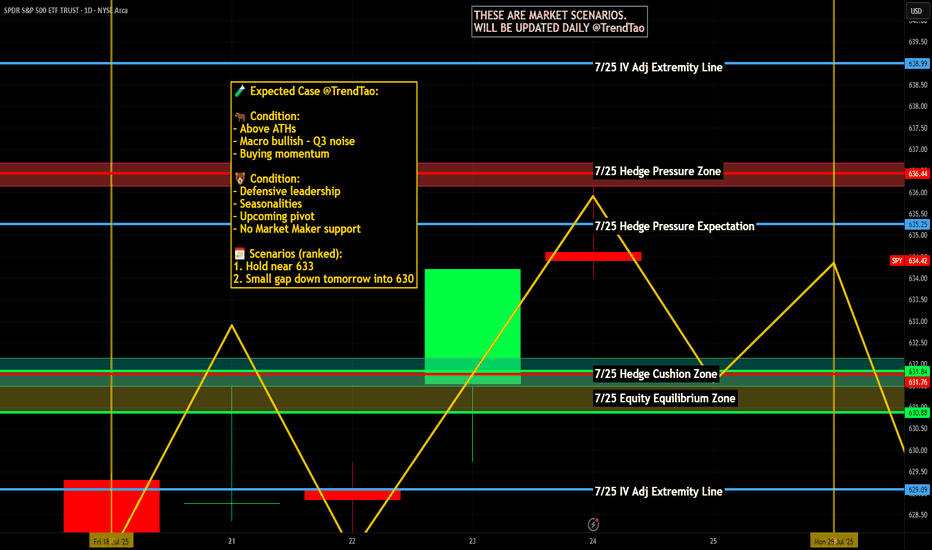

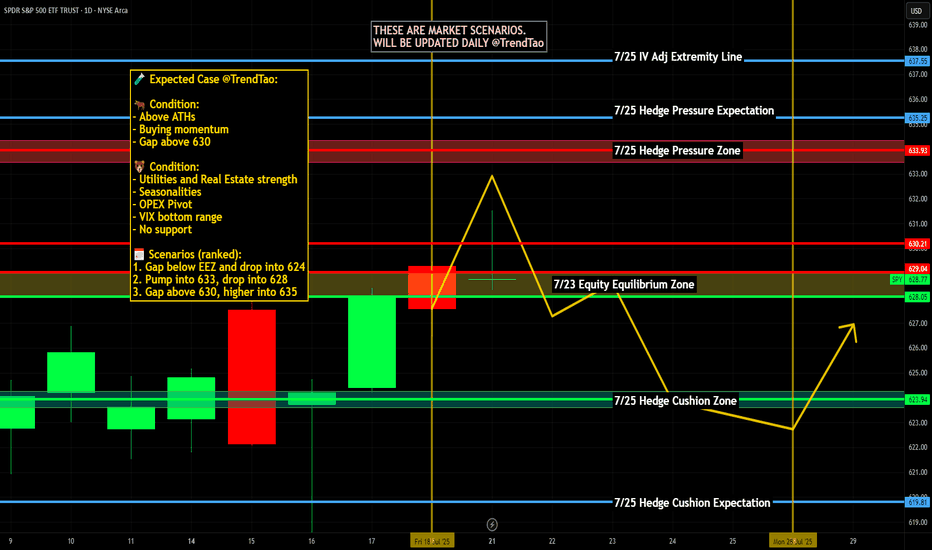

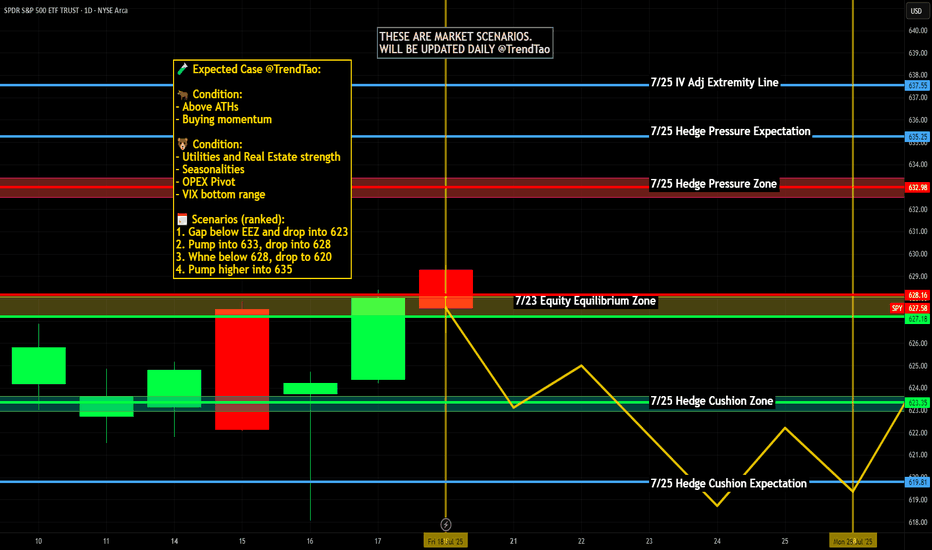

Nightly $SPY / $SPX Scenarios for July 25, 2025🔮 Nightly AMEX:SPY / CBOE:SPX Scenarios for July 25, 2025 🔮

🌍 Market‑Moving News 🌍

🏔️ Copper Market Flashpoint

Following President Trump’s announcement of steep copper tariffs (15–50% range), U.S. copper futures surged, then sharply reversed. Inventory arbitrage between CME and LME markets surged, distorting pricing dynamics and triggering concern over metal market stability.

🇪🇺 EU–China Summit Signals Trade Reset

EU leaders concluded their 25th summit with China, fostering deeper economic and strategic ties. Observers expect follow-up on mutual trade agreements, particularly regarding tech and sustainability sectors.

🌍 EM Equity Rally Consolidates Gains

Emerging markets continue to outperform global equities in 2025—with MSCI EM up ~18% vs. S&P 500. Analysts highlight strong opportunities in AI/fintech stocks in China and Latin America, suggesting further rotations out of U.S. markets.

📊 Key Data Releases & Events 📊

📅 Friday, July 25:

8:30 AM ET – Durable Goods Orders (June):

Forecast shows a sharp drop (~–10%), following a ~16% gain in May—signaling possible cooling in business-related equipment purchases.

10:00 AM ET – U.S. Imports of Steel Products (June):

Trade-data release monitoring steel flows amid evolving tariff frameworks.

All Day – Corporate Earnings Reports:

Companies such as First Financial Bancorp (FFBC), HCA, AON, Charter, and others report earnings. Outlooks may influence small- to mid-cap sentiment.

