SH trade ideas

SH Bullish IdeaThe purple Bearish union ABC is the primary bearish pattern in play where I anticipate D to complete in the upside target area. The powerful pattern is the blue bearish union ABC because it has a B extension of its XA swing which means I anticipate price to complete above B. This particular pattern is very powerful when we have such a clear B extension of XA. I am anticipating both bearish patterns to complete their CD legs simultaneously.

SH S&P500 SPX Is The US market crash coming ? Is The US market crash coming ?

We have 3 types of “crashes”

Correction <15% downward movement in a major indicy

Bear Market <20% downward movement in a major indicy

Black Swan event, something very unexpected that tanks the market, think 1987, 1929, challenger disaster, 911 and so on.

The fourth type is the 1919, 1929, 1999 and 2008 scenario that people generally refer to as a “crash” 2022 a new one ?

Sincereley L.E.D In Spain 14/05/2022

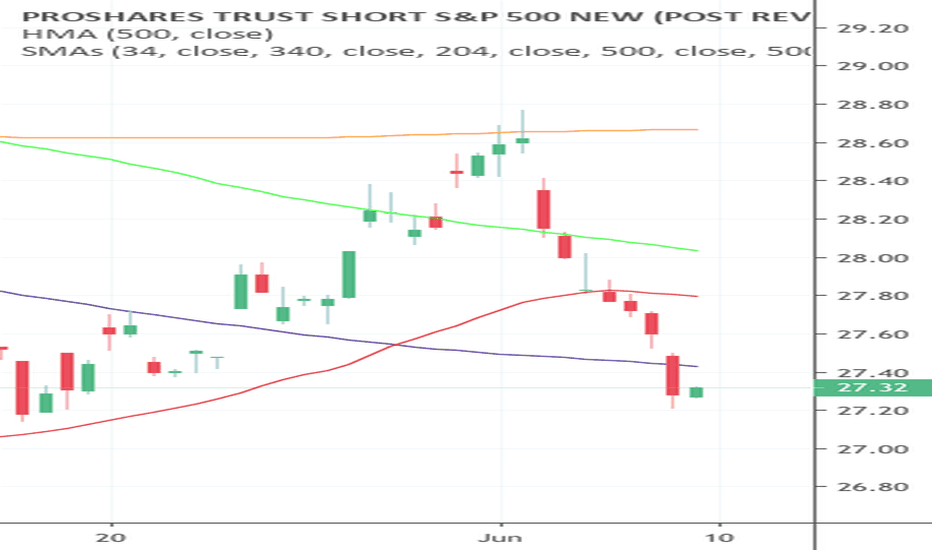

SH - (SPX Inverse ETF) - WatchingThis is now back at a Support level. I am keeping this on my radar...what is happening in the markets confuses me everyday...but here we are. This is an ETF that shorts the S&P500. Thusly, you buy it to "short"the market. Interesting instrument.

I am mentioning the level only, no confirming price action for me.

Not meant as a buy and hold forever ETF.

No leverage used in this ETF.

SH, cleared for take off, runway Covid2020, no delayEquities are about to burst, I am very bullish SH.

USA leadership has spectacularly fumbled the ball in responding to covid. Hot spots are developing as Trump is hellbent on reopening the economy. This will set the USA up for a massive 2nd wave this fall, unfortunately. This will ensure business remains crippled, if not completely shuttered till spring 2021.

Trump doesn't realize that 'the economy' isn't an abstract thing--it's comprised of individuals whose health under-girds all else. The general health, safety, and well being of the country is our chief capital stock. Queue Abraham Maslow: Meet basic health and safety needs 1st.

Insane R:R available

Targeting $75-100 to begin

SH Hedge portfolio? *UPDATE* Hedge Future PlanAMEX:SH This investment, while in conjunction with positive beta investments, is very useful. With this strategy, if it touches the RED line I buy more, if it touches the GREEN line I sell. If this drops, the market is Bullish and positive beta investments increase. If it increases, the market is bearish and providing insurance for the portfolio.