UAMY Breakout Setup: Strong Earnings, High Volume, and Sector TaUnited States Antimony Corporation UAMY is the only significant U.S.-based producer of antimony, a critical mineral used in flame retardants, batteries, semiconductors, and military applications. The company controls mining, refining, and sales, positioning itself to benefit from growing domestic demand and geopolitical supply risks as China dominates over 80 percent of global supply. With antimony classified as a critical mineral in the U.S., domestic production is gaining strategic importance.

The antimony market faces supply constraints due to Chinese export restrictions, driving prices higher. Demand is increasing for use in energy storage, defense, and industrial applications, supporting a bullish long-term outlook for UAMY.

The stock surged 17.64 percent post-earnings, breaking resistance with 76 million shares traded, well above its 2.1 million average. It has been in an uptrend since late 2024, with RSI nearing 70, indicating strong momentum. Resistance is at 2.10 to 2.35, with a breakout confirming further upside. Support at 1.80 to 1.90 provides a strong risk-reward entry zone.

Entry signals

Breakout entry above 2.35 with high volume confirmation

Pullback entry at 1.80 to 1.90 if support holds

Supporting signals

Sustained high volume above 10 million shares daily

RSI stabilizing above 50 to 60 after a pullback

Consolidation near resistance before a breakout

Take profit targets

2.75 initial target from previous highs

3.50 potential price extension on strong momentum

4.00 plus if antimony prices surge or macro trends strengthen

Stop loss

Breakout entry stop below 2.00

Pullback entry stop below 1.70

What to monitor

Volume retention and price strength to confirm accumulation

Antimony price trends and policy developments on U.S. critical minerals

Institutional buying activity and government support for domestic supply

UAMY presents a strong bullish setup backed by sector tailwinds and increasing demand. A breakout above 2.35 could confirm further upside, while a pullback to 1.80 to 1.90 offers a secondary entry. Traders should watch volume and macro trends for confirmation.

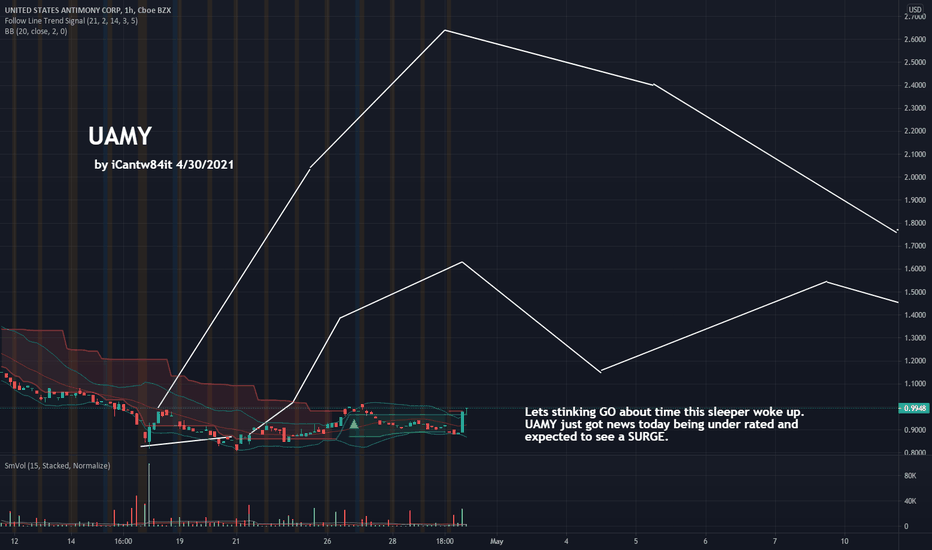

UAMY trade ideas

UAMY Ready for Another Run UpI believe UAMY is ready for another run up now. According to SimplyWall.St, UAMY earnings are forecast to grow 158.07% per year and has had a very volitile past months compared to the US market. SimplyWall.St is a website I just discovered yesterday and I am glad to share it with everyone. It has a lot on a stocks fundamentals, going over risks and rewards, is very user friendly, and more importantly, is FREE.

