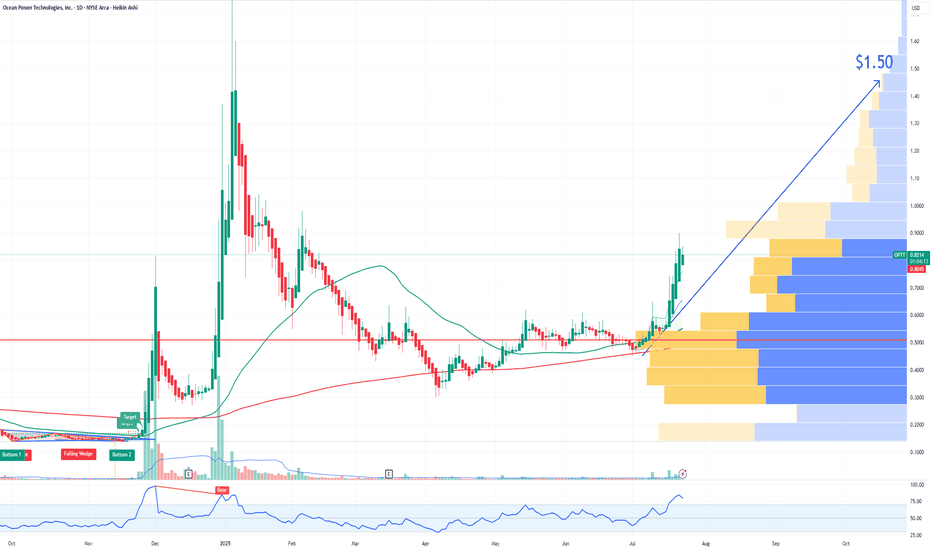

OPTT Ocean Power Technologies Options Ahead of EarningsAnalyzing the options chain and the chart patterns of OPTT Ocean Power Technologies prior to the earnings report this week,

I would consider purchasing the 1.50usd strike price Calls with

an expiration date of 2025-11-21,

for a premium of approximately $0.25.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

OPTT trade ideas

Autonomous Maritime Platforms & AI: OPTT at the Crossroads 🔧 Core business

Ocean Power Technologies develops low-carbon, autonomous maritime systems: PowerBuoy® platforms combining wave, solar, and wind energy, and WAM‑V® autonomous surface vessels for sectors like defense, offshore energy, scientific research and environmental.

Their integrated Merrows™ AI suite enables advanced ocean monitoring with subsea sensors and 5G connectivity.

📈 Past 3 Years (2022–2025)

2022: DOE grant to advance MOSWEC wave energy converter and refine the PowerBuoy design

Ocean Power Technologies

2023–2024: OEM partnership with Teledyne Marine, strategic alliances with Red Cat (drone integration) and distribution with Remah International in the UAE for deployment of PowerBuoys and WAM‑Vs

May 2024: Approached 15 MWh of global renewable energy production across deployments in the Atlantic, Pacific, Mediterranean, and North Sea

Late 2024: Completed over four months of offshore testing of its Next‑Gen PowerBuoy off New Jersey, with 100% data uptime and battery state-of-charge above 90%.

Pipeline and backlog surge: Q3 FY25 backlog raised to $7.5 M, pipeline ~$92 M, up sharply year-on-year

Cost reductions: Operating expense declined by 39% in Q1 FY25, net loss narrowed, on track for profitability in calendar 2025

March 2025: Added sales executive for U.S. defense agencies; showcased WAM‑V and PowerBuoy AI at NAVDEX Abu Dhabi with RIG

🚀 Next 3 Years (2025–2028)

Plan to reach profitability in 2025, transitioning fully from R&D to commercialization

Expanding into Latin America, Middle East, Europe, and strengthening U.S. defense market presence through new reseller agreements

Deploying PowerBuoy and WAM‑V systems for defense, hydrographic surveys, maritime monitoring, and environmental projects.

Further technology enhancements—AI-based autonomy, enhanced sensor payloads, modular marine energy systems.

Participating in global conferences and trade shows to boost visibility and strategic networks (over 15 events globally in early 2025)

