SPY trade ideas

SPYAs investors, we must understand that in order for consumers to access cheaper products, sacrifices will be required in several key areas. Adjustments in Federal Reserve monetary policy (changes in the federal funds rate and balance sheet reduction) will directly impact GDP and real income. Likewise, consumer prices will reflect the impacts of inflation (CPI) and fiscal policies. Increases in labor costs (adjustments in wages and employment costs) will also play a crucial role in these changes. Private consumption (PCE) will be pressured by these dynamics, and businesses will have to decide between maintaining profit margins or passing these costs onto consumers. The key will be how these adjustments in prices and wages are negotiated, as the market seeks a new equilibrium between supply and demand. Prepare yourself, as these adjustments are part of a long and challenging process, but they are inevitable.

#SPY #SP500

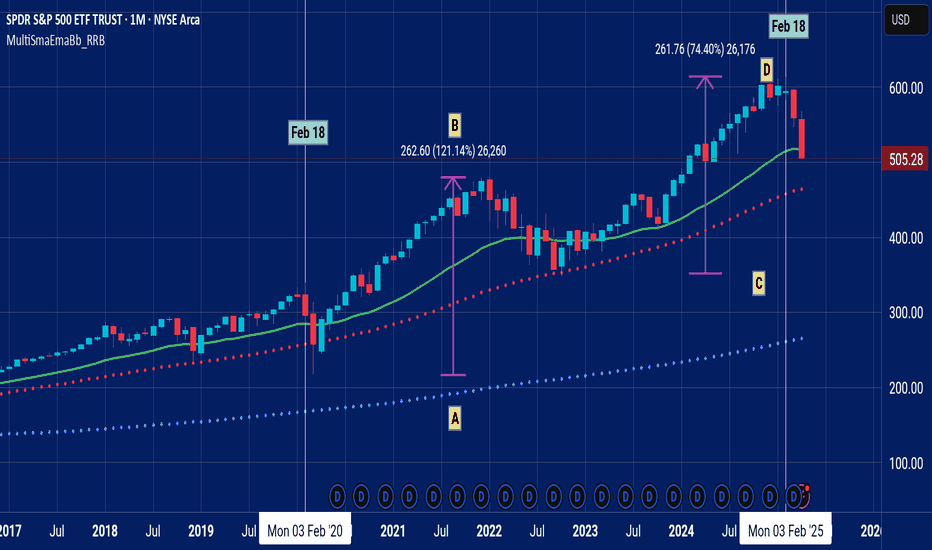

SPY Equal Distance Top followed by takedown.The CD runup equaled the AB runup. 3 months of distribution followed as the SPY could not breakout. The week of 2/18/20 was the scamdemic top. The week of 2/18/25 top was the 5 year anniversary. Trump in office both times. I believe this is more than a coincidence and not just some tariff bs.

There was a reason Buffet was hoarding cash.

SPY: Week of April 7Hey everyone,

Sharing the levels for next week.

I don't have much of a forecast tbh, the thing is, in bullish markets its harder to forecast the long term, easier to forecast the short term.

In bearish markets its easier to forecast the long term, harder to forecast the short term.

Each week we have been up and down, taking out all highs and lows for the past few weeks owning to the volatility, and that is what makes it difficult to really adopt any forecast when most times we are just hitting all targets with the volatility.

Here are some things for the short term:

About 78% chance spy Retraces 528

507 is the reference target

Based on the EMA 21, there is an 89% chance of seeing a bounce on SPY.

Based on the EMA 50, there is a 69% chance.

POC from last week is at 537.

Will it bounce?

Yes, I mean like I said, we take both highs and lows out each week, I don't really foresee this week to be any different, haha.

And the longer term?

So the real interesting stuff I guess is the longer term, but not that interesting.

SPY is rapidly mean reverting. Right now the mean for SPY is around 481. This is actually within the forecasted levels for next week, so that's curious.

In 2022, the mean was 350. It took exactly 10 months (from January to October) before we finally hit it (and went 2 points lower).

At this pace, we are hitting it this month. Which is a concern. Why? Well let me tell you.

There are corrections that are required to happen generally, just a general mean reversion, not necessarily fundamentally driven. That was the example of 2022.

