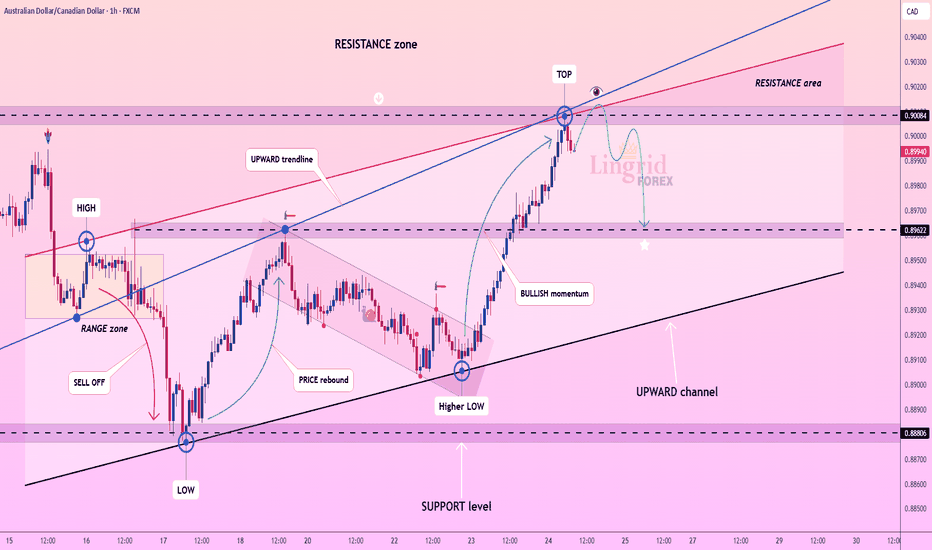

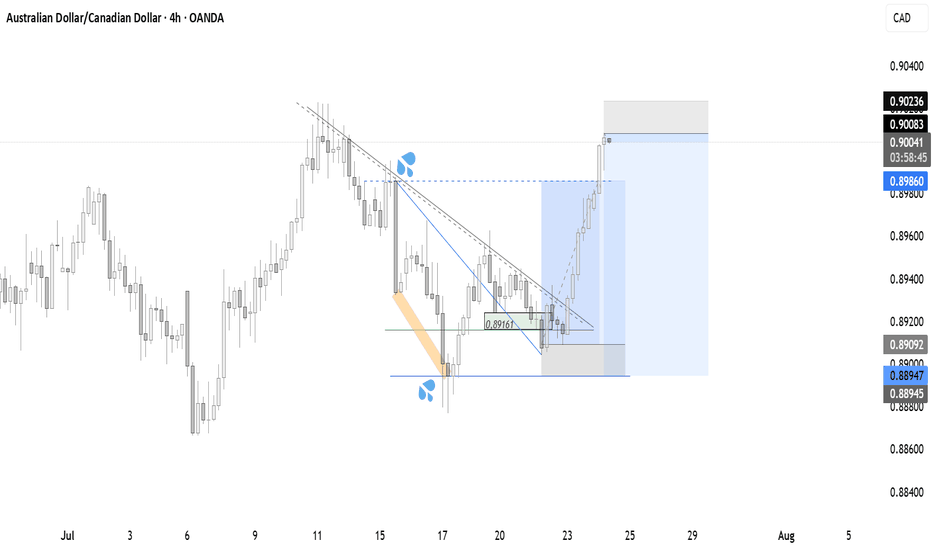

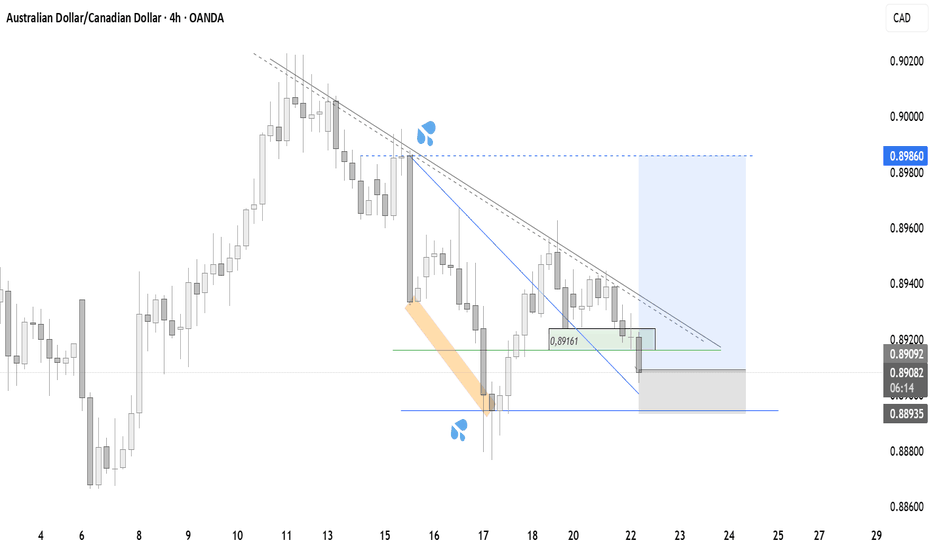

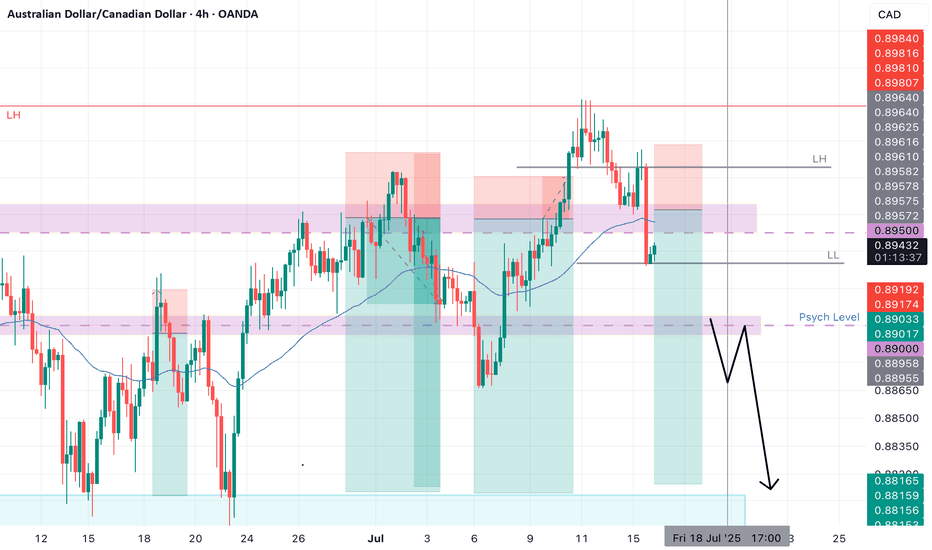

Lingrid | AUDCAD Short Following Resistance Fake Breakout The price perfectly fulfilled my last idea . FX:AUDCAD is rejecting from the top of the resistance zone after a strong bullish impulse and has started forming a rounded top pattern. Price remains inside an upward channel but is showing signs of exhaustion with the blue arrow projecting a pullback. As long as the price stays below 0.9008, we expect a descent toward the 0.8962 region. Momentum is cooling, and a bearish correction is likely before any bullish attempt resumes.

📉 Key Levels

