ARB in weekly chart Hello everyone

I am not sure if this is a correct chart of Arbitrum or there is older ones but it does not matter for what I want to say.

The first upward trend is surely the end of a rally and what has happened then was clearly a correction so we set a good strategy for that and if it does not work we leave this chart unless you want to see ARB as an investment opportunity and hold it that is another strategy.

Our strategy is that:

We wait till this trend reverses and breaks out the red resistance zone and then make a pullback and we get in a position after it rise up and put our SL in the end of pullback.

ARBUSDT trade ideas

ARB/USDT.P Long IdeaLong Idea for ArbitrumDescription:Arbitrum is showing strong potential for growth as Layer 2 solutions gain traction in the Ethereum ecosystem. Recent developments and increasing adoption of Arbitrum's scaling solutions suggest a positive outlook.Key points of my analysis:Technical Analysis:Breaking Resistance Levels: Arbitrum has broken through key resistance levels, indicating a bullish trend.Bullish Patterns: Formation of bullish patterns like the "Ascending Triangle" suggest further upward movement.Momentum Indicators: RSI and MACD show positive momentum, supporting a continued rise.Fundamental Analysis:Adoption and Usage: Increasing usage of Arbitrum for DeFi projects and transactions is driving demand and price appreciation.This idea is based on current market analysis and may need adjustments as market conditions evolve. Monitor closely and manage risks accordingly.

LONG #ARBUSDT target 1.6$LONG #ARBUSDT from $1.19 stop loss $0.9

1h TF. The asset moves in a parallel channel after the spill. There are horizontal resistance levels. Now we have pushed off from the support level of 0.9$-1$ and are moving in an uptrend. There is also a support level of ~ $1.14, from which you can expect a rebound when the asset price falls. Open long, the first goal is ~1.3$, the final one is ~1.6$

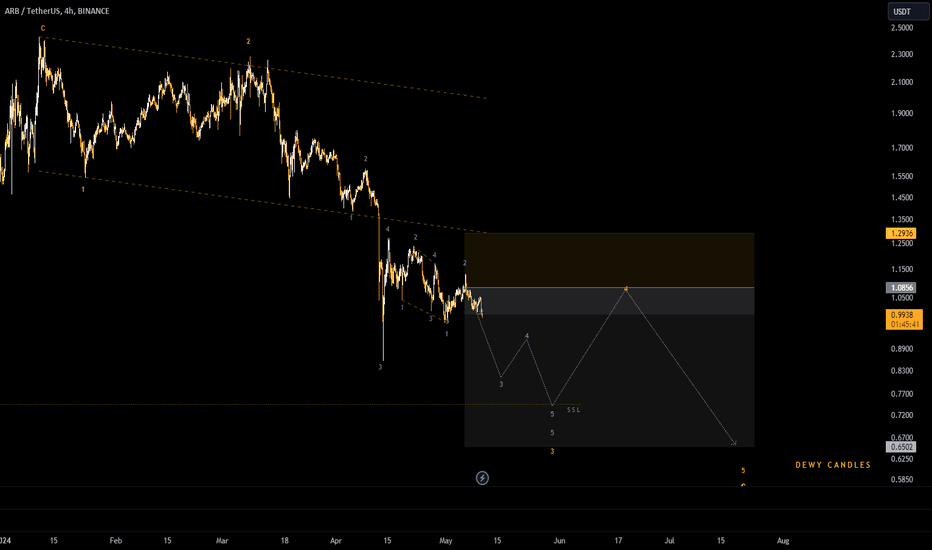

ARBUSDT Elliott Waves Analysis (Local Setup)Hello friends.

Please support my work by clicking the LIKE button👍(If you liked). Also i will appreciate for ur activity.

Everything on the chart.

Entry: Market and lower

Targets: 1.3 - 1.45 - 1.6

after first target reached move ur stop to breakeven

Stop: 0.95 (depending of ur risk).

ALWAYS follow ur RM

risk is justified

Good luck everyone!

It's not financial advice.

DYOR!

#ARB "Rally Mode: Your Chance to Buy and Prosper!"**Technical Analysis Chart Description:**

Welcome to my Technical Analysis charts on TradingView! Before we dive into the analysis, it's essential to understand some important warnings:

1. **Subjectivity Alert:** Technical analysis involves interpreting market data and chart patterns, which can be subjective. Different analysts may interpret the same data differently, leading to varied conclusions.

2. **Historical Performance Doesn't Guarantee Future Results:** Past price movements do not guarantee future price movements. While historical data can provide insights, it's crucial to consider other factors that could influence price action.

3. **Risk of False Signals:** Technical indicators and chart patterns can produce false signals, leading to potential losses if relied upon blindly. Always cross-verify signals with other indicators or fundamental analysis.

