ATHUSDT trade ideas

$ATH Sitting at ATL Support, Reversal Loading?TSX:ATH is sitting at the ATL support, RSI is in the oversold range.

And in the LTF, it is forming bullish divergence,

which is a trend reversal pattern, as we all know.

Accumulate above $0.0256 with SL of $0.0233 or consider if any daily close below $0.026.

DYOR, NFA

#ATHUSDT #Altseason2025

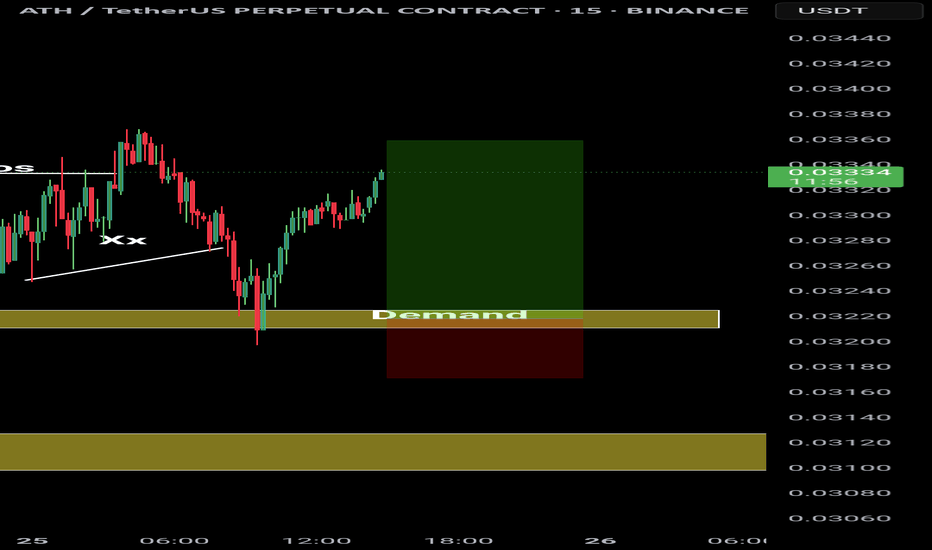

ATH/USDT Reversal Play from Strong Demand Zone! Potential 100%AETHR/USDT Daily Analysis – June 26, 2025

AETHR has reached a key demand zone around 0.024–0.028 USDT, which has historically acted as a strong support area. The price has formed a clear double bottom structure and is currently showing early signs of a bullish reversal.

📌 Key Observations:

Strong bounce expected from the 0.024–0.028 zone.

First resistance levels to watch:

🔹 0.03195 (minor resistance)

🔹 0.03673

🔹 0.04096

Medium-term targets:

🔸 0.05093

🔸 0.05729

🔸 0.06820

Ultimate bullish target zone:

🔺 0.07605 – 0.08935

📉 Invalidation Level: A daily close below 0.02413 (previous swing low) could invalidate this bullish setup.

ATH/USDTKey Level Zone: 0.05030 - 0.05050

LMT v1.0 detected.

The setup looks promising—price previously trended upward with rising volume and momentum, then retested this zone cleanly. This presents an excellent reward-to-risk opportunity if momentum continues to align.

Introducing LMT (Levels & Momentum Trading)

- Over the past 3 years, I’ve refined my approach to focus more sharply on the single most important element in any trade: the KEY LEVEL.

- While HMT (High Momentum Trading) served me well—combining trend, momentum, volume, and structure across multiple timeframes—I realized that consistently identifying and respecting these critical price zones is what truly separates good trades from great ones.

- That insight led to the evolution of HMT into LMT – Levels & Momentum Trading.

Why the Change? (From HMT to LMT)

Switching from High Momentum Trading (HMT) to Levels & Momentum Trading (LMT) improves precision, risk control, and confidence by:

- Clearer Entries & Stops: Defined key levels make it easier to plan entries, stop-losses, and position sizing—no more guesswork.

- Better Signal Quality: Momentum is now always checked against a support or resistance zone—if it aligns, it's a stronger setup.

- Improved Reward-to-Risk: All trades are anchored to key levels, making it easier to calculate and manage risk effectively.

