Finer Market Points: ASX Top 10 Momentum Stocks: 11 Jul 2024ASX:I88 ASX:AL3 NYSE:WTM ASX:FBR ASX:ACW AMEX:TTT NYSE:ENR CBOE:RXM ASX:DRO NYSE:BIO

Momentum leading shares are the market's best performers today. They are the fastest-growing shares on the ASX over the last 90 days. These companies can't get to be leaders without first appearing on our Launch Pad list.

The Launch Pad List is published weekly on Fridays.

Today's ASX's Top 10 Quarterly Momentum Stocks are:

Infini Resources Ltd (I88)

Aml3D (AL3)

Waratah Minerals Ltd (WTM)

FBR Ltd (FBR)

Actinogen Medical (ACW)

Titomic Limited (TTT)

Encounter Resources (ENR)

Rex Minerals Limited (RXM)

Droneshield Limited (DRO)

Biome Australia Ltd (BIO)

FBR trade ideas

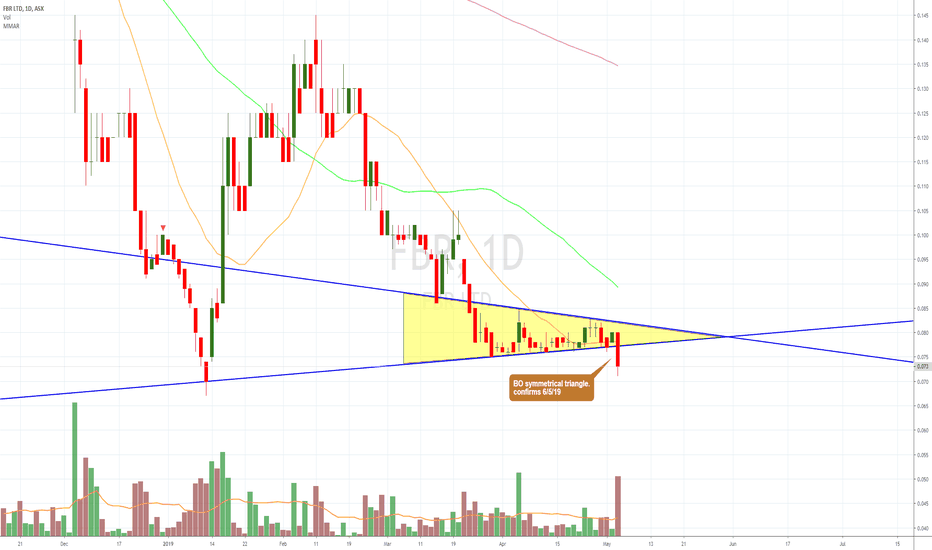

$FBR.AX is setting up nicely - Higher prices coming #ASX $FBR$FBR.AX is setting up nicely - Higher prices coming #ASX $FBR

FBR Ltd (FBR, formerly Fastbrick Robotics Ltd) designs, develops and builds stabilised robots to address global needs. These robots are designed to work outdoors using the FBR's Dynamic Stabilisation Technology. FBR is commercialising products for the construction sector together with DST- enabled solutions for other industries. The first application of DST is the Hadrian X, a construction robot capable of building the walls of a structure from a 3D CAD model

SHORT ON FBR (4hr)- Historically FBR trends have respected all Descending Triangle Formations

- The blue shaded area represents the Orange Descending triangle size, which projects the fall size

- There appears to be strong support at 2 cents, this could take a crack before pushing though

- There's a gap at around 1.8 cents which will be the magnet to be filled once 2 cents falls

- Not much upside fundamentally as Management are stalling with signs they're not ready to build

- Capital Raise around the corner, this could be the catalyst sends the price to or beyond previous lows

Its tough to say how the trends will act around the 2 cent level to begin with as there could be some resistance, once breached it should be a clear path to previous lows

