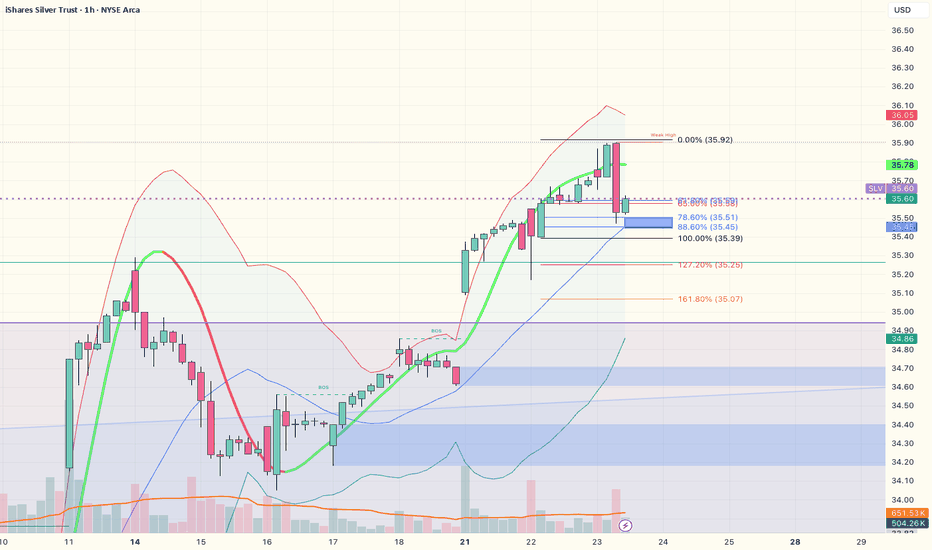

SLV Maintains Strong Uptrend AMEX:SLV continues to trade within a strong uptrend, supported by a weakening US Dollar, rising US deficit spending, and growing market uncertainty. Similar to trends observed in precious metals and Bitcoin, the move away from US Treasury Bonds has been a significant bullish catalyst for these asse

Key stats

About iShares Silver Trust

Home page

Inception date

Apr 21, 2006

Structure

Grantor Trust

Replication method

Physical

Dividend treatment

Distributes

Distribution tax treatment

Return of capital

Income tax type

Collectibles

Max ST capital gains rate

39.60%

Max LT capital gains rate

28.00%

Primary advisor

iShares Delaware Trust Sponsor LLC

Distributor

BlackRock Investments LLC

SLV gives investors direct exposure to silver by physically holding the metal in vaults in London. As such, investors get exposure to spot silver (determined by the London Silver Fix), less fund expenses. As this fund is considered a collectible for tax purposes, taxes on long-term gains are quite steep. Still, SLV provides stability for buy-and-hold strategies.

Related funds

Classification

What's in the fund

Exposure type

Miscellaneous

Bonds, Cash & Other100.00%

Miscellaneous100.00%

Top 10 holdings

Long Silver - Buy the DipSilver is making 20-day highs (green candles in the main chart), while pulling back towards the 20D EMA line. Meanwhile, looking at a proxy of net buying/selling (bottom panel), we are almost at net selling levels.

There is good risk/reward to buy silver here, with a stop-loss if the price closes

Small SLV positionTaking a small position in SLV here.

Long term looking at the gold to silver ratio trading around 90 If gold holds its grounds and silver plays catch up to a ratio of 70 even 60. I will be playing this position less about price and more about the ratio. If slv breaks all time high I will start sel

All That Glitters Is Not Gold (But Silver?)And another long Idea - this time in the Silver ETF, SLV.

Looking at the daily chart for SLV, a couple of things standout from a few days ago;

- The price just broke the all-time high at 31.80, along with significant resistance at ~31.50, and

- SLV gapped up, leaving tight stops a bit problemat

SILVER Multi year Breakout in the works. SLV /SIAMEX:SLV – Silver Setting Up for a Multi-Year Breakout

Silver is quietly coiling under a major 10+ year breakout level, and AMEX:SLV is right in the center of it — with a powerful setup developing.

