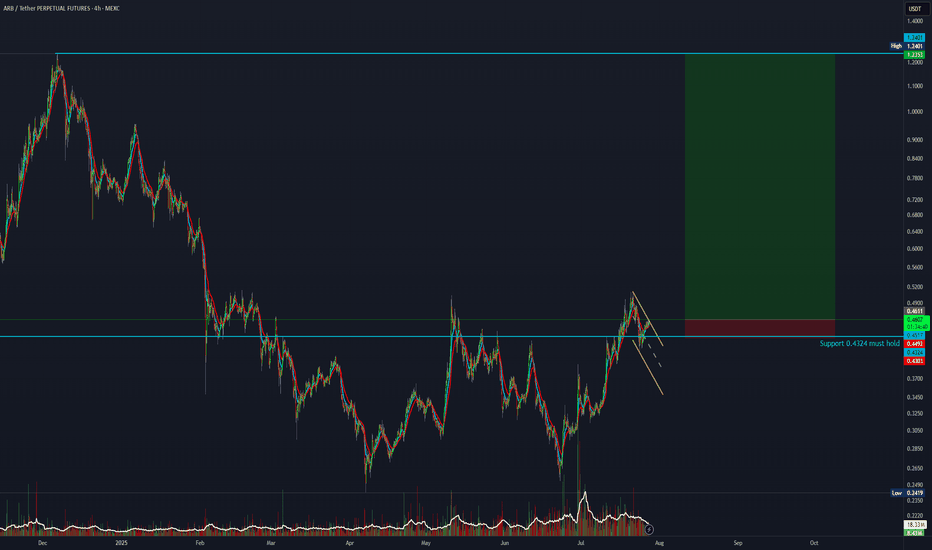

ARB – Critical Support ZonePrice is retesting a major support at $0.363. This level has acted as a strong pivot multiple times in the past, providing both support and resistance. Bulls need to hold this zone to avoid a deeper retrace. Below it, next support is down at $0.264.

Plan:

• Hold above $0.363 – could see a local bounce and retest of $0.44–0.50 resistance

• Lose $0.363 – opens the way for a larger flush down toward $0.26

• No setup for longs if we close below support — would flip bias to short on breakdown

ARBUSDT trade ideas

Altseason is Loading... Which One’s Your 10x Pick – $POL or $ARB🚨 BULL MARKET ACCUMULATION ALERT 🚨

Both PSX:POL and AMEX:ARB are currently trading below $0.40, and both charts are showing strong long-term bullish structure.

PSX:POL Analysis:

• Current Price: Under $0.40

• Strong Entry Zone: $0.20 – $0.17

• Bull Run Targets: $2 – $5

• Backed by powerful fundamentals, strong tech, and serious investors.

AMEX:ARB Analysis:

• Current Price: ~$0.40

• Key Accumulation Zone: $0.40 – $0.30

• Bull Run Targets: $2 – $5

• One of the strongest L2 ecosystems with deep liquidity and solid fundamentals.

Both are technically oversold, fundamentally strong, and positioned for major upside in the coming altseason.

Question for the community:

Which one hits $2 first — PSX:POL or AMEX:ARB ?

