APTUSDT trade ideas

#APT/USDT#APT

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 5.67

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the Moving Average 100

Entry price 5.74

First target 5.87

Second target 6.03

Third target 6.26

APT/USDT : Next Stop $20?BINANCE:APTUSDT

"In the weekly timeframe, the price is at a bottom and has shown a positive reaction. Considering the current conditions of Bitcoin and Ethereum—especially Ethereum, which has had a significant drop and is now at strong support—I believe this Symbol has strong potential for a substantial upward move. My price target, based on liquidity above key highs, is over $20."

Aptos APT Will Reach $100 This CycleHello, Skyrexians!

Recently talked enough about the Bitcoin and Dominance, it's time to come back to altcoins with great potential. This is time for BINANCE:APTUSDT because it looks like to flash the insane long signal.

Let's take a look at the weekly time frame. We cannot define the Elliott waves, but we have the great performance in the past by the Bullish/Bearish Reversal Bar Indicator on this asset. Recently it flashed the green dot. You can see how it performed in the past. Moreover t is happening next to 0.61 Fibonacci zone. We can consider this move a a huge accumulation before the bull run. The target for the long term is $100.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

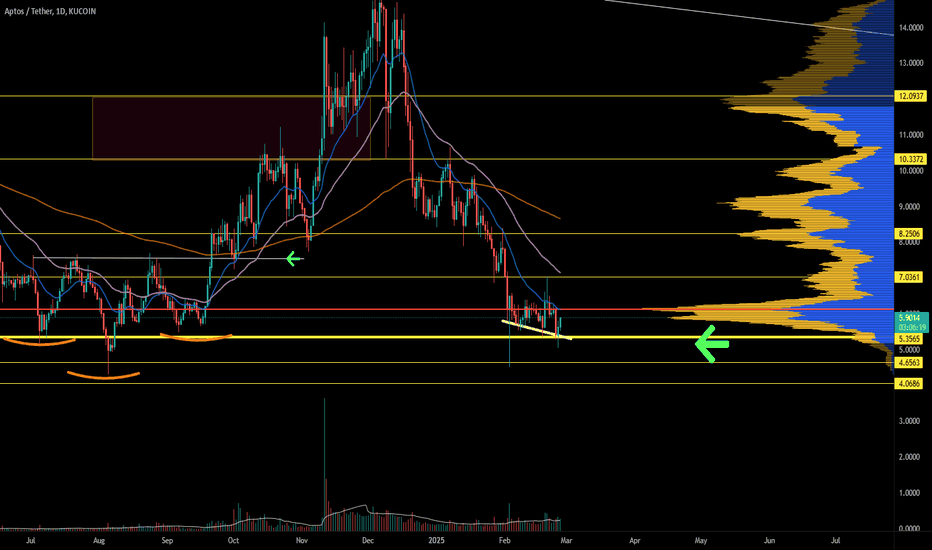

Bullish Aptos, Bullish Crypto: Buy & HoldThis is the daily chart, two signals:

1) Three green days and a break above EMA13.

2) A higher low: 25-Feb vs 3-Feb.

The weekly timeframe also shows a higher low but based on the long-term. February 2025 vs August 2024. There is also a triple-bottom when we consider the low set in October 2023 and count these last two lows as reaching the same level.

This week, in early February and in August 2024, in all instances, APTUSDT produced a long lower wick on the session. This means that buyers were ready and buyers bought. Prices dropped but the close happened close to the session open. After these candles, there was never a retest of the lower levels. Something very similar can be happening today.

The theme is now looking for proof that supports the end of the correction, the start of a new bullish wave. So far I shared the same signal repeated throughout many charts.

Aptos has great potential for long-term growth. In this chart setup, it is hard not to go LONG.

The correction is over. The next major move will be up. All sellers are being bought.

Do not sell now. Right now is the best time to buy and hold.

Either buy or if you already bought, just hold.

Namaste.

APT : an Ethereum Layer 2 project | Univers Of SignalsLet's take a quick look at APT, an Ethereum Layer 2 project with a market cap of $3.3 billion, currently ranked 31st in coin market cap.