Good chance the descending triangle will be tested after first break downward

AIMO

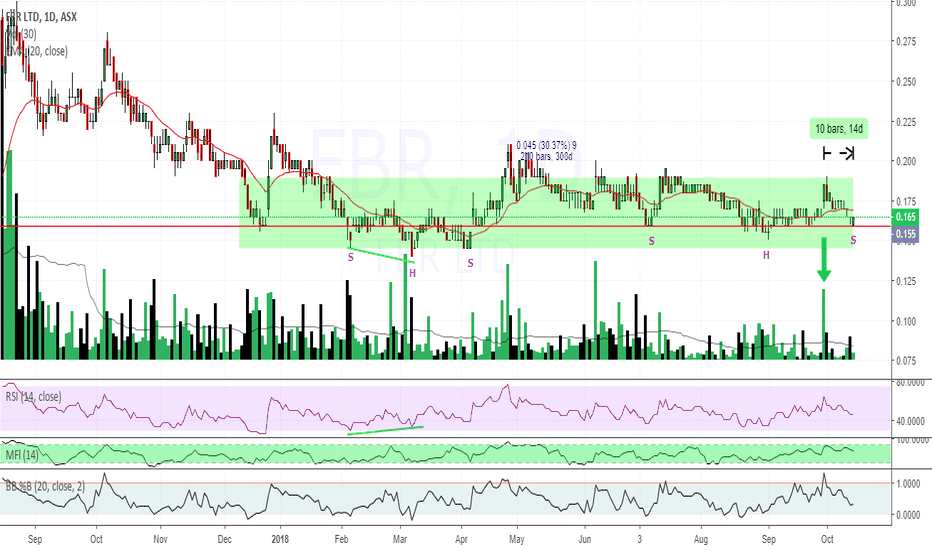

FBR overall Short Bias but Potential Bullish H&S formimgThis is my first chart ever so definitely not advice

Overall I have a short bias due on this stock at the moment with a continuation of the downtrend. On the contrary: It is historically cheap, so the H&S could be a contending reversal at this point...

Should be watched closely for confirmation to see which way it could play out

Fundamentals (Negative)

- No long term revenue

- Burning cash

- No progression for 6-9 months

- Lack of SH confidence

- CR required inside 6-9 months

- Government will likely drop the R&D rebate incentives due to Covid-19

Fundamentals (Positive)

- Heavily sold

- Recent reduction of cash burn

- currently sitting near IPO baseline

- Market Cap is very low

Technical Analysis: Short play

- Descending Tangle showing strong potential to break downward out for a small short position

- Could potentially re enter for a short position if it comes up to test the breakout of the descending triangle

Technical Analysis: Long play

- If the head and shoulders form and the trendline & neckline is broken, we could see a good sized run up to the previous high

Last chance for FBR?FBR stock prices have taken a huge hit following the news that construction giant Caterpillar Inc. and FBR were terminating the memorandum of understanding between the two companies. Prices are down 74% since all time highs last year and down by 65% in just the last two months. It is unsure exactly why the memorandum was cancelled, but both companies have stated the split up was mutual. This news came not long after FBR unveiled it's 3 day house build using the Hadrian X. The build was a success, but the dealings between the companies are unknown.

Looking at the chart, FBR is looking extremely weak and not yet showing any signs of recovery. Key support levels have been smashed through, and as I type this, price is tightening at the end of a very aggressive falling wedge. Having given up almost all gains since it's 2016 bull run, FBR might be on it's last legs unless it can break upwards and remain within the larger descending channel. Selling pressure currently remains strong, and a continuation downward might have us eventually seeing 2 cent stock prices again. However, if selling slows and price can close above 8.1 cents, a relief rally may be in order - but there is not much time left if this is to be the case.

Moving nicely to start Wave 2 Minor within Wave 3 intermediateFBR Fastbrick Robotics (FBR:ASX) Moving nicely LONG on Intermediate Period with a start SHORT for Wave 2 Minor within Wave 3 intermediate.

A good entry point for this stock will be on the completion of Wave 2 on the Minor period to go LONG

Reference to my previous chart here:

15th August 2017: Fastbrick have announced, Robots to assist building homes in Saudi Arabia, which has driven the price of this stock to a high of almost 0.30, thus developing a Wave 3 on the minor period inside a Wave 3 within an Intermediate period.

Twitter Announcement here: twitter.com

ASX Announcement here: www.asx.com.au

Other Media here: thewest.com.au

----------------------------------------------------------------------------------------------------------------------------------------------------------

DISCLAIMER: This chart is for sharing and educational purposes only and is not intended to be a signal service or similar.

This chart analysis is only provided as my own opinion, based on my own analysis and comes with absolutely no warranty that this analysis is correct, whatsoever. Do not trade this chart if you do not have your own strategy. Trade only with your own strategy at your own risk. Plan your trade and trade your plan... and IF in doubt, stay out.

.....::::: If you like this chart, please click on the THUMBS UP ! :::::.....