Drop your pick below 👇

NFA & DYOR

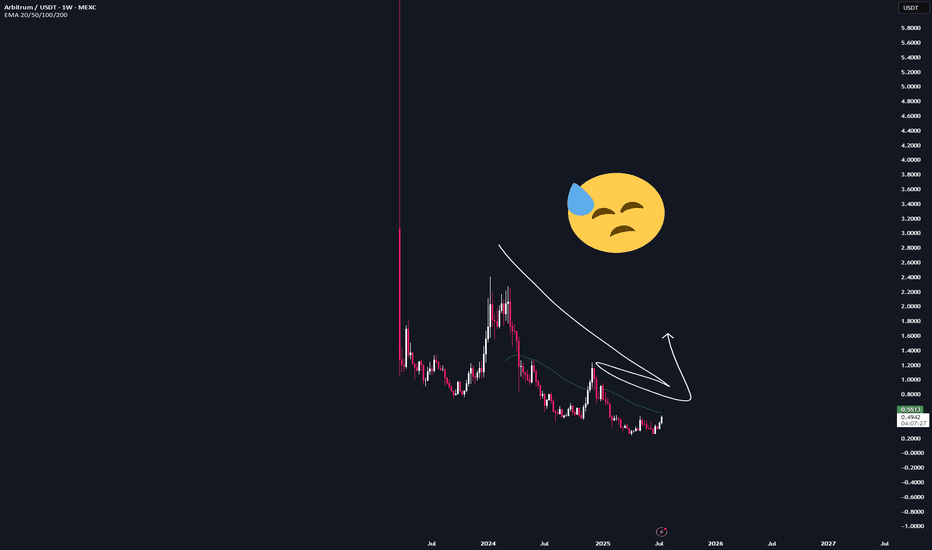

Arbitrum ARB price analysis — Can It Reclaim $1 ?Airdrop history 🪂 left a trail of regret — #ARB was widely distributed near $1, but most holders are still underwater 2 years later 💀

🔹 For recovery to start: break $0.50

🔻 Avoid the death zone: $0.30 must hold

🔄 If momentum returns and GameFi/DeFi reawakens — #ARB could lead.

🎯 If OKX:ARBUSDT price touches $1 again — don’t let greed win this time 😉

________________

📚 Follow us ❤️ for daily crypto insights & updates!

🚀 Don’t miss out on important market moves

Relief Rally or Further Drop? Key Levels to Watch on ARBUSDTARBUSDT continues its descent after invalidating the macro rising wedge, with price action firmly suppressed below key supply zones. Current wave structure hints at a potential relief rally toward 0.3886 before resuming the broader bearish trajectory toward the projected drop target at 0.1718. Until the macro descending trendline at 0.6259 is decisively broken, bearish sentiment remains dominant.

Today’s Crypto Market – From Ethereum Strength to ALTS Setup📅🔥 Today’s Crypto Market – From Ethereum Strength to ALTS Setup 🚀💡

In today’s market update video, we broke down what could be the critical handoff from Ethereum’s dominance to a broader ALT season.

The sequence is clear:

1️⃣ Bitcoin led the way.

2️⃣ Ethereum took control, smashing through $4,100.

3️⃣ Altcoins now have the setup to run, with BTC dominance breaking lower.

🎯 Key Levels from Today’s Charts:

Ethereum (ETH/USD) – $4,222 with breakout above $4,100.3; upside targets $4,420 – $4,800; supports at $4,005.9 and $3,789.6.

Bitcoin (BTC/USD) – Breaking out from wedge at $117,500; supports $115,803 & $115,054; upside potential to $120K+ and $122,795.8.

ARB/USDT – Rebound from $0.3784 aiming for $0.5380; key support $0.3500 and $0.2722.

Cardano (ADA/USDT) – At $0.8131; resistance $1.1930, then $1.4757; support $0.6799, $0.4112.

BTC Dominance – Breakdown under 60.80%, supports 58.34% & 56.91% — historically a strong trigger for ALT rallies.

📽️ Full breakdown and reasoning are in today’s video — we looked at why BTC dominance losing support is the green light for possible sector rotation, and which alts are primed.

One Love,

The FXPROFESSOR 💙

Arbitrum Structural Bull Unfolding Amid Ethereum ETF Surge 🚀📊 Arbitrum Structural Bull Unfolding Amid Ethereum ETF Surge 🌐🔥

🏦 Institutional Tidal Wave – Ethereum ETF Inflows Surge

Spot Ethereum ETFs have minted over $7.7 billion in net inflows, with more than $533 million coming in on a single day—a new record level of institutional capital deployment

Analysts estimate $50–100B more capital is set to flow into ETH over the next 12–18 months, fueling long-duration structural demand beyond speculators

ETF inflows are now collectively absorbing more ETH than new issuance, tightening supply dynamics and driving pricing power

🌉 Why ARB Is Positioned to Capitalize

Arbitrum TVL exceeds $2.5B, with network activity up more than 90% since spring. ⚙️ ARB’s price surged ~91% from April lows, though $0.50 remains critical resistance

Stablecoin supply on Arbitrum hit an all-time high in July , highlighting real use-case growth and on-chain USD demand

Robinhood launched tokenized U.S. stock trading on Arbitrum— a major milestone showing enterprise-level trust and integration

📈 Network Fundamentals & Technical Drivers

The In-kind ETF ruling link s real ETH custody to TradFi flows —Arbitrum sits directly in that fast lane as a scaling infrastructure ﹘ this isn’t theory, it's architectural necessity.