- Stronger Confidence: With clear invalidation points beyond key levels, it's easier to trust the plan and stay disciplined—even in tough markets.

Whenever I share a signal, it’s because:

- A high‐probability key level has been identified on a higher timeframe.

- Lower‐timeframe momentum, market structure and volume suggest continuation or reversal is imminent.

- The reward‐to‐risk (based on that key level) meets my criteria for a disciplined entry.

***Please note that conducting a comprehensive analysis on a single timeframe chart can be quite challenging and sometimes confusing. I appreciate your understanding of the effort involved.

Important Note: The Role of Key Levels

- Holding a key level zone: If price respects the key level zone, momentum often carries the trend in the expected direction. That’s when we look to enter, with stop-loss placed just beyond the zone with some buffer.

- Breaking a key level zone: A definitive break signals a potential stop‐out for trend traders. For reversal traders, it’s a cue to consider switching direction—price often retests broken zones as new support or resistance.

My Trading Rules (Unchanged)

Risk Management

- Maximum risk per trade: 2.5%

- Leverage: 5x

Exit Strategy / Profit Taking

- Sell at least 70% on the 3rd wave up (LTF Wave 5).

- Typically sell 50% during a high‐volume spike.

- Move stop‐loss to breakeven once the trade achieves a 1.5:1 R:R.

- Exit at breakeven if momentum fades or divergence appears.

The market is highly dynamic and constantly changing. LMT signals and target profit (TP) levels are based on the current price and movement, but market conditions can shift instantly, so it is crucial to remain adaptable and follow the market's movement.

If you find this signal/analysis meaningful, kindly like and share it.

Thank you for your support~

Sharing this with love!

From HMT to LMT: A Brief Version History

HM Signal :

Date: 17/08/2023

- Early concept identifying high momentum pullbacks within strong uptrends

- Triggered after a prior wave up with rising volume and momentum

- Focused on healthy retracements into support for optimal reward-to-risk setups

HMT v1.0:

Date: 18/10/2024

- Initial release of the High Momentum Trading framework

- Combined multi-timeframe trend, volume, and momentum analysis.

- Focused on identifying strong trending moves high momentum

HMT v2.0:

Date: 17/12/2024

- Major update to the Momentum indicator

- Reduced false signals from inaccurate momentum detection

- New screener with improved accuracy and fewer signals

HMT v3.0:

Date: 23/12/2024

- Added liquidity factor to enhance trend continuation

- Improved potential for momentum-based plays

- Increased winning probability by reducing entries during peaks

HMT v3.1:

Date: 31/12/2024

- Enhanced entry confirmation for improved reward-to-risk ratios

HMT v4.0:

Date: 05/01/2025

- Incorporated buying and selling pressure in lower timeframes to enhance the probability of trending moves while optimizing entry timing and scaling

HMT v4.1:

Date: 06/01/2025

- Enhanced take-profit (TP) target by incorporating market structure analysis

HMT v5 :

Date: 23/01/2025

- Refined wave analysis for trending conditions

- Incorporated lower timeframe (LTF) momentum to strengthen trend reliability

- Re-aligned and re-balanced entry conditions for improved accuracy

HMT v6 :

Date : 15/02/2025

- Integrated strong accumulation activity into in-depth wave analysis

HMT v7 :

Date : 20/03/2025

- Refined wave analysis along with accumulation and market sentiment

HMT v8 :

Date : 16/04/2025

- Fully restructured strategy logic

HMT v8.1 :

Date : 18/04/2025

- Refined Take Profit (TP) logic to be more conservative for improved win consistency

LMT v1.0 :

Date : 06/06/2025

- Rebranded to emphasize key levels + momentum as the core framework

ATHUSDT breakdown alertATHUSDT breakdown alert

ATHUSDT has broken down from a triangle pattern and seems to have completed a retest of the breakdown level. If the price continues to reject that zone, it could confirm bearish momentum and lead to further downside movement.

Key levels to watch:

– Retest zone acting as resistance

– Immediate support levels below

– Volume confirmation on rejection

Stay alert — if the retest holds, ATHUSDT may continue its downward move.

