ASX 200 Futures: Back-Test Bounce Keeps Bulls in ControlASX 200 futures remain a buy-on-dips prospect, putting the contract on track to test the 9000 level soon.

Already sitting in an established uptrend, the latest leg higher coincided with a three-candle morning star pattern being completed on Tuesday, providing a bullish signal that goes some way to explaining the price taking out the former record high of 8751 a day later. The back-test and bounce from this level overnight suggest the path of least resistance remains higher. It also provides a level to build bullish setups around should we see a retracement to the level.

If we see a pullback towards 8751, longs could be established above with a stop below for protection. Wednesday’s high and 8900 are levels of note for those contemplating the trade, although 9000 comes across as a more appealing target.

Momentum indicators are also signalling growing topside pressure, with RSI (14) breaking its downtrend above 50 while MACD has crossed the signal line from below in positive territory. Combined, it provides a backdrop that favours a bullish bias.

Good luck!

DS

APU2025 trade ideas

ASX 200 Looks Set to BounceThe ASX 200 has drifted lower since its latest record high was set six days ago. 8500 held as support before doji formed on Tuesday to mark a false break of this key level. ASX 200 futures also tried but failed to break beneath it overnight.

Given the bullish divergence on the 1-hour RSI (14) and RSI (2), the bias is to seek dips towards 8500 for a cheeky long towards the December high.

Matt Simpson, Market Analyst at City Index and Forexc.com

Markets rally as missiles fly | how long can risk be ignored? Markets may be underpricing Israel and Iran risk.

Despite continued fighting—including high-impact strikes and rising casualties—global equities moved higher to start the week.

U.S. indices led the advance, with the Nasdaq gaining 1.5%, followed by the S&P 500 and Dow. Earlier in the session, European and Asian markets also closed higher, with Germany’s DAX up 0.8% and Japan’s Nikkei rising 1.3%. Now Asian markets are set to open for the second trading day of the week.

Tensions escalated further on Monday as Israel launched drone strikes on Iran’s state-run IRINN television headquarters in Tehran, interrupting a live broadcast. Additional Israeli attacks hit the South Pars gas field. In retaliation, Iran launched a fresh wave of missile attacks into Israel, killing at least five people.

ASX Bulls Sniff Record HighsASX 200 SPI futures have broken above the 8400 level and May 16 high of 8424, opening the door to a bullish setup—provided the price holds these levels into the close.

Longs could be considered above 8424 with a stop below 8400 for protection, targeting a retest of the record high at 8581. While momentum indicators are nearing overbought territory, they continue to trend higher, keeping the bullish bias intact.

A close below 8400 would invalidate the setup.

Fundamentally, the underlying index remains expensive across several valuation metrics—especially the banking sector, where multiples are hard to justify. But that hasn't stopped the rally so far. Optimism following the RBA’s dovish shift in May is helping fuel the latest breakout.

Good luck!

DS

With Dow at Resistance, it Could be Make or Break for ASX 200The Dow Jones tends to share the strongest correlation with the ASX 200, out of the three Wall Street indices. It is therefore worth noting that Dow futures formed a bearish pinbar at trend resistance on Thursday, following an intraday false break of the March low. The daily RSI (2) was also overbought by the day’s close. The March 31 low also hovers nearby for additional resistance.

Given futures volumes were declining while Dow futures rose, I suspect a pullback is due.

ASX 200 futures formed a hanging man candle beneath the January high, near a weekly VPOC (volume point of control). The 200-day SMA also hovers nearby. A bearish divergence has also formed on the daily RSI (2). And like the Dow, volumes were declining while ASX prices rose.

Bears could fade into moves around the Jan low or 2000-day SMA with an initial target at the March high, a break beneath which assumes aa deeper pullback towards the 7939 VPOC and 7900 handle.

Matt Simpson, Market Analyst at City Index and Forex.com

ASX 200 Futures Stare Down Resistance Ahead of Pivotal ThursdayThursday looms as an important session for Australian ASX 200 SPI futures, with the price approaching a tough layer of technical resistance overhead.

Horizontal resistance at 8135, the 200-day moving average at 8142, and the October 2023 uptrend around 8180 all stand between a potential run back towards the record highs set earlier this year or a possible reversal towards 8000. The price has already broken below the uptrend established from the April lows, although the late fightback in overnight trade suggests bulls won’t give up just yet.

Momentum indicators continue to trend higher in positive territory, favouring a bullish bias that prefers buying dips over selling rips.

If price fails to break and close above the 200DMA, it creates an opportunity to establish shorts targeting a pullback to 8000, a psychologically important level. The 50-day moving average is also nearby at 7956. A stop above the 200DMA would protect against a continuation of the prevailing trend.

