QAN trade ideas

Will Qantas take off?ASX:QAN

Yeah... it looks like it wants to get off the ground.

DMI is accelerating and Didi index confirming the buy. The Bollinger band just opened the gate.

1st scale @4.66 and second @6.42

if the engine power is not enough, I'll set my parachute to open at @3.55

Get on board and fasten your seat belt, but don't follow me. I am lost too.

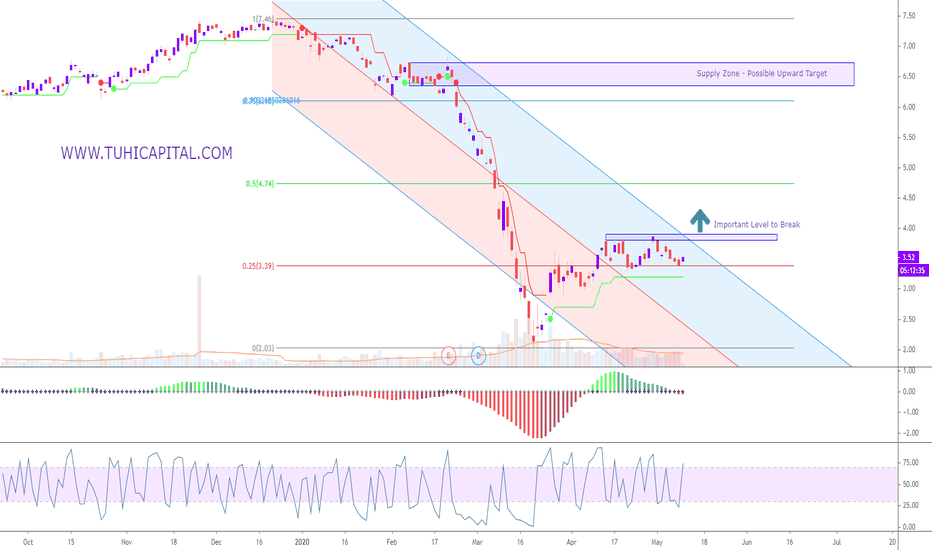

Qantas in Talks with the Government- Qantas is in talks with the government to secure an exemption for 1.5m social distancing rules on its its flights.

- If given the green light and the ability to kick off at full capacity for domestic flights / (possibly incl. New Zealand) we expect the stock to move higher - possible to the 50% retracement.

- Technically we are in a downward Channel and we need to break out of the immediate resistance and out of this channel. Our Momentum Squeeze is ON and we are waiting for a breakout.

What is Keeping QANTAS from going up?Many people are scratching their head wondering why the bought ASX:QAN and it is stuck and not following other stocks recovering. But the TA has all the answers here.

Look at the green line that is the 50MA, the stock could not go beyond this key indicator and on the contrary it tested it and failed to break it.

The price action structure doesnt look bad as the 0.236fib has been acting as support so far but again for those who impatiently want to buy this stock, I think it is better to wait for the price to close few days above the 50MA. And target can be calculated according to your trading TF.

Atm the daily velocity has turned negative which is a warning signal though weekly velocity is positive which is a good thing for the bulls. RSI is neutral so nothing much about it.

Keep you updated when things change.

Qantas heading south?Qantas is moving up towards a strong resistance area with prior support and resistance lining up with the 50% retrace of the move up from 2012-2020 and the 38.2% retrace of the move down from Jan - March. The 55 SMA is also not far above and moving south.

The RSI seems to be making an ascending wedge that is coming to an apex.

If the ascending wedge or trendline breaks to the downside I think it's likely to revisit the recent lows and possibly head to around $1.20 which is roughly the lows of 2012 & 2014 as well as 1.618 and 0.618 fib extensions of wave 1 & 3 respectively.

I assume a lot of traders might have been speculating on Qantas possibly being the only airline in Australia after Virgin stopped trading. The news of virgin being offered a $200 million bailout from the QLD government after hours on Friday might cause some to exit their positions going into resistance.

Profit taking time for Qantas? $QANTopped on a green 9.

We are on red 1 right now and if we get a red 2 below the red 1 on Monday.

It is a good shorting opportunity.

The RSI, MACD, and CMF are showing the bulls are running out of energy.

I am bullish on Qantas long term and therefore I am expecting the bulls to take back control on the trendline or near the moving averages.

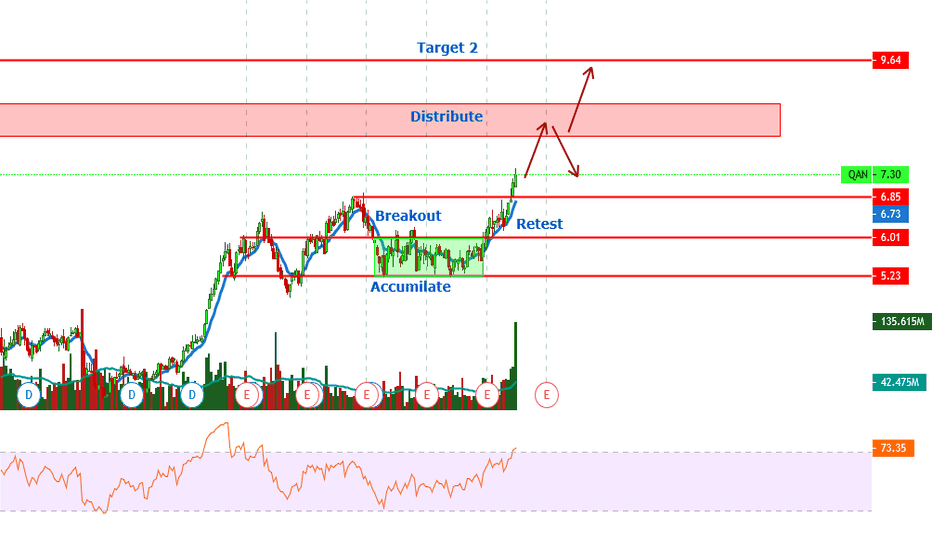

QANTAS - Wait and watchHey guys welcome to my back. This week we are looking at QAN. If your liking the charts so far show some support and give me a follow. Likes and comments are also appreciated.

