ASX trade ideas

Barley and Sun Tzu Art of WarRead latest news here

Sun Tzu Art of War :

You can be sure of succeeding in your attacks if you only attack places which are undefended. #

Typically, at least half of Australia's barely exports would be bound for China............

The tariffs, based on dumping and farm subsidy claims, would end Australia's $1.5 billion barley trade to China......

Barley is Australia's second most valuable agriculture export to China.......

In War, it is never clear and the art of staying ambiguous is what China , 5000 years of history has provided them with. It is a known fact that transparency is not THE word to use in China where media is controlled and anyone found posting negative comments about it are dealt with , sometimes in mysterious ways.

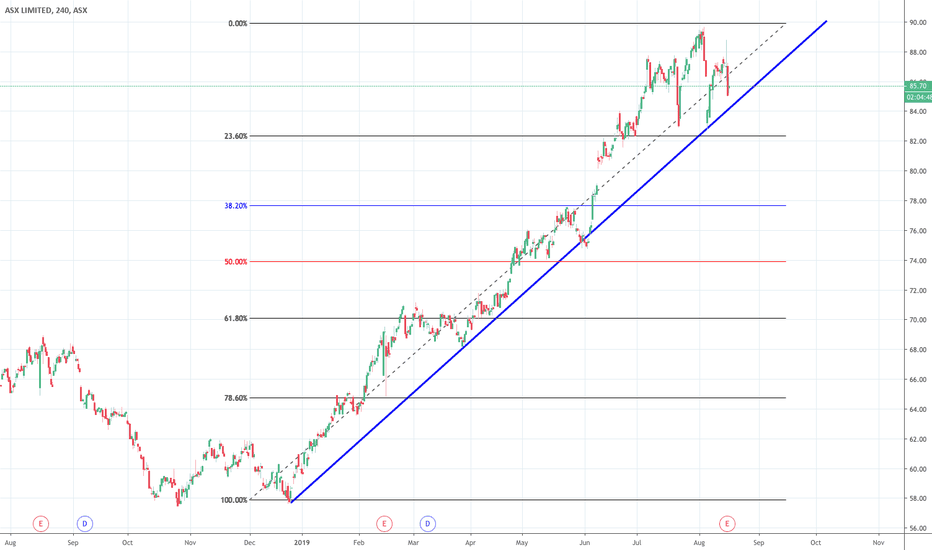

The chart tells us the constipated feeling the ASX index is feeling right now, unable to break above the resistance after so many attempts.

The price can stays within the rising channel for a while before it breaks down and this barley incident may or may not be the catalyst.

ASX 200 1st April BOOOM Look at this monthly wick it’s dying to bounce up 1st of April is the new wick all the stimulus etc,etc,

#ASX200

#BTC

buckle up this market has a bounce incoming

Manipulated global panic cause the largest and most devastating destruction around the world and this market gonna go boom somehow 🧐

I’m somewhat dissapointed and a little saddened by the fact this literally all seems to be China controlling the world on a global economy and potentially doing it for BTC HALVING 🧐 just a theory far fetched but hey this year has been messed up enough, ❤️

ASX200 HUGE MARKET REVERSAL INCOMINGHUGEEEE TRADING OPPORTUNITY

This is going to pop up for the stimulus package in Australia, I don’t particularly care about this but I am looking for an indicator for BTC and if BTC is still following traditional markets there is a huge bounce incoming

Weekly chart showing a very possible upwards direction

I’m guessing whenever Scott Morrison releases his beefed up stimulus this market will go straight back up to where it was

I think this is like the original BTC bubble from 2017 it’s just the start all the markets are going to make for amazing trading

2020

Not advice do not use this in anyway as investment idea

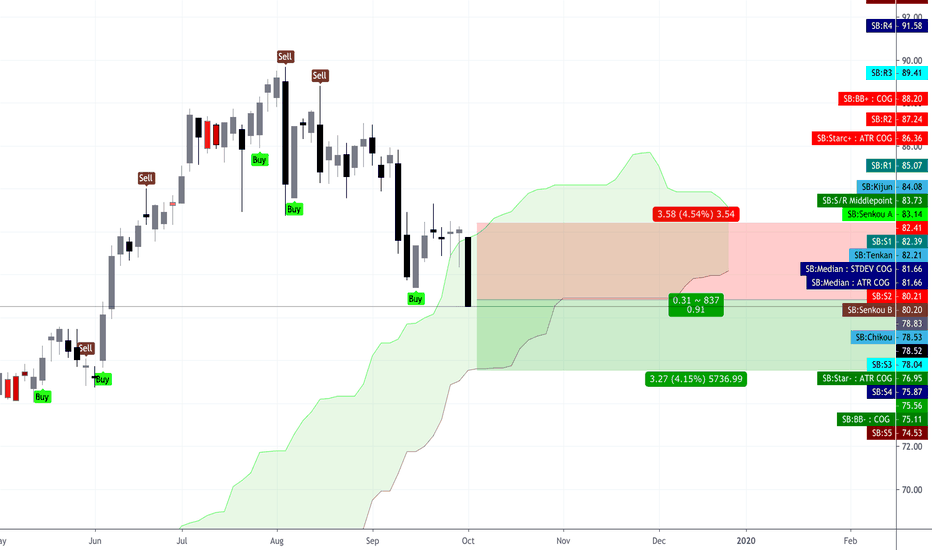

ASX needs helpThe market has slipped nearly 13% from its peak in Aug 19. Chart shows several times that the price action has displayed fake breakouts.Now, we see a pin bar outside the bearish trend line. It is likely to fall back into the bearish trend line next week and may even goes further south to the direction indicated.

