SLV trade ideas

SLV - 2020 is here!I am expecting good things for silver in the upcoming year. Precious metals and commodities are due! XLE has also done nothing for ten years. SLV appears to have broken out of its flag pattern and an important FIB level after a long consolidation. Based on the impulse leg I am looking for $19.63 or so for this move. Silver miners making new highs still but looking a little tired at this point. This is a long term buy and hold for me and 2020 should see some nice gains.

Silver Elliot Wave Trend AnalysisBy this count, it appears we may be in wave 1 of an impulse count. There's a good deal of overhead resistance at previous highs. My expectation would be to eventually break through this, possibly after a wave 2 down, which would initiate a wave 3 on the way to higher highs.

SLV - Weekly Chart BreakoutThe weekly chart for the iShares Silver ETF shows how it has been pulling back from its recent highs back in early September. The stock broke down in early November but was able to find support along the 50-day EMA line. It has managed to break out again this week as it nears volume levels that will not be able to hold much resistance against the price. Continued strength in price should help a Golden Cross occur to confirm the bullish strength behind this commodity.

I would like to see this ETF clear $17.10 just so it gets above and holds that last volume level but definitely looking promising. My potential price targets are noted.

SLV Triggers Weekly Parabolic BuySilver's strong performance this week triggers the Wilder's parabolic indicator signal. As price breaks through the upper resistance marker, one would buy at this point. In future periods, the dotted line will shift from the upper range of prices to the lower. One would stay long until the bottom signal is breached.

My first target remains 19.54 however, I expect price to break through previous highs to complete the double bottom formation.

SLV Good indicator to watchAs SLV starts to rally and quickly becomes overbought due to recent low volatility, A good indicator to watch now is the BBW. I track it in Excel with the formula stdev(range). As this indicator continues to expand, it shows me that price is moving away from the moving average at a pace quicker than the moving average is rising. As long as this indicator is rising, one wants to stick with the trend. When it reverses, price generally will revert to the moving average or sometimes even reverse to an opposite (oversold in this case) extreme.

Happy Holidays everyone

A Pirate Adventure: Bull flag breakout!Ahoy mates! Looks like we have early signs of a breakout on gusting winds. The treasure may still be ours to discover if we can continue sailing in strength!

First target is a break of the prior highs toward the 20 region. Then, reassess to see if it becomes a subdivided third wave or something else.

Always keep in mind that the officials are still close behind and may shoot down our galleon at any time. Use tight stops.

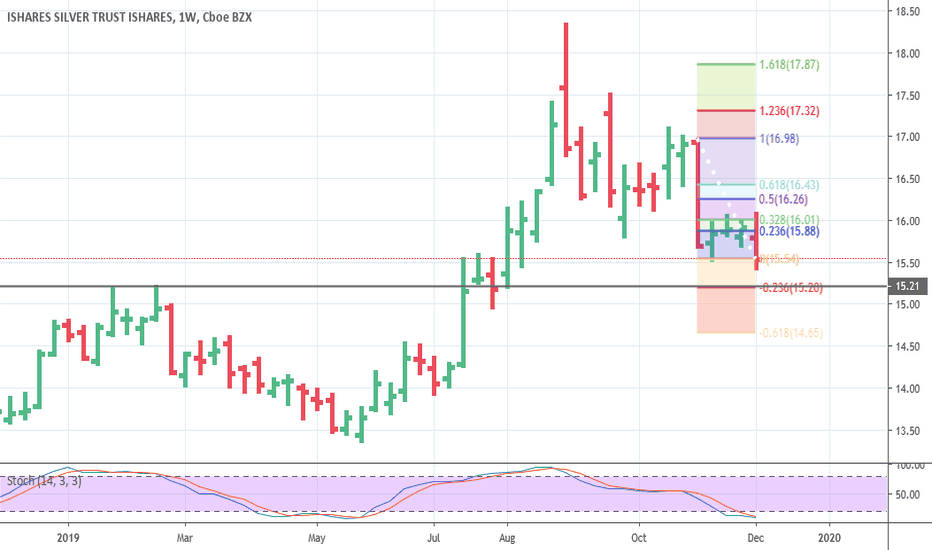

SLV = Fave 2020 PlaySLV price action is constructive. Fib level holding with MACD and RSI looking favorable. Looks like $15.50 is the line in the sand and coincides with a solid FIB correction level. This is a weekly chart with 50 day moving up through 100 day. Volume drying up on correction phase. Impulse leg that began move up has me looking for $20 over the next three months or so as the uptrend continues.

SLV and dollar correlated?As news that the Fed will be injecting hundreds of billions more dollars into the repo market, one has to expect that an increase of the money supply surely needs to affect the price of precious metals. But looking at a comparison of SLV and the dollar show that overall, Silver and the dollar appear to be very correlated. From time to time, I look at the numbers at usdebtclock.org

Looking in the far right column, we can see that the dollar to silver ratio is $1,053 an ounce. Yet silver languishes at prices far below this. One reason is the paper to silver ratio of 201.96. Not sure that the prices of precious metals will ever reflect their true value, that is, until the fiat currency system resets or collapses. But this prospect is a key reason why buying the actual physical products make sense. Where else can a worthless piece of paper buy so much value?

