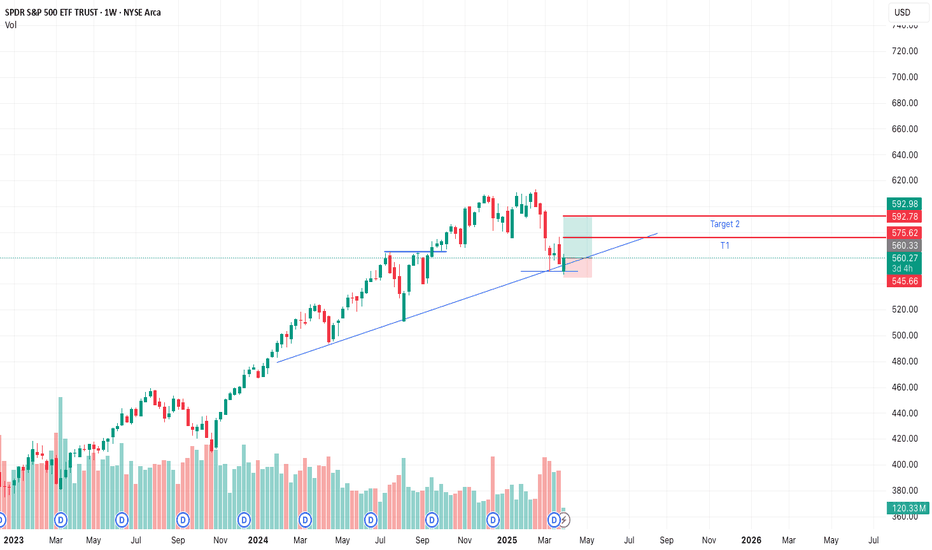

Spy Road To?Weekly Thesis for SPY

Weekly High: $594.50

Weekly Low: $589.28

Weekly Close: $594.20

52-Week Range: $481.80 – $613.23

Critical Breakdown Level: 581

Why 581 matters:

It sits well below S₃ (585.60) and aligns closely with the 38.2% Fibonacci retracement of the past four-week swing (High 594.50 → Low 566.76), which calculates to roughly 581.10.

A decisive weekly close below 581 would breach both pivot-derived supports and this Fibonacci zone, opening the door to deeper pullbacks toward the May 9 low near $564.34

Potential Sell-Wall at 604

Why 604 is a resistance cluster:

It sits just above R₃ (601.26), a confluence of weekly pivot resistance and likely profit-taking levels.

A series of limit orders tend to cluster near these round-number extensions, forming a “sell wall” that may cap any rally unless broken on strong volume.

4. Strategy & Outlook

Caution advised: SPY must hold above 581 on a weekly close basis. A failure to do so would invalidate the recent up-move and likely lead to a test of lower support zones around 587 and 585, then potentially the mid-560s.

Bullish breakout: Only a sustained weekly close above 604—ideally on above-average volume—would signal renewed upside conviction and pave the way toward the 52-week high at $613+.

Action plan:

Wait for confirmation – don’t enter new longs until either 581 holds convincingly or 604 is cleared.

Use tight risk controls – if deploying swing trades, place stops just below 581 for longs or just above 604 for shorts.

Monitor volume – validate any breakout/breakdown with volume spikes to confirm institutional participation.

Im Waiting On Confirmation as Always Safe Trades & JoeWtrades

SPY trade ideas

Weekly $SPY / $SPX Scenarios for May 19–23, 2025🔮 Weekly AMEX:SPY / SP:SPX Scenarios for May 19–23, 2025 🔮

🌍 Market-Moving News 🌍

📉 Moody's Downgrades U.S. Credit Rating

Moody's has downgraded the U.S. sovereign credit rating from Aaa to Aa1, citing concerns over rising national debt and interest payment ratios. This move aligns Moody's with previous downgrades by Fitch and S&P Global, potentially impacting investor sentiment and increasing market volatility.