Sell trigger: Break below 0.8990

Sell zone: 0.8995 – 0.9012

Target: 0.8962

Invalidation: Break and close above 0.9025

💡 Risks

Strong bullish momentum may resume if support holds

Failure to break 0.8990 could trap early sellers

Macro data from AUD/CAD region may disrupt the structure

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

AUDCAD trade ideas

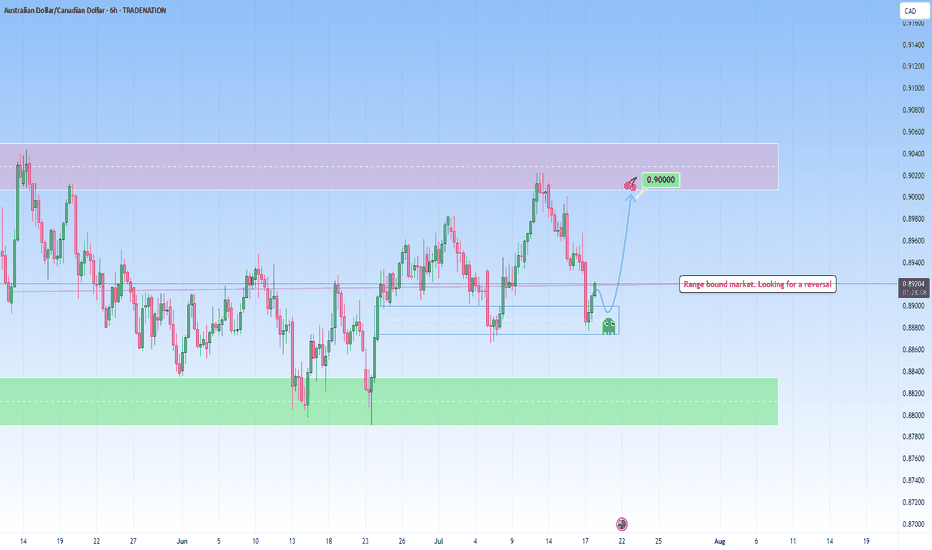

AUDCAD: Respecting Structure, Repeating OpportunityWhat we’re looking at here is a beautifully balanced range market, the kind I love trading, because it speaks so clearly when you take a moment to listen. Price is respecting both sides of this range clearly. The lows are being protected and respected multiple times before.

