ARB | Full-analysisHere is the top-down analysis for ARB as requested 🫡

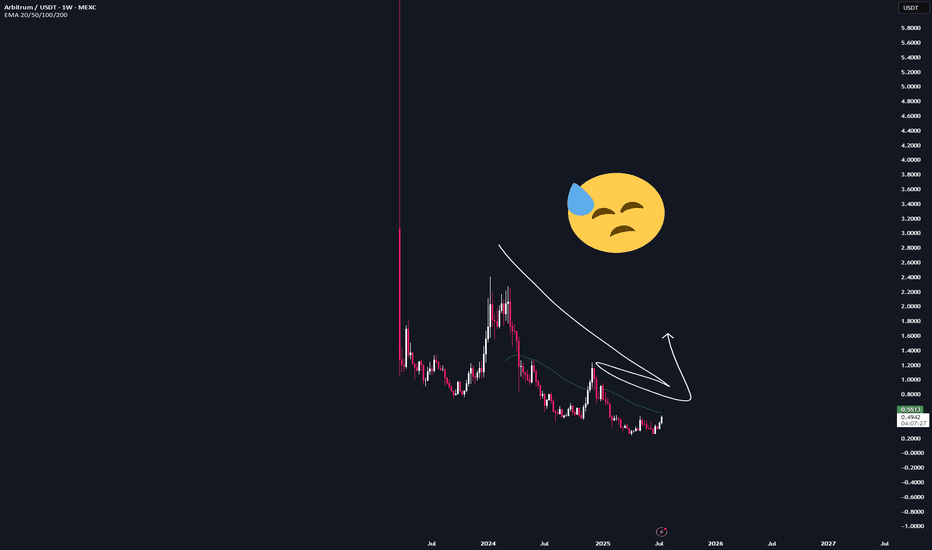

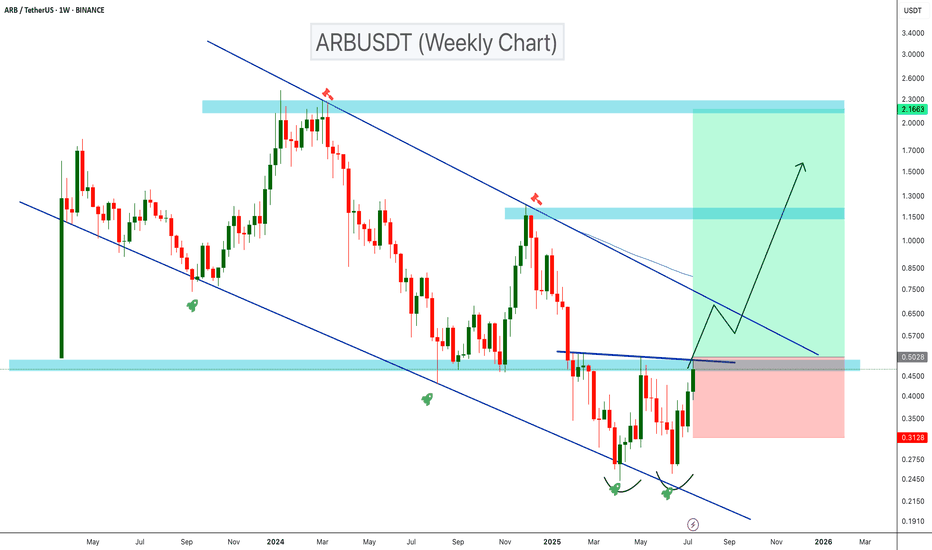

Weekly Timeframe:

There are currently no valid bullish structures on the weekly chart, as AMEX:ARB has put in lower lows.

So we have no clear targets from a weekly perspective at this point.

Daily Chart:

A new bullish sequence was ju

Related pairs

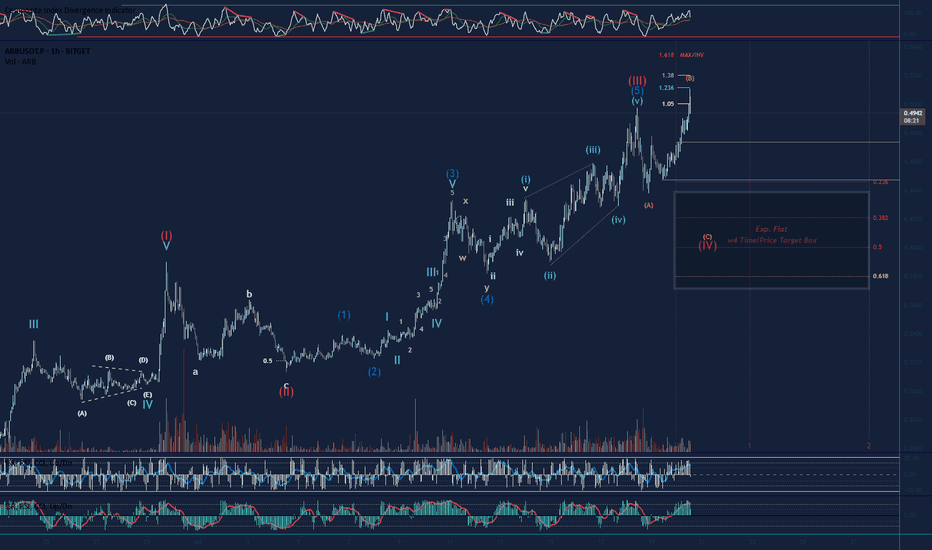

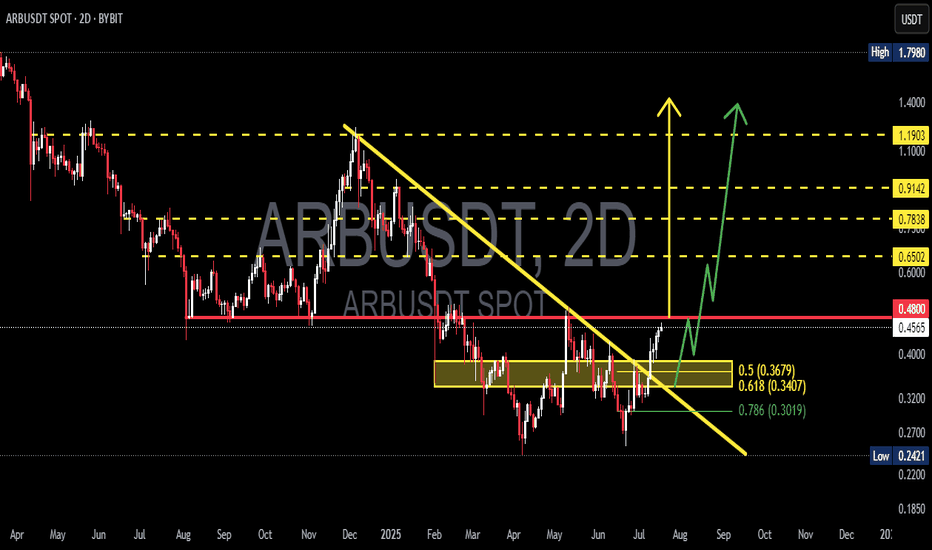

Looking to complete a wave 4 Retracement on Arbitrum Short term outlook is bearish as we are looking to complete an expanding flat to the downside. Wave B neared it invalidation, but reversed down. Lets see if the bears can push it down to the 0.5 Fib Target, soft target is the 0.382 Fib. If volume increases this could be a third up, but we need the w