🛍️ Retail Earnings in Focus

Major U.S. retailers, including Home Depot ( NYSE:HD ), Lowe’s ( NYSE:LOW ), Target ( NYSE:TGT ), TJX Companies ( NYSE:TJX ), Ross Stores ( NASDAQ:ROST ), and Ralph Lauren ( NYSE:RL ), are set to report earnings this week. Investors will be closely monitoring these reports for insights into consumer spending patterns amid ongoing tariff concerns.

💬 Federal Reserve Officials Scheduled to Speak

Several Federal Reserve officials, including Governor Michelle Bowman and New York Fed President John Williams, are scheduled to speak this week. Their remarks will be scrutinized for indications of future monetary policy directions, especially in light of recent economic data and market developments.

📊 Key Data Releases 📊

📅 Monday, May 19:

8:30 AM ET: Federal Reserve Bank of Atlanta President Raphael Bostic speaks.

8:45 AM ET: Federal Reserve Vice Chair Philip Jefferson and New York Fed President John Williams speak.

10:00 AM ET: U.S. Leading Economic Indicators for April.

📅 Tuesday, May 20:

8:30 AM ET: Building Permits and Housing Starts for April.

10:00 AM ET: Federal Reserve Bank of Minneapolis President Neel Kashkari speaks.

📅 Wednesday, May 21:

10:00 AM ET: Existing Home Sales for April.

10:30 AM ET: EIA Crude Oil Inventory Report.

📅 Thursday, May 22:

8:30 AM ET: Initial Jobless Claims.

9:45 AM ET: S&P Global Flash U.S. Manufacturing and Services PMI for May.

📅 Friday, May 23:

10:00 AM ET: New Home Sales for April.

⚠️ Disclaimer:

This information is for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

$SPY Daily Chart Taz Plan - May 2025 into June-July Breakdown📉 SPY Daily Chart Trading Plan — May 2025

Thesis:

Price has returned to the exact level ($594.20) where the February impulse breakdown began. This zone is acting as a Lower High rejection within a broader bearish structure. A clean rejection here opens the door to multiple inefficiency fills below.

🔍 Structure Breakdown:

Feb High (ATH): $613.23

Feb Open: $592.67

Feb Close (last green candle before impulse): $594.20

Current Price: $594.20

Marked LH: $592.50

This is a rally back into rejection, not strength.

📉 Key Zones & Gaps:

🔺 Gap Supply: $566.48 – $578.50

🔺 Wick Gap: $558 – $566 → Needs a full-body candle to initiate fill

🟥 FVG (4/22): $528 – $541.52

🧱 Major Support: $481.80

🧠 Trade Plan:

Short Entry 1 (Confirmation-Based):

🔻 Red candle rejection under $592.50 = starter short

🔻 Watch RSI and MACD for momentum fade

Short Entry 2 (Gap Breach):

🔻 If $578 is broken and retested → scale in

🔻 Gap fill expected quickly once triggered

Short Entry 3 (Wick Gap):

🔻 Body close through $558 = last add

🔻 Sets up for final flush to FVG

🎯 Targets:

$578.50 → $566.48 (Gap Fill)

$558 → $541.52 (Wick Gap & FVG Top)

$528 – $530 (FVG Close)

$481.80 (Long-Term Panic Target)

❌ Invalidation:

Daily close > $595.50 = Pause thesis

Weekly close > $600 = Structural shift, short squeeze zone

🧠 Final Thoughts:

This isn’t just a gap fill play — it’s a structural fade from a lower high back into memory. The Feb impulse wave left behind layers of inefficiency, and price just tapped the origin of the breakdown.

Momentum is peaking. If this is a trap, the downside should begin immediately.

Let the chart prove it.

SPY volatility this weekI'm posting the rest of the readings I did for each week this month on SPY. This week I'm expecting a drop into Wed. I get all my info from dowsing, btw.

I noticed all last week it kept suggesting to sell rallies, which makes me thing we're going to pull back. The weekly (done at the beginning of the month) did suggest over 5% down this week. But my dowsing now says to watch for a bounce Wed. with a look below & fail. Move up to some extent Wed. & reverse down Thursday (implies gap up or some up). Then Friday up. Short term watching the $575 area for the bounce or resumption of trend.