----------------------------------------------------------------------------------------------------------------------------------------------------------

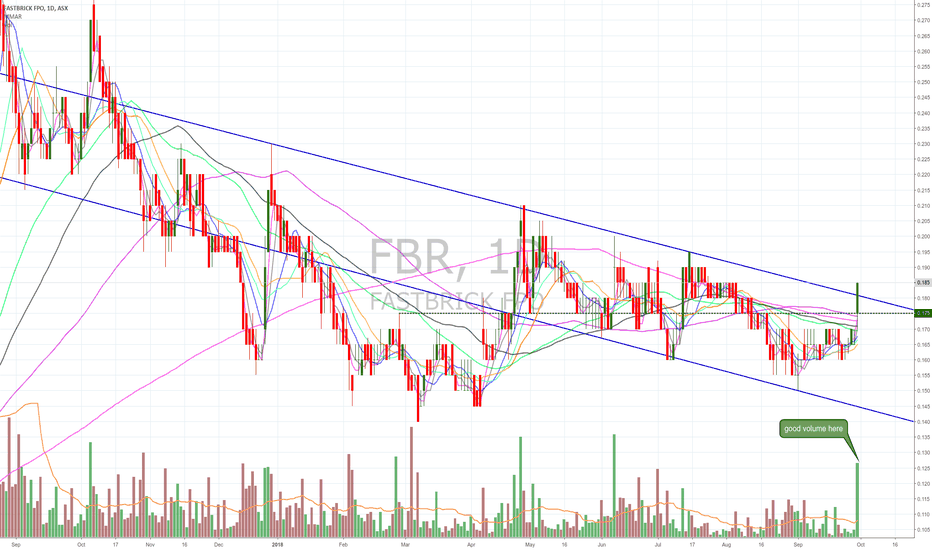

FBR Kicking Ass -Currently towards end of Bullish Wave 3 ImpulseIt is quite evident that FASTBRICK ROBOTICS LTD (ASX:FBR) has broken out of a Wedge and is continuing on a BULLISH trend, not only due to technicals, but also due to the recent announcement of an agreement with CATERPILLAR (NYSE:CAT), to Provide services to Caterpillar's construction customers. The global addressable market is now estimated to be $100 ~ $200 Billion.

Just after pinning the Mayo (200 EMA), price action seems to be towards the final stages of a Wave 3 Impulse where we will see a small pullback, possibly down to the Support (which was completely obliterated), for continuation upwards to a Wave 5 Impulse. I do not expect the ABC correction waves to drop below wave 4 and in my opinion, the next Impulse wave it seems should have the same agression as the Bullish trend continues as more financial information comes in and more projects are acquired. All EMAs are flaring outwards whilst TDI shows definite Sharkfin with Blood in the water, however the outer bands have widened considerably, thus suggesting pending upwards movement.

I have purchased this stock back here:

Where I first identified this stock as being a very high probability Buy/LONG trade to hold long-term. There will be an entry opportunity at the bottom of wave 4, and I'll update this chart when structure is broken

----------------------------------------------------------------------------------------------------------------------------------------------------------

DISCLAIMER: This chart is for sharing and educational purposes only and is not intended to be a signal service or similar.

This chart analysis is only provided as my own opinion, based on my own analysis and comes with absolutely no warranty that this analysis is correct, whatsoever. Do not trade this chart if you do not have your own strategy. Trade only with your own strategy at your own risk. Plan your trade and trade your plan... and IF in doubt, stay out.

.....::::: If you like this chart, please click on the THUMBS UP ! :::::.....

----------------------------------------------------------------------------------------------------------------------------------------------------------

FBR Fastbrick (ASX) Possible Wave 3 LONG?It seems that FBR (FastBrick Robotics Ltd - House Building Robotics Company) has already completed a wave 2 and is now on it's way 1/4 way through a wave 3 Impulse wave. Based on company fundamentals and performance, it seems that this not only would be great to long, but also great for investment portfolio investment stock. In my opinion, I see this company as a fast growing company that will reach significantly high price range in the months/years to come. I'm going to LONG this stock and retain it as investment stock. Great find in my opinion.

Here is the source for additional information which I've based my fundamental analysis on.

shareprices.com.au

My technical analysis is displayed in the chart above.

----------------------------------------------------------------------------------------------------------------------------------------------------------

DISCLAIMER: This chart is for sharing and educational purposes only and is not intended to be a signal service or similar.

This chart analysis is only provided as my own opinion, based on my own analysis and comes with absolutely no warranty that this analysis is correct, whatsoever. Do not trade this chart if you do not have your own strategy. Trade only with your own strategy at your own risk.

Plan your trade and trade your plan... and IF in doubt, stay out.

.....::::: If you like this chart, please click on the THUMBS UP ! :::::.....

----------------------------------------------------------------------------------------------------------------------------------------------------------