Currently I have QAN as a wait and watch. The reasoning, I believe we have just entered our fifth wave. that being said and to put if frank there is no clear sign of when we can expect a pull back. Momentum is looking strong for the bulls on the weekly and monthly and I have marked two potential targets that sellers and ETF's would use to distribute their holdings (remembering this has to be done slowly over time because it's dependant on volume). However it is to early to tell if the fifth wave will end at denoted targets or we will have a pull back slightly and continue on for a extended fifth wave.

If you would like to request a chart for me to look at comment them below!

If you want to learn more about market cycles, Elliot wave or company investing check out the books below! Use my link and support me directly!

www.amazon.com.au

www.amazon.com.au

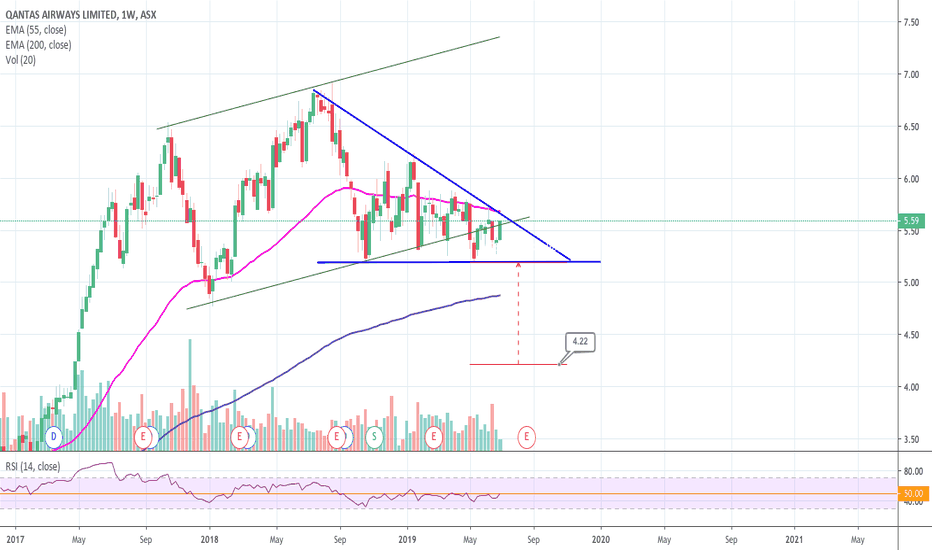

ASX:QANTAS - Running out of room on the weekly - Long termQantas ASX:QAN is running out of room in what seems like a descending triangle. If there's no break to the upside, expect more downward pressure to $4.22 in the coming months - long term outlook.

Due to the uncertainty of the market - trade wars and oil prices - a breakout in the coming weeks should also be taken with a pinch of salt as it might be a bull trap and may revisit $5.20. However, a break with conviction to the upside and doesn't look back will bring us to the top of the channel above $7.

A break below $5.20 invalidates this outlook.

[QANTAS] BEARISH SETUPHello Traders!

From a technical point of view, possible completion of impulsive structure (12345), so we expect some corrective structure ABC. We will try to take short position as shown on chart, limited risk and good R/R Ratio (> 1:3)

COMPANY PROFILE

Qantas Airways Limited is an Australia-based company, which operates domestic and international airline. The Company is engaged in the operation of international and domestic air transportation services, the provision of freight services and the operation of a frequent flyer loyalty program. Its segments include Qantas Domestic, Qantas International, Jetstar Group, Qantas Freight, Qantas Loyalty and Corporate. The Qantas Domestic, Qantas International and Jetstar Group segments include passenger flying businesses. The Qantas Freight segment is engaged in the air cargo and express freight business. The Qantas Loyalty segment is engaged in the customer loyalty recognition programs. Its main business is the transportation of customers using two airline brands, which include Qantas and Jetstar. It also operates subsidiary businesses, including other airlines and businesses in specialist markets, such as Q Catering. Its airline brands operate regional, domestic and international services.

Sector: Industrials

Industry: Airlines

Employees: 29.359

If you think this analysis can be useful and you want to receive new updates about this idea, click on LIKE button!

Thank you for support and trade with care!

$QAN Qantas trade set-up long off optimal entry fib zoneDouble click the price column to see the chart. Here's my trade setup for today, $QAN : ASX long off bullish momentum and.382-.618 fib zone. This has been profitable of late with some nice s/r swings and stock holding up well during the recent downturn. Not financial advice. As always, trades can go against us no matter how good a chart looks, risk management is king.

ASX:QAN 189 days ascending triangle BREAK ?ASX:QAN The 189 day ascending triangle is nothing short of exciting for me. When such a long trend happens, it happens for a reason and usually the break out will be 'intense'.

Watch out for it.

Earnings announcement coming on the 23 Feb. Keep a lookout for it. Conservative target at $8.28.

A break below $6.19 will invalidate this bullish outlook.