⚠️ Disclaimer:

This report is for educational and informational purposes only—not financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #data #earnings #commodities #EM #technicalanalysis

SPY trade ideas

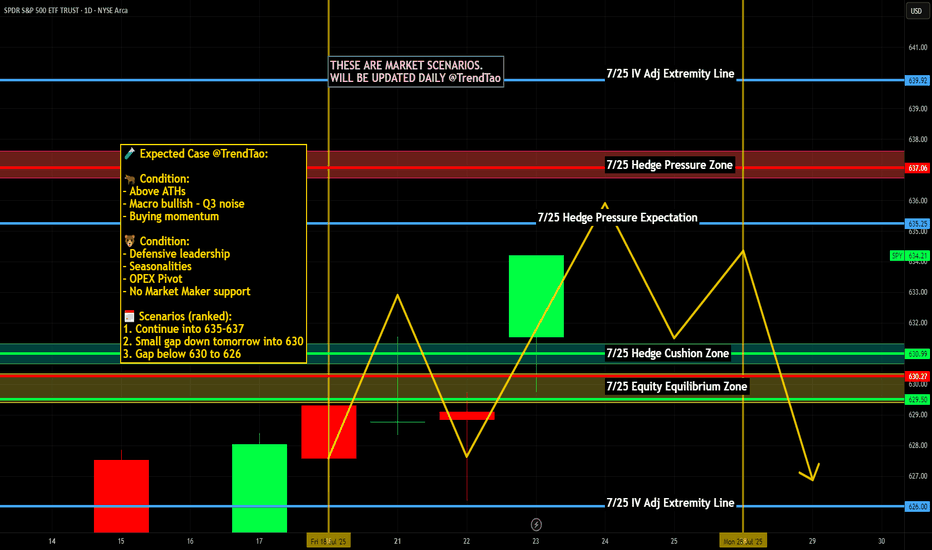

Nightly $SPY / $SPX Scenarios for July 24, 2025🔮 Nightly AMEX:SPY / SP:SPX Scenarios for July 24, 2025 🔮

🌍 Market-Moving News 🌍

🤝 U.S.–EU & U.S.–Japan Trade Optimism Lifts Sentiment

The S&P 500 and Nasdaq hit record-high closes on July 23, fueled by optimism over a potential U.S.–EU trade deal mirroring the U.S.–Japan framework, with the EU-set tariff on autos potentially halved to 15%

💵 Dollar Retreats, Yields Climb

As markets shifted toward risk assets, U.S. Treasury yields increased and gold softened, while the dollar eased—highlighting growing confidence in trade-driven growth news

🏦 Fed Independence Under Pressure—But No July Cut Expected

A Reuters poll shows economists see heightened political pressure on the Fed jeopardizing its independence, though the consensus remains that rates will stay unchanged this month

📊 Key Data Releases & Events 📊

📅 Thursday, July 24:

8:30 AM ET – Initial Jobless Claims

Weekly tally of new unemployment benefit applications—key indicator of labor-market conditions.

10:00 AM ET – New Residential Sales (June)

Tracks signed contracts for new homes, offering insight into housing demand under tightening mortgage rates.

All Day – Trade Headlines & Fed Watch

Continued focus on U.S.–EU trade developments and any follow-up to Fed independence concerns from policy circles.

⚠️ Disclaimer:

This information is for educational and informational purposes only—not financial advice. Please consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #trade #economy #Fed #housing #jobs #technicalanalysis

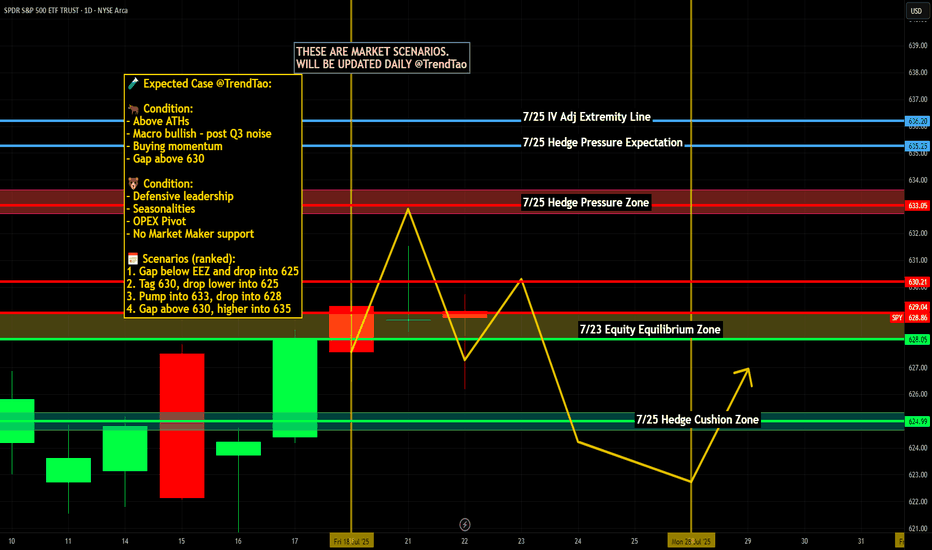

Nightly $SPY / $SPX Scenarios for July 23, 2025🔮 Nightly AMEX:SPY / SP:SPX Scenarios for July 23, 2025 🔮

🌍 Market-Moving News 🌍

📈 Morgan Stanley Stays Bullish

Morgan Stanley reaffirmed its optimistic view, forecasting the S&P 500 will reach 7,200 by mid‑2026. They cited strong earnings and anticipated rate cuts as key drivers, though warned of risks from rising Treasury yields and tariff-related cost pressure

📉 Inflation Debate Reignites

A renewed debate is underway regarding whether tariffs are "transitory" or persistent inflation drivers. Treasury counselor Joseph Lavorgna argued tariff impacts will be one-off, while others caution long-term price pressures may persist, complicating Fed policy directions

🏛️ Calls for Fed Reform Intensify

Treasury Secretary Scott Bessent suggested structural reforms to the Federal Reserve could have greater long-term impact than removing Chair Powell, highlighting ongoing concerns over central-bank governance amid political criticism

💳 Investors Shift to Corporate Bonds

As equity valuations have surged, investors are reallocating toward investment-grade corporate bonds, reducing credit spreads to the tightest levels since 1998—a sign of elevated risk appetite balanced with caution

📊 Key Data Releases & Events 📊

📅 Wednesday, July 23:

(No major U.S. economic releases)

Market focus remains on tech earnings (Tesla, Alphabet) and Fed signals following Tuesday’s Powell address.

⚠️ Disclaimer:

This information is for educational/informational purposes only and does not constitute financial advice. Please consult a licensed financial advisor before making investing decisions.