Recent academic research shows that optimistic MEV (arbitrage probing) constitutes over 50% of L2 gas consumption on Base/OP, though only ~7% on Arbitrum —suggesting steadier, lower-waste gas dynamics and room for growth in blockspace usage

🔧 Chart Structure – ARBUSDT (8H & 30m)

Horizontal support around $0.3950 held, while resistance at $0.5196 defines the upper micro‑range. Holding above support suggests buyers are stepping in.

Macro channel structure points toward $1.33 (mid-channel) and $2.66 (upper channel) as multi-month targets—now in play if resistance breaks

30-minute consolidation turned into a textbook breakout— volume picked up above $0.3950, reinforcing the resumption of bullish momentum.

🧠 Risk & Narrative Considerations

Vote-buying incidents in the Arbitrum DAO raised questions about governance integrity—though these were isolated and transparently addressed

A $140K exploit via signature bypass in March highlights the need for continued security evolution—though the protocol responded promptly

On-chain data shows user churn remains an obstacle—some studies find 80% of users quit blockchains within 90 days. Retention is the next frontier for L2 credibility

✅ Trade Setup Recap

📌 Entry zone: Hold above $0.3950, target initial breakout to $0.5196; next extensions toward $1.33 / $2.66.

📌 Catalysts: ETF capital flow, TradFi infrastructure demand, tokenized stock settlement, stablecoin adoption, and developer activity.

📌 Metrics watching: Futures open interest, DAO participation, new dApp deployment, stablecoin inflows.

🧵 Narrative Summary:

Arbitrum is sitting at the intersection of scaling demand, institutional capital landing in Ethereum, and real-world utility use cases. The current structure—which includes firm technical support, active protocol adoption, and ETF-induced capital flows—sets it apart from altcoin speculation cycles.

If ARB can close convincingly above $0.52, expect the macro expansion phase to begin.

Stay sharp. Structure > Noise.

One 💙 Love,

The FX PROFESSOR

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

ARB Setup – Watching Key Support for Long EntryArbitrum (ARB) has pulled back into a critical support zone after recent declines. This level is showing strong buyer interest, and we’re eyeing a potential spot long entry as price consolidates near the lows.

📌 Trade Setup:

• Entry Zone: $0.386 – $0.38

• Take Profit Targets:

o 🥇 $0.50 – $0.60

o 🥈 $0.95 – $1.20

• Stop Loss: Just below $0.33

ARB/USDT 1H – Clean Breakout, OB Retest & Push to POI CHoCH confirmed bullish intent, and price now breaking above Day High. Eyeing retest around Bullish Bias before a push to the upper OB and POI.

🔹 Clean EQL formation before breakout

🔹 OB + POI above offer next liquidity targets

📌 Watching for reaction on pullback near 0.3885

Smart entry comes from smart patience — let the market come to you.

#ARB/USDT#ARB

The price is moving within an ascending channel on the 1-hour frame, adhering well to it, and is on track to break it strongly upwards and retest it.

We have support from the lower boundary of the ascending channel, at 0.3735.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area (in green) at 0.3688, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.3832.

First target: 0.3913.

Second target: 0.4025.

Third target: 0.4145.

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

ARB Breakout Watch – Red Resistance Being Tested!🚨 AMEX:ARB Breakout Watch – Red Resistance Being Tested! 🔴⏳

AMEX:ARB is testing the red resistance zone.

📊 If breakout confirms, next move could target:

🎯 First Target → Green line level

A breakout could trigger bullish continuation and upside momentum.