Alternatively, it could gain some support at 79.15 level and rebound and continue to bring cheers to the buyers. We will be monitoring the price action first.

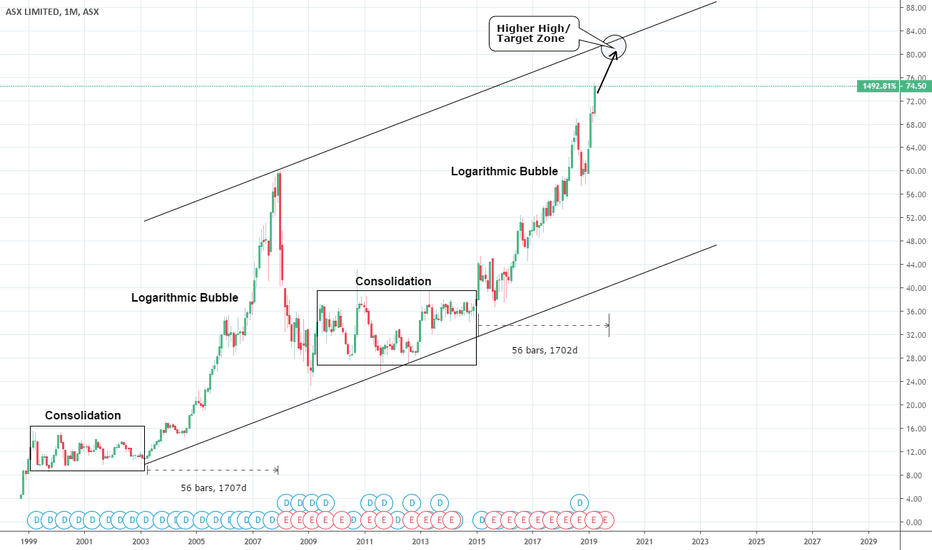

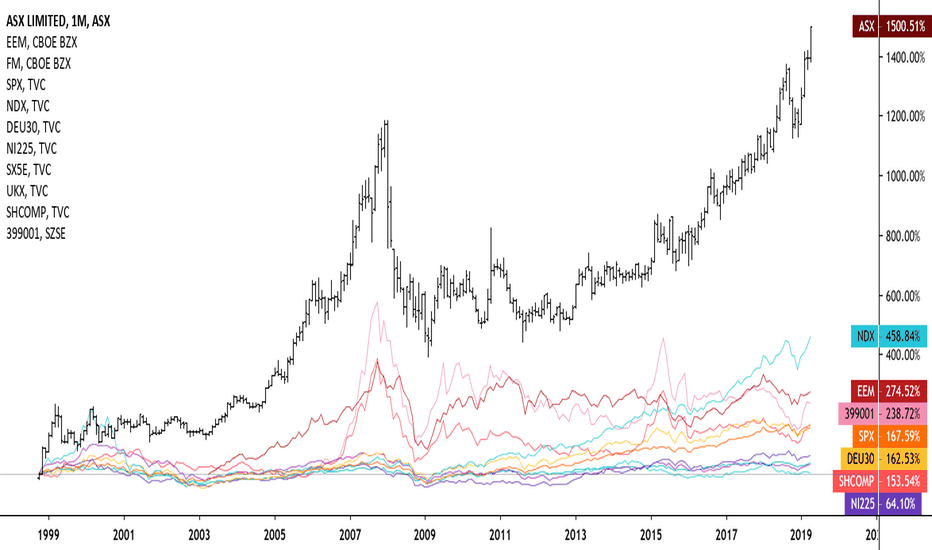

ASX: Australian stocks approaching a peak.The ASX Ltd is on a very strong bullish monthly streak having gained over +25% in 2019 alone. It appears to be trading inside a 20 year Channel Up that displays all phases of a Bubble (aggressive rise, blow-off, consolidation) from Higher Low to Higher.

Currently it is near the end of the bullish leg towards a new Higher High (peak) which is projected within 80.00 - 84.00 towards the end of 2019 (based on a 1702 day Bubble Duration). All charts are overbought (or close to) from 1D (RSI = 72.582) to 1W and 1M (RSI = 76.630 and 73.368 respectively) indicating that the peak of the bubble is indeed near and should be achieved on this final 2019 push.

Our strategy is to buy on every dip until this Target Zone. Then depending on circumstance and mostly global trade dynamics, we will most likely start building up a short base but updates will follow.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.