📌 #trading #stockmarket #economy #tariffs #Fed #earnings #corporatebonds

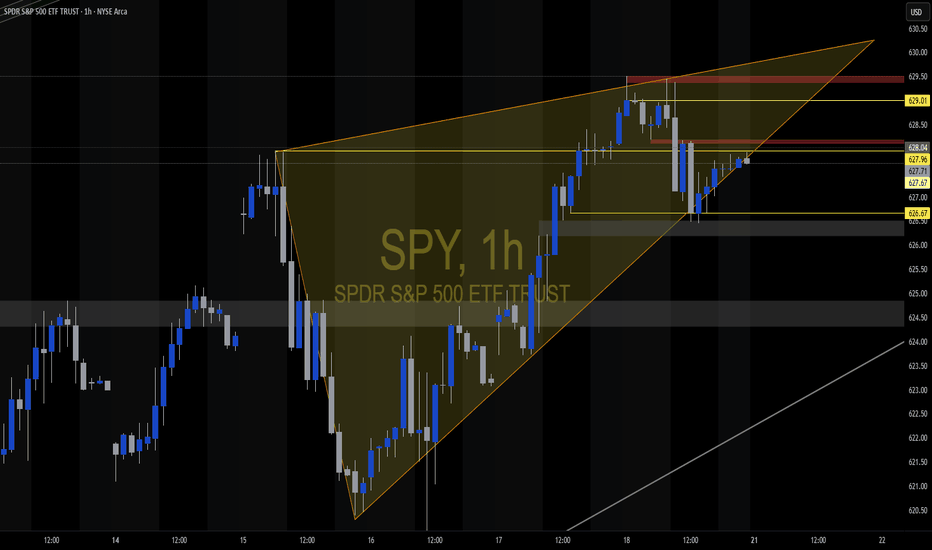

SPY "SP500 ETF" 1️⃣ Market Structure Overview

Change of Character (CHoCH) – Level: 626.19

The market printed a clear CHoCH at 626.19, breaking below a recent higher low. This shift signals the end of bullish dominance and marks the first warning of potential trend reversal. It’s a critical structure break indicating weakness in prior buy-side momentum.

Break of Structure (BOS) – Level: 631.54

A firm Break of Structure followed at 631.54, confirming the downtrend. This BOS came after price failed to establish a new high and instead reversed from the premium area, solidifying bearish continuation. It now acts as a key upper boundary for sellers.

2️⃣ Demand Zone Analysis (Support Levels)

The demand zones (green areas) are historical locations where price previously reacted strongly to the upside—suggesting institutional buying or significant liquidity absorption. These zones act as potential long-entry areas and support during pullbacks:

625.50: Immediate demand zone; price has hovered above this level recently, signaling short-term support.

624.80: Strong base formed after earlier accumulation; minor rally originated here.

623.80: Clear area of bullish imbalance; look for wick rejections here.

622.75 & 621.90: Deeper demand zones—likely to hold if the market retraces further and volatility spikes. These levels represent high-probability reversal points if liquidity sweep occurs below 624.

Each zone increases in risk/reward the deeper price pulls back, but also carries a higher chance of forming strong bullish reaction.

3️⃣ Supply Zone Analysis (Resistance Levels)

The supply zone (red area) at 628.85–631.54 was the origin of the last sharp bearish move following the BOS. It now acts as a potential reversal or distribution zone:

628.85 – 631.54:

This area previously held heavy sell-side interest and rejected bullish advances. It overlaps with a structural BOS and sits near the high of the prior rally. Watch for bearish price action or lower-timeframe exhaustion here. A break and close above 631.54 would invalidate this zone and indicate a major structural reclaim.

4️⃣ Current Price Action (Inside the Marked Border)

Price is currently reacting around 627, just above the CHoCH level (626.19). This zone lies between the upper boundary of the nearby demand and the lower edge of the supply. Within this boxed region:

Price is showing temporary consolidation, suggesting indecision.

A short-term dip into the 625.50–624.80 demand cluster is expected before any bullish leg.

If price holds above 626.19 and shows reversal signals (like bullish engulfing, hammer, or low-volume rejection), we may see continuation to test the 628.85–631.54 supply zone.

If structure fails and price breaks below 626.19 with conviction, the next downside targets are deeper into the 622–624 range.

This bordered zone represents a transitional area where the next directional move will likely be decided.

5️⃣ Momentum & Structure Bias

Structure remains bearish after the BOS, but current price is attempting to build a base.

If price maintains above CHoCH (626.19) and demand levels begin to hold, we may enter a bullish corrective phase.

Watch for rising volume on bullish candles or absorption wicks in demand zones as confirmation.

6️⃣ Macro/Fundamental Context (as of July 22, 2025)

While the chart is technical, the SPY ETF (S&P 500) is influenced by broader economic data. Around this date, watch for:

Earnings Season: Mid to late July often brings earnings from major S&P 500 companies. Positive tech earnings can fuel bullish momentum.

FOMC Speculation: If investors expect no rate hike or a dovish Federal Reserve stance, demand zones are more likely to hold.

Economic Reports: Look out for PMI or consumer confidence reports this week. A weak reading may drive SPY lower into demand, while a strong reading could help push it toward the supply zone.

If any bullish macro surprise occurs this week, it would support the bounce from the demand zone.

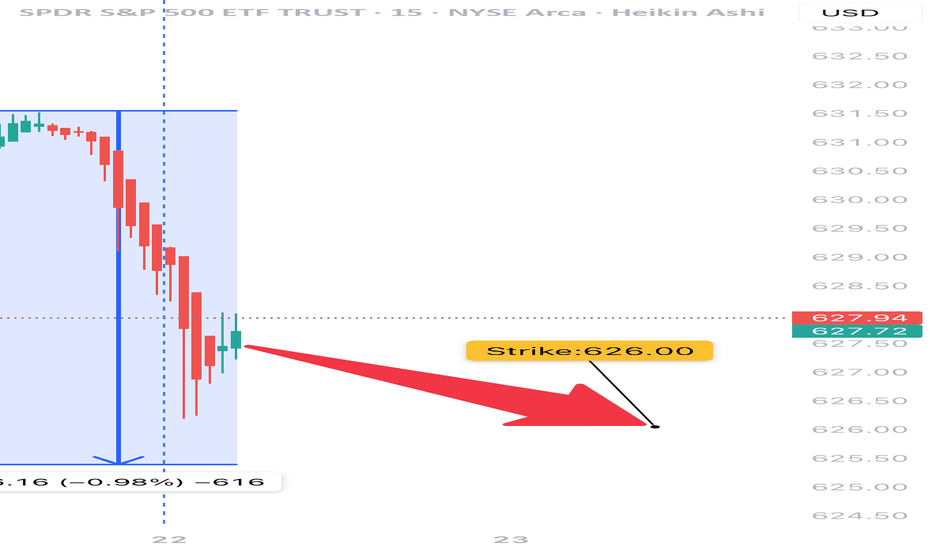

SPY Options Analysis Summary (2025-07-22)

🔻 AMEX:SPY Weak Bearish Put Setup (0DTE) – 07/22/25

All models agree: price is weak, momentum is limp, and VWAP is above.

But conviction? Not unanimous. High-risk, high-reward 0DTE scalpers only.