simplywall.st

United States Antimony (UAMY) Stock AnalysisCompany Overview:

- United States Antimony Corporation (UAMY) is a company focused on the mining, production, and sales of antimony and related products. They operate in various mining and processing activities, extracting antimony and producing antimony oxide, which is crucial for a wide range of industrial applications, including flame retardants, battery materials, and other specialty chemicals. The company is uniquely positioned as one of the few domestic producers of antimony in the United States, and its operations are key for national security, given the strategic importance of antimony in manufacturing critical materials like semiconductors and military technology.

- UAMY’s business model is structured around both the acquisition of high-potential antimony deposits and the development of processing capabilities to refine and sell the material to domestic and international markets. Their focus on maintaining a sustainable supply chain for antimony, especially as it is a critical material in the electronics and defense sectors, sets them apart from many of their competitors. The company is also working on improving the efficiency of its operations and expanding its production capacity to meet growing demand.

Impact of China’s Antimony Export Ban:

- In a significant development for the global antimony market, China recently announced a ban on the export of antimony to the United States. This move is part of a broader effort by China to control the supply of key rare earth and critical minerals, such as antimony, that are essential for advanced technologies. As one of the largest producers and exporters of antimony, China's restriction has immediate implications for industries relying on antimony as a raw material, including semiconductor manufacturing, aerospace, and defense.

- The United States is highly dependent on imports for its antimony supply, and China's move could exacerbate the ongoing supply chain challenges faced by American manufacturers. This creates an opportunity for companies like United States Antimony Corporation (UAMY), which is one of the few U.S.-based producers of antimony. With the potential for domestic production to fill the supply gap, UAMY could benefit from increased demand for its products. Moreover, as the U.S. government and private sectors look to diversify their supply chains away from reliance on China, UAMY’s operations could see a boost in demand and pricing.

_____________________________________________

Technical Analysis of UAMY (United States Antimony) Stock:

Price Action and Resistance Levels:

Recent Price Surge: UAMY recently experienced a significant spike in price, jumping from $0.71 to $1.90. This sharp increase signals strong market interest and a potential breakout.

Resistance at $1.90: The price is currently encountering resistance around the $1.90 level. This price point has acted as a ceiling, suggesting that further upside movement could be limited unless this level is breached. The price action near $1.90 will be crucial in determining whether UAMY can continue its upward momentum.

Potential Resistance at $4: Beyond $1.90, the next notable resistance lies around the $4 mark. This would be a significant level to watch for potential price action if UAMY can maintain its momentum above $1.90.

Moving Averages:

50-Day MA vs. 200-Day MA: Currently, the 50-day moving average (blue) is below the 200-day moving average (magenta), a common bearish signal. However, the recent spike in the 50-day MA suggests an emerging uptrend. If the 50-day crosses above the 200-day, this would signal a stronger bullish trend.

RSI (Relative Strength Index):

RSI at 86.37: The RSI is quite high at 86.37, which indicates that UAMY is in overbought territory. While this signals strong momentum, it also suggests that a pullback or consolidation is possible. Overbought conditions often precede price corrections, so traders should remain cautious.

Directional Movement Indicators (DMI):

DI+ at 55.49: The positive directional index (DI+) is strong, confirming that the bulls are in control. A DI+ value above 25 is considered a sign of a strong trend, and at 55.49, this is a very strong reading.

DI- at 7.66: The negative directional index (DI-) is low, indicating that there is little selling pressure. This supports the notion that the current bullish trend is firmly in place.

ADX at 43.38: The ADX, which measures trend strength, is at 43.38, indicating that the current trend is strong. This is another sign that UAMY’s bullish momentum is significant and likely to persist as long as key resistance levels hold.