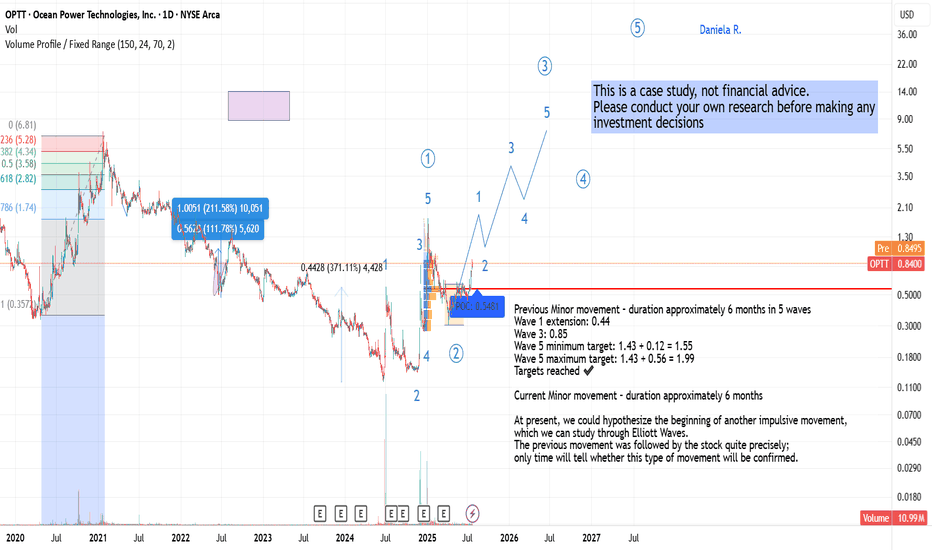

This study it's pulished only as a case study.

This is not a financial advise, please do your own research.

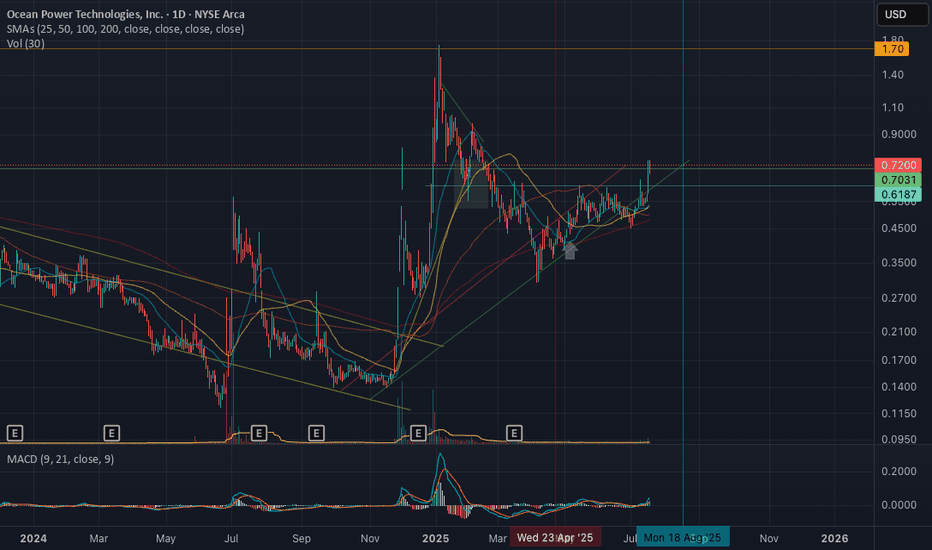

OPTT to $1 this year?Price recently closed above the local high with a bullish hammer bring us above the daily trend line, after bouncing off .29 in early '24 & April '25. If it can hold above ~.46-.47 range then I think we are going to be $1+ by EOY.

I'm gonna grab some Calls for .50c at various expirations since they are super cheap. Company's tech is pretty solid, wouldn't be surprised if there were NATO contracts being discussed currently or within the next year and we see a massive pop.

OPTT Breakout Opportunity!

- **Entry Point:** $0.8796

- **Stop Loss (SL):** $0.7663

- **Take Profit Targets:**

- **Target 1 (T1):** $1.02

- **Target 2 (T2):** $1.19

The chart highlights a wedge breakout pattern with bullish momentum on the 30-minute timeframe. The price has broken out of the resistance zone (yellow line) with significant volume, indicating a potential continuation towards the take-profit targets.

### **Trading Plan:**

1. **Entry:** Place a buy order at $0.8796 after confirmation of breakout.

2. **Stop Loss:** Below recent support at $0.7663 to minimize risk.

3. **Targets:**

- First target: $1.02.

- Second target: $1.19 for extended gains.

Risk-to-reward is favorable; adjust your position size accordingly.

$OPTT 33-41 CENTS REVERSALIf the bounce gets confirmed, I would aim to collect profits around .67 to play it safe.

Thank you for watching, please keep in mind this is my personal opinion on the crypto and you should not trade/buy/short based on this information.

Please do your own analysis and give me a big smile :)

- DREAM1ZR :)

OPTT BUY/LONG NOW READY! 2.30 to 2.40 by ARD DEC21TICKER CODE: OPTT

Company Name: OCEAN POWER TECHNOLOGIES, INC

Industry: US Stocks Producer Manufacturing Electrical Products

Position Proposed: BUY/LONG

Entry: 2.30-2.40

1st Partial Take Profit: 3.55-3.60

2nd Partial Take Profit: 4.10-4.15

3rd Partial Take Profit: 5.10-5.15 (~Dec 2021)

Stop Loss: 1.75-1.80

Technical Analysis

1. Descending wedge/Pennant (completed and broke out)

2. MEGAPHONE forming at a bigger time frame

3. 1st Partial Take Profit will be at next major structure level & Fibonacci retracement at 0.786

4. 2nd Partial Take Profit will be at the next major structure level & Fibonacci retracement at 0.618

5. 3rd Partial Take Profit will be at 100% of flag pole length