⸻

📉 Trade Setup

• 🟥 Direction: PUT

• 🎯 Strike: $626.00

• 💵 Entry: $0.57

• 💰 Target: $1.70 (+200%)

• 🛑 Stop: $0.28 (–50%)

• 📅 Expiry: Today (0DTE)

• ⚖️ Confidence: 65%

• ⏰ Entry Timing: Market Open

⸻

🧠 Multi-AI Consensus

Model Bias Action

Grok/xAI Weak Bearish ⚠️ No Trade

Claude Weak Bearish ⚠️ No Trade

Gemini Bearish ✅ $627 Put

Llama Moderately Bearish ⚠️ Conservative Put

DeepSeek Bearish ✅ $626 Put

🔹 VWAP < Price = Bearish bias

🔹 RSI = Neutral → watch for fakeouts

🔹 VIX favorable (<22)

🔹 Volume = weak = risk of whipsaw

⸻

⚠️ Risk Notes

• Bounce risk off session lows is real

• Lack of momentum may cause theta burn

• Best for scalpers who react fast — not a swing trade

• No conviction = smaller size, tighter leash

⸻

📢 Tagline (for virality):

“ AMEX:SPY is limping, not bleeding. But if it breaks, 200% comes fast. 0DTE scalpers: this is your window.” 💣

Nightly $SPY / $SPX Scenarios for July 22, 2025🔮 Nightly AMEX:SPY / SP:SPX Scenarios for July 22, 2025 🔮

🌍 Market-Moving News 🌍

🚀 Tech & EV Stocks in Focus Ahead of Earnings

Futures were quiet ahead of Tuesday’s open, but key movers included Astera Labs (+19%), Alphabet (+2.7%), Netflix +2%, and Robinhood –4.9% after being passed over for the S&P 500. Investors are positioning ahead of major tech and EV earnings this week — including Tesla, Alphabet, Lockheed Martin, Coca‑Cola, and Honeywell

📣 Powell Speech Eyed for Rate Clues

Fed Chair Jerome Powell is set to speak at 8:30 AM ET today at the Integrated Review of the Capital Framework for Large Banks Conference in D.C. Markets will be watching for any indications on future interest rate direction

🌏 Japan’s Political Shift Has Little Market Impact

Japan’s ruling coalition lost its upper-house majority over the weekend, but markets remained stable as it was largely expected. The yen held steady, and Asian equities stayed calm amid the holiday—focus remains on upcoming corporate earnings

📊 Key Data Releases & Events 📊

📅 Tuesday, July 22:

8:30 AM ET – Powell Speech: Key address at the bank regulation conference. Tone and forward guidance may sway bond and equity markets.

After Market Close – Alphabet & Tesla Earnings: Heavyweights due today—market attention will track revenue guidance, especially on advertising, EV demand, and AI.

⚠️ Disclaimer:

For educational and informational purposes only. Not financial advice—consult a licensed advisor before making investment decisions.

📌 #trading #stockmarket #tech #Fed #earnings #AI #infrastructure #volatility

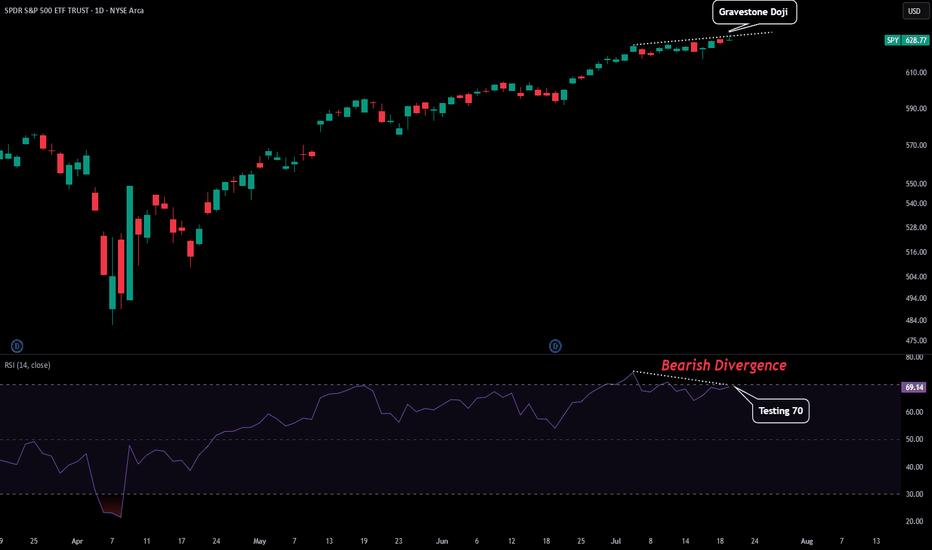

SPY - First Signs of TroubleFrom this entire uptrend we might be seeing the first signs of trouble.

Here are some reasons for this from a technical perspective:

-Daily Printed a Gravestone Doji

-RSI Testing Overbought as Resistance

-Slight Bearish Divergence on Daily RSI

-Momentum Stalling

There could also be some catalyst tomorrow that contribute to this. Powell speaks tomorrow so depending on what he says could either add fuel to a market reversal or negate these bearish signals and send us on another leg. Prepare for volatility.