We’ve already tapped into that lower bound, and the reaction has been good, together with liquidity collecting. And when price finds its feet in these kinds of zones, I immediately think of what the range is offering, right now, with risk clearly defined and reward just sitting at the other edge, waiting.

If price gives us one more small retest, I’m watching for confirmation: not just in candlestick structure, but also in volume behavior. I have my eyes set straight on that upper resistance zone near 0.90000.

And from there unless there’s a news catalyst or volume breakout, that’s where the move likely might exhaust… and that’s where I’m out, before the reversal can bite.

If the structure shifts, I’ll shift too. But until then, this is a perfect range.

Just sharing my thoughts for the charts, this isn’t financial advice. Always confirm your setups and manage your risk properly.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

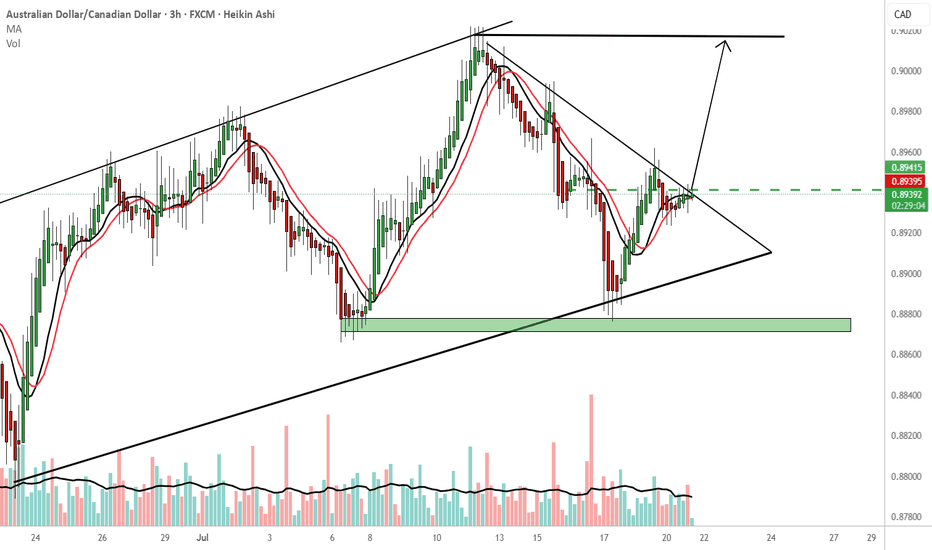

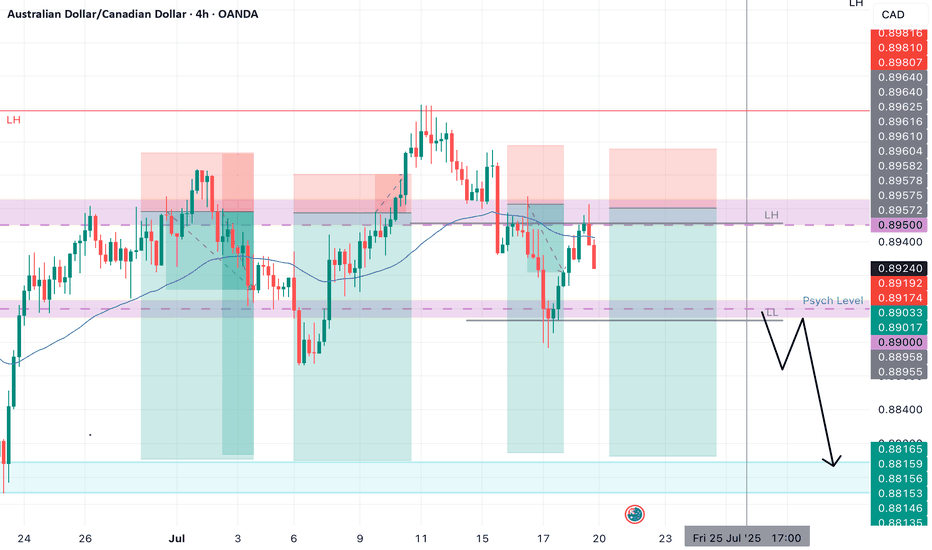

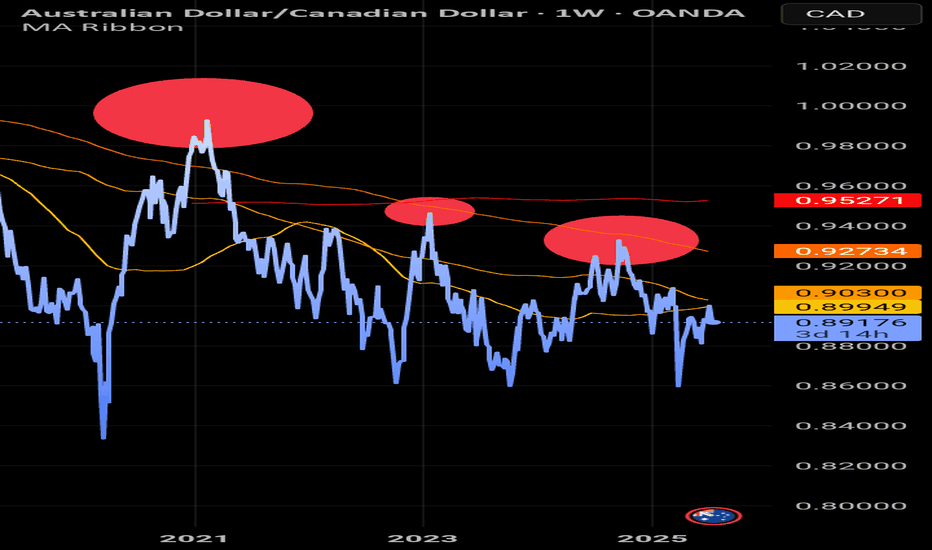

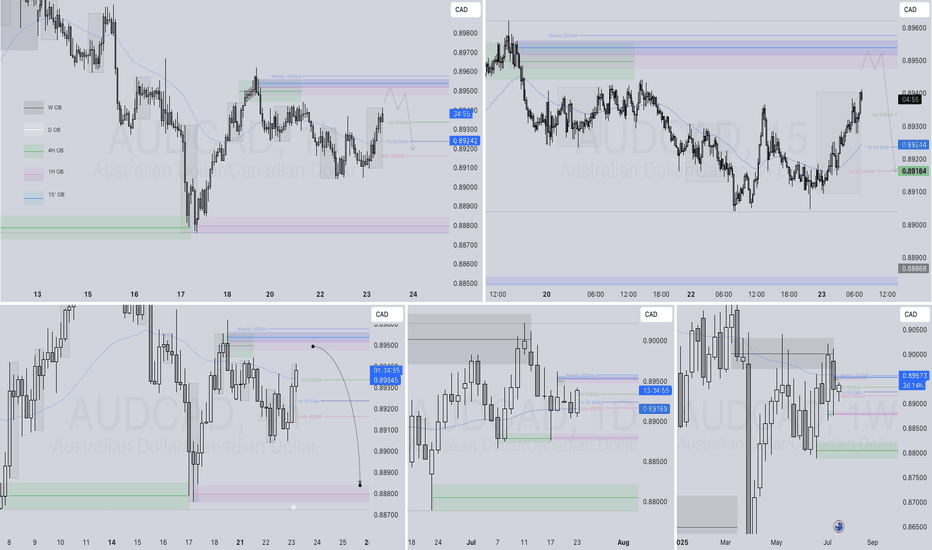

AUDCAD SHORTMarket structure bearish on HTFs DW

Entry at both Weekly and Daily AOi

Weekly Rejection at AOi

Weekly Previous Structure Point

Weekly Rejection at AOi

Daily Rejection at AOi

Daily Previous Structure Point

Around Psychological Level 0.89500

H4 EMA retest

H4 Candlestick rejection

Levels 4.17

Entry 100%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.