ATR (Average True Range):

ATR at 0.1924: The ATR suggests moderate volatility. While the stock has seen some sharp movements recently, the volatility is not excessive. This indicates that the price action is likely sustainable, at least for now, without extreme fluctuations.

Volume:

Slight Increase in Volume: Since August 12th, UAMY has seen a slight increase in volume, signaling that market interest is gradually growing. A sustained increase in volume could support further price increases, especially if the stock breaks through resistance at $1.90.

_____________________________________________

Summary & Outlook:

UAMY appears to be in a strong bullish phase, but there are several factors at play:

Antimony Supply Dynamics: The recent export ban by China on antimony to the U.S. could be a significant long-term catalyst for UAMY. As a key domestic supplier, UAMY is well-positioned to capitalize on increased demand for antimony, particularly from sectors like semiconductors, defense, and electronics. This geopolitical development may enhance UAMY’s market value and earnings potential.

Overbought Conditions and Resistance: While UAMY shows strong upward momentum, the RSI at 86.37 signals that the stock is overbought, which could lead to a price correction or consolidation. The immediate resistance at $1.90 is a crucial level, and the price action around this point will determine if the stock can break higher or face a pullback.

Bullish Trend with Strong Momentum: The strong DI+ (55.49) and high ADX (43.38) suggest that the bulls are firmly in control, with a strong trend behind UAMY's recent move. This trend, however, could be tested if the $1.90 resistance holds.

Volume and Moving Averages: Although the volume is increasing slightly, it is not yet explosive. A sustained increase in volume and a potential cross of the 50-day MA above the 200-day MA would further solidify the bullish case.

In conclusion, while the stock is currently in overbought territory and encountering resistance, UAMY’s position as a key domestic supplier of antimony, especially amid the China export ban, makes it a potentially valuable player in the growing market for antimony and related products. Traders should watch the price action around the $1.90 level for a breakout or pullback. With strong trend indicators and the potential for increased demand, UAMY’s long-term outlook remains promising, but caution is warranted given its current overbought conditions.

Sources:

United States Antimony Corporation - About Us - www.usantimony.com

China Bans Antimony Exports to the U.S. - AP News - apnews.com

UAMY - Beautiful Setup with Key Changes in ManagementNew CEO is Mr. Evans Evans has served for 24 years as a Director of Novavax Inc., a NASDAQ listed (“NVAX”) clinical-stage vaccine biotechnology company (Covid-19 Vaccine) with a market capitalization in excess of $15 Billion, and previously served as Chairman, CEO and Lead Director.

Gary Evans has been buying the stock and now owns 1millin share @ price of $0.45

Volume is really low at the moment but Money flow has been consistently +ve

with Golden star indicator on a daily which is a really bullish signal.

Currently showing under consolidation

Little bit of volume can really send it

5million share buyback was announced by the company in latest 10Q

UAMY Liquidity GrabI only like this for a small position. There is a pretty low probability that it will drop to this point, but they arent currently mining silver and could see a sell off happen because of global depression before reaching new ATH after they start silver production. Its very possible this bounces at the 0.056 level, but I am willing to miss out if that happens.

Just a little bit of spaghetti thrown at the wall

$UAMY Reversal Rare earth metal needs for batteries - ammunition production.

They are only American-licensed antimoney smelter

After breakdown - good consolidation between 0.36 - 0.45 range.

Seems ready to breakout.

Volume is creeping up slowly with one day last week showing 3 x the average volume.

Recent insider buys @ 0.45 Jul 18, 2022 Buy 65000 Bardswich Lloyd United States Antimony Corp.