ATH (Range) Breakout - retest on Golden Fib

After forming a range on the 1h timeframe, ATH successfully broke out and sweeped the liquidity above, before retesting the Golden Fib level below perfectly.

Strong Support level at 0.052 held, and has shown us the initial reaction was a push upwards with momentum. Providing us with a clean entry for the next push to 0.56 level.

Aethir $ATH - Channel based TALooks like liquidity was taken from under the lower channel.

We should now see a swing to take out the liquidity at the top of

this channel. After consolidation, we'll push into the next channel

(Equal height of the first in LOG scale), and target the upper bounds

of this one. Athir has enormous potential, so $1 is a first stage target.

ATH Crossing 7 day High - Breakout on 1h chartConfirmed breakout on the 1h timeframe, successfully establishing a new 7-day high. With an daily volume increase of at least 10-20% - Market cap is rising fast, expenationally.

This is a legit project, ATH is like Google Cloud or Amazon Web Services - but takes payments in Cryptocurrency instead of Visa cards. This is a huge industry, especially since people need Cloud Computing to create AI programs. And guess what? ATH specialized in high end GPU''s, exactly those NVIDIA chips required for large AI models. I am still waiting for some lower end GPU's to come available for the creation of web applications, but I think they will add it soon.

Even if you are a day trader, buying ATH is a solid investment, forget about stop loss.

ATH/USDTENTRY

TP

SL

Aethir is a decentralized, real-time rendering network unlocking content accessibility in the Metaverse. Aethir builds scalable, decentralized cloud infrastructure (DCI). Their network helps gaming and AI companies - big or small - put their product directly in the hands of consumers, regardless of where they live or the hardware they own. Aethir solves market fragmentation in a way only the decentralized cloud can

ATH is Ready to Break Out? TSX:ATH is showing a solid accumulation zone between $0.061 and $0.068, with strong support around the 0.618 Fibonacci level ($0.061).

If ATH can maintain this range and successfully break the upper trend resistance, a bullish move could be on the horizon! 🚀

Stay patient and manage your risks!

DYOR & NFA

#Crypto #Altseason2025

ATH/USDT Forming Higher Lows: A Must-Watch AI CoinATH/USDT is currently trading within a wide sideways zone. The price is moving upward, supported by a rising trendline marked in black, and consistently forming higher lows.

As an AI-driven coin with strong fundamentals, it’s worth adding to your watchlist.

DYOR, NFA

#ATH/USDT a Solid Investment Opportunity!10X POTENTIAL!TSX:ATH : A Cheaper and Better Alternative to CRYPTOCAP:RENDER

TSX:ATH is emerging as a strong competitor to CRYPTOCAP:RENDER , offering decentralized GPU rendering services for digital creators at a more cost-effective price point. While RENDER leads in market cap and adoption, ATH is catching up with its blockchain-based approach and value-driven proposition.

ATH Market Cap: $374.75 million

RENDER Market Cap: $3.46 billion

If ATH reached RENDER's market cap, it could potentially deliver a 10x return from its current levels. This potential is why ATH remains one of my largest holdings.

If you feel that FOMO, focus on accumulating fundamentally strong coins like ATH, which feature robust use cases and display bottom-reversal chart patterns.

##Why TSX:ATH is a Strategic Accumulation Opportunity

Due to the ongoing bearish market conditions, nearly all altcoins, including ATH, are under pressure. However, this creates a golden opportunity to accumulate quality projects.

I hold a low-leverage futures position with an average entry of around $0.75, and I plan to add more if the price dips further. My target is $4-$5, especially if the much-anticipated altseason materializes.

For spot entries, the $0.054-$0.066 range is an excellent zone to accumulate. With strong fundamentals and promising potential, ATH remains a key project to watch.

Note: Always conduct your own research (DYOR) before making any investment decisions.

If you found this analysis helpful, don’t forget to hit the **like button** and share your thoughts in the comments below!

Thank you and #PEACE ✌️

ATHUSDT | AI & Altcoin 3X-5X Candidates | Near Term (4HR)ATHUSDT | AI & Altcoin 3X-5X Candidates | Near Term (4HR)

Based on concept of money flow... BTC, then ETH, then Large Caps, Then Mids and Smalls, I am personally heavier skewed loaded up on mid to small cap coins with bullish chart setups and high profit potentials.