Alternatively, a break and close above the 200DMA would flip the setup, allowing for longs to be established with a stop below for protection. 8280—having acted as both support and resistance earlier this year—would be a logical upside target. Beyond that, a retest of the former record highs would be on the cards.

Good luck!

DS

ASX 200 Bulls Take the Reins as Trade Hopes BuildThe signal from last week’s bullish engulfing candle on ASX 200 SPI futures has proven reliable so far, with the price rocketing above 7900 on Monday, providing a platform to establish long positions around.

With optimism building over trade deals between the United States and major partners, including China, bulls may look to enter above 7900 with a stop beneath for protection. The 50-week moving average screens as a potential target, with futures bouncing strongly from it the last three times it’s been tested.

If the price reverses and closes below 7900, the bullish bias would need to be reassessed.

Momentum indicators remain net-bearish, though RSI (14) is lifting toward neutral. Given the headline-driven nature of the market, these signals may be less reliable than usual.

Good luck.

DS

Momentum Turns Against the ASXThe rally of the past two week on the ASX took a turn for the worse on Wednesday, on the warning (and official announcement) of Trump's 25% tariff on non-US cars.

This has seen the ASX get caught in the negative sentiment on Wall Street.

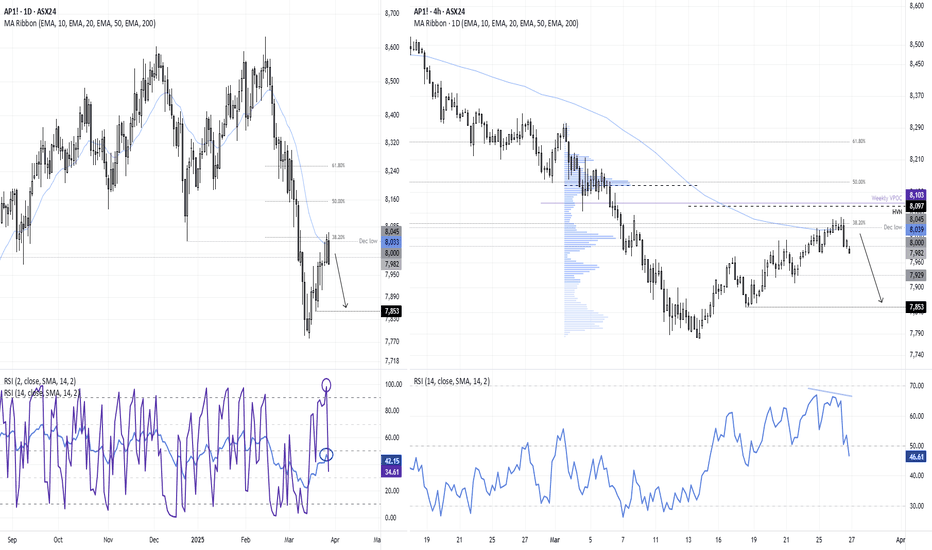

The daily chart shows that momentum has turned lower around a resistance cluster, including the December low, 38.2% Fibonacci ration and 20-day EMA. The daily RSI (2) reached a highly overbought level on Wednesday and now sits below 50, and the RSIK (14) has remained beneath 50 to show negative momentum overall.

A bearish divergence also formed on the 4-hour RSI ahead of the selloff.

The bias is for a move down to at least the 7930 area, a break beneath which brings the lows around 7850 into focus.

Matt Simpson, Market Analyst at City Index and Forex.com

ASX 200: Oversold Signals Flash, But Bulls Need ConfirmationASX 200 SPI futures are so oversold on the daily timeframe that you can’t help but notice, especially when looking back over recent years. The only time an RSI reading this low didn’t spark some form of bounce was during the height of the pandemic panic in early 2020.

But being oversold alone isn’t enough to trade against the prevailing strong bearish trend, putting extra emphasis on Wednesday’s price action. To get bullish and position for a countertrend squeeze, we need a price signal for confirmation.

I’m watching 7796—the price dipped below this level in low-volume trade during the night session before reversing back above. It’s only a minor level, but beneath it there’s not much for bulls to hang their hat on until 7600, where buyers stepped in last year.

Depending on the price action around the open at 9:45 am AEDT, if bulls defend 7796 again, the risk of a squeeze increases, similar to what we saw on Tuesday.

Longs could be considered above the level with a stop beneath the session low for protection. 7900 is one potential target, with 7996 and former uptrend support around 30 points higher alternative options for those seeking greater risk-reward.

A clean break and close below 7796 would invalidate the squeeze setup. Unless accompanied by fundamentally bearish news, flipping short after recent declines would be risky.

Potentially working in bulls’ favour, iron ore futures in Singapore had a solid session overnight, lifting nearly 1% to $101.70 per tonne.

