WBC shares have breached a significant point at 15.33 WBC shares have breached a significant point at 15.33 in today's trades after a long consolidation period at 15.03 and 15.33.

Share prices took off from the opening and crossed over 15.58 in the first hour of trade. Share prices are now approaching another critical point at 15.98 and might retreat to 15.84 and 15.70. 15.84 is an excellent spot to keep an eye for a retracement.

WBC trade ideas

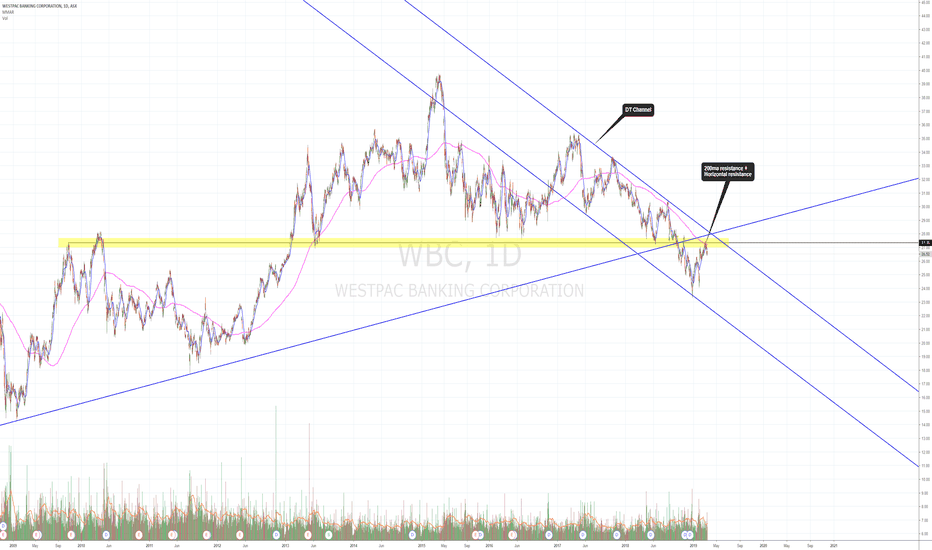

WBC and NAB prices back into demand zone, HTF and LTF stacked demands. Both charts have same price structure though WBC is clearest. l'm tending towards buy side although no final confirmation PA yet so standing by. fomo sellers/ stoplosses are triggering , l'm looking for discount buys down here while worlds selling and running for the hills.

WBC - short to medium term share price forecastShare prices had a short burst to the upside from 27.00 to the 30.00 mark but stalled and pushed back down after failing to break above Its 500 EMA and the price curve labelled in blue.

Share prices also fell out of the wedge price pattern which is a strong indication of prices could be heading down to the bottom of the price curve marked in blue and also a support trend line in red. These two support points are around 29.18 and 28.83.

Share prices will need to break and hold above 30.00 before we could confirm a change of price direction to the upside

WBC.ASX - Short to Medium Term Price ForecastThis is a followup of my price callout in my live trading room in yesterdays trading session Shere prices breached 28.75 resistance to the upside and closed around 29.15 resistance. A break above the current resistance could see share price continue to 29.30-29.65