4. **Market Volatility:** Crypto markets are highly volatile and can experience rapid price fluctuations. Be prepared for sudden and unexpected price movements, which may invalidate previously identified patterns.

5. **Risk Management:** Proper risk management is essential. Never invest more than you can afford to lose, and consider using stop-loss orders to mitigate potential losses.

6. **Emotional Bias:** Avoid emotional decision-making based on short-term price movements. Stick to your trading plan and strategy, and don't let fear or greed influence your decisions.

**Disclaimer for Crypto Trading:**

Trading cryptocurrencies carries inherent risks, and it's important to understand the following:

Cryptocurrency markets are highly speculative and can be subject to extreme volatility. Prices can fluctuate significantly within short periods, leading to substantial gains or losses.

Investing in cryptocurrencies involves the risk of total loss of capital. Unlike traditional assets, cryptocurrencies are not backed by any tangible assets or central authority, making them inherently risky.

Regulatory uncertainty and market manipulation are additional risks associated with cryptocurrency trading. Regulatory changes or negative news can have a significant impact on prices.

This analysis is for informational purposes only and should not be construed as financial advice. It's crucial to conduct thorough research and consult with a qualified financial advisor before making any investment decisions in the cryptocurrency markets.

By using this analysis, you acknowledge and accept the risks associated with cryptocurrency trading and agree to trade at your own discretion. The author of this analysis shall not be held responsible for any losses incurred as a result of using the information provided.

"ARB" RBI came out!!!Hello! friends, How have you been?

I brought a VERY attractive chart for you today.

It's the ARBUSDT chart that can reverse the long bearish. If you take a position, It can better attractive position as the RR.

■It is being adjusted after breaking the big downtrend line.

■ Adjustment value is 0.786 (very stable)

■it is being Retested of bullish.

■The horizontal resistance line just above the overlaps with zone as a very having heavy buttocks zone.

ARBUSDT.1DUpon examining the ARB/USDT daily chart, several key technical indicators and levels emerge that help forecast potential price movements.

Trend and Resistance Analysis:

The price has experienced a significant decline from its high of around 2.4250 USD. Currently, it is trading at approximately 0.9749 USD. The price has been following a downward sloping trend line, labeled as R1, indicating persistent bearish sentiment. There are two major resistance levels to watch: R1 at around 1.3914 USD and R2 at approximately 1.3914 USD. The first resistance level (R1) has been tested multiple times but has held firm, preventing any upward breakout.

Support Levels:

There are clear support zones identified on the chart. The primary support level, labeled S1, is around 0.5000 USD. This level has been tested before and has shown considerable buying interest, suggesting it could act as a strong floor for future price declines.

RSI and MACD Indicators:

The Relative Strength Index (RSI) is currently at 36.59, indicating that the asset is nearing oversold territory. Historically, this suggests that a reversal could be imminent, as the selling pressure may soon exhaust itself. The Moving Average Convergence Divergence (MACD) indicator shows a bearish trend with the MACD line (blue) below the signal line (orange)

, though the histogram indicates a potential weakening of the bearish momentum.

Volume Analysis:

There is a noticeable volume pattern where the price dips are accompanied by significant trading volume, which typically suggests strong market reactions to the price movements.

Conclusion:

In conclusion, the ARB/USDT pair is currently in a bearish trend but is approaching key support levels that might offer a reversal opportunity. The RSI indicates a potential oversold condition, which, coupled with weakening bearish momentum in the MACD, suggests that the price may stabilize or attempt a minor rally towards the first resistance level (R1). Traders should watch for a break above the R1 trend line to confirm any bullish reversal. Conversely, a failure to hold the S1 support could lead to further declines.

Overall, the market sentiment remains cautious, and close attention to the aforementioned levels and indicators is crucial for making informed trading decisions.

Arbitrum ($ARB) Set for a Bullish Breakout soonThe Arbitrum DAO has approved an eight-week pilot M&A program following overwhelming support for the proposal. On-chain metrics suggest that Arbitrum ( AMEX:ARB ) may experience a rally soon, despite a recent 7.5% increase in its value.

The pilot program received over 99% support from DAO members and aims to conduct data-driven research and discussions to inform the Arbitrum DAO's decision on the operationalization and funding requirements of the M&A unit. The goal is to utilize M&A as a growth driver for the Arbitrum ecosystem, expanding non-organically through acquisition opportunities to enhance capital allocation methods.

Additionally, on-chain metrics indicate potential for a rally in AMEX:ARB 's value. Despite the recent gain, a significant percentage of ARB addresses are still out-of-the-money, suggesting that investors may be holding onto their assets in anticipation of tangible price appreciation. Furthermore, with 55% of ARB's circulating supply held in out-of-the-money addresses, caution is advised for investors looking to open a position in the Ethereum Layer 2 altcoin, especially considering the large holdings by whales.

