SPXU trade ideas

BUY SPXU soon?I trade this swing chart. No ambiguity All Analysis is TradingView Community Scripts. MACD (X0 or XX no! Not kisses and hugs) must confirm/filter price chart signal (Price must penetrate all chart indicator lines and get a Lorentzian green flag. Note : displayed WINRATE is associated with Lorentzian ..

No guarantees. Luck always helps.

Betting on a crash SPXUPretty obvious we are on the brink of a year end rally based on seasonality and election cycles OR we are about to see the biggest system crash since the great depression based on absolutely bananas monetary policy for the last 50 years and over correction helicopter money from the Federal Reserve.

As always based on price action, timeline, and risk VS rework here is the long entry play I am in on a small scale right now.

Price action: we got a bottom with higher low then pump.. (test pump) now price has come back down to test the moving averages and make a completion of fib golden zone.

Timeline: clearly after the election we will see some improvement once certainty is restored... if Trump wins rates go to zero and we will get a can kick with a great 4 years no doubt...but until then FUD of every type. This is a hedge on my Bitcoin / Bitcoin miner stock positions.

R/R it doesnt get any cleaner than this... we either get stopped out with a small loss or catch a liquidity crisis to the moon.

SPXU - bears are in control after CPI release$SPXU - bears are in control after CPI release

Shorting the US market is not an easy business, but this is the trend since the beginning of 2022 and there is no sign of it changing.

In addition to my previous post...

On Friday I have been stopped out from both $SPXU and $SQQQ, locking in roughly 1,5% and 2% profit accordingly. I have also been stoped out from $UVXY, realising around 0,55% loss in absolute terms.

Yesterday I have decided to reopen my position in all of the three above mentioned instruments at better price, with increased volume and same risk. So far it proved to be a good idea, but we are far from evaluating it.

Inflation is not cooling, volatility is... well you see it.

Today's CPI number made the futures market to reprice the yield curve. 4,25-4,50% is the new most probable FED target rate...

There is no secret, based on my research and opinion I don't think fundamentally things have changed. Are they getting worse? Did macro environment changed in favour of risk-on bulls?

I honestly don't want to see capitulation, severe depression, strong increase in unemployment, world war 3 - you name it... but as you have noticed I have changed my view and will stick with bears for now.

Trend is your friend.

You may find how I see the technical picture on weekly timeframe.

My base case scenario as per now is that $SPX500 is heading towards 3400 price level.

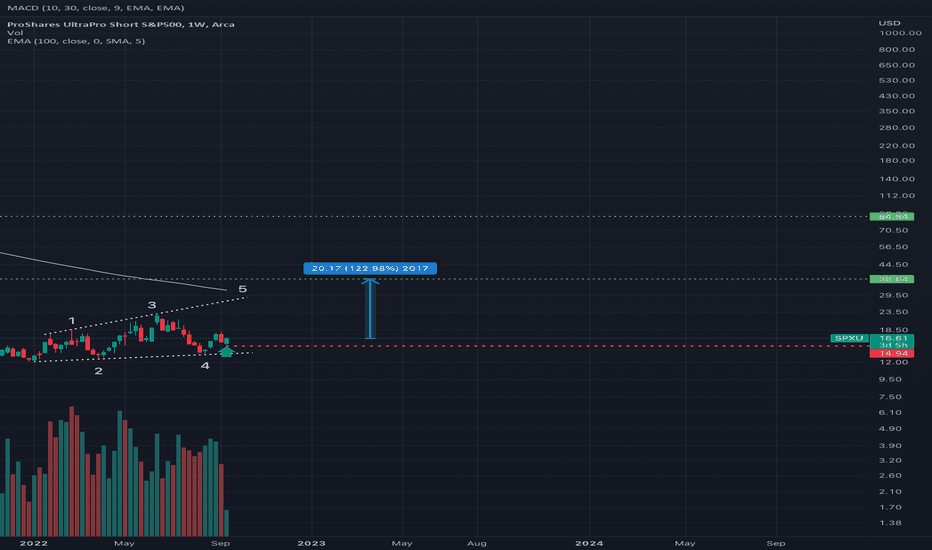

More than 100% upside potential in $SPXU?

I wish it would be a straight road, but I strongly doubt it...

Using Put options in SPXU to trade the SPXDisclaimer

All TRADING involves high risk and YOU can LOSE a substantial amount of money, no matter what method you use. All trading involves high risk; past performance is not necessarily indicative of future results.

For Educational Use Only – Not To Be Utilized As Trading Advice

Strategy

-----------

SPXU is inversely correlated to the SPX.

Trade SPXU weekly put options for cheaper premiums and expecting a larger move.

Purchase the weekly SPXU put options contract to trade upside in SPX. (A short term trading strategy to reduce capital outlay)

Use Level 2 Tape Reading to see the supply/demand of the market, including the

Pros

-----

Less capital outlay so much more efficient

There is a tracking error in the SPXU which can help in getting a better price into the put option (the option pricing will change based on the buyers and sellers in the options market). This can help in time delay for trade setup before the move comes into the SPXU instrument.

SPXU provides (-3x) exposure to a market-cap weighted index of 500 large- and mid-cap US companies selected by the S&P Committee. This -3x exposure can help speed up the change in price of the underlying, which can help move faster towards breakeven and above into profitability in the options contract.

Cons

------

Options have an expiry date so some timing does come into question.

There could be a change in the negative correlation between SPXU and SPX due to tracking error.

The trade does not move enough in the direction of the put in SPXU over and above the breakeven that the premium

Premium decay in the option for short-term options which can result in Theta decay.

Put options tend to move slower (shorter deltas) than call options (larger deltas).

Summary

------------

This strategy is only meant for reducing the capital required to get exposure to the SPX via leveraged instrument such as option.

Are you bullish on Short ETFs? $SQQQ $SPXUWhat do you see when looking aty these charts? I see higher highs and higher lows.

The NASDAQ:SQQQ broke a short-term trendline to the upside and then, the AMEX:SPXU followed.

Now the next test is the last week's high, which it seems that it will break today. If it does, the next resistance is at the June highs. Thats +34% for SQQQ and +25% for SPXU, it could be a really good swing trade.

You could also say that both ETFs are making a head & shoulders but until the neckline is broken is not a head & shoulders.

SPXU us500 s&p 500 Is The US market crash coming ?Is The US market crash coming ?

We have 3 types of “crashes”

Correction <15% downward movement in a major indicy

Bear Market <20% downward movement in a major indicy

Black Swan event, something very unexpected that tanks the market, think 1987, 1929, challenger disaster, 911 and so on.

The fourth type is the 1919, 1929, 1999 and 2008 scenario that people generally refer to as a “crash” 2022 a new one ?

Sincereley L.E.D In Spain 14/05/2022

S&P500 ProShares UntraPro Short OpportunityS&P 500 has had a tough go in Q1 2022 and looks to continue it's correction given the broader macro-environment and economic headwinds.

Upside opportunity if a market correction similar to the black swan event in March of 2020 would be greater than 1,000%... even a smaller correction as the Fed tightens in the short-term has potential to deliver phenomenal gains.

Looking at OBV and moving averages, the downside to SPXU is quite manageable relative to the upside.

Because this is an inverse relationship to the S&P, it's shorting the S&P but it is LONGING $SPXU.