Good luck!

DS

ASX 200 futures (SPI 200) stablising around 8200The ASX 200 futures market has fallen close to 5% from its all-time high, with 5 of the 7 candles since the top being bearish. However, the daily RSI (2) reached oversold on Friday, a bullish pinbar formed on Monday and a small bullish divergence is now forming on the daily and 1-hour chart. The pinbar low also found support at a weekly VPOC (volume point of control) and weekly S1 pivot.

Given the selloff came in a relatively straight line, I cannot help but suspect at least a minor bounce is due.

The near-term bias remains bullish while prices hold above last week’s low, and bulls could seek dips towards 8200 / 8191 VPOC area. 8300 and the weekly pivot point at 8345 could make viable upside targets for bulls.

Sellers in Control as 50DMA Rejection Reinforces Bearish BiasAustralian ASX 200 SPI futures were firmly rejected at the 50-day moving average earlier Friday, reinforcing the message that sellers remain in control following the bearish break of uptrend support flagged earlier this week.

With RSI (14) and MACD both firmly bearish, the near-term bias remains to sell rallies and downside breaks.

If the price squeezes back toward the 50DMA, it could present a short setup, allowing for positions to be established beneath the level with a stop above for protection. Ideally, another test and failure at the 50DMA would bolster the merits of the trade. Potential targets include 8251, 8135, or the key 200DMA.

Alternatively, a clean downside break of 8251 could open the door for shorts beneath that level, again with a stop above. Targets would be the same as the latter two mentioned above.

Beyond technicals, there’s been little discussion about how the sharp rally in Chinese equities is impacting markets outside of China. For years, investors wary of direct exposure to China gained access indirectly through other Asian markets, including the ASX. With China now looking far more investable, this shift—beyond earnings season—may help explain the abrupt weakness in Australian equities.

Good luck!

DS

ASX 200 SPI Futures Test Key Support as RBA Decision LoomsWith disappointing earnings from major names like Westpac and BHP in recent days, and with more than three rate cuts priced for this year, ASX 200 SPI futures look vulnerable to downside heading into today’s RBA policy decision.

They’re now testing major uptrend support—a level that has attracted buyers in recent months. While it’s holding for now, the technical picture is far less convincing for bulls than on previous occasions.

Friday’s false break above the former record highs formed a shooting star daily candle, a clear reversal signal. While the price bounced off the uptrend again on Monday, unlike past instances, this one didn’t last with the price quickly gravitating back towards it.

RSI (14) has diverged from price, flashing a bearish signal, while MACD is curling up and looks close to confirming with a crossover from above.

Everything comes across as heavy.

A break of the uptrend would put the 50DMA in focus as an initial target for bears, with further downside levels at 8280, 8135, and the key 200DMA. A stop above the uptrend would help manage reversal risk.

If support holds, an alternative approach would be to set longs ahead of it with a stop beneath for protection. Potential upside targets include 8546 and 8581.

Good luck!

DS

ASX 200: Why I don't trust today's 'record high'The ASX 200 reached a record high in today's session, but it's not a convincing record high in my books. If anything, it could signal yet another false break. Using the ASX cash and futures market alongside Wall Street indices, I delve into why we need to be on guard for another bull trap before the real move potentially begins.

Matt Simpson, Market Analyst at City Index and Forex.com

ASX 200 SPI: Buying Dips Until the Price Action Says OtherwiseAustralian ASX 200 SPI futures remain a buy-on-dips play until the price action suggests otherwise, bouncing again off channel support on Tuesday, repeating the pattern seen numerous times over the past two months.

Even though momentum indicators don’t look great, with MACD rolling over while RSI (14) remains in a modest downtrend, it’s hard to turn outright bearish unless the price breaks and closes beneath channel support.

Risk-reward doesn’t favour entering longs around these levels—unless you’re aiming for a run beyond the record highs—but moves towards the trendline would generate a decent bullish setup. Longs could be established above the level with a stop beneath for protection. 8494—the February 7 high—looms as one potential target. The record highs at 8546 is another.

If the price were to break and close beneath channel support, the bullish bias would be invalidated.

Good luck!

DS

ASX 200 Futures: Finding a Signal Amid the NoiseWe're sandwiched between an incoming NFP report and the turbulence from Trump's tariffs. That could provide a double dose of 'fickle' price action, which we tend to see leading up to big events such as nonfarm payrolls or Fed meetings. With that in mind, I update my bearish bias on ASX 200 futures, using the intraday timeframe and a glance at Wall Street indices.