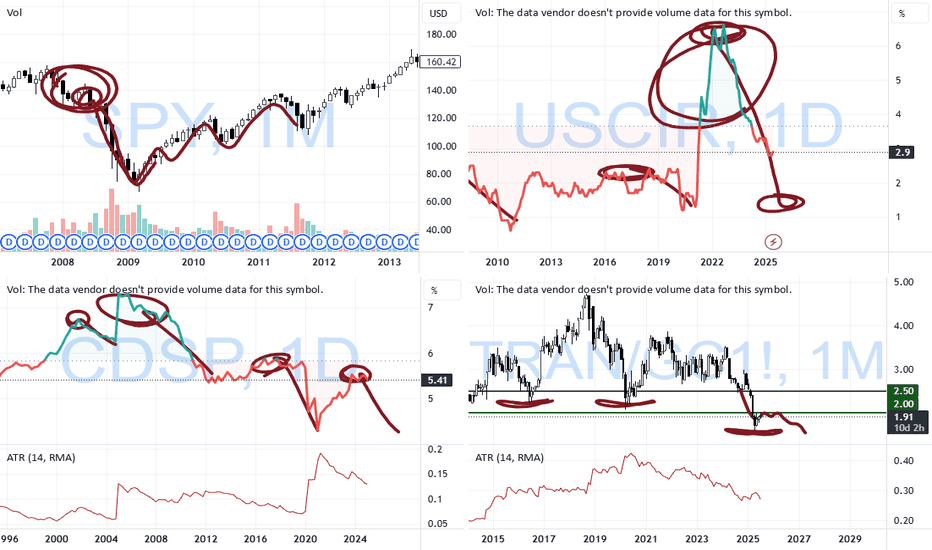

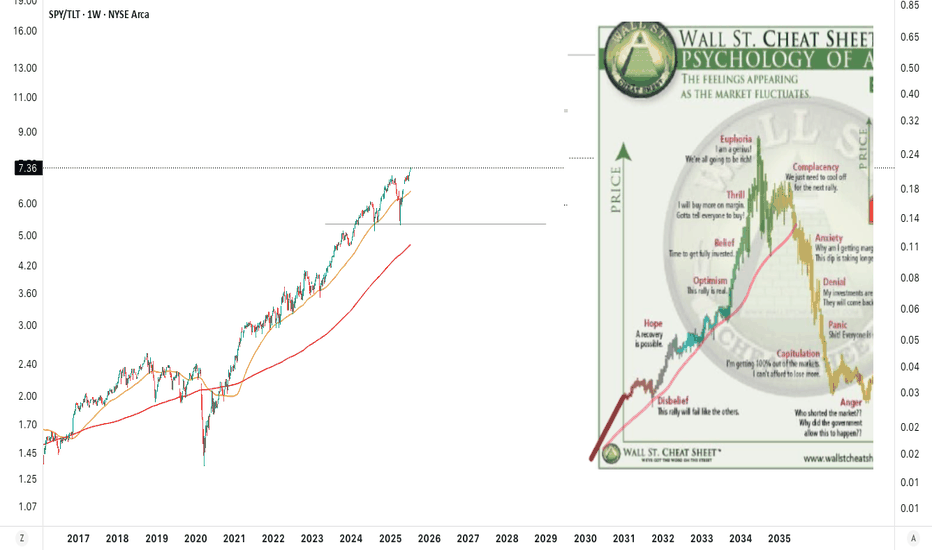

July 21 Special Update : Metals, SPY & More. What's Next.This special update is to highlight why I continue to believe traders should stay very cautious of this rally in the SPY/QQQ/BTCUSD.

Underlying economic data suggest that this is one big speculative rally following the April Tariff collapse.

And, the economic data I see from my custom indexes suggests the markets are moving into a very volatile and potentially dangerous topping pattern.

As I've stated many times in this video. I'm not saying the markets have topped and you should SELL EVERYTHING. I'm suggesting this market is extremely over-valued in terms of the underlying risk factors at play and the very clear data that suggests the markets are already in a recessionary price trend.

You may ask, "How can the markets continue to rally like this in a moderate recession?".

The answer is simple.

All bubbles end with a super-speculative phase. This phase is where everyone piles into a euphoric attempt to ride the rally higher.

It happened in the late 1990s. It has happened again through the 2000-2005+ housing bubble. Heck, it has occurred in the collectors market over the past few decades where people spent fortunes on the "hottest items" (think Beanie-Babies) only to find out they bought at the height of the bubble.

That is why I continue to urge traders to remain cautious and to withdraw profits from this speculative rally phase. Protect your investment capital immediately and consider the risks associated with the information I share in this video.

I'm not trying to scare anyone. I'm just trying to be realistic in terms of what I see in my data and why I believe now is the best time to MOVE TO SAFETY.

My data suggests that the markets are about to enter a fragile and potentially dangerous pullback phase. If you want to ride it out - go for it.

Otherwise, prepare for significant volatility over the next six months or more.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