Next week's reading of down more is a bit of a head scratcher, so that's why I think things could just be really volatile.

Low on QQQ I'm looking for is 498.

I was early, but not wrong - 571 target still standsHello Traders,

We can clearly see a top signal as SPY has started to play out a bearish divergence at the 594 level. The 594 level seemed to fade during after hours upon the announcement of Moody's US credit downgrade as the price sliced through the 590 level all the way down to 588.

I believe the price will rapidly cascade down sub 580, down to 571 Monday - Tuesday. The gap fill is at 565.13. The gap fill level is too obvious, therefore I would be surprised if the price perfectly reversed (although, expect a reaction at this level).

My target for this downturn is 561.63, which is the 38.2% fib level, as low as 551.48.

This would offer a great pullback and buying opportunity for the long term, for the bullish case.

I personally believe that the stock market won't make all time highs, but does not mean I will miss out on bullish opportunities, if the trend does truly reverse.

As always, we will have to see what Monday brings us.

SPY (S&P 500 ETF) Weekly Technical Analysis4H Chart (Short-Term View)

Trend: Ongoing bullish momentum with dominant green candles.

Key Breakout: Strong breakout above the $594–$596 resistance zone, which now acts as support.

Volume Profile (VPVR): A low-volume area between $595 and $610 suggests potential for a swift move higher.

Indicators: The Ichimoku Cloud shows rising support, with positive band compression.

Projection: As long as the price holds above $594, there is potential to test the $610–$615 area.

Daily Chart (Medium-Term View)

Fibonacci Levels: The 0.786 level was broken decisively, indicating strong bullish momentum.

Trend: Clearly bullish, supported by declining volume on pullbacks and steady upward movement.

Volume: Consistent increase in buying volume since April strengthens the bullish case.

Upcoming Resistance: $610–$615 (previous highs).

Weekly Chart (Long-Term View)

Recovery: A solid rebound from the March lows.

VPVR: The high-volume node between $455 and $475 has been left behind, now acting as a structural support.

Macro Trend: Price has returned to a previous consolidation area from the prior bull market.

Risks: While there is room for further upside, the $610 area could act as both technical and psychological resistance.

Key Levels

Immediate Resistance: $610–$615

Technical Support: $594–$596

Structural Support: $560 (significant volume cluster)

Conclusion

SPY maintains a strong bullish structure across all timeframes, with sustained upward momentum and room to challenge previous highs. The reaction around the $610 zone will be critical. As long as price holds above $594, the structure remains favorable for buyers. However, given the lack of historical volume in this price range, short-term volatility or pullbacks are possible.

Disclaimer:

This analysis is intended for informational and educational purposes only. It does not constitute financial advice or an investment recommendation. Always assess your own risk profile and consult a licensed professional before making investment decisions.

SPY or SPX vs 3 month Treasury yieldLets just few the picture and let it tell us a 1000 words.

Everyone says to the moon...Just like 2009, up we go....Just like 2020, up we go

But let us view it another way...eh?

You "stole/froze" whatever you label it...Russian Assets and kicked them from Swift, which they return the favor by arguing that the ceasefire deal cant be done cause they don't like the style of pen you brought that day....

You decided to show the the world that you will turn a certain area of the Mediterranean into a French Plaza with beach front hotels, and may...maybe give the inhabitants vouchers to move away- one can say its a booming deal for them.

You decide to demonstrate to the world that on a tweet's notice you will change policy without official announcements and policy update for the rest of the world.

Then you decide...well I think that picture is becoming clear- Japan just bit the hand of Uncle Sam and said 'if you step any closer the treasuries get it'

So in all, the rally to ATH is literally exactly like 2009 and 2020, since there is literally nothing that has changed and everything above was equally going on, just change the dates and the people/places involved but exactly the same right.

Except for that weird number 0...0% which seemed to occur in 2009 and 2020- no coincidence there and todays 4.3% means absolutely nothing...just slight inflation, roughly 12-13k % increase...but its no issue.