Matt Simpson, Market Analyst at City Index and Forex.com

ASX 200: Why I'm not banking on [an immediate] record highThe ASX 200 cash market is tantalisingly close to retesting its record high set in December. Traders are betting on an RBA cut in February (and 100bp of cuts this year) which is helping to support the market. Yet I doubt the ASX will simply break to a new high without a fresh catalyst. Comparing the ASX 200 cash and futures market and their key levels, I explain why.

Matt Simpson, Market Analyst at City Index and Forex.com

ASX futures tease bearish with a potential swing highSanta's rally put in a poor performance this year. ASX futures sold off into Christmas before the 200-day SMA and 8000 handle came before the market eked out a weak comeback into the new year. Yet price action on the daily chart suggests we could be approaching a swing high.

It appears we're in a third wave higher from 8000, yet momentum lacks the legs of the initial bounce to suggest an ABC correction could be nearing an end. The 50-day SMA has so far capped today's rally and could leave a bearish pinbar should it close the day around current levels. A multi-week bearish divergence has formed on the RSI (14) and the daily RSI (2) is approaching overbought.

The bias is to fade into moves towards the 50-day SMA and target the November low. But if appetite for risk truly sours, we could see prices break beneath the 200-day SMA and 8000 level and head for the lower trendline of the rising channel.

MS

ASX 200: Is the Santa Rally Finally on the Runway?Did we just see the start of the ‘Santa Rally’ on Australia’s ASX 200? If the daily candle on SPI futures finishes around these levels, the price signal will likely embolden those who have been pining for its arrival.

As things stand, we’re looking at a key reversal with the body and range greater than the candle of 24 hours earlier, pointing to the potential for an extended run higher. RSI (14) has broken its downtrend – hinting at a shift in price momentum – although MACD is yet to confirm the signal.

While the timing of the futures contract roll emphasises the need for risk management, with just a handful of trading days left until Christmas, this has often been a strong seasonal period Australian stocks.

If the price closes above 8310, one setup to consider would be to initiate longs above the level with a stop beneath for protection, targeting the downtrend established from the record highs. A break of that level may open the door for a larger thrust, possibly towards 8420 or 8480.

The price needs to overcome 8353 for the setup to succeed, meaning traders should be on alert for signs of hesitancy from this known reversal level. If the price were to close beneath 8310, the bullish setup would be invalidated.

Good luck!

DS

ASX dragged lower by the DowThe Dow Jones futures market fell for an 8th consecutive day on Monday, a bearish sequence not seen in over 12 years. And that's not good news for ASX 200 bulls, as the index tends to track the Dow very closely.

The daily chart looks like it wants to head to 8200, and it just 1 - 2 bearish trading days away from it looking at a typical day's range. The 1-hour trend has favoured bearish swing traders, who could seek to fade into moves towards the 20-50 hour EMAs.

ASX 200 futures look set to bounceThe Nasdaq reached a record high and the S&P 500 is close to reaching its own record high. So while the Dow was lower for a fourth day, 2 out of 3 indices rising could help support the ASX today.

It's been over a week since the ASX began retracing from its record high, and with prices now trying to form a base above the monthly pivot point and historical weekly VPOC (volume point of control), I'm now looking for longs.

The ASX has opened lower but remains within the overnight range. Assuming prices hold above the spike low, the bias is for a move higher to last week's VAL (value area low) or VPOC.

ASX 200 futures could tease bears at these highsThe ASX 200 futures market has struggled to retest 8500, after a brief and uninspiring spell above it. Overnight gains on Tuesday were seen on low volumes, and Wall Street indices have provided a weak lead today. A bearish divergence has also formed on the daily and 1-hour chart.

While prices have rebounded from the weekly pivot point, price action looks corrective. Hence the bias for it being a corrective channel that could break to the downside.

If we see prices rise at the open, I am on guard for it being a 'last hurrah", which could make it a suitable market to fade into with a stop above the record high. The weekly pivot (8390), weekly VPOC (8348) and weekly S1 around 8300 make viable downside targets for bears.

MS

Australian ASX 200 SPI futures look good if you're a bearThe picture for Australian ASX 200 SPI futures look good if you're a bear.

We've seen a bearish engulfing candle on Wednesday with follow-through selling today, accompanied by an uptick in volumes. Momentum indicators are providing bearish signals, too.

But it is month-end and the price does find itself sitting on the 50DMA, a level that has been respected consistently apart from a period between June and July this year.

Even though price and momentum signals suggest selling rallies may work better than buying dips in near-term, unless we see a close beneath the 50DMA, going short beforehand comes across as a low probability play given prior interactions with the level.

If the price closes and holds beneath the 50DMA, you could sell with a stop either above it or 8200 for protection. On the downside, 8080 is the first level of note, but to make the trade stack up from a risk-reward perspective, 7860 comes across as a more appropriate target.

Good luck!

DS