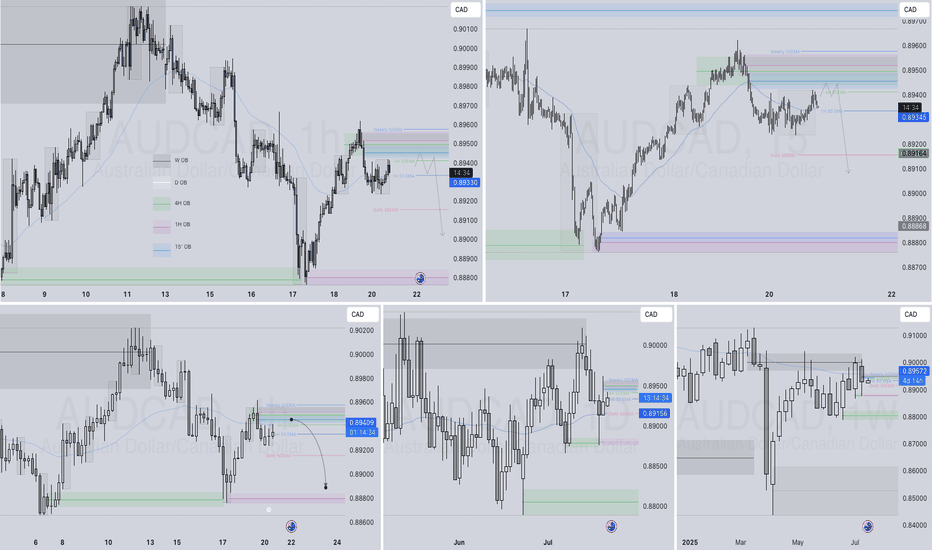

AUDCAD Q3 | D21 | W30 | Y25 📊AUDCAD Q3 | D21 | W30 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FRGNT 📊

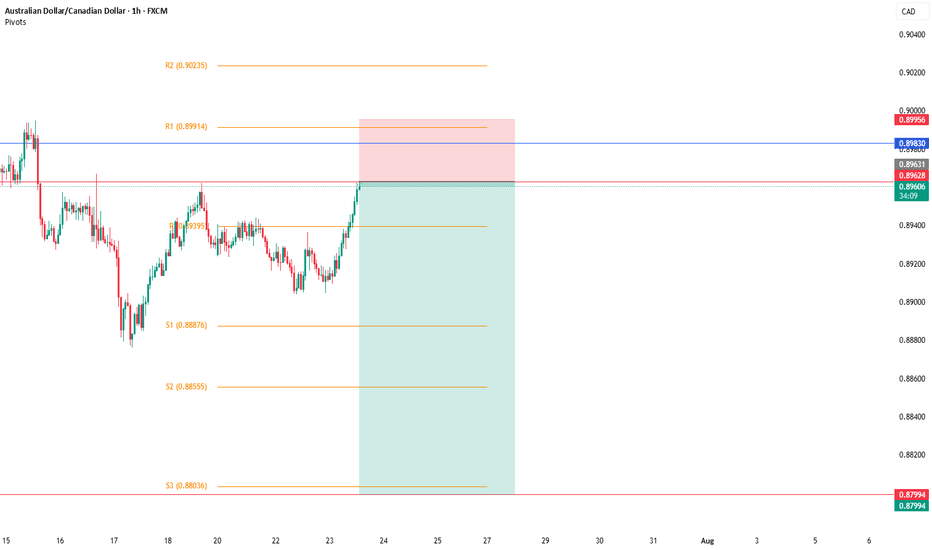

Australian Dollar to Weaken Against Canadian Dollar Over Next 6 AUD/CAD has broken below key support at **0.8900**, confirming a bearish trend. The pair is trading below the 200-day MA (~0.8950), with RSI holding below 50, indicating sustained selling pressure. Next downside targets: **0.8750** (2024 low) and potentially **0.8600** (2023 support zone).

Canada’s oil-linked CAD benefits from resilient crude prices (supply risks, geopolitical tensions), while Australia’s iron ore exports face demand concerns (China slowdown).

RBA may cut rates before the BoC as Australia’s growth slows, while Canada’s sticky inflation delays easing. AUD (risk-sensitive) suffers if global growth fears rise, while CAD gains from safe-haven flows into oil.

CFTC data shows net-short AUD positions growing, reflecting bearish bias. Speculative longs on oil (supporting CAD) remain elevated.

