Chart Pattern Analysis Of YINN

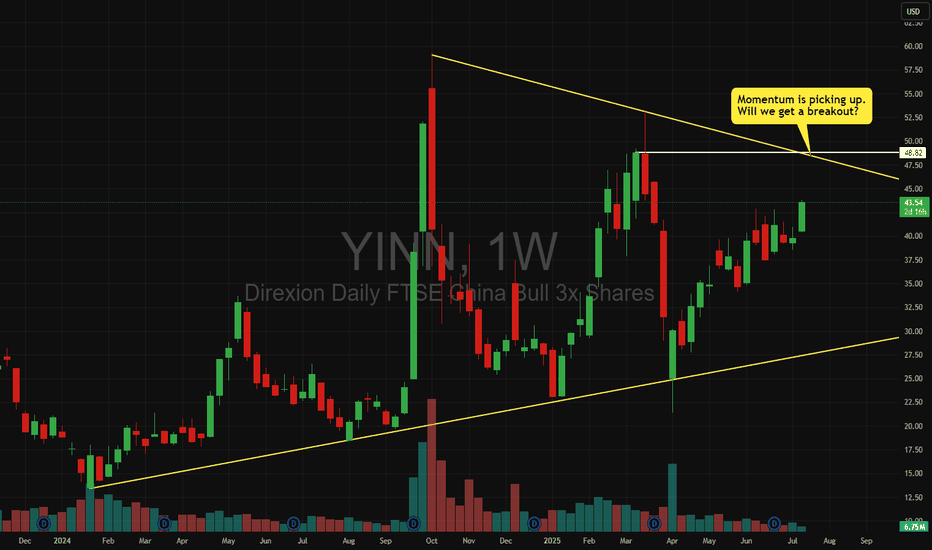

From K1 to K5,

It is a small scale consolidation or a bullish triangle pattern.

The supply pressure is decreasing too.

It seems that K6 or K7 will break up or fall down.

If the following candles close upon K3 or K4,

It is likely that another bull run will start here to test 77USD area.

On the other hand,

If the following candles close below the neck line,

The risk will sharply increase.

Long-41.6/Stop-39.9/Target-77

YINN trade ideas

YINN Stock Chart Fibonacci Analysis 042525Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 30/61.80%

Chart time frame: D

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provides these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.

YINN Massive drop, hold! Today’s drop on AMEX:YINN was brutal — no sugarcoating it. But in every downturn lies opportunity. This isn’t the first time we’ve seen this kind of volatility, and it won’t be the last.

Why I’m holding:

Long-term China exposure still holds strategic value.

🌱 Patience = Power

If you believed in the long thesis yesterday, a dip doesn’t change the fundamentals overnight. The storm may be rough, but clear skies follow.

✊ Not financial advice, just conviction. Let’s ride this out.

YINN Stock Chart Fibonacci Analysis 040525Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 30/61.80%

Chart time frame: B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: C

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provides these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.

YINN to the Moon? Here’s Why We’re Bullish!💥 YINN is setting up for what looks like a textbook breakout moment, and we’re here for it! 📈 With a combination of strong market momentum, improving sentiment in the Chinese economy, and a solid technical setup, this triple-leveraged China ETF is catching fire.

🔥 Why YINN is a Strong Play:

1️⃣ China's Economic Recovery: Recent policy shifts suggest that the Chinese government is ramping up its support for growth sectors. We see this fueling positive momentum across the index.

2️⃣ Technical Momentum: YINN is riding above key support levels, and it’s flirting with the top of its trading channel. A break could signal a rocket launch 🚀.

3️⃣ Global Macro Trends: With cooling inflation globally and easing U.S.-China tensions, risk-on assets like YINN are primed for gains.

📊 The Chart Speaks for Itself!

SOY 2024 - YINN (China) Monthly Seasonality StatsThe chart for YINN (Direxion Daily FTSE China Bull 3X Shares) reveals notable seasonal trends and volatility from 2015 to 2024. Historically, the YINN ETF shows strong performance in the first quarter, particularly in January and February, with gains in 2017, 2020, and 2021. However, the ETF faces significant declines during May and June, especially in 2015, 2018, and 2022, indicating that the market often struggles during mid-year. July shows mixed results, with notable volatility, and August typically brings significant negative returns, especially in 2015, 2019, and 2022. September is generally a weak month for YINN, aligning with a broader market tendency for underperformance, though there are some exceptions in 2017 and 2020. October and December tend to show strong positive returns in several years, notably in 2020, 2021, and 2022, suggesting a late-year rally.

Geopolitical risks play a crucial role in the performance of YINN , as this ETF is directly exposed to China’s economic and political developments. Tensions between the U.S. and China, trade wars, and the potential for conflict could lead to significant market volatility. The Tail Ratio for YINN indicates that the risk of extreme downside moves is substantial, especially in years marked by heightened geopolitical instability, such as during trade disputes or military tensions. The strong swings, particularly in mid-year months, suggest that political events and government policies in China can have a pronounced effect on YINN's returns, amplifying volatility. Investors should be cautious and aware of the potential impact of geopolitical developments on Chinese markets, especially in periods of high tension.

SIZZLING-YINN-HANDLE!!!! There's been a global paradigm shift As Biden's re-election prospects diminish and recent events are raising concerns. While US and Europe valuations are within fair value range based on forward P/E ratios the tremendous laggard China has turned its corner in cracking the chip after Pres Xi spent about $2T equivalent in US dollar that is a lot but at least he accomplished what he intended when he came in office and announced the "common prosperity initiative" to solve demographic generational chasm from the one child policy before and thee are not enough producers to support the rest and to solve this make home affordable again as children live with their parents until age 55 on average and this is not ideal for starting a family they need their own home. Well fold housing down 95% mission accomplished lol Tech Sector crackdown and sanctions on top of a strong US dollar also beat down China tech index clubbed like a baby seal down 75% . many have contemplated is China investable. We ladies and gentlemen. Bottom Line = YES! .........PLAY BALL!