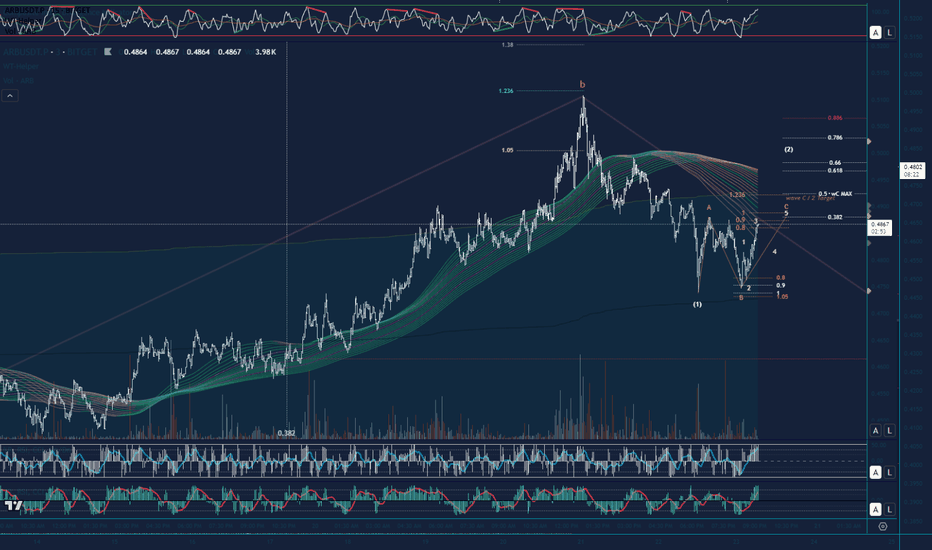

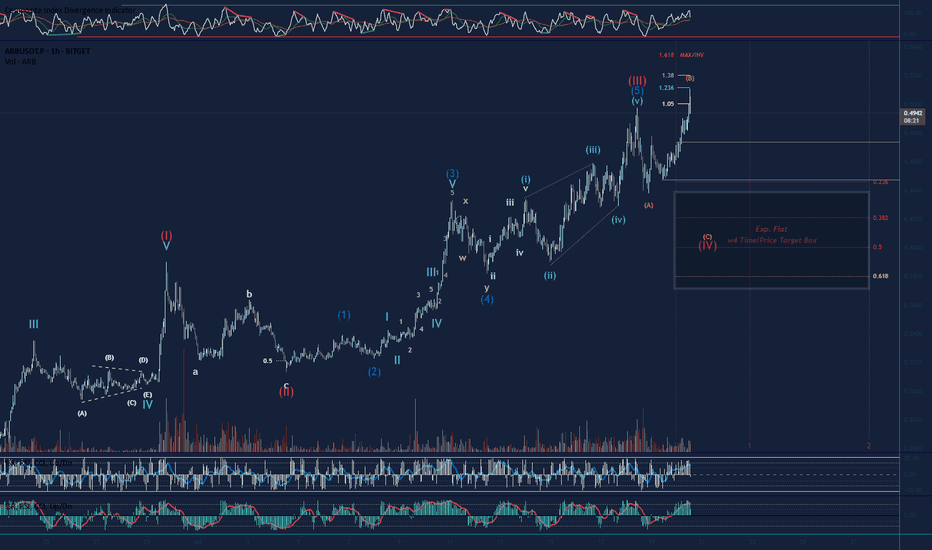

Arbitrum Bullish Elliott Wave Scenario! It seems the wave 4 Expanding Flat correction idea (previous post) played out well with our fib time and price targets! Always a good thing to have the right look in your wave count, fib time and price projections paired with the Elliott Wave rules and guidelines... its a whole other feel to my trading psychology and it gives me more confidence in the end. Breaking to the upside in the first of a few nested wave 3s, so i expect a bullish run up. (Keep in mind we finished red wave 4 just past the 1:1 fib time), if we are in a complex wave 4 still, it could easily extend to the 4 fib time without affecting probabilities. Starting to love this haha. Happy Trading 🌊🧙♂️

Arbitrum (ARB): Bullish Trend | Good Risk:Reward Setup!Arbitrum is hovering near a bullish trend where, despite being close to a bearish CME gap, we are looking for a proper bounce from here.

