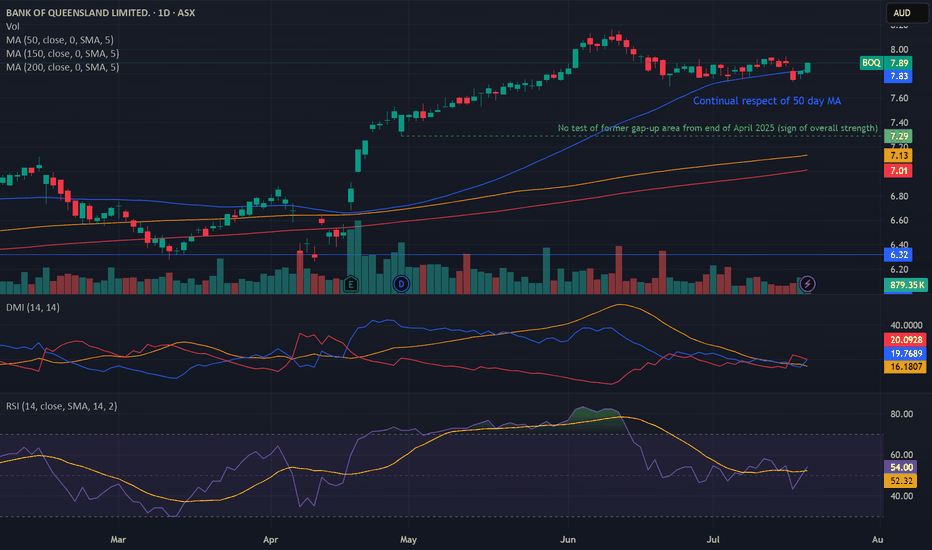

Bullish potential detected for BOQEntry conditions:

(i) higher share price for ASX:BOQ along with swing up of indicators such as DMI/RSI.

Depending on risk tolerance, the stop loss for the trade would be:

(i) a close below the 50 day moving average (currently $7.83), or

(ii) below previous swing low of $7.69 from the low of 23rd June, or

(iii) below previous support of $7.60 from the open of 12th May.

BOQ trade ideas

BULL Put spread on 23 Sept

Picked this up at recent low a few days ago - prbably not the best pick of bank stocks in hind sight ( see WBC)

but good enough follow through to make me less anxious of being exercised at expirey on 15 OCT.

sold 70 contracts ( 7000shares) Put OCT strike 5.75 ( European) for -0.115

buy 5.25 ( American) for + 0.035 net -0.08 premium paid +560

Bank of Queensland short-10 Year+ Symmetrical triangle (dubious without a launching pattern)

-Weekly 50/200 SMA pinch

-Weekly volume confirmation on primary pattern breakout

-7 Week symmetrical triangle launching pattern just outside the bounds of larger pattern

-Daily Bollinger band squeeze and expansion

30 basis points

Trend follow model for trade management

I saw this and acted without planning trade out thoroughly, breaking discipline rules. Alert went off and I went short just before I had to leave before an appointment, do not know why was not on my active watchlist.

Breakout is strong but not a daily close yet

Short at market @ 9.91 12:23 AEST

SL @ 10.20