Notice: Think for yourself before comparing your analysis. Past does not equal future, same goes with price discovery. Leverage ETF products have additional risks and design for short term trading and speculation and someone who has a system with automations and watching the Bloomberg. This is not intended to be a recommendation in absolute. If you do not fully understand please consult an advisor, make sure you have adequate cash reserve and can afford to lose as invest like this leverage 3x so that is a notional value of 300% of a potential 25%83=74% in one handle (move). Remember to cut your losses because it takes a 100% return to break even from a 50% loss. I would expect this trade to take 2 weeks to mature but could take a month and it may be down at first, but the paradigm has changed, and this is the trade for now.

Trading YINN? Two sides of a COINFrom China "uninvestable" to social media influencers calling bulls in the HK/China market and there are some followers getting edgy what they should do.

I know what I will do since I am clear with my objectives , time horizon, risk tolerance, capital management, etc.

For my existing holdings, I am selectively averaging down on some of these companies - Tencent, Alibaba, Meituan, Xiaomi,etc. One follower wants to know if he should trade YINN . Note that it is leverage by 3 times , ie if you win you triple your returns and also the losses. Most want to focus on the wins but may not be able to accept the losses when it happens!

Also, if the WINS come too easily, it is easy to get a bloated ego and one can starts to go "all in " in order to win BIG and fast. That itself is dangerous, leading into the path of gambling. For that, I wouldn't be touching this myself and am happy with the FXI ETF which has rally nearly 30% from the bottom.

Please DYODD

YINN Stock Chart Fibonacci Analysis 021424 Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 17/61.80%

Chart time frame : B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress : B

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) Hit the bottom

D) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provide these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.

YINN - a leveraged bullish ETF for Chinese stocks.YINN is a 3X leveraged bullish ETF of Chinese stocks. As can be seen on this one hour chart,

YINN has jumped nearly 30% since the beginning of the moth. On the chart is a moving average

ratio indicator ( with settings SMA7 / SMA28 ratio ). When the ratio crosses the zero line, the

shorter average is rising faster than the longer average demonstrating bullish momentum. Here

I used it as an entry signal. ( the exit signal would be the ratio dropping below the zero

horizontal line which has not yet occurred) For confirmation and further entry justification,

the volatility indicator shows spikes above the running average volatility in order to be

that there is enough volume and price action to get into a good trade in the direction of

the trade. Fundamentally, the Chinese economy is open and growing. the CCP has resisted the

urge to raise prime rates as compared with Western central banks. ( BABA and NIO have

good current price action.) Given the guidance of the chart, YINN seems to be a

good long trade I will continue to add to the trade when the chart tells me the time is right.

Is YINN ( Chinese 3X )ready to re-enter or add to the position?YINN is shown here on a 15-minute chart. It had several good NY sessions in a row adding about

4% daily. In the last session however, it had a 3% pullback to its present price. Fundamentally,

the Chinese central bank in just the past few days, lowered the prime rate something the US

fed has been unwilling to consider. There can be little doubt that this will be helpful to

Chinese stocks overall. On the chart, I find several confluences that give YINN support and

so make it likely that YINN will have a bullish continuation:

(1) it is currently at the same value of the POC line.

(2) it is currently near to the convergence of the SMAs 50 20 and 10 from the

Alligator indicator

(3) it is sitting just above the line representing one standard deviation above

the anchored mean VWAP

Given these confluences, the support is strong favoring my analysis that YINN is ready

for me to add to my position which was very profitable when I took a partial closure

of my shares at the beginning of the last trading day. I am confident that the buy

high and sell higher in an uptrend is the best approach to gain with low risk.

Apr/2023 Plan for YINN. Plan A: Sell Put Option $35 monthly (4 weeks ~ 30 days) to earn premium income 4-5% the collateral fund.

Plan B: I'm willing to hold YINN $35.00 for long term and write cover call to earn 4-5% premium income every month + dividend income.

$35 is the Order Block (OB) level in the Weekly TF.

Continuation Wedge (Bullish) | 44% move possible"Continuation Wedge (Bullish)" chart pattern formed on Direxion Daily FTSE China Bull 3x Shares (YINN:NYSE). This bullish signal indicates that the stock price may rise from the close of $45.07 to the range of $59.00 - $62.00. The pattern formed over 28 days which is roughly the period of time in which the target price range may be achieved, according to standard principles of technical analysis.

Tells Me: After a temporary interruption, the prior uptrend is set to continue.

A Continuation Wedge (Bullish) represents a temporary interruption to an uptrend, taking the shape of two converging trendlines both slanted downward against the trend. During this time the bears attempt to win over the bulls, but in the end the bulls triumph as the break above the upper trendline signals a continuation of the prior uptrend.

YINN | China LONG | BounceThe fund, under normal circumstances, invests at least 80% of its net assets (plus borrowing for investment purposes) in financial instruments, such as swap agreements, exchange-traded funds ("ETFs") that track the index, securities of the index and other financial instruments that provide daily leveraged exposure to the index or to ETFs that track the index. The index consists of the 50 largest and most liquid public Chinese companies currently trading on the Hong Kong Stock Exchange. The fund is non-diversified.

The balloons, the big short, and the long longIf you was looking when to buy, maybe this is your chance, inclusive Michael burry is Buying chinese stocks, the only one difference between the Michael Burry strategy and this option is that $YINN have shares from the chineses companies in the origin market, so, if there is some problem with the chineses you will be fine.