Although recent activity has shown equal participation from bulls and bears, recent price movement suggests signs of a potential rally. The market value to realize value (MVRV) ratio has also confirmed these rally signs with a 6.54% growth in the past 24 hours. It is important to note that a bearish change in the general crypto market sentiment could invalidate this thesis.

CHANNEL BREAK OUT A channel breakout is a trading concept in technical analysis where a security's price breaks out above or below a established trading channel, indicating a potential new trend or direction.

A trading channel is formed by drawing two parallel lines, one representing support and the other resistance, which contain the price action over a specific period. The channel can be ascending, descending, or neutral, depending on the trend.

A channel breakout occurs when the price:

1. Breaks above the upper resistance line (bullish breakout)

2. Breaks below the lower support line (bearish breakout)

This breakout signals a potential change in the trend, as the price is now moving outside the established range. Traders and investors often consider channel breakouts as a trading opportunity, as they can indicate:

1. A new trend is emerging

2. A continuation of the existing trend

3. A reversal of the existing trend

On this Chart we will be focusing on the bullish side because it's a bullish break of candlestick but be on a market watch about the white doted line which is the support and resistance which I have identified. If you look closely you will notice a 200 Moving Average . Be careful at the point.

By recognizing channel breakouts, traders and investors can potentially capitalize on new trends and market movements.

ARBUSDT.1DThe daily chart for ARB/USDT provides a clear view of its current technical setup, which can help us understand the potential future movements.

Key Resistance and Support Levels:

Resistance 1 (R1): Not specified, but closer analysis suggests it's near where recent peaks have been formed.

Resistance 2 (R2): $1.3914 - This level is above the current trading range, marking a significant target for bullish momentum.

Support 1 (S1): $0.7712 - Acts as the primary support level where the price could potentially find buying interest if it dips to this range.

Technical Indicators:

Relative Strength Index (RSI): Currently at 35.11, which is below the neutral 50 mark, indicating bearish momentum. The RSI is nearing the oversold territory, suggesting potential for a reversal if it goes below 30.

Moving Average Convergence Divergence (MACD): The MACD line is below the signal line, indicating bearish momentum. However, the histogram is near zero, suggesting that the downward momentum is not particularly strong.

Trend Analysis:

The price has been in a downward trend, indicated by lower highs and lower lows. The current setup shows the price near a descending trend line or resistance level, which could act as a key area for reversal if broken above.

Conclusion:

Given the current technical analysis of ARB/USDT, the market seems to be in a bearish phase with a potential for reversal highlighted by the near oversold RSI condition. Traders might consider looking for buy opportunities near $0.7712, which could act as a robust support level, especially if the RSI moves into the oversold territory and starts to curve upwards.

For those looking at potential sells or waiting for a confirmation of trend continuation, a decisive break below $0.7712 could open the path towards lower prices, potentially towards newer lows not defined on the current chart.

Investors should remain cautious and watch for any changes in the MACD and RSI for early signals of a trend reversal or continuation. Setting stop-loss orders just below the support levels and taking profit near resistance levels can help manage risks effectively in this volatile setup.

#ARBUSDT.P #Analysis & #LongSetup #Eddy#ARBUSDT.P #Analysis & #LongSetup #Eddy

For example, in an altcoin"Arbitrum", I have provided you with proper analysis & long setup so that you are aware of the general movements of the market and other altcoins & don't rush to buy, the structure is not complete.

((This analysis was based on the liquidity structure and its combination with other styles, including : PA,RTM,ICT,VT,Lvl2+3,DOW,Wyckoff,...))

>> The possibility of growth and explosion of altcoins is very high & they can see much higher targets.

Be sure to visit Bitcoin analysis update :

ARB Sell Off Over?I am not super big into side chain layer 2's as a permentant soloution to the transaction cost issue with crypto. At the same time they are the current leading way this problem is solved and intrest in their tokens is certainly not lacking.

ARB is a little bit different for layer 2's as they set them self apart from competitors by gaining massive awareness attention with a valuable word call "free". This massive air drop has likely sold off but not without catching the awarness and attention of masses.

Looking at the price action we can see the down trend has curled over or lost momentum into the value area low of the entire chart. Momentum has shifted sideways for long enough to nearly brake the linear down trend and looking at the volume we can see that it has nearly dried up. All these things signal the loss of energy in the "trend".

Unless a new reason presents to create another massive sell off higher prices are likely.

Current Trading Plan:

Assuming current low is the a true pivot low, target first the 50% retrace area. IF price can make to the this region a pull back and reaccumulation will likely take place above the high volume node at $1.15. With a final target in the 1.5 - 1.618 expansion region of $3-$4

Trade Well,

Your Friend

Degen