So what can we surmise here....:

Well you were dropping for a good amount of time in 2009- ~504 days and in 2020 you basically turned the lights off and then on again...so that seems to fit with what just happened here right>>

you had 282 days of drop in 2022, which is 56% of 2009 and you literally made up a number of tariffs, then made up a lower number a month later and bingo-bango back up you go....

butttt...one of these things in pink just doesn't quite fit...so honestly it will be a delight to see how the see-saw theory works:

I call it a theory cause there is no proof on the chart that when the market goes up- yields go up, no case for it and not visible on the chart anywhere....So we should be good. Ergo....

As the market makes ATH and keeps charging up, the yields will go back down to 0% or so on the 3month and stay there cause that follows the see-saw theory. You don't keep money in the markets for too long as they rise, you rotate it into the treasuries cause you get a better stable return.

So...Trump and Bessent win...getting lower yields and a higher stock market- cause just look at the Technical Analysis everyone- there is only emotion in people saying Yields go up as the S&P goes up, its not cold hard logical facts right...only emotional people think stocks make yields go up..jeez

----

If you agree with the last bit there...you may need to check your local big city, over 2-3million inhabitants, to see how you are doing in these ATH markets....you may find that when treasuries are up....you arent doing so well on the street..

You can lie to a Tiger and say according to the charts you are more advanced than him and you will, according to the charts, beat him due to your superiority. He however lives in reality and wonders why you are talking to him and showing him a paper- so he offs you and walks away- feeling nothing cause you were the emotional one trying to use a chart to tell nature what it isn't. :)

be careful out there...cause V-bottom explosions need a 0 or close to 0% interest rate...and 4.3 isn't 0, so study an elliot wave guy and see if this isnt what is called the "B-wave" where you may settle back in the 400 range soon..and low 400 at that.

SPY Breakdown – May 16, 2025📉 SPY Breakdown – May 16, 2025

Posted by ThePlotThickens

We’re hitting resistance at the top of this price channel, and I think we drop to 585-587 tomorrow. I believe the market has topped for now.

Most of the market looks weak, overbought tapping resistance walls, except for the big tech names that just keep running (especially chip stocks — total madness. Endless speculative market cap for chips lol). But overall, it feels like things are starting to slow down, not dumpy per se.

👉 Key Levels:

We’re right at the bottom of the Feb 2–5 weekly candle, when the Trump tariffs were dropped. This is a major support zone, and a lot of traders are watching it. Also, a quick reminder — weekly candles are super important right now. They show the bigger trend and are way more reliable than just looking at daily moves.

We might still tap the low of this week’s candle, but I believe 575 is the real line in the sand. That level marked the start of our bull run. As long as we stay above it, the long-term trend still looks strong.

💸 Short-term outlook:

I expect profit-taking tomorrow — probably a red day. Even if Trump tweets again, I doubt it does much unless he removes all tariffs (which would be wild). It took 6 weeks to get here.

📌 My main point:

Keep your eyes on 575 support. If we close the weekly candle above that, bulls are still in control. That’s the psychological level most traders are watching. If we drop below, we could revisit lower zones before trying to go higher again.

🔴 Channel Resistance at the top — The “toppy” zone where price is struggling.

🟠 Short-term target at 583-585 — Where you expect a drop.

🟢 Major Support at 575 — The key psychological and technical level.

🔴 Watch Zone below 575 — Where bulls could lose momentum.

Opening (IRA): SPY June 20th 490 Short Put... for a 5.26 credit.

Comments: Targeting the strike that is both at 16 delta or below and that is paying 1% of the strike price in credit ... .

Metrics:

Buying Power Effect/Break Even: 484.72

Max Profit: 5.26

ROC at Max: 1.09%

Will generally look to ladder out at intervals, assuming I can get in at prices better than what I currently have on, roll out at 50% max ... .

SPY Charging Toward $593? JoeWTrades AlphaPulse Says YES.

After-hours we’re sitting at $573, and the AlphaPulse Momentum Suite just fired a major dual-confirmation breakout signal.