Then, there are corrections/crashes and cycles that are fundamentally driven. An example of this, for SPY, would be 2008.

In the fundamentally driven crashes, for SPy those would be COVID, 2008 Financial Crisis, those surpassed means and let to a stark sell. COVID was pretty quick, but 2008 was really drawn out owning to the unfolding of economic events.

The reason the 2 require distinction, is because technical and analysis are useless during fundamental corrections. You could draw fibs to the cows come up in 2008 and you would be bankrupt by month 3.

However, in 2022, technicals and such worked fine because we were just doing a basic correction from getting too far from the mean.

Interestingly enough, my comparison algorithm that compares the current year to similar years, for both SPY and SPX, has indicated that 2008 is the most similar year as of right now. This is a huge change from the results it gave even just a month ago.

For fundamental sells, it doesn't stop until stuff gets resolved. As was the case in 2008 with the required bailouts, and once the dust settled from the multiple industries and businesses that went under. Then the market started a slow and painful recovery.

The situation here is more similar to 2008 than the COVID crash. The reason being the main concern with COVID was economic shut down as a result of the pandemic. However, this was quickly curbed with modification of the work routine (industries working from home where applicable), the continuation of industries functioning and the huge stimulus that the government injected into the economy.

Right now, the issue is a global trade war. In 2018, Trump only tariffed random items (mostly metals) on a few random countries. Right now, he is blanket tariffing the global economy. He doesn't even stop there and has to bring in my favourite animal, the Peunguins.

God, Trump, what did they ever do to you? Leave the penguins alone!

This is incredibly bad, its actually unprecedented. It is essentially a world war from an economic standpoint. And we are still waiting for the verdict on some bigger nations retaliatory tariff results.

The global tariff war extends beyond just increase the cost of things, it actually may lead to a decrease in the US money supply, a rise in inflation and a huge cut to GDP for the US and other countries impacted.

Trump could lift them, ease them or something. This would probably lead to some initial reaction to the market, but it seems the market doesn't even trust him anymore because when he kept playing those "just kidding" games into the beginning of the year, the market just stopped reacting to them. It is kind of funny.

So the result is, it could be much worse than most anticipate, even myself.

As of right now, my plan is to go long in the 480s, kind of on most things. Rebuild a portfolio.

But as we progress, it seems that 480 may not indeed be the end. It just depends on Trump's mood at the time I suppose.

From a purely math analysis:

481 is the mean for spy, we are following the annual bear market path which has as low as 468.

Here is where we stand now on the annual assessment:

And then in terms of mean reversion, SPX is the most interesting to take a look at:

4,791 is the mean. The last mean correction it has had was in 2022, same as spy:

In addition, SPX just signaled a top/mean reversion signal.

On the prospects of a bottom formation:

None of my stuff indicates a bottom formation. In fact, we have some top signals just newly triggering, which is nuts I know but the reality.

So that's .. good? Maybe, haha.

Anyway, those are my thoughts.

My suggestion is to continue to position defensively in anticipation of both up and downside next week.

Safe trades!

Also, for more deep diving into the fundamentals, sort of, consider reading this post from me if you haven't already:

The Perfect Trade. How I've been preparing you for this S&P DUMPThis has been the basis of my 5 recent videos on SPY - walking you through what the market was doing, what algorithms were in play and important to keep an eye out for - and ultimately, how to catch this most recent dump on a rejection (and proof) of teal strong selling.

My best trade ever in terms of profit and preparation, patience, etc.

Happy Trading :)

Spy.. Where we standSoo... I will go in detail for you so you can see where my POV comes from..

A summary of this post is a bounce. Back to 525-530 and then a possible new low to 470..

Let's start on the monthly time frame..

I will show you the chart regular then I will show you log scale (Logarithmic).

AMEX:SPY regular

Price is nearing a 5yr trend support

That support is at 495-500. There's a gap at 495 to close from April 19th 2024.. I would say if we were to gap down Monday below 500.00 that's where they will take this before buying it back up to 510.

Now do I think the correction Is over here at this trendline support? I'm leaning at it's a 70% chance we will break this support before End of May.

Why? Because of the sectors.. XLC and XLF is promising more pain to come.. imagine Spy as a car, the sectors are the important parts to keep things in motion . I'll get to the sectors later but let's stick with spy..