SLV Long Bull flag on monthly chart Monthly Chart shows a very nice Bull Flag for SLV A long stock play can be done if I want to hang onto the stocks for a few months. The length of the flag pole shows about a $3.5 move, so an option about half way up that move with the expiration of March would also work. In fact. I'm looking at the decently16 s priced strike that expires on March 31 2020

a Debit spread can also be done if i also sell the 17 strike on the same expiration That would make the cost of the spread at the current market price $21 with a profit potential of $79

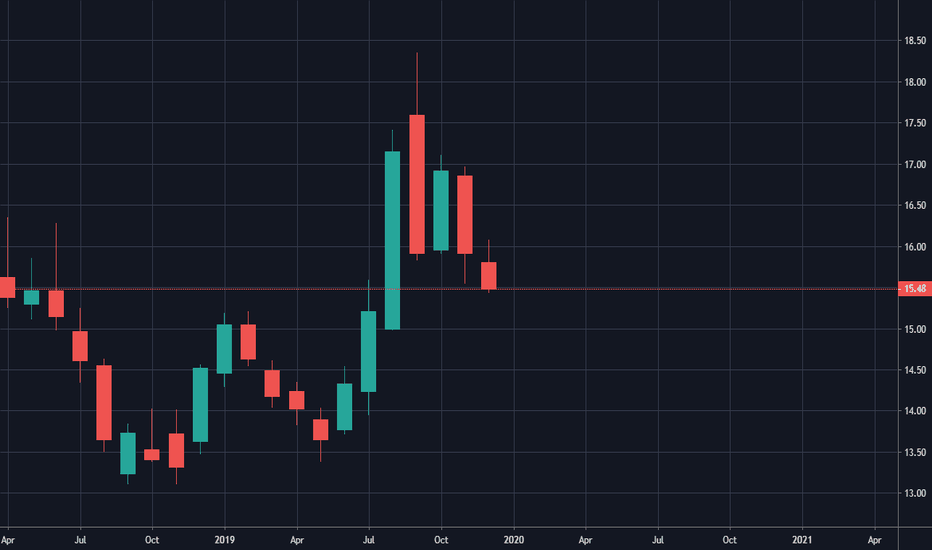

SLV - Time Symmetry predicts a Bottom on MondayFor a long time now, I had wondered if the apparent wave 4 needs to be as long as a wave 2. Wave 2 ran from Feb 20 to May 28, 67 trading days. Our recent wave 3 high marked on Sep 4. We are now 64 days into this correction. We should be close to an end. 67 days hits on Monday. Can't wait to see an impulsive wave. These constant smack downs have made me lose total interest but my positions stand and will be prepared to roll any 2020 positions to Jan 2021 next month.

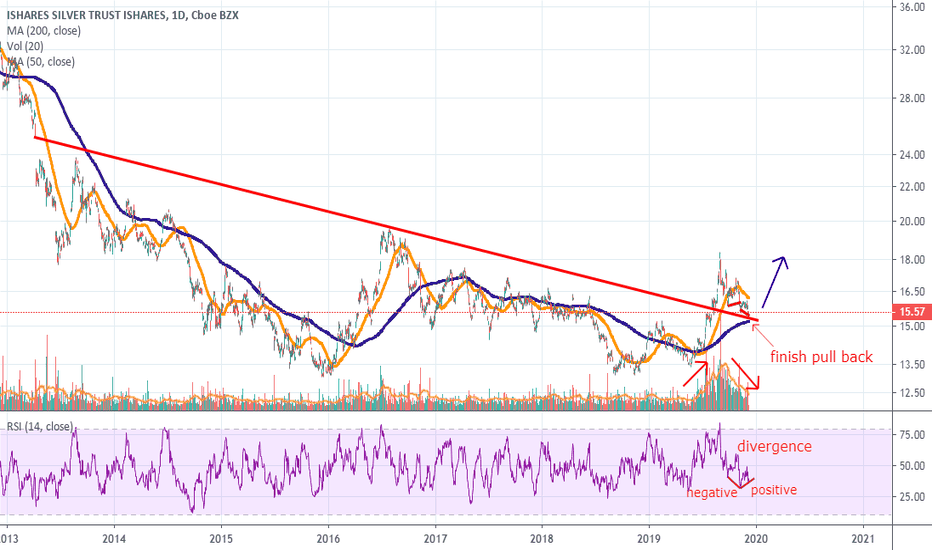

SLV - at an inflection point?I think so. Unless my chart reading skills are off, SLV is right at an inflection point. There is a perfect FIB retracement in place and $15.74 represents an important break out/down point from 2016. Down channel resistance just begging to be taken out. Volume drying up on sell-off. MACD and RSI favorable. A little W bottom with 200 day holding us up below. If the saying is true that the miners lead the metals, WPM and PAAS have been screaming up. Feels like it's coiling, Looking for it to attack the 18.35 high and fairly quickly.

The pirate adventure resumes?ARGH, ARGH, my friends, it has been a very long a painful wait, but perhaps it is time to revisit the treasures abound in gold and silver. As you can see, there is a shimmer or GREEN on the WEEKLY chart propagated by a spark of ignition on the DAILY. Perhaps there is still hope for the X that marks the spot. However, we must tread very very carefully at first. Any sighting of an officials ship and it's time to run for the exits again, less we be captured and capsized.

SLV - One more down move left?Silver's apparent wave 4 correction has been long and boring. Might be one down draft left still. Looking at a weekly line chart and parallel channels, it's quite possible that we hit 15.42 on some weekly close in the very near future. If the channel holds, we may begin wave 5. If the channel doesn't hold, then back to the drawing board.