Currently Broke SMA50,100 Next possible resistance is SMA100 0.5169

Holding EMA Clouds really well

I'm long UAMY

UAMY - Huge accumulation - Potential for Huge BreakoutUAMY - Huge price accumulation - Potential for Huge Breakout

- If the larger descending trend line breaks we could see a very sharp increase in price - I would look for an entry upon confirmation of breakout - set alerts

- Look out for down side risk if the bottom support breaks first

- Very good fundamentals on this stocks too

UAMY - Fundamental catalysts and bullish chartBullish Thesis for UAMY:

1. UAMY share price has historically followed the raw price of Antimony. The last period that it traded in a similar price per metric ton was 2011-2012, in which the shares price traded in the $2-4 range on average. In 2021, the share price only briefly exceeded the $2 mark.

2. China is the world leading exporter of antimony and there is currently a supply shortage (along with global shipping issues due to covid), further driving up the price www.metalbulletin.com

3. Antimony is a critical element of many items, an in particular battery technology ( EV sector), and flame retardents, brake pads, and now alloys for CARBON CAPTURE as well. As part of the infrastructure deal, the carbon capture sector is benefitting with a ton of recent market interest (stocks like CEI and ENG are examples). Demand for antimony should continue to rise with the proliferation of EV's and pollution reduction legislation

4. UAMY has a subsidiary called Bear River Zeolite, which manufactures a chemical used for many pollutants, including CARBON CAPTURE and METHANE removal (worse than CO2) www.bearriverzeolite.com

5. UAMY has seen more volume in the past year than at anytime in it's history. Since peaking in March, it has been consolidating in the $0.80-1.10 range ever since, while the high price of raw antimony has remained high.

6. The current share price is sitting on a volume shelf support level

Risks -

1. If prices of raw antimony were to drop, the price would fall based on historical behavior. Unlikely in the near term due to high market demand

2. 50 day SMA just crossed under the 200 day SMA (death cross)

UAMY Long SwingI like the multiple bottoms around .98 over the last month or so and the MACD cross. Also the 9ema is crossing the 20 ema showing strength in the short term trend. Most recent candle closed just under the .23 fib level which is also resistance ($1.35).

The price is still well under the YTD POC level and this looks like a buy on the break of $1.35

First target $1.59

Second target $1.96

Third target $2.56

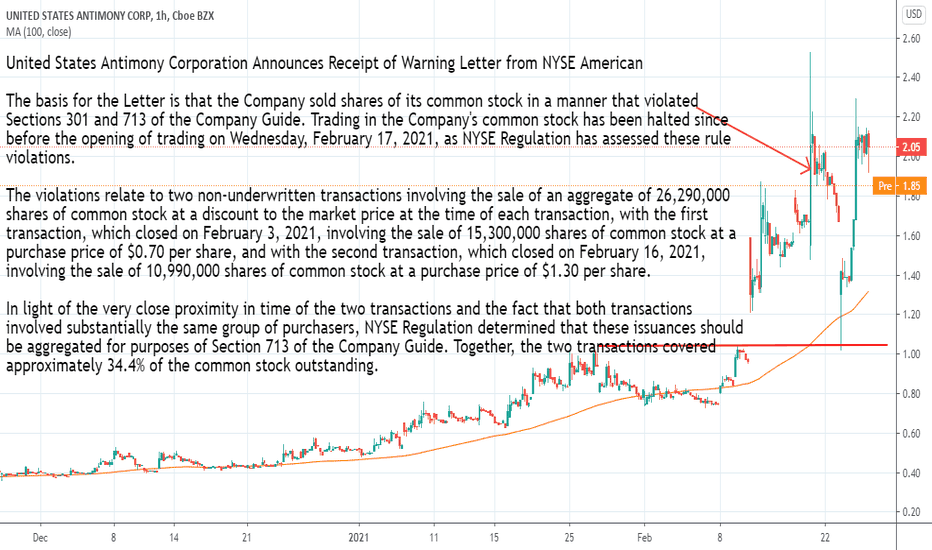

$UAMY Announces Receipt of Warning Letter from NYSE AmericanUnited States Antimony Corporation Announces Receipt of Warning Letter from NYSE American

The basis for the Letter is that the Company sold shares of its common stock in a manner that violated Sections 301 and 713 of the Company Guide. Trading in the Company's common stock has been halted since before the opening of trading on Wednesday, February 17, 2021, as NYSE Regulation has assessed these rule violations.

