UniCredit: One Step Away from 30% in Alpha Bankhe relationship between UniCredit and Alpha Bank is reaching a turning point, as all indications suggest the Italian banking giant is accelerating its push to acquire more than 30% of the Greek systemic lender. If confirmed, the move would not only make UniCredit the dominant shareholder but also allow it to fully consolidate Alpha’s earnings under IFRS standards.

After acquiring the stake held by Dutch investor Rob Holterman, UniCredit brought its holding close to 20%. Following stalled merger talks with Germany’s Commerzbank and Italy’s Banco BPM, attention has now firmly shifted to Greece. Athens is becoming a strategic hub, and Alpha Bank the key growth vehicle.

The timing aligns with UniCredit’s record Q2 2025 profits (+25%), supported by strong liquidity and capital. Behind-the-scenes efforts are reportedly underway, potentially involving secondary market purchases or private deals with current shareholders.

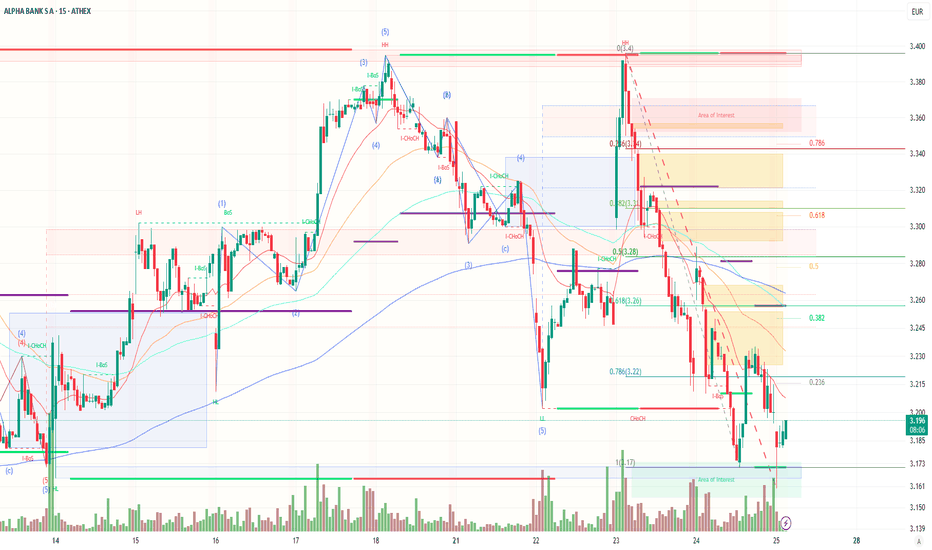

Technical Analysis

Alpha Bank’s stock (ATHEX: ALPHA) trades at €3.186, currently in a corrective phase after completing a strong five-wave bullish cycle peaking at €3.384. A clear A-B-C retracement has followed, with support emerging near €3.17, confirmed by high-volume buying. The stock faces key resistances at €3.245 and €3.28 (Fibonacci 0.382 & 0.5 levels), which it must reclaim to reverse the short-term downtrend. Failing that, a break below €3.17 could trigger further downside. Market structure shifts (CHoCH, BoS) suggest high sensitivity to any new buying pressure. Investor sentiment around UniCredit’s strategic intentions may be the catalyst for the next major move.

ALPHA trade ideas

Alpha Bank Shows Impressive Performance Alpha Bank Shows Impressive Performance in the First Nine Months of 2024, with Positive Indicators Boosting Investor Confidence and Paving the Way for Upgraded Forecasts for the Rest of the Year.

Alpha Bank reported adjusted net profits of €666 million, showing a 16% annual increase, while net profits reached €489 million. The impressive increase in earnings per share to €0.27 highlights the bank's profitability, with a return on equity of 14.4%.

Net interest income showed a 2% annual increase, while fee income saw an impressive rise of 11%, reaching €306 million. This growth in fee income reflects the bank’s success in diversifying its revenue streams and expanding into payment and wealth management services.

The non-performing exposure (NPE) ratio stands at a low 4.6%, underscoring the resilience of the bank’s portfolio and prudent risk management. Meanwhile, the cost of risk has been significantly reduced to 63 basis points, contributing to the improvement in the bank’s asset quality.

The increase in loans by 8% and deposits by 10% reflects strong customer confidence and the continuous strengthening of the bank’s portfolio. Alpha Bank seems to be adapting exceptionally well to the increased market needs, especially in the business loan segment.

The bank’s balance sheet is well-structured to withstand interest rate reductions, with strong capital adequacy and a proper asset allocation. This provides stability and protection against potential market fluctuations, with minimal impact on net interest income.

The increased demand for business loans is reflected in a 67% rise in corporate loans since 2018, with Alpha Bank outperforming the sector average in loan growth. The positive trend in loan demand is expected to continue, offering further growth opportunities.

Alpha Bank holds a leading position in wealth management, with the largest mutual funds under management in Greece. The expected increase in fee income by 2026, particularly in the payments and wealth management sectors, supports the bank's strategy for revenue diversification.