Sasha Charkhchian

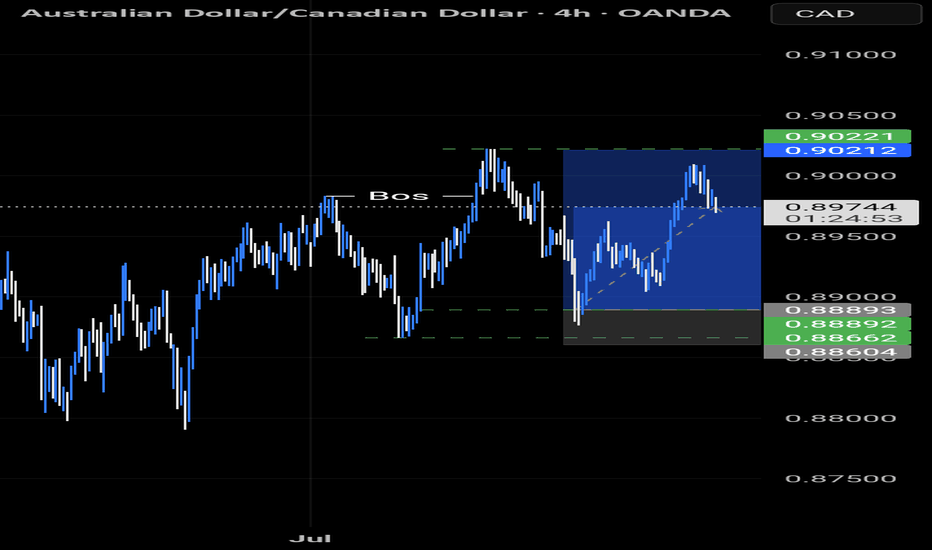

AUDCAD Wk Top Down Bullish Price Action Analysis 1.The weekly price is reaching a premium zone, suggesting a potential reversal or reaction area.

2. Daily BOS + Tap into Daily imbalance FVG.

3. HR is still in a bullish sentiment

4. Waiting for 15 minutes for displacement or BOS

5. Tap into 15 minutes of FVG.

5: Pending price action...