We are waiting for more bullish signs here and once we see them, we are going to aim to see the EMAs broken, after which we will be going long up until the local high, which is also a major resistance zone on bigger timeframes currently.

Swallow Academy

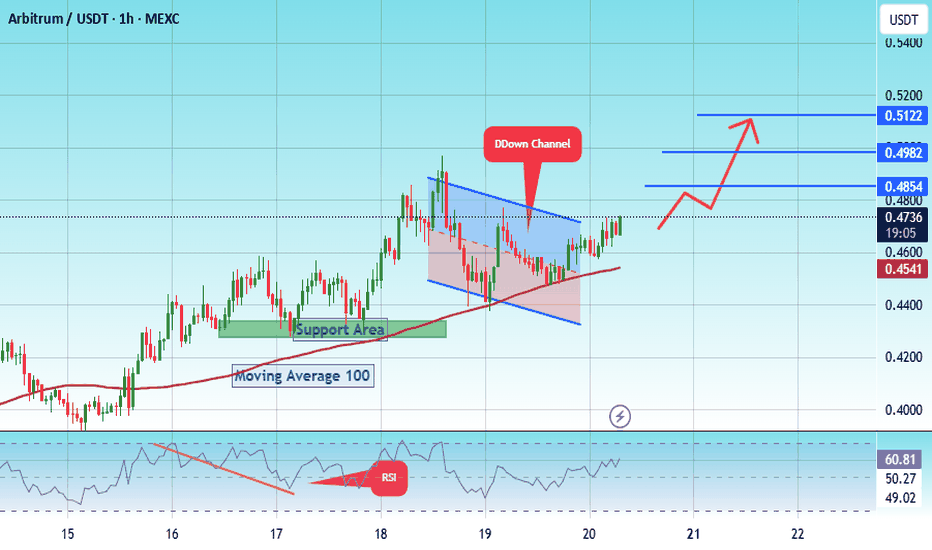

#ARB/USDT#ARB

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking strongly upwards and retesting it.

We have support from the lower boundary of the descending channel, at 0.4550.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 0.4520, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.4616

First target: 0.4751

Second target: 0.4923

Third target: 0.5135

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#ARB/USDT Arbitrum scalp long to $ 0.5122#ARB

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking strongly upwards and retesting it.

We have support from the lower boundary of the descending channel at 0.4270.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 0.4300, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.4720

First target: 0.5554

Second target: 0.4982

Third target: 0.5122

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

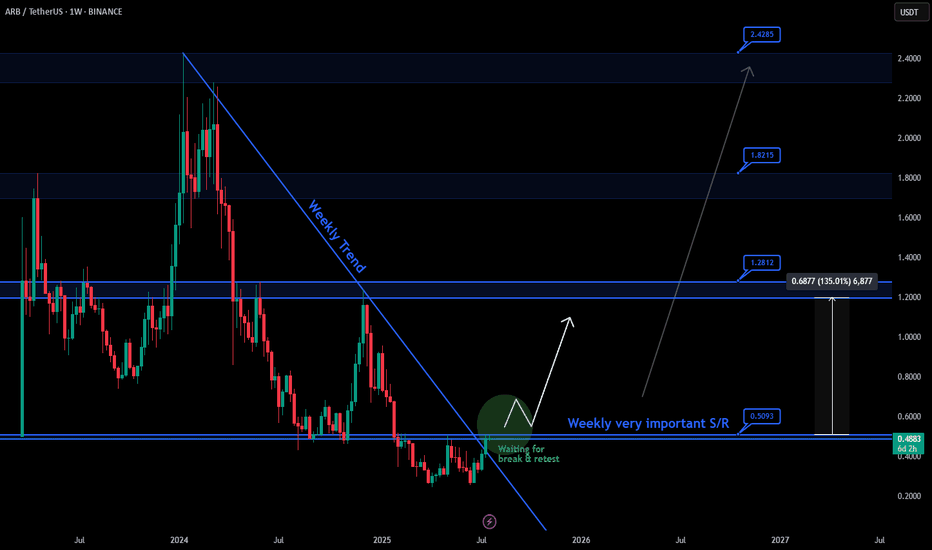

Big Move soon for Arbitrum (ARB) !, EASY 100%On the weekly chart, ARB is facing a clear long-term downtrend line. Currently, price is approaching a very important weekly resistance zone around $0.5, which has been tested multiple times.