With the recent price action from BTC, we are just a matter of days/weeks away from the altseason. I think the most prevalent sector to invest in right now ahead of this moment, will be AI, Supporting Infrastructure, Gaming, and Web3.

As part of my profit taking strategy, I like to go through and map out potential levels of interest based on semi-bullish to very bullish mock up price action using fractals and fibs.

Bulleted below my top AI picks and top speculative altcoin picks that for me, have the highest possible profit potential in the shortest amount of time, along with where I trade them. Below that, are some of my related near term and mid term chart ideas.

DSYNC (Coinbase Wallet)

HASHAI (Coinbase Wallet)

ANYONE (Coinbase Wallet)

AIOZ (Coinbase, Uphold)

IO (BloFin)

ATH (BloFin)

ARKM (BloFin)

MYRIA (BloFin Futures)

GRASS (BloFin Futures)

GRT (Coinbase)

JASMY (Coinbase)

VRA (Coinbase Wallet)

GLMR (BloFin)

ETC (Coinbase)

DOT (Coinbase)

ALGO (Coinbase)

GPUUSDT | AI & Altcoin 3X-5X Candidates | Near Term (4HR)

IOUSDT | AI & Altcoin 3X-5X Candidates | Near Term (4HR)

AIOZUSDT | AI & Altcoin 3X-5X Candidates | Near Term (4HR)

ANYONEUSDT | AI & Altcoin 3X-5X Candidates | Near Term (4HR)

www.tradingview.com

HASHAIUSDT | AI & Altcoin 3X-5X Candidates | Near Term (4HR)

DSYNCUSDT | AI & Altcoin 3X-5X Candidates | Near Term (4HR)

DOTUSDT | Personally Loading Here | Mid Term (1D)

ALGOUSDT | Personally Loading Here | Mid Term (1D)

VRAUSDT | Personally Loading Here | Mid Term (1D)

GRASSUSDT | Mapping Out Possibilities | Near Term (12HR)

ALGOUSDT | Mapping Out Possibilities | Near Term (12HR)

GRASSUSDT | Mapping Out Possibilities | Mid Term (1D)

MYRIAUSDT | Mapping Out Possibilities | Mid Term (1D)

CSPRUSDT | Mapping Out Possibilities | Mid Term (1D)

XCHUSDT | Buy Now, Thank Later | Near Term (4HR)

VRAUSDT | Buy Now, Thank Later | Near Term (4HR)

CSPRUSDT | Buy Now, Thank Later | Near Term (4HR)

VRAUSDT | Buy Now, Thank Later | Near Term (4HR)

XCHUSDT | Buy Now, Thank Later | Near Term (4HR)

CSPRUSDT | Buy Now, Thank Later | Near Term (4HR)

VELOUSDT | Buy Now, Thank Later | Near Term (4HR)

OGNUSDT | Buy Now, Thank Later | Near Term (4HR)

DOTUSDT | Buy Now, Thank Later | Near Term (4HR)

Mock Up Price Action for ALGOUSDT | Mid Term (12HR)

MYRIAUSDT | Interested to see where this goes | Mid Term (2D)

Mock Up Price Action for VRA w/ Timeline | Mid Term (3D)

Mock Up Price Action for XCH | Mid Term (12HR)

OGNUSDT | Interested to see where this goes | Mid Term (3D)

Mock Up Price Action for CSPRUSDT | Near/Mid Term (2D)

#ATH primed for a 1000% Gain here's why!!TSX:ATH is a competitor to RENDER – a cheaper and better alternative.

RENDER provides decentralized GPU rendering services for digital creators, while ATH offers similar blockchain-based services with a more cost-effective approach.

If ATH matches RENDER’s market cap, it could 10x from here. That’s why it’s one of my biggest bags.

If you feel that FOMO, focus on accumulating coins like these, strong fundamentals and bottom reversal charts.

ATH is one of the best-looking ones out there and it has already started moving.

DYOR, NFA.

Do share your views in the comment section and hit that like button if you like it.

Thank you

#PEACE