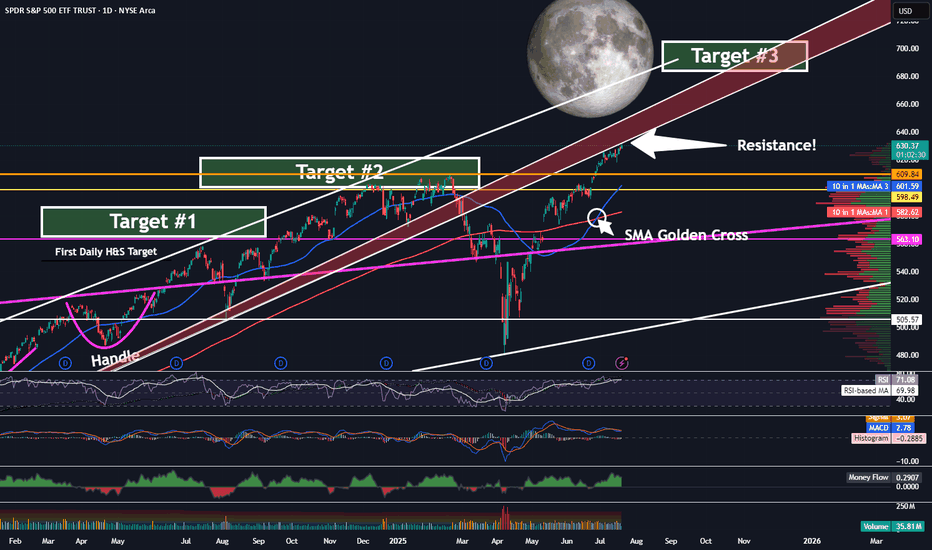

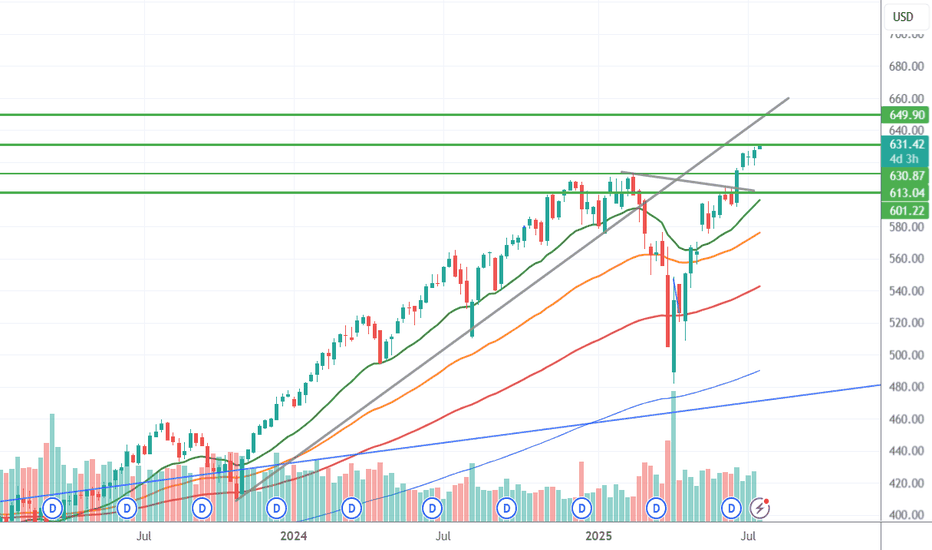

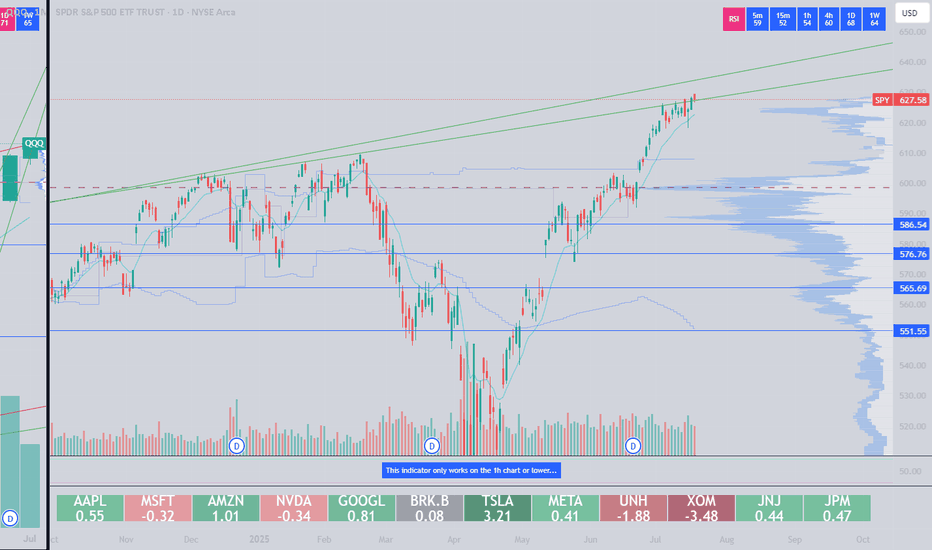

SPY - On Our Way To Target 3 ...But First?Trading Fam,

It's been a while since I updated you all on the SPY, which, as you know, we track closely to help us determine the overall market trend. Since we have now exceeded my Target #2, it's time for me to give you all another update. But first, a little context for my new readers which I have been getting a lot of recently, thanks to my new indicator hitting it out of the park.

So, we began marking targets on our chart here after spotting an inverse H&S on the daily chart a few years ago. Many of my followers back then were doubtful the pattern would fully form, or if it did, that it would actually play out. But the pattern completed about 14 months ago and subsequently broke the neckline in June of last year. I then knew we were going full send and have been predicting a 700 SPY final target since. This target has been made utilizing both that inverse H&S pattern as well as a longer-trend Elliot Wave, which I don't have denoted here at this point. The chart gets too messy with all of my markings. Regardless, we are currently in wave 5 and heading steadily towards that 670-700 target #3, my final target.

But be careful! Today, we have hit the underside of that RED area, which is HUGE resistance. I would expect that we will NOT break straight through this without some pullback prior. Indeed, the market is overextended at this moment, and we'll need the volume to be able to push through. Could this occur? Of course, anything is possible. But, it is not likely right now.

My guess is that we'll at least pull back to one of those levels below us or possibly even re-touch that 200 SMA in red before the final push.

Anyways, it is worth taking note of what may be ahead of us in the next few weeks or months so that you can plan your trades accordingly. Stay with me. We're almost there.

✌️Stew

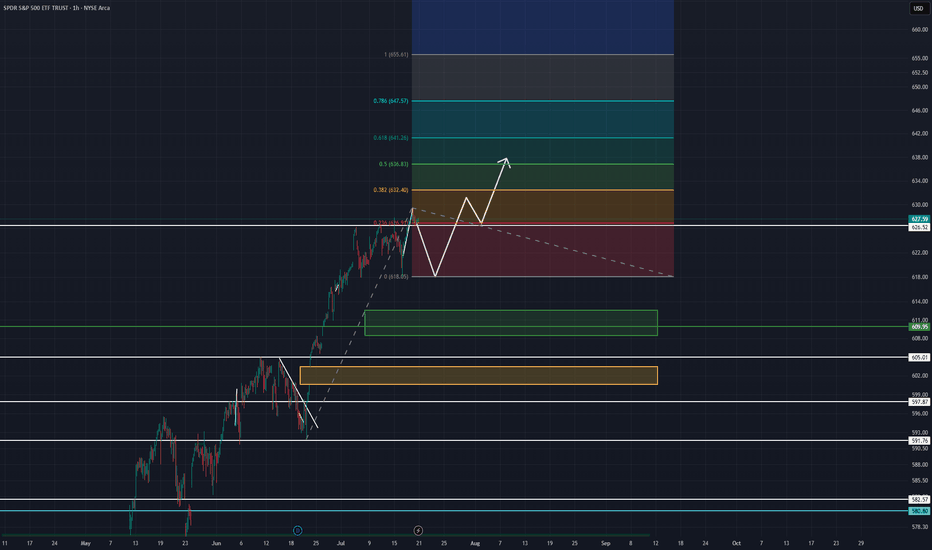

SPY: Climbing the Wall of Worry — But Is a Turn Coming?SPY: Climbing the Wall of Worry — But Is a Turn Coming?

The S&P 500 (SPY) is pushing into a critical zone as we approach July 28th, and I can’t ignore the confluence of signals piling up here.

Technical Setup

We’re testing the top of a rising wedge formation.

Key round number overhead at $640 — a psychological and options magnet.

Price is extended well above moving averages with declining volume, often a warning sign for bulls.

Multiple resistance lines converge in this zone, creating a high-pressure point.

📆 Timing Matters

July 28 = weekly options expiry — with massive open interest clustered around $630–$640.

Seasonally, late July often marks a peak before August chop.

Add in some “tin foil hat” vibes: SPY’s riding momentum while major indices are diverging (looking at you, IWM), and the macro narrative feels shaky at best.

What Would Confirm a Reversal?

Breakdown below $625 with a high-volume red candle.

Bearish engulfing or shooting star candle near resistance.

VIX divergence or big money flowing into puts mid-week.

Key Levels

Resistance: $640 / $649.90

Support: $630 / $622 / $595

Reversal target (if confirmed): $594–$575 area

Final Thoughts

As we all know, markets can stay irrational longer than you can stay solvent. However, when trendlines, round numbers, timing, and seasonality align, I start watching for cracks. This may not be the top — but it might be the spark.

Following closely. Alerts set. Ready for the flush if it comes.