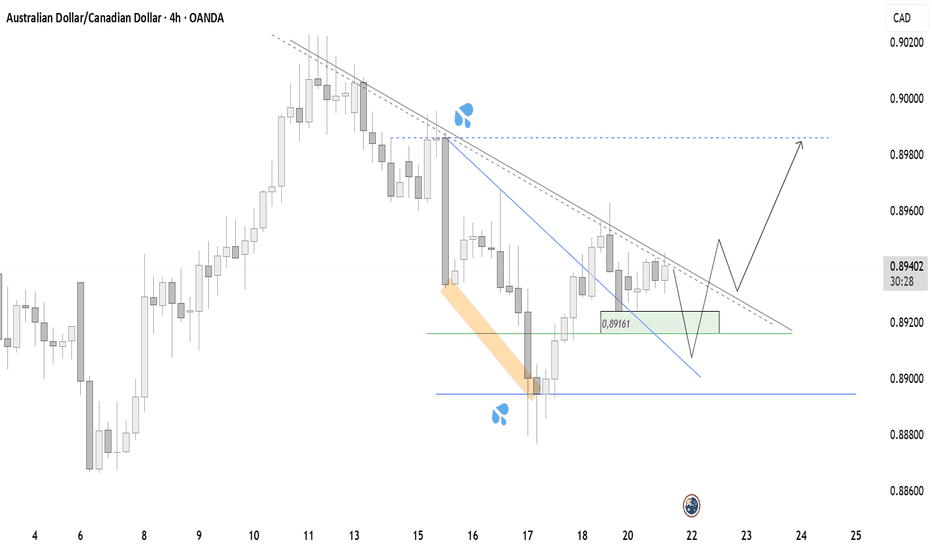

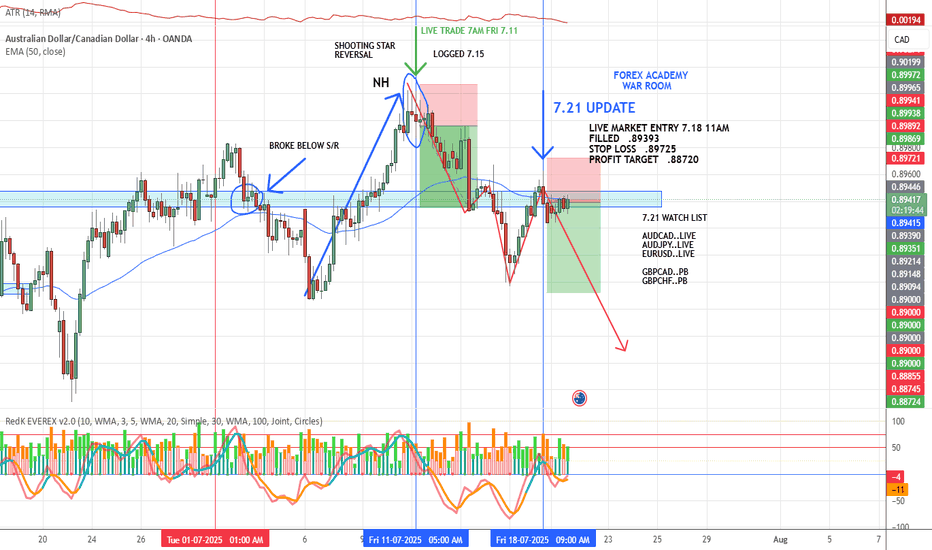

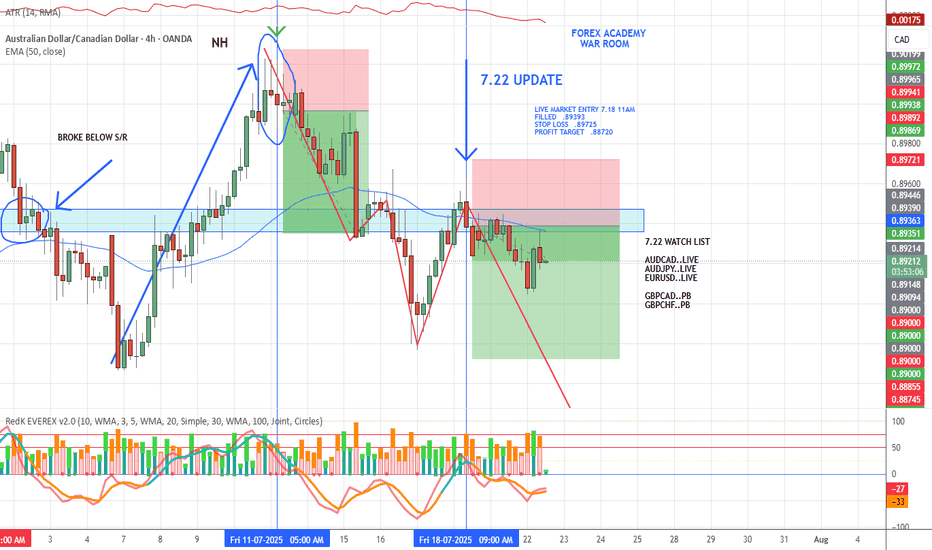

AUD/CAD LIVE TRADE UPDATELIVE TRADE – VMS Pullback Strategy

We entered this trade based on a classic VMS pullback setup:

Price pulled back into a 3-touch S/R zone

Volume and momentum aligned with the direction

Engulfing candle trigger confirmed the move near the 50EMA

Now we’re simply letting the trade play out.

📌 The work is done before entry. Discipline does the rest.

AUDCAD Q3 | D23 | W30 | Y25📊AUDCAD Q3 | D23 | W30 | Y25

Daily Forecast🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FRGNT

AUDCAD SHORTMarket structure bearish on HTFs 3

Entry at both Weekly and Daily AOi

Weekly Rejection at AOi

Weekly Previous Structure Point

Weekly Rejection at AOi

Daily Rejection at AOi

Daily Previous Structure Point

Around Psychological Level 0.89500

H4 EMA retest

H4 Candlestick rejection

Rejection from Previous structure

Levels 4.17

Entry 120%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.

AUDCAD Trade plan: Waiting for bullish confirmation at RetestPrice broke above resistance with a momentum candle, indicating buyer control. This is our first clue that a structure shift might have occurred.

This retest is essential. Many traders make the mistake of entering too early without confirmation. But it's right here, once price touches the former resistance, that you must observe how price reacts. Look for price exhaustion or reversal candlesticks such as bullish engulfing patterns, or even inside bars.

Once rejection is confirmed, I'm looking to go long to 0.90450.

Just sharing my thoughts for the charts, this isn’t financial advice. Always confirm your setups and manage your risk properly.

Bullish bounce?AUD/CAD is falling towards the support level which is an overlap support that aligns with the 71% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 0.89106

Why we like it:

There is an overlap support that lines up with the 71% Fibonacci retracement.

Stop loss: 0.88668

Why we like it:

There is a pullback support.

Take profit: 0.90090

Why we like it:

There is a pullback resistance.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

121Hello awesome traders! 👋

Hope you’ve managed to grab some solid pips from the markets this week. As we head into the weekend, I’m wrapping things up by dropping a few clean chart setups for you to review and reflect on.

Enjoy the weekend, recharge well — and I’ll see you sharp and ready next week for more structure-led opportunities.