✅ A confirmed breakout and retest above $0.5 could open the way for higher targets like 1.2$ and more ...

📌 Summary: Bullish scenario only valid after a clean breakout and successful retest

Update on Arbitrum Expanding FlatZooming in on the 3min TF the Target for completion of wave C of regular flat (White wave 2 retracement) will be 0.4888. Looking to reverse lower at this level to complete the white impulse down for wave C of larger degree Expanding Flat (See earlier post for HTF count)

ARB | Full-analysisHere is the top-down analysis for ARB as requested 🫡

Weekly Timeframe:

There are currently no valid bullish structures on the weekly chart, as AMEX:ARB has put in lower lows.

So we have no clear targets from a weekly perspective at this point.

Daily Chart:

A new bullish sequence was just activated with the break of the recent high at $0.505, targeting the $0.67–0.77 region.

This strongly suggests that the cycle low for AMEX:ARB is likely in.

Every pullback into the B–C correction zone (Fib 0.5–0.667) is a potential long opportunity, and I plan to take it if we revisit that area.

I will place 4 long orders, each with a stop-loss just below the next level.

There is currently nothing interesting happening on the lower timeframes.

--------

Thats the my full Analysis for AMEX:ARB , hope it was helpful if yall have anymore questions feel free to ask, and if you want me to do another analysis for any other pair just comment down below.

Thanks for reading❤️

Looking to complete a wave 4 Retracement on Arbitrum Short term outlook is bearish as we are looking to complete an expanding flat to the downside. Wave B neared it invalidation, but reversed down. Lets see if the bears can push it down to the 0.5 Fib Target, soft target is the 0.382 Fib. If volume increases this could be a third up, but we need the wave 4 at the moment, and wave B of the expanding flat is a clear 3 waver so far. Long term we are still bullish with plenty of nested wave 3s to keep us counting to the upside in the future haha. Not Financial Advice

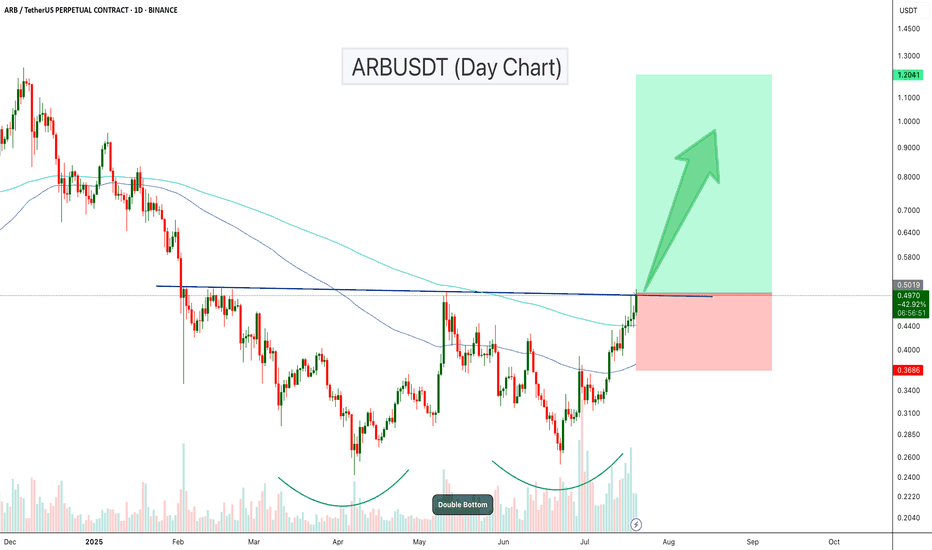

ARBUSDT Breaks Out of Double Bottom!ARB has formed a clear double bottom pattern on the daily chart, signaling a strong reversal structure. After multiple rejections, the price has now broken above the neckline resistance, confirming bullish momentum.

The breakout is also supported by increasing volume and a bullish crossover of the 100 and 200 EMA zones. If the current momentum holds, ARB could reach the target of $0.75- $1.20 level.