Now here's a monthly chart again but this time Log scale

As you can see with exception of the Covid crash spy has pretty much channel traded this the last 14yr bull run

Let's zoom in

As you can see, the bottom of this channel is around 2021 high 477. So I think Spy is headed there before End of May , it could happen sooner but you have to factor in A rally and i don't know how long that can last.

Also NASDAQ:QQQ monthly chart log scale is showing similar outlook

Zoomed in NASDAQ:QQQ

Lastly TVC:NYA

Monthly log scale

Same as Qqq and spy, headed back to 2021 high

NYA no log scale

So I've showed you the indexes now I will show you AMEX:XLF (Financials) and AMEX:XLC (Meta, NFLX)

Here's XLF price is headed back to trendline support 38-39.00 by end of May; that's another 10% drop which supports my theory that spy will tag 470

Zoomed in

XLF

Monthly 50sma aligns with trendline support so that's your target. I think any bounce on banks going into earnings should be faded!

XLC

I can't hammer on the table hard enough about how much pain is coming for this sector and it's tech stocks.. compared to the other sectors this hasn't even got started with the selling when looking at its monthly RSI and MFI. Friday price stopped right at its previous ATH

we are headed back to 82.00 which is another 8% drop on this sector, if 82 doesn't hold them , 60 comes next.. If you OWN meta on NFLX I hope you have a 5yr outlook because there will be pain

..

Now let's get into the bounce, I think a nice bounce comes next week as long as spy opens Monday above 495.00

When it comes to being oversold one of the most reliable tools I like to use is the PRICE RANGE tool with 20sma.

When you look at spy, you'll notice that in a normal market it usually moves between 2½-3½% from it's 20sma.

As of Friday's close we are 10% away from it's 20sma

This type of extension is extreme

Below I will post the last time spy was over 8% extended from it's 20sma and you can see what happened the next few sessions

June 17th 2022

Jan 24th 2022

June 8th 2020

March 2020 Covid crash

Dec 2024 2018

So in the last 7yrs spy has on dropped more that 8% from it's 20sma 5 times and with the exception of the Covid crash 10% extension was the area where you saw price Rallied back within days to retest the 20sma.

So that places us bouncing this week. Now the 20sma is fluid so even though the 20 is at 559 right now depending on how long spy takes to get there the 20ma could gravitate lower

I think 536 gap close minimum comes before we break below 495.

I will update this more tomorrow.. this right up took awhile

SP500 - Shiller PE RatioSPY

Looking back we can see where the Shiller PE ratio values provided an insight into buying into the SP500

We have altered courses from the High Interest rates of 1988 - the lows of 2020

I believe we are in a new Inflation cycle. This could result in rising rates over next 20 years.

It makes for a harder decision for buying the market.

If they are not going to truly rally @ 31.31 then will they at 27.08 or lower?

Will the market beat inflation?

(SPY) Technical's Signal Another -30% Drop to $350 Incoming!In this video, I break down the technical setup pointing to a potential -30% market correction, with a key price target of $350. Using trend structure, market volatility, and key support/resistance levels, I highlight why this level could be revisited in the coming months. I also examine historical price behavior during similar setups and discuss the factors that may align with this bearish scenario. Whether you're a short-term trader or long-term investor, this is a critical level to watch.

SPY going down down downI just make simple technical charts, and have no idea about matters at play from leaders in plain sight as well as those behind the curtains.

Things can only crash when they have been inflated. So far SPY is still in long term uptrend. Only when it drops below the thick blue lower line and stay below, it will be a down trend to me.

RSI on the daily hangs around 23. Switch to the monthly chart and the RSI is only at 50 yet. Plenty of room to go down! Remember, the all time highs of 2021 and 2023 were around 450. Fridays close was at 505!

SPY: Breaking Levels; TASPY broke down the Weekly demand line and now looking to break the Monthly demand.

Looking to possibly test the bottome weekly trendline.

Possibly a 530 price target and if weakness continues, possibly below more to 520 then 510.46 to fully retest that bottom trendline.

The market has bene crazy, people calling bottom, wanting to catch the reversal. I mean, I would want to catch this “V” up too, but have to see if it keeps trending down to the bottom trendline.