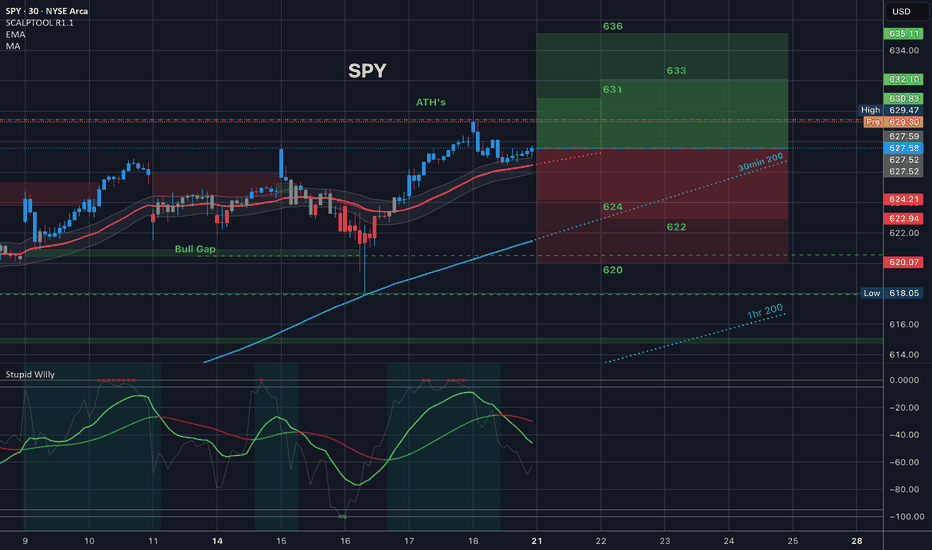

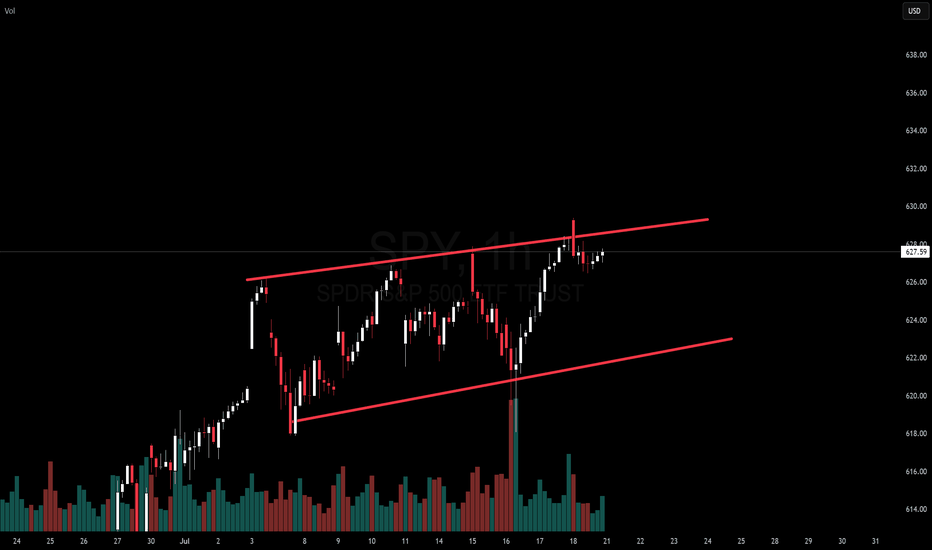

SPY July 21-25AMEX:SPY

Looking at the 4 hr. timeframe on SPY. Bearish divergence is signaling a need for some cool off. I assume this will happen almost immediately, Monday maybe into Tuesday. I expect to keep above strong support levels at 618 and 609.95. Drops below 609 will change my stance to a more bearish tone. assuming we hold these levels, I expect that SPY will continue upward after some small consolidation up here in the range. Looking at a trend-based fib, some price points to the upside above ath's(all time highs) would be 633.52 and 637.85. Even 654.

Economic and policy fundamentals could shift any bullishness into another sharp pullback or even up into higher price targets.

Not much to be bearish abut this week, earnings season is kicking off and this could play a role as well; Tesla and google & blue chips happening Tuesday- Thursday.

These earnings could be the mystery seasoning to shake up this week's movement.

Weekly $SPY / $SPX Scenarios for July 21–25, 2025🔮 Weekly AMEX:SPY / SP:SPX Scenarios for July 21–25, 2025 🔮

🌍 Market-Moving News 🌍

🏦 Fed Chair Powell Speaks — Markets Key Into Tone

Federal Reserve Chair Jay Powell’s Jackson Hole speech is the week’s centerpiece. Markets will be closely listening for clues on inflation strategy, rate-cut timing, and sensitivity to geopolitical inflation drivers like tariffs.

📦 Tariff Deadlines Gain Spotlight

Multiple tariff deadlines are set this week for targeted trade partners including the EU, Mexico, Canada, Japan, South Korea, and Thailand. Any new announcements or extensions could trigger volatility in trade-exposed sectors.

🛢️ Oil Market Mixed Signals

Brent crude prices have stabilized near mid-$70s, but OPEC+ discussions regarding supply extensions and global growth concerns continue to inject uncertainty into energy-linked equities.

📈 Big Tech Earnings Kick Off

The “Magnificent Seven” tech giants begin reporting: Nvidia leads on Tuesday, followed by Microsoft, Amazon, Alphabet, and Meta later in the week. Expect significant sentiment swings based on forward commentary.

📊 Key Data Releases & Events 📊

📅 Monday, July 21

Quiet session ahead of a packed week of speeches and data.

📅 Tuesday, July 22

8:30 AM ET – Existing Home Sales (June):

Measures signed contracts on previously owned homes—a key housing indicator.

After Market Close – Nvidia Q2 Earnings:

Market will watch guidance and China commentary.

📅 Wednesday, July 23

8:30 AM ET – Leading Economic Indicators (June):

An early gauge of U.S. economic momentum.

📅 Thursday, July 24

8:30 AM ET – Initial & Continuing Jobless Claims:

Labor-market health indicator.

📅 Friday, July 25

8:30 AM ET – Durable Goods Orders (June):

Signals demand for long-lasting goods, often driven by business spending.

8:30 AM ET – New Home Sales (June):

Follows existing home data for housing sector insight.

4:00 PM ET – Fed Chair Powell Speech at Jackson Hole:

Expect commentary on inflation, growth, and rate-path clarity.

⚠️ Disclaimer:

This content is for educational and informational purposes only and should not be construed as financial advice. Consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #Fed #earnings #housing #durablegoods #JacksonHole #technicalanalysis

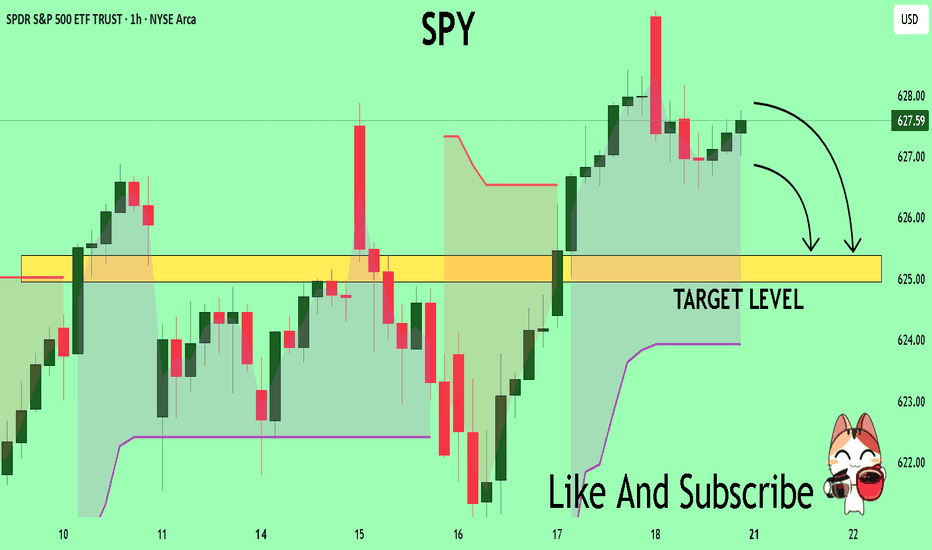

SPY What Next? SELL!

