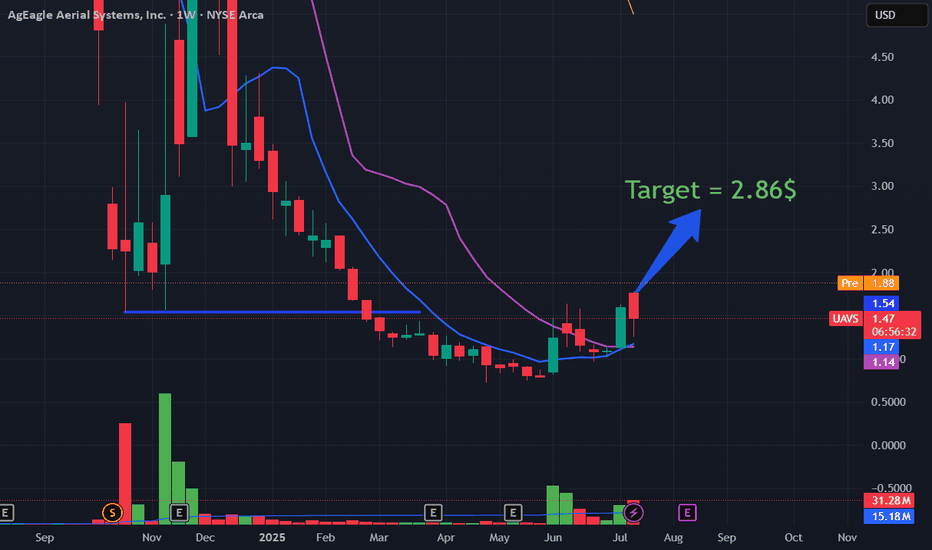

UAVS trade ideas

UAVS OVERSOLD LONGStock is very oversold with a gap to fill. No position yet, will likely open a long position soon, possibly today but want to watch to see if I can get a better price maybe 0.15 - 0.17 but won't wait around too long to take action. Target is 40%-60% upside but even 15% or 20% from these levels would be very nice. I am always ready to take profit if a trade goes my way. I am not looking to hold these penny stocks for very long. Simply looking to try to capitalize on oversold stocks while the penny stock market is heating back up. I like oversold opportunity because since the stock is so highly oversold it is likely there will be some sort of bounce and if the stock turns hard to the upside, it is easier for me to manage the trade than when chasing a stock the crowd has already found. My strategy is usually to take partial profit early, on the first big bounce and then set a stop loss not too tight to see if it can get more upside but will never hesitate to sell whole position, secure profit and move on if it feels like it is losing steam and will likely not make another entry if the stock continues high than from where I took profit. Also will not hesitate to cut my losses if the trade does not work out how I planned. In my opinion that is the key to not getting burned in this very fast moving market.

I like this UAVS set upI like the profits and the earnings, and to be honest I don’t want the stock price to go up because I want cheaper shares. I have some buys set up around .47 and looking to double down below .30

This set up looks like it could pop…

- Major MA’s are crossing.

- looking to break out of the descending triangle with strong weekly candles.

- could easily hit .67, 1.37, 1.87 and possibly crest into the 2$ range.

This scenario may be followed by a sharp retest of 52W lows before attempting to climb into 5y highs

Not financial advice

UAVS is waking upCheck out revenue and profit margins, first time positive in years.

Last time UAVS was in this position, it reached out to touch the monthly 20 day moving average.

Roughly 6-8 months later, after confirming 52W lows it took off…

One can only hope the new drones and positive revenue in the next quarters produce something similar this time around.

Not financial advice.

UAVS | Nice Entry | Dollar Cost Average InAgEagle Aerial Systems, Inc. engages in designing and delivering autonomous unmanned aerial systems for the energy/utilities, infrastructure, agriculture, and government industries worldwide. The company operates in three segments: Drones and Custom Manufacturing; Sensors; and Software-as-a-Service (SaaS). It offers fixed-wing drones, including eBee Ag, eBee Geo, eBee TAC, and eBee X; and sensor solutions, such as Altum-PT, RedEdge-MX, RedEdge-MX Dual Camera Imaging System, RedEdge-P, Aeria X, Duet M, Duet T, S.O.D.A., S.O.D.A. 3D, and S.O.D.A. Corridor. The company also provides software solutions comprising FarmLens, a subscription cloud analytics service that processes data collected with a drone for use by farmers and agronomists; HempOverview, a web- and map-based technologies to streamline and standardize hemp cultivation; Ground Control that provides individual pilots and large enterprises to automate and scale drone operations workflows; and eMotion, a drone flight and data management solutions. AgEagle Aerial Systems, Inc. was founded in 2010 and is headquartered in Wichita, Kansas.