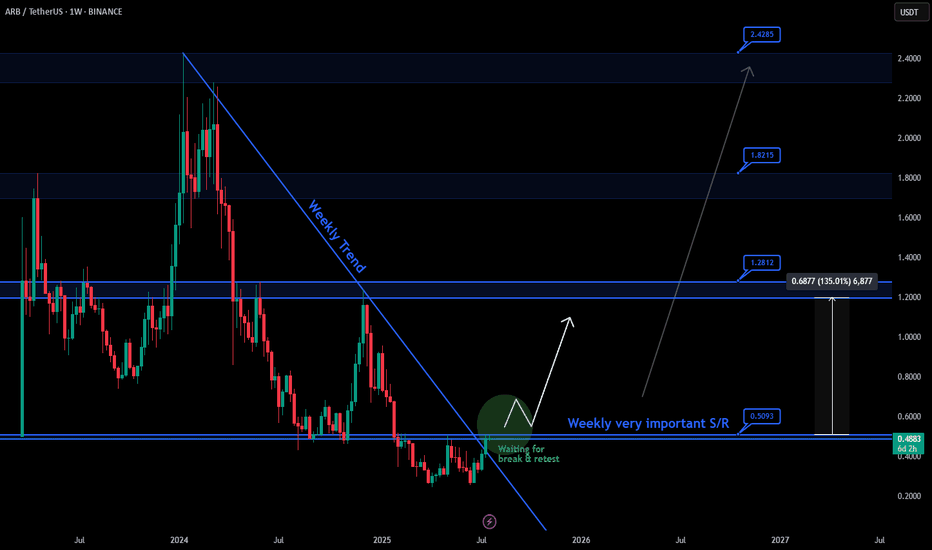

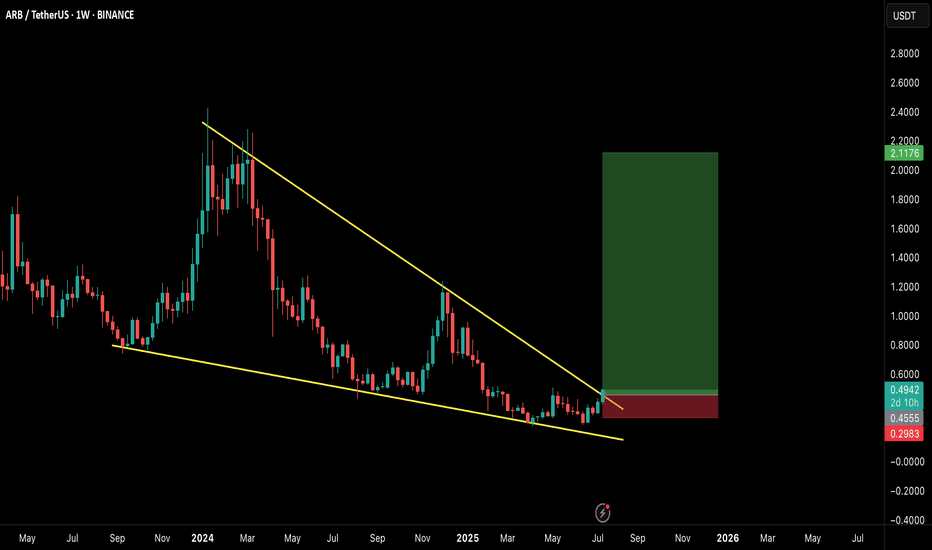

Big Move soon for Arbitrum (ARB) !, EASY 100%On the weekly chart, ARB is facing a clear long-term downtrend line. Currently, price is approaching a very important weekly resistance zone around $0.5, which has been tested multiple times.

✅ A confirmed breakout and retest above $0.5 could open the way for higher targets like 1.2$ and more ...

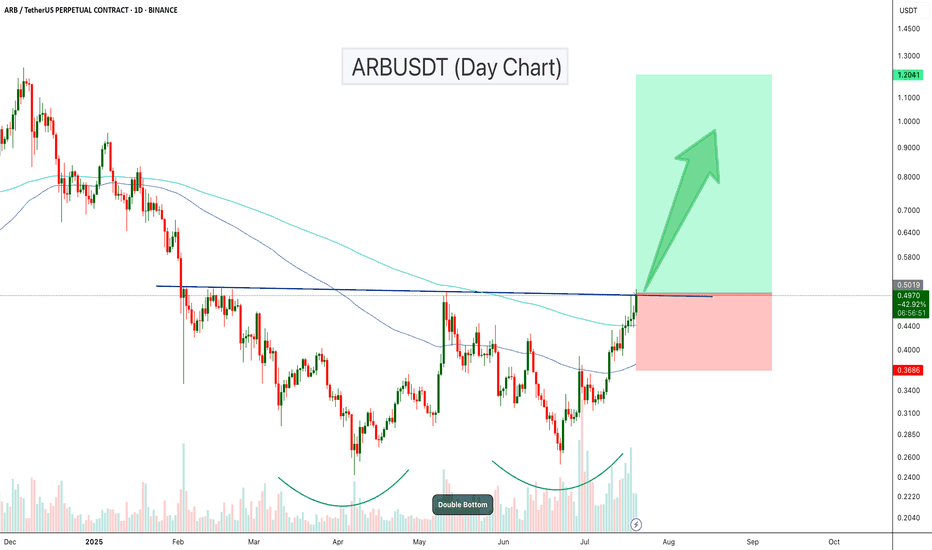

ARBUSDT 1D#ARB has formed a Double Bottom Pattern on the daily chart. This is a bullish pattern, and the price is currently moving above the daily SMA200. However, based on the RSI and other indicators, a pullback toward the support level at $0.4007 is possible. In any case, in the event of a breakout above t

ARBUSDT Breaks Out of Double Bottom!ARB has formed a clear double bottom pattern on the daily chart, signaling a strong reversal structure. After multiple rejections, the price has now broken above the neckline resistance, confirming bullish momentum.

The breakout is also supported by increasing volume and a bullish crossover of the