My dear friends,

Please, find my technical outlook for SPY below:

The instrument tests an important psychological level 627.59

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 625.38

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

hihiThe convergence of artificial intelligence and decentralized finance presents a paradigm shift in global economic systems, where algorithmic governance, autonomous agents, and smart contracts could redefine trust, efficiency, and access. This fusion offers transformative potential but raises critical ethical, regulatory, and socio-technical challenges demanding interdisciplinary exploration and resilient systemic safeguards.

Ask ChatGPT

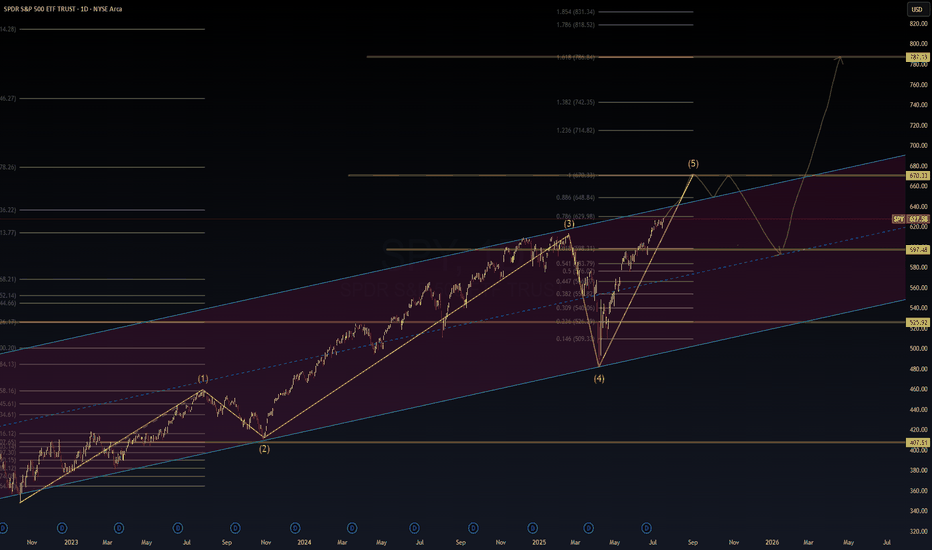

SPY Macro Wave Outlook – Bullish Fifth Wave into AI Supercy📈 SPY Macro Wave Outlook – Bullish Fifth Wave into AI Supercycle?

🧠 WaverVanir DSS | VolanX Protocol | Institutional AI Alignment

The SPY rally appears to be unfolding within a 5-wave macro impulse, currently inside Wave (5) targeting the 670–787 zone, depending on macro alignment and Fed behavior. This structure converges with long-term Fibonacci clusters and macro transition signals.

🔍 Thesis:

Wave (5) in Progress – Next resistance seen at ~670.33, followed by long-term targets near 787.19.

Pullback Scenario – A temporary correction into the 597–600 range is possible before further upside.

Structure Validity – Channel and Fibonacci extensions confirm bullish continuation unless macro conditions deteriorate sharply.

🧠 Macro Alignment Required:

Fed Pivot Late 2025 → Probability: 60%

Earnings Growth Led by AI → 11% projected for S&P500 (GS)

Productivity > Consumption → AI-led industries showing 5%+ labor productivity growth (Dallas Fed)

Low Inflation Reacceleration Risk → Core PCE stabilization key

⚠️ Risk Matrix:

Macro Risk Probability Notes

Fed Hawkish Reversal 30% Data-dependent but unlikely unless inflation re-flares

AI Concentration Shock 25% Tech-heavy rally, breadth remains a concern

Valuation Compression 20% Shiller CAPE near 37

Trade War Reignition 15% Tariff risk remains a geopolitical tail

🎯 Target Zones:

Near-term: 670.33 (Wave 5 peak)

Medium-term: 714–787 (Fib clusters)

Correction Zone: 597–600, invalidation below 525

The AI economy is accelerating—productivity is now outpacing consumption in several sectors. This macro regime shift could be the foundation for the next secular bull wave.

🔺 Powered by VolanX Protocol

⚠️ Not financial advice. Educational chart generated by institutional DSS models.

#SPY #VolanX #WaverVanir #ElliottWave #MacroTrading #AIProductivity #Fibonacci #FedPivot #USEquities #TradingSignals #SmartMoneyConcepts #InstitutionalStrategy #AIInvesting #SP500

SPY: Market of Sellers

Our strategy, polished by years of trial and error has helped us identify what seems to be a great trading opportunity and we are here to share it with you as the time is ripe for us to sell SPY.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

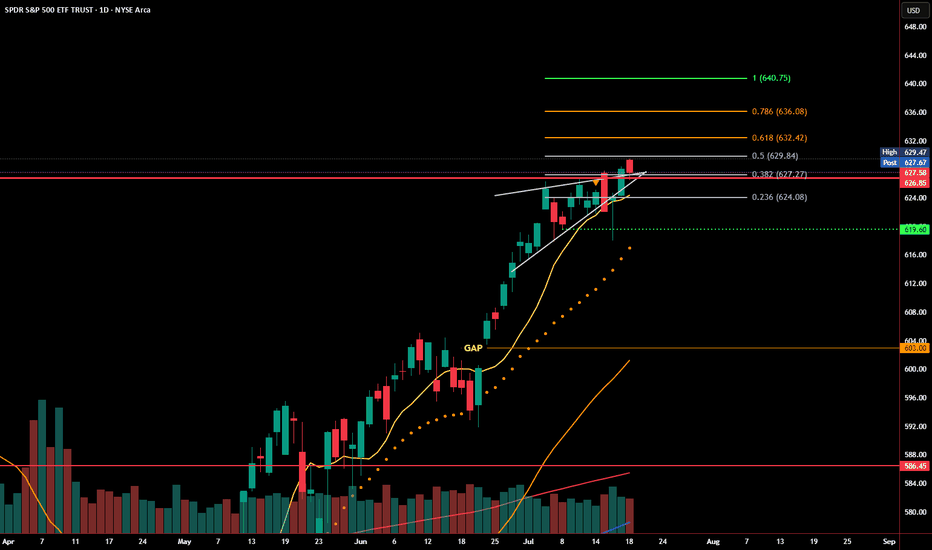

SPY Reclaims Rising Wedge Support - Bear Trap or Breakout Setup?SPY dropped below its rising wedge earlier this week, but that move may have been a bear trap. Price quickly reversed, reclaiming the wedge trendline and closing just below a key Fibonacci level at 629.84.

Buyers stepped in aggressively near the 0.382 and 0.236 retracement zones, defending short-term support. The bounce came on increased volume, signaling strength behind the recovery. Momentum remains intact as long as SPY holds above 626.

Now, bulls need to confirm with a breakout above 629.84–631.96 to open the door to the next levels at 635.63 and 640.30. Failure to break through could lead to another rejection and revisit lower support zones.

Levels to watch:

Support: 626.64, 623.62, 619.60

Resistance: 629.84, 631.96, 635.63

SPY is at a decision point. Reclaiming wedge support is a bullish signal, but bulls need follow-through to avoid another fakeout in the opposite direction.