🔹 Long-Term Breakout Level: $31.75

AMEX:SLV is pressing up against $31.75, a key breakout spot

$SLV Silver could finally trend some longer timeframeAMEX:SLV finally show some strength and had a continuation day today, which is rare. I also see it as a good hedge or other position than stocks, which could react less to random moves (or maybe also not - calculate your risk on your own please)

My stop is the red line and I accumulated lower but

$SLV pullback before the real bull trend starts?Silver looks to be trading in a large rising wedge, I could see the possibility of a pretty substantial pullback should price break down from the pattern.

We have the potential to fall between 30-60% from here should price break the pattern. The level to look for is a break of $22 on the downside,

Silver Poised for Upside?SLV is setting up a strong case for a position trade. A similar situation recently played out with Palantir, although with greater risk involved due to being an individual stock, but we don't need to exclude the intrinsic value of precious metals. Multiple timeframes are showing technical confluence

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

An exchange-traded fund (ETF) is a collection of assets (stocks, bonds, commodities, etc.) that track an underlying index and can be bought on an exchange like individual stocks.

SLV trades at 34.84 USD today, its price has risen 1.19% in the past 24 hours. Track more dynamics on SLV price chart.

SLV net asset value is 34.85 today — it's risen 5.83% over the past month. NAV represents the total value of the fund's assets less liabilities and serves as a gauge of the fund's performance.

SLV assets under management is 18.35 B USD. AUM is an important metric as it reflects the fund's size and can serve as a gauge of how successful the fund is in attracting investors, which, in its turn, can influence decision-making.

SLV price has risen by 4.29% over the last month, and its yearly performance shows a 40.94% increase. See more dynamics on SLV price chart.

NAV returns, another gauge of an ETF dynamics, have risen by 5.83% over the last month, showed a 18.18% increase in three-month performance and has increased by 41.09% in a year.

NAV returns, another gauge of an ETF dynamics, have risen by 5.83% over the last month, showed a 18.18% increase in three-month performance and has increased by 41.09% in a year.

SLV fund flows account for 870.78 M USD (1 year). Many traders use this metric to get insight into investors' sentiment and evaluate whether it's time to buy or sell the fund.

Since ETFs work like an individual stock, they can be bought and sold on exchanges (e.g. NASDAQ, NYSE, EURONEXT). As it happens with stocks, you need to select a brokerage to access trading. Explore our list of available brokers to find the one to help execute your strategies. Don't forget to do your research before getting to trading. Explore ETFs metrics in our ETF screener to find a reliable opportunity.

SLV expense ratio is 0.50%. It's an important metric for helping traders understand the fund's operating costs relative to assets and how expensive it would be to hold the fund.

No, SLV isn't leveraged, meaning it doesn't use borrowings or financial derivatives to magnify the performance of the underlying assets or index it follows.

In some ways, ETFs are safe investments, but in a broader sense, they're not safer than any other asset, so it's crucial to analyze a fund before investing. But if your research gives a vague answer, you can always refer to technical analysis.

Today, SLV technical analysis shows the buy rating and its 1-week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1-month rating SLV shows the strong buy signal. See more of SLV technicals for a more comprehensive analysis.

Today, SLV technical analysis shows the buy rating and its 1-week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1-month rating SLV shows the strong buy signal. See more of SLV technicals for a more comprehensive analysis.

No, SLV doesn't pay dividends to its holders.

SLV trades at a premium (0.26%).

Premium/discount to NAV expresses the difference between the ETF’s price and its NAV value. A positive percentage indicates a premium, meaning the ETF trades at a higher price than the calculated NAV. Conversely, a negative percentage indicates a discount, suggesting the ETF trades at a lower price than NAV.

Premium/discount to NAV expresses the difference between the ETF’s price and its NAV value. A positive percentage indicates a premium, meaning the ETF trades at a higher price than the calculated NAV. Conversely, a negative percentage indicates a discount, suggesting the ETF trades at a lower price than NAV.

SLV shares are issued by BlackRock, Inc.

SLV follows the LBMA Silver Price ($/ozt). ETFs usually track some benchmark seeking to replicate its performance and guide asset selection and objectives.

The fund started trading on Apr 21, 2006.

The fund's management style is passive, meaning it's aiming to replicate the performance of the underlying index by holding assets in the same proportions as the index. The goal is to match the index's returns.