The bank is on track for further growth in earnings per share, with an expected return reaching €0.35 by 2026, thanks to continuous improvements in operational efficiency and strong financial performance.

Alpha Bank’s capital adequacy is higher than the average of Greek banks, with a CET1 ratio of 15.5%, while over 30% of its market cap is expected to be distributed as dividends by 2026. This strong capital base enables management to reward shareholders while maintaining sufficient capital reserves.

Detailed Financial Data of Alpha Bank for the First Nine Months of 2024

Net Interest Income

Net interest income amounted to €1.243 billion for the first nine months of 2024, showing an annual increase of 2%. Despite stable interest income in recent quarters (€410 million in Q3 2024), the bank manages to maintain a steady income in its core area.

Fee Income

Fee income reached €306 million, up 11% compared to the same period in 2023. This increase confirms the effectiveness of the bank’s strategies to diversify its revenue sources, primarily through payment services and wealth management.

Trading and Other Income

Trading and other income saw an impressive 81% increase, reaching €95 million. This reflects the bank’s success in seizing opportunities in the markets and other investment activities.

Operating Income and Expenses

Operating income for the first nine months of 2024 amounted to €1.643 billion, up 6% compared to the previous year.

Total operating expenses remained steady at €627 million, with no change, indicating successful cost management despite increased activity. The combination of revenue growth and expense stability demonstrates the bank’s improved efficiency.

Pre-Provision Income

Pre-provision income increased by 11%, reaching €1.016 billion. This increase is particularly significant as it strengthens the bank’s resilience to potential risks and lays the groundwork for healthy growth.

Impairment Losses

Impairment losses decreased by 20%, amounting to €173 million. This reduction is very positive, reflecting the improvement in the bank’s portfolio quality and reduced need for provisions against bad loans.

Profit Before Tax

Profit before tax amounted to €838 million, marking a significant increase of 18% compared to the same period last year. This increase reflects the positive impact of cost management and increased revenues.

Net Profit After Tax

Net profit after tax amounted to €489 million, showing a slight decrease of 2% compared to 2023. Although this decrease might seem negative, it is offset by the increase in adjusted net profits.

Adjusted Net Profit After Tax

Adjusted net profit after tax increased by 16%, reaching €666 million. This increase reflects the bank's strong financial performance and positive results without the impact of extraordinary expenses or other adjustments.

Alpha Bank Shares Show Several Positive Indicators According to Analysts:

Undervalued Market Price: Alpha Bank shares are trading at levels significantly below their estimated fair value, with a 55.5% discount. This means it offers substantial value for investors seeking to benefit from its potential future appreciation.

Earnings Growth Forecast: Alpha Bank’s earnings are forecasted to grow at an annual rate of 18.2%, significantly exceeding both the market average and savings rates. Additionally, historical data show a 25.5% annual growth in earnings over the past five years.

Analysts’ Consensus for an Upward Trend: Analysts are optimistic and agree that Alpha Bank’s stock price will rise by around 49.2% over the next year. This reflects market confidence in the company’s potential.

Valuation Based on Price-to-Book Ratio (PB): The price-to-book ratio for Alpha Bank shares is at 0.5x, indicating that the market values the stock at a very low level compared to its net book value. This suggests the stock could be a good buying opportunity relative to its sector.

Strong Financial Health: Alpha Bank shows adequate deposit levels and healthy loan levels, with an appropriate loan-to-deposit ratio of 70%. Although non-performing loans are at 3.8%, this percentage is not high enough to pose a risk, and the company has sufficient provisions for bad loans.

Expected Revenue Growth: Although the forecasted annual revenue growth is 7.9%, this rate is positive for the company’s growth prospects, surpassing the market forecast (5.1%).

Technical Analysis

The technical analysis of Alpha Bank’s stock shows a strong upward trend, supported by various indicators and support and resistance levels.

Moving Averages (EMA)

The Exponential Moving Averages (EMAs) for 20, 50, 100, and 200 periods indicate an upward trend, with the stock trading above all these levels, signaling strong bullish momentum.

Relative Strength Index (RSI)

The RSI is at 80.72, indicating that the stock is in the overbought zone. While this suggests high demand and bullish momentum, it also poses a risk for a possible correction.

MACD (Moving Average Convergence Divergence)

The MACD line (0.0359) is above the signal line (0.0278), indicating an upward trend. The positive value of the Histogram (0.0081) further reinforces the bullish trend.

Trading Volume

Volume is on an upward trend, with a total volume of 1.777 million. The increase in volume supports the upward movement, as it indicates growing investor interest in buying the stock.

Fibonacci Levels

The Fibonacci levels confirm support and resistance points:

0.618 level at 1.4680 serves as support.

Level 1 at 1.4960 also acts as a significant support level.

Support and Resistance Levels

R1 (Resistance 1): 1.5495, which has been exceeded, with the current stock price slightly above this level.

R2 (Resistance 2): 1.5795, which could act as a point of slowing the upward trend.

S1 (Support 1): 1.4275, providing fundamental support in case of a correction.