LMK what you think and if you have any TA, tag me!

*Not FA

Post-Liberation Day Sell-Off – Crash or Correction?Liberation Day has turned into a dramatic "blow the markets back out" day for the SPY , with a significant daily drop of nearly 6%, slicing decisively below the critical 200-day moving average at $574.46. Historically, breaking below the 200-day MA is a strong bearish signal, indicating potential further downside momentum.

The previously identified key bearish pivot, the "Best Price Short" at $565.16, served as a crucial resistance level from which sellers aggressively stepped in, intensifying today's sell-off. Given the current bearish sentiment, the next immediate downside targets without a significant bounce (dead-cat bounce) include:

Half 1 Short (Momentum target): $505.28 (already tested)

High Vol Momentum Target 1a: $497.66

Half 2 Short (secondary bearish momentum): $486.41

Extended Momentum Target (HH Vol Momo Target 2a): $475.16

For traders who missed the initial move, look to re-enter shorts if there's a modest retracement toward the previously broken "Weeks High Short" at $520.16, maintaining tight risk control with stops ideally set just above the "Best Price Short" ($565.16).

Critical levels summary:

Ideal Short Re-entry Zone: $520.16

Profit Targets: $497.66, $486.41, and ultimate $475.16

Stop Loss Area: Slightly above $565.16

Major Broken Support (Resistance now): 200-day MA at $574.46

Today's significant volume spike further reinforces bearish conviction. RSI is deeply oversold at 23.24, suggesting caution for potential short-term bounce, but any bounce is likely to be short-lived unless there's a substantial political or economic pivot soon.

These levels are algorithmically defined, designed to remove emotions from trading. Trade responsibly, adhere to your strategy, and protect your capital.

Rollercoaster Continues For SPYMy overall thesis is we are in the very early stages of a multi-year decline ultimately with the S&P 500 below 3500. I am estimating this symbol to be in wave position SuperCycle 2, Cycle A, Primary 1, Intermediate 3 (pink), Minor 3 (yellow), Minute 3 or 4 (green). I originally had this symbol nearly complete with Primary wave 1, but the continued declines received significant wave 3 of 3 signals (pink lines in bottom chart band). It is still unclear if we are in my theoretical larger decline or if we are in a simple corrective wave. It will take at least another two months to likely achieve the answer.

Theory 1 is my hypothesis where we are about to finish Minor wave 3 in Intermediate wave 3 in Primary wave 1 in a multi-year market correction. This would see SPY bottom around 486 within two weeks and briefly head up toward 535 before continuing significant downward movement. Currently Intermediate wave 1 lasted 111 trading hours. Intermediate wave 3 is somewhat on pace to finish in the same amount of time around 17 April. Extensions based on Minor wave 1's movement could put Minor wave 3's bottom around 499.

Theory 2 is that Intermediate waves 1, 2 and 3 (pink) are actually waves A, B, and C (white) in a short-term corrective wave. This would mean this symbol returns to all-time highs around the fall of 2025.

Theory 3 places the stock in the third wave about to finish a wave A down over the next two months. Wave B up would last a few months before wave C takes the market to a bottom sometime around the end of 2025.

All three theories will observe the same movement over the next few weeks with a low soon and then a bounce up. Theory 2 becomes the likely winner if SPY breaks above 576.33 within the next 3 months. Theories 1 and 3 will trade the same for quite some time.

I will reevaluate this ETF once Minor wave 3 finishes. It should aid in providing a better bottom for Intermediate wave 3 in the next two weeks.

Market Falls comparison of the last 25 yearsBetween 2000-2019 the market had 7 big falls.

Since the Pandemic in 2020, the market has fallen 2 times and currently experiencing the 3rd big fall.

Although the current and last two falls seem big, percentwise have not been as big as the ones from 2000 and 2008.

Get ready for the current market to continue falling for the next 2-3 months and it will still only feel like a 20% correction, nowhere as big as the 3 biggest falls from the last 25 years.

US stock market vs CryptoUS stock market vs Crypto

Here's a YOY comparison chart of the US stock market vs Crypto. While all US stock market indices are down year over year, crypto is still up. Is crypto a better investment, or is this a temporary snapshot in time? Please drop a line and let me know your opinion.