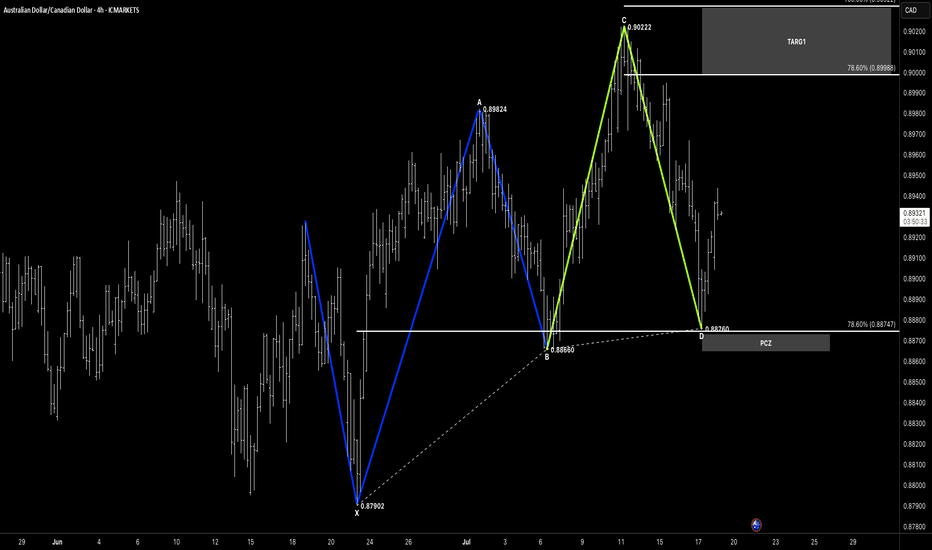

📌 Pattern Breakdown

This one's a 1-2-1 Bullish Formation — clear, clean, and already reacting:

🔹 XA: 0.87902 → 0.89824

🔹 AB retracement → 0.88660

🔹 BC extension: 0.88660 → 0.90222

🔹 CD drops into the PCZ at 0.88760 — aligning with 78.6% retracement

We’ve now seen a clear bullish reaction off the PCZ, confirming it as a valid demand zone.

🎯 Targets Now in Play

With structure holding and price climbing from the PCZ:

✅ Target 1:

• 78.6% = 0.89988

• 100% = 0.90322

🔄 Target 2 (Extension):

• 78.6% = 0.90584

• 100% = 0.91080

We’ll keep managing toward Target 1, then reassess momentum and candle structure for continuation into Target 2 next week.

🧠 Key Concepts in Play

✅ 121 Bullish pattern

✅ Reaction at fib-based PCZ

✅ Controlled impulse off demand zone

✅ Target structure mapped + invalidation clearly below PCZ

🗝 Final Thoughts

Textbook measured move off the 1-2-1 setup, with price now rotating higher from structure.

This is what we look for every week — precision, confirmation, and opportunity.

Let’s protect gains, lock partials near Target 1, and come back Monday with a clear head.

“Structure gives you the zone — reaction gives you the trade.”

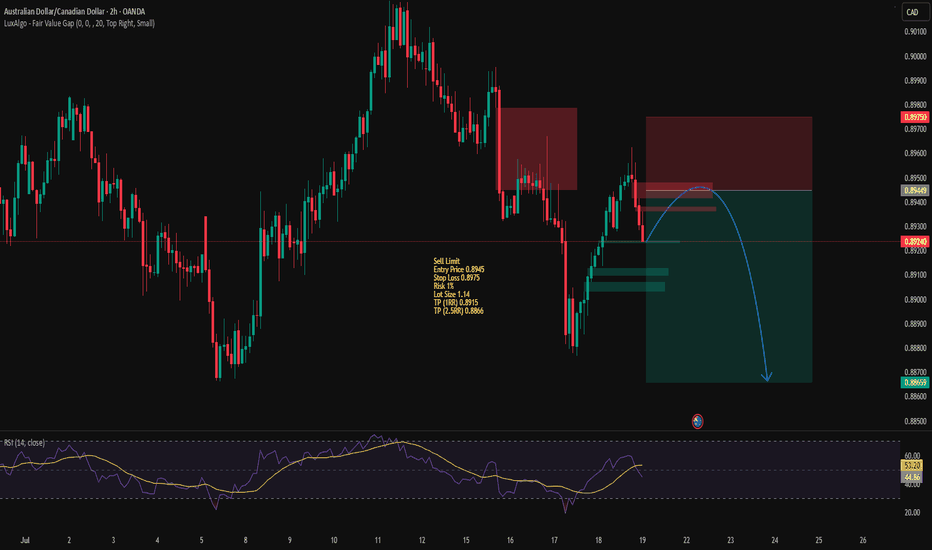