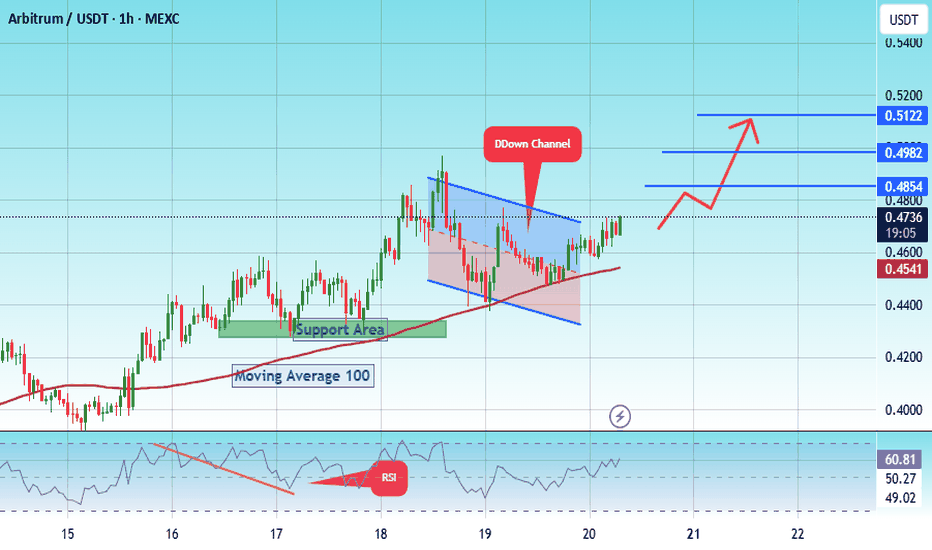

#ARB/USDT Arbitrum scalp long to $ 0.5122#ARB

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking strongly upwards and retesting it.

We have support from the lower boundary of the descending channel at 0.4270.

We have a downtrend on the RSI indicator that is about to be

#ARB/USDT#ARB

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking strongly upwards and retesting it.

We have support from the lower boundary of the descending channel, at 0.4550.

We have a downtrend on the RSI indicator that is about to be

ARB/USDT – Weekly Breakout Setup!Hey Traders!

If you’re finding value in this analysis, smash that 👍 and hit Follow for high-accuracy trade setups that actually deliver!

Massive Falling Wedge Breakout in Play!

ARB just confirmed a breakout from a long-term falling wedge pattern on the weekly timeframe, which has historically b

ARBUSDT Ready to Fly? Strong BreakoutARBUSDT has just completed one of its most critical technical phases in recent months — a clean breakout from a medium-term descending trendline that has been suppressing price since December 2024.

📌 Pattern and Price Structure Analysis:

🔹 Descending Trendline Breakout:

After months of downward p

ARBUSDT Double Bottom Signals Bullish Reversal!ARBUSDT is showing a bullish reversal setup on the weekly timeframe after trading within a descending channel for over a year. A clear double bottom has formed near the channel’s lower support, and the price is now breaking above key resistance around $0.50. If this breakout holds, a move toward the

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of ARB / USDT Spot Trading Pair (ARB) is 0.4476 USDT — it has risen 0.67% in the past 24 hours. Try placing this info into the context by checking out what coins are also gaining and losing at the moment and seeing ARB price chart.

ARB / USDT Spot Trading Pair price has fallen by −3.62% over the last week, its month performance shows a 37.54% increase, and as for the last year, ARB / USDT Spot Trading Pair has decreased by −35.93%. See more dynamics on ARB price chart.

Keep track of coins' changes with our Crypto Coins Heatmap.

Keep track of coins' changes with our Crypto Coins Heatmap.

ARB / USDT Spot Trading Pair (ARB) reached its highest price on Mar 23, 2023 — it amounted to 11.4902 USDT. Find more insights on the ARB price chart.

See the list of crypto gainers and choose what best fits your strategy.

See the list of crypto gainers and choose what best fits your strategy.

ARB / USDT Spot Trading Pair (ARB) reached the lowest price of 0.2429 USDT on Apr 7, 2025. View more ARB / USDT Spot Trading Pair dynamics on the price chart.

See the list of crypto losers to find unexpected opportunities.

See the list of crypto losers to find unexpected opportunities.

The safest choice when buying ARB is to go to a well-known crypto exchange. Some of the popular names are Binance, Coinbase, Kraken. But you'll have to find a reliable broker and create an account first. You can trade ARB right from TradingView charts — just choose a broker and connect to your account.

Crypto markets are famous for their volatility, so one should study all the available stats before adding crypto assets to their portfolio. Very often it's technical analysis that comes in handy. We prepared technical ratings for ARB / USDT Spot Trading Pair (ARB): today its technical analysis shows the buy signal, and according to the 1 week rating ARB shows the neutral signal. And you'd better dig deeper and study 1 month rating too — it's sell. Find inspiration in ARB / USDT Spot Trading Pair trading ideas and keep track of what's moving crypto markets with our crypto news feed.

ARB / USDT Spot Trading Pair (ARB) is just as reliable as any other crypto asset — this corner of the world market is highly volatile. Today, for instance, ARB / USDT Spot Trading Pair is estimated as 2.89% volatile. The only thing it means is that you must prepare and examine all available information before making a decision. And if you're not sure about ARB / USDT Spot Trading Pair, you can find more inspiration in our curated watchlists.

You can discuss ARB / USDT Spot Trading Pair (ARB) with other users in our public chats, Minds or in the comments to Ideas.