SPY -3.3%

QQQ -4.88%

DIA -3.68%

IWM -13.8%

TOTAL +4.93%

TOTAL3 +3.24%

Tariff FUD is reking ports. SPY 505 First Stop. 460 Second.Trading Fam,

It's no surprise that Trump's implementation of high tariffs would cause initial FUD. This can be observed in the massive spikes on the $VIX. What is unknown and has caught many traders by surprise, myself included, is how substantial of a drop would be incurred by investor uncertainty.

Initially, it did appear that 500 might hold. That was a huge support. I knew if it broke, the sell-off would be deep. But I held hope that the market would hold above this trendline. It did not. So, yesterday and today, investors who held are incurring substantial losses.

For those who were smarter than me and sold at or near the top, congratulations! You've saved yourself some duress and cash. Now, some are calling this the beginning of a longer bear market. I still don't see it that way. Honestly (and I know this will be hard to believe), I still see the SPY hitting my target #3 at 670-700 before 2026 comes to an end. Longer-term we still remain in a massive secular bull market since 2009 and to break this long-term trend, the SPY would actually have to break below 300. That is a long way down and I just don't see that happening, though as always, I definitely could be wrong.

Shorter-term I am seeing two prominent areas of support. The first has almost been reached at 505. If I would have played this correctly, I'd be DCA'ing in my first load of cash here. The second area of support is at around 460 and slightly rising daily. This would be where I DCA'ed in another load of cash. However, if that broke, I'd exit immediately and reassess the charts. 300 is a long way down, but over the past 5 years we have seen some extraordinary market price action and volatility. TBH, even the best of us technicians are struggling to understand the larger macro-economic picture, but I'd wager to say that tariff fears may be overexaggerated as market reactions often tend to be.

One interesting note is that crypto price action no longer seems to correlate and prices have help up surprisingly well. Could this be our first indicator that the markets are due to turn up again in a few weeks/months? Unknown. But I can promise you I'll be watching this all closely.

✌️Stew

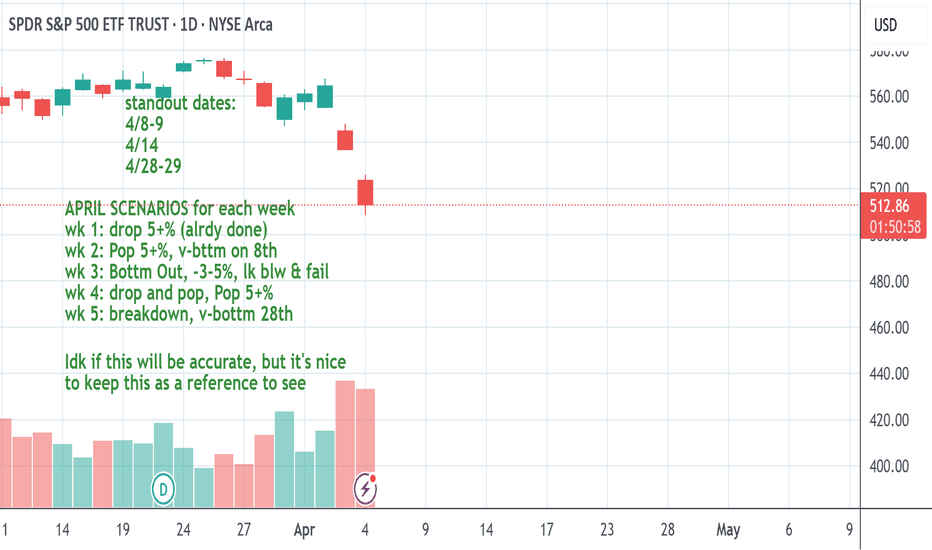

SPY April weekly forecasts - New stuff-This is an idea I've done in the past, but never posted on here. Sometimes it's pretty close to how things play out with variances on timing. Regardless, I want to see it as a journal entry for my dowsing work with all my notes with the chart.

It may be interesting to other people as well, so I'm posting it.

Dates are often reversals. I do think next Tuesday could be a bounce.

I'd like to get monthly highs/lows on SPY/QQQ, but that doesn't seem to be in the cards atm. :(