Here’s why $593 is in reach within 2 weeks:

Technical Backing:

RSI (14): 72 — strong bullish continuation without divergence.

MACD (Fast/Slow): Fresh bullish crossover with expanding histogram = momentum ignition.

Squeeze Pro Indicator: Just released from squeeze with explosive green bars.

Volume Surge: Smart money accumulation above $568 on aggressive volume.

Fibonacci Extension (1.618): Maps to $593–$595 from prior leg ($543 → $573).

Gamma Pressure Zone: $570–$580 shows extreme call OI buildup — market makers likely to push through.

Max Pain: Below spot (at $565) = upward pressure through weekly expiration.

AlphaPulse Signals Fired:

"💎 Run Mode: SPY - Confirmed"

"🔥 High IV Zone Breakout - Validated"

"🚀 Aggressive Entry at $572 Triggered"

Target: $593

Stop: $567

Watch for confirmation above: $576 daily close.

Timing Window: 7–10 trading days.

Fyi my first T/P is $584

and as always safe trades and JoeWtrades

SPY Breakout Watch: Triangle Pressure Builds Above 590SPY has surged in a strong V-shaped recovery from the March low of ~480 to testing major resistance around 595–600. The daily chart shows sustained higher highs and higher lows, but price now stalls at a key supply zone with multiple doji candles—signaling indecision. A rising trendline provides strong support near 570.

Zooming into the 60-minute chart, SPY forms an ascending triangle with flat resistance at 590 and rising support from 584. Volume contraction suggests accumulation, priming a potential breakout. A 60-min close above 590 targets 596, with a stop under 588.

On the 15-minute timeframe, bull-flags form frequently after morning gaps, with breakouts typically launching 4–5 points higher. VWAP and the 20-MA converge near 588.5, making it an ideal pullback entry zone.

Strategy for May 19–23:

Long on a clean breakout above 590 (target: 594–596)

Stop under 587.5–588

Caution if daily closes below 570

Expect early-week upside tests of 590–594, followed by a potential breakout toward 595–600. If a high-volume rejection occurs near that zone, a quick scalp-short may be in play.

SPY/QQQ Plan Your Trade For 5-16 : Gap Potential PatternToday's pattern suggests the SPY will attempt to GAP at the open. The current price structure suggests the SPY/QQQ are in an upward FLAGGING formation related to a broad Excess Phase Peak pattern. I believe this upward trend will continue until price attempts to break either the upper previous Ultimate High pattern or break the lower channel of the current FLAGGING formation.

The wonderful thing about these Excess Phase Peak patterns, and other techniques I'm trying to teach you, is that they provide very clear triggers/directions/opportunities for traders who understand these patterns.

Today, I highlight my SPY Bias (Primary & Secondary) trending system that shows the SPY is much weaker than many people believe. Because of this, I believe we are potentially nearing an Exhaustion Peak in the SPY/QQQ - time will tell.

The use of my extended Biasing systems and Custom Index charts helps me understand what is taking place behind the SPY/QQQ price action. It's like peaking behind the curtains in terms of what my Custom Indexes and other specialized data can provide. I can see what is really taking place related to price action - moving beyond the simple SPY/QQQ charts.

Gold and Silver appear to be setting up an Inverted Excess Phase Peak pattern off a potential Ultimate Low in price. It will be interesting to see how this downward price flag plays out over the next week+. If this pattern holds, we should see the FLAG end and price should rally up into the consolidation phase. Very exciting for metals.

Bitcoin, which tends to lead the SPY/QQQ, is stalling near a peak. Keep your eyes on BTCUSD over the weekend as I believe we may be able to identify how the SPY/QQQ will react on Monday by watching what BTCUSD does.

Thanks for being patient and understanding my schedule over the past 30+ days. I've had multiple family member visit the hospital over the past 5-6+ weeks and my world has been filled with doctors, hospitals, follow-ups, work, and trying to keep everyone healthy and away from trouble.

It appears these issues are starting to get more settled - which means I'll be able to stay more focused on work - instead of driving around everywhere and waiting for appointments.

Get some..

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver