TZA 4H gann fan RSI This is my way of getting a price range on tza using gann fan

if you follow all my ideas, you'll see im a bear market for the last 2 years

im doing this for fun and get experience

i usually check 3m 15m 4m and weekly montly to make sure im not a idiot

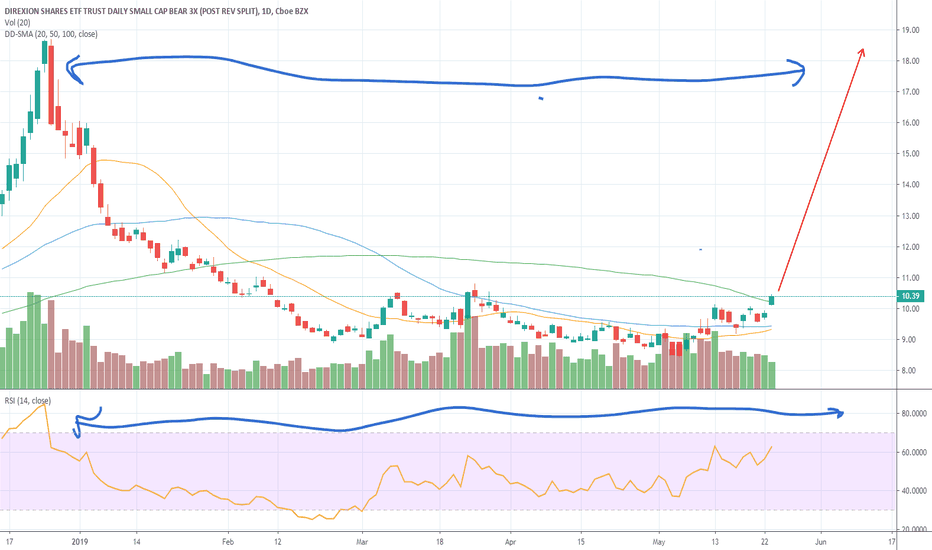

RSI is over needs to go back at 70-80 eventually

and didn't go to 80 since a long time

TZA trade ideas

TZA set to explode... 12% upside in this setupM2K futures are looking weaker than I have seen in almost 12 years. Crash is definitely on the table right now. TZA is a great instrument to capture a huge leveraged move with low risk. The entry in this scenario would be a buy at around $5.60 and to sell around $6.85 with a stop at $5.10. Ultra rare setup here with a huge gain potential in possibly a few hours... or minutes!

National 3x Leveraged Bearish ETF Week is Not Cancelled YetLast year, a certain holiday week was founded in secret. It involves the one time during the calendar year when it is a good idea to long the bearish 3x ETFs as a speculative play, rather than a hedge.

While they tried to cancel the festival this year for Covid-related reasons (money printing reasons), it seems the bearish folk are coming out to celebrate it anyway.

TZA is my favorite of the bunch, but my next two favorites have got to be SQQQ and SDOW. SPXS is just not my cup of tea, maybe because the S&P hasn't seen a proper correction in several decades.

Come celebrate this year and show your support with a donation to the increasingly corrupt, 51-week Negative Bagger Association of America (the NBAA) and purchase a share or two this week. Its the only week that its worth the roulette spin.

-SPigPigPig

AMEX:TZA

NASDAQ:SQQQ

AMEX:SDOW

AMEX:SPXS

AMEX:SPY

GLOBALPRIME:US2000 SPCFD:SPX NASDAQ:NDX DJCFD:DJI

TZA 4HTZA 4H

NORMAL RESISTENCE/SUPPORT IS GREEN LINE

OVER THAT IS BULLISH TERRITORY

UNDER IS BEARISH TERRITORY

to go up

VOLUME HAS TO BE OVER 700K

RSI HAS TO BE BETWEEN 35 AND 85, 51+ IS VERY BULLISH

WHEN TOUCHING 400MA over green line, this is gambling

short term between 200ma and 400ma is a healty normal goal

inside triangle, is a safe zone

make a decision when you are outside that.

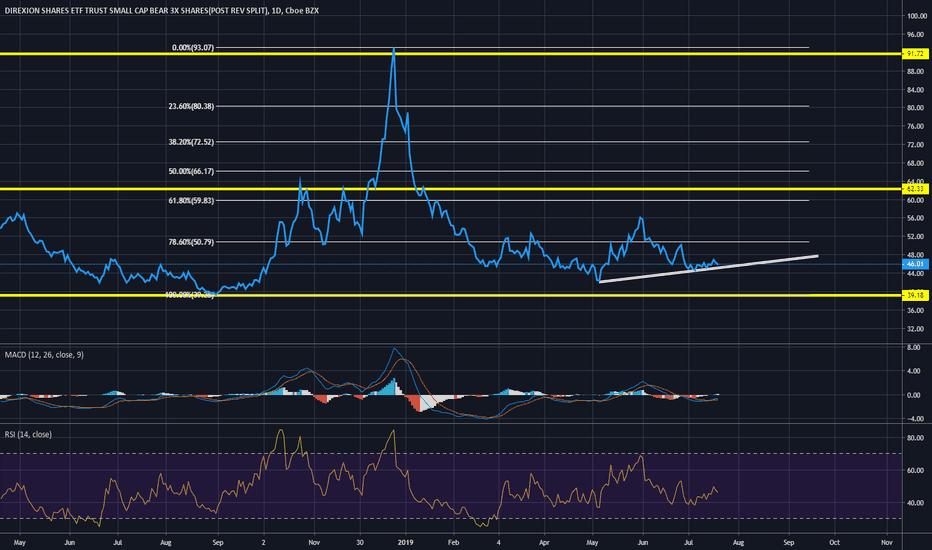

When Life Gives You A Lemon - Make LemodaideDon't wait until it's too late to hedge against your upcoming losses if your heavily invested...remember the last quarter of 2018? Well, it's happening again! If it's as rough as it was just 5 months ago your looking at upwards of 80% gains near term if your in...but if your not I feel for you (Also see SDS and SPXU). I've been day trading these short stocks and ETF's off and on for two weeks and it's worked out well; It's quickly turning into a buy and hold...and you better strap in because they are getting ready to launch!