What is dollar cost averaging?

Dollar cost averaging is the practice of investing a fixed dollar amount on a regular basis, regardless of the share price. It's a good way to develop a disciplined investing habit, be more efficient in how you invest and potentially lower your stress level—as well as your costs.

Let's say you invest $100 every month. When the market is up, your $100 will buy fewer shares, but when the market is down, your money will buy more. Over time, this strategy could lower your average cost per share—compared to what you would have paid if you'd bought all your shares at once when they were more expensive than the average.

UAVS ReversalNot a financial advisor

UAVS looks to create a momentum spark here with a 3 white soldiers reversal here.

With a very beaten down performance over the last year, this presents a favorable entry for people shopping in the market.

A reversal will clearly show a signal of strength and give investors a signal to buy, RSI curling up. MACD bullish territory. TSI about to cross bullish.

I believe we will witness an impulse wave up. Will need to come back down and stabilize after a nice little run up. To be in under $1.30 is a steal. This is a long hold in my opinion.

Mark Minervini's Style Analysis1) good pattern diagonal breakout

2) lot of accumulations (big green skyscrapers bars)

especially in Dec with very low volume in selling

after BO:

huge topping tail =good time to sell partial into strength

-after few days, it collapse

Dan Zanger said: a racing horse never goes back to starting point =time to close trade at EMA cloud

Oversold RSI with a long consolidation, its time!AgEagle Aerial Systems, Inc. designs, develops, produces, distributes, and supports unmanned aerial vehicles for the precision agriculture industry in the United States and internationally. It offers FarmLens, a subscription based cloud analytics service that processes data collected with a drone for use by farmers and agronomists; and HempOverview, a software-as-a-solution web- and map-based technology platform to support the operations of domestic industrial hemp programs for state and tribal nation departments of agriculture, growers, and processors. The company also offers fixed-wing drones, such as AgEagle Classic, RAPID System, RX-60, and RX-48; drone subcomponents; and ancillary drone support equipment. In addition, it provides technology solutions to the agriculture industry through delivery of best-in-class drones, sensors, and data analytics for hemp and other commercial crops. Further, the company provides turnkey, end-to-end, and tailored drone solutions to international clients. AgEagle Aerial Systems, Inc. was founded in 2010 and is headquartered in Wichita, Kansas.

Not Financial Advice - Just perfecting a process... At the time of this posting, I do not own positions in this stock!

Idea:

Price Target 1: 3.45

- Bullish

Not Financial Advice - Just perfecting a process... Do you own due diligence before investing!

Leave a comment that is helpful or encouraging. Let's master the markets together

UAVS LongCurrent in downtrend channel

Possible Reverse H&S.

WR > -80

OBV> OBV34

Entry 5.4

Stop 4.5

Target 15

Risk management is much more important than a good entry point.

The max Risk of each plan should be less than 1% of an account.

I am not a PRO trader. I trade option to test my trading plan with small cost.

I created some tradingview scripts to improve my trading entries:

OBV and OBV SMA comparison;

Williams %R two lines;

expecting a jump soonUAVS chart is reaching the bottom of the pitchfork. I'm expecting a bounce from here back to the middle of the pitchfork for massive gains or potential a breakdown which would require a revisit to previous base around 4 bucks. This is a daily chart so by friday we should see some action or direction.

$UAVS - Ag Eagle Aerial Systems - LONG Idea- After a major pull back together with many other tech stocks , UAVS is giving a favourable risk/reward ratio for a reversion to the mean trade.

- Entries closer to $5 or the 200 day moving average will make for a great entry

- NB This stock can be volatile, manage position size accordingly

-- MANAGE YOUR RISK - -

Disclaimer: All ideas are my opinion and should not be taken as financial advice.