The violations relate to two non-underwritten transactions involving the sale of an aggregate of 26,290,000 shares of common stock at a discount to the market price at the time of each transaction, with the first transaction, which closed on February 3, 2021, involving the sale of 15,300,000 shares of common stock at a purchase price of $0.70 per share, and with the second transaction, which closed on February 16, 2021, involving the sale of 10,990,000 shares of common stock at a purchase price of $1.30 per share.

In light of the very close proximity in time of the two transactions and the fact that both transactions involved substantially the same group of purchasers, NYSE Regulation determined that these issuances should be aggregated for purposes of Section 713 of the Company Guide. Together, the two transactions covered approximately 34.4% of the common stock outstanding.

Section 301 of the Company Guide states that a listed company is not permitted to issue, or to authorize its transfer agent or registrar to issue or register, additional securities of a listed class until it has filed an application for the listing of such additional securities and received notification from the NYSE American that the securities have been approved for listing.

Section 713 of the Company Guide requires shareholder approval when additional shares to be issued in connection with a transaction involve the sale, issuance, or potential issuance of common stock (or securities convertible into common stock) equal to 20% or more of presently outstanding stock for less than the greater of book or market value of the stock.

As stated in the Letter, the Company failed to submit a completed listing application in advance of the February 16, 2021 transaction to obtain advance approval as required by Section 301 of the Company Guide and also did not obtain shareholder approval for the aggregate issuance of 26,290,000 shares that exceeded 20% of the common stock of the Company outstanding as required by Section 713 of the Company Guide. NYSE Regulation noted in the Letter that, after it became aware that the Company had entered into a purchase agreement in relation to the second transaction, NYSE Regulation informed representatives of the Company that it would be a violation of the applicable NYSE American rules for the Company to close the second transaction without first obtaining shareholder approval . Notwithstanding this clear guidance from NYSE Regulation, the Company went ahead with closing the transaction without notifying the Exchange.

The Company has been advised by NYSE Regulation that the Company's common stock will resume trading on the NYSE American following the issuance of this press release and the filing of a Current Report on Form 8-K disclosing the receipt of the Letter, which the Company anticipates will be prior to the open of trading on Friday, February 19, 2021.

finance.yahoo.com

UAMY - UP 70% OVER 90 DAYS. CAN IT SUSTAIN?United States Antimony Corp. engages in the exploration, production and sale of precious metals. It operates through the following segments: United States Antimony Operations, Mexican Antimony Operations and United States Zeolite Operations. The company was founded by John C. Lawrence in 1969 and is headquartered Thompson Falls, MT.

SHORT INTEREST

235.6K 07/31/19

P/E Current

58.56

P/E Ratio (with extraordinary items)

82.00

P/E Ratio (without extraordinary items)

47.93

UAMY taking - going higher on good MOMO and fundamentalsUAMY has enjoyed massive gains recently and over the past year. Looking at the business is has both good fundamentals and momentum going for it. Although today saw a healthy correction across the board in all major indices - UAMY is expected to go higher due a strong business model that sells antimony (an important resource), market conditions and momentum. Looking at the daily chart its clear most stock holders are not selling and so new buyers will cause higher demand and a higher stock price is sure to follow. I will be watching this stock in the next few days to buy when it has its next green day. Good luck :)

UAMY - Very good patternUAMY has drawn a cup with handle, the volumes are strongly increasing on this stock. A first bullish impulse has been initiated. The stock can enter a consolidation phase of several days or weeks before the rocket impulse. It is also possible that the rocket impulse start immediately without consolidation. The potential of this stock is very important (+50%).