trade Set Up in General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

# Centrus Energy Corp.

- WXY & ABC Wave | Center Settings

* Resistance

* Support

* Retracement

* Trend Line

Active Sessions on Relevant Range & Elemented Probabilities;

London(Upwards) - NYC(Downwards)

Conclusion | Trade Plan Execution & Risk Management on Demand;

Overall Consensus | Neutral

LEU - Opportunity to reload on swing position if this is activeWe are currently being controlled by our white buying continuation - we rejected off the top and have sold off in our controlled selling algorithms. Today we will be opening up right on top of the bottom of this white channel and will be interested to see if this can pick up price and break out of our strong selling purple. If that happens I will add to my current swing position.

Happy Trading :)

- TraderDaddyOG

LEU - Updated Analysis after nice bullish movement and reversalWe've been eyeing this breakout since we started to prove sell-side tapering from our strong selling algo to our more tapered teal. Since then, we've seen healthy movement and if we're looking back to a year ago, we can see a similar pattern that formed prior to a larger breakout.

So here I am going to allow us to come back and retest white if that's what price wants to do - if it does I will add to my swing position there, and once we break out of teal tapered selling, we have some nice room up to our retest and attempted breakout of magenta/red tapered selling.

That will be the real test and for that breakout we will need to see our strongest purple and yellow algorithms be in control to break out of there.

Hope this was helpful - as always, feel free to ask further questions on any of my analysis either in the comments or in a personal message to me.

Have a great day all and...

Happy Trading :)

- TraderDaddyOG

LEU - We've been prepared for this breakout all along! With signs of tapering kicking in a month ago and our strong buying channels awaiting activation, we've been preparing for this breakout and finally got our entry last week!

There's plenty more room for this to go although we can see some immediate signs of resistance here at our tapered teal. Look for yellow strong buying continuation to continue to activate and hold price for a breakout of teal and test of magenta.

Happy Trading :)

LEU - Finally a bullish signal with lots of room to the upsideI've been watching Centrus Energy (LEU) for the past few weeks considering they are a strong company and we're in a very strong controlled selling (yellow) algorithm for some time. I was waiting for a bullish sign of reversal prior to finding support at tapered blue - which we saw last week when price was picked up by teal buying continuation. We are now gapping up above our strong yellow selling algo and our next stop will be to test the breakout of orange more tapered selling.

If we reject off of orange, we will be looking for one of our buying continuation channels, preferably yellow (very strong) to pick up price and take us out of orange where we will then have the opportunity to attempt a magenta tapered break.

Will keep you posted with further analysis as price develops!

Happy Monday and as always,

Happy Trading :)