🔍 In the 4-hour timeframe, we're witnessing a bearish trend where the price has reached a support level at $5.16, forming a range between $5.16 and $6.49. This coin has managed to maintain its crucial support at $5.16 during Bitcoin's recent price drops, staying above this level.

☄️ Following the Bybit exchange hack news, the price, which had broken above $6.49, sharply reversed, faking out that breakout and reintroducing bearish momentum into the market. However, the support at $5.16 has held strong, preventing further price declines and proving itself as a significant support level.

📉 Given the importance of this support, breaking below $5.16 could initiate the next bearish leg, and I would personally consider opening a short position if this level is breached.

📈 On the flip side, given the resilience shown by the $5.16 area, there's a possibility that the price could rebound from here. In such a scenario, if $6.49 is breached, it could be a good opportunity to enter a long position, banking on a recovery and potential uptrend continuation.

APT target $8.64h time frame

-

Entry: $5.95

TP: $8.6

SL: $5.77

RR: 14.3

-

(1) APT has broken out the wedge structure on 19th Feb.

(2) Currently retesting this wedge and fibonacci 0.382 at $5.95

(3) One more time to retest $5.95 with effective support is our entry opportunity

(4) Targets analyzed from structure and fibonaaci are $7.27 and $8.76

(4) Stop loss once going below $5.77

APT SHORT targeting further downside continuation.[MICRO OUTLOOKAPTUSDT is respecting a clear downtrend structure, consistently rejecting the descending trendline. Price recently tapped the 6.12 resistance zone, aligning with the 0.786 Fibonacci retracement, reinforcing bearish sentiment. The market structure suggests a continuation to the downside, with a potential short setup targeting the -0.5 Fibonacci extension at 5.67. A break above 6.18 could invalidate this bearish outlook.

[LONG] APTOS' time to shineAPTOS started the year in free fall, the so called "SOLANA killer" is testing the $5 support for the 3rd time since 2023. APTOS needs buyers ASAP and this week so far is finding them.

On the daily chart some signs of strength and a more consistent volume are giving hope for the bull case

On the 4H chart price broke bellow $5.50 but quickly found buyers and went to try and break the top of the descending channel. It failed, but was expected, now buyers need to commit on this pullback for a definitive breakout and continuation

Entry: $6.00

current price

1st target: $7.10

at this price bulls are in control, move SL to break even point

1st take profit: $8.80

big volume node and 200d EMA, this can be a hard nut to crack

2nd take profit: $12.45

sellers took control here last December and most likely will be there again

Stop loss (conservative): $5.25

bellow the last swing low

Stop loss: $4.85

is $5 is lost I'm giving up my hopes on APTOS for the time being

APTUSDT Analysis & Signal📢 APTUSDT Analysis & Signal 📢

🔍 Market Condition: Distribution Phase 📉

📊 Timeframe: 4H (Heikin Ashi)

💰 Entry: Around 6.80 - 7.00 USDT

🎯 Target 1: 10.50 USDT

🎯 Target 2: Higher breakout possible

❌ Stop Loss: 4.49 USDT

📈 Analysis:

APTUSDT appears to be breaking out of an accumulation zone, but given the strong resistance above, we could be entering a distribution phase. If price struggles to break above 7.00-7.50 USDT and starts forming lower highs, we might see a rejection and a potential drop back to the range lows.

🔹 If the price holds above 7.00, it could push towards 10.50.

🔹 If rejection happens, expect a retest of 6.30 - 6.50 support zone.

💡 Risk Management:

🔸 If price fails to sustain momentum, trailing stop recommended.

🔸 Monitor volume—decreasing volume near resistance signals weakness.

📊 React & Engage! Your feedback motivates us to share more signals! 📢🚀

⚠️ Not a financial advice! do your own research as well

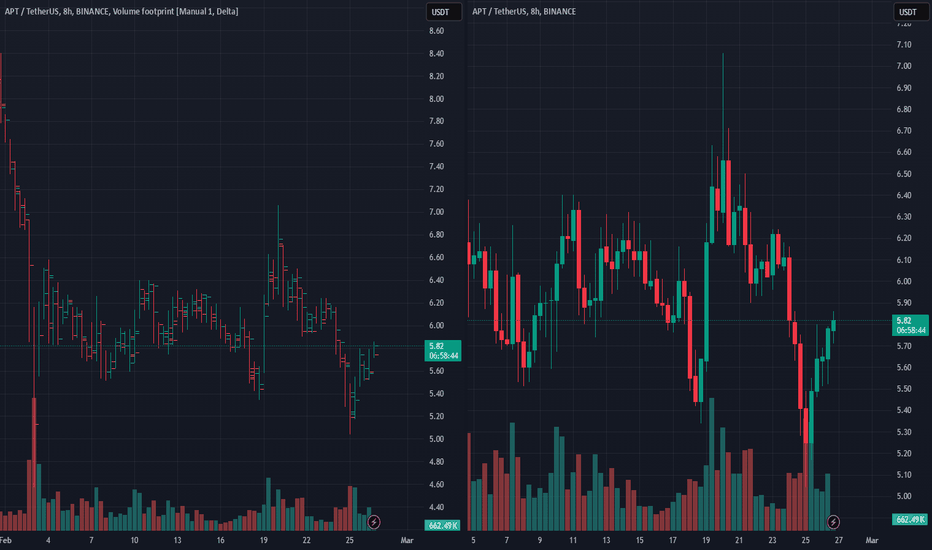

APTUSDT Analysis: Waiting for Lower LevelsI see no reason not to wait for lower levels in APTUSDT. The market conditions suggest that there might be a better opportunity for entries at these levels.

Key Points:

Lower Levels: Waiting for lower levels might provide better risk/reward setups.

Market Conditions: Keep in mind that market conditions can change quickly, so stay cautious.

Confirmation Indicators: Use CDV, liquidity heatmaps, volume profiles, volume footprints , and upward market structure breaks in lower time frames for validation.

Learn With Me: If you're interested in learning how to use these tools for accurate demand zone identification, feel free to DM me.

If this analysis helps you, please don’t forget to boost and comment. Your support motivates me to share more insights!

If you think this analysis helps you, please don't forget to boost and comment on this. These motivate me to share more insights with you!

I keep my charts clean and simple because I believe clarity leads to better decisions.

My approach is built on years of experience and a solid track record. I don’t claim to know it all, but I’m confident in my ability to spot high-probability setups.

If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

My Previous Analysis

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

Aptos (APT) Surge 16% as Token Unlocks Spark Market AnticipationAptos (APT), one of the emerging Layer 1 blockchain networks, saw a remarkable 16% price surge today despite the upcoming release of 11.31 million APT tokens—representing 1.97% of its total supply—on February 10, 2025. This release, valued at approximately $71.25 million, had initially created uncertainty, causing APT to dip 6.08% last week to $5.80, with a 20.62% drop in trading volume to $219.93 million. However, today’s bullish movement suggests traders have already priced in the token unlock event and are positioning for potential gains.

Token Unlock and Market Sentiment

Token unlocks can often introduce downward pressure due to an increase in circulating supply. However, in the case of Aptos, previous major unlock events have historically led to significant trading activity and, in some cases, price recoveries. The anticipation surrounding this unlock indicates that investors are still confident in Aptos’ long-term fundamentals and its position in the Layer 1 blockchain space.

Moreover, Aptos’ past all-time high (ATH) of $44 demonstrates its potential upside, and with market sentiment stabilizing, analysts suggest a potential rally towards $20 in the coming weeks. The broader crypto market’s resurgence and increasing demand for high-performance Layer 1 networks further support this bullish outlook.

Technical Analysis

Currently, APT is trading within a bullish zone, up 13.82% at the time of writing, with the Relative Strength Index (RSI) at 61.44—indicating strong momentum but still within a range that allows further upside movement.

- Support Level: The one-month low is serving as a key support point. If APT were to break below this level, it could test the $3 mark.

- Resistance Level: The 38.2% Fibonacci retracement level is acting as a significant resistance point. A breakout above this level could propel APT towards $10 and potentially $15.

Conclusion

Technical indicators suggest APT could target $10–$15 in the near term. As the market adjusts to the increased supply, Aptos remains one to watch in the coming weeks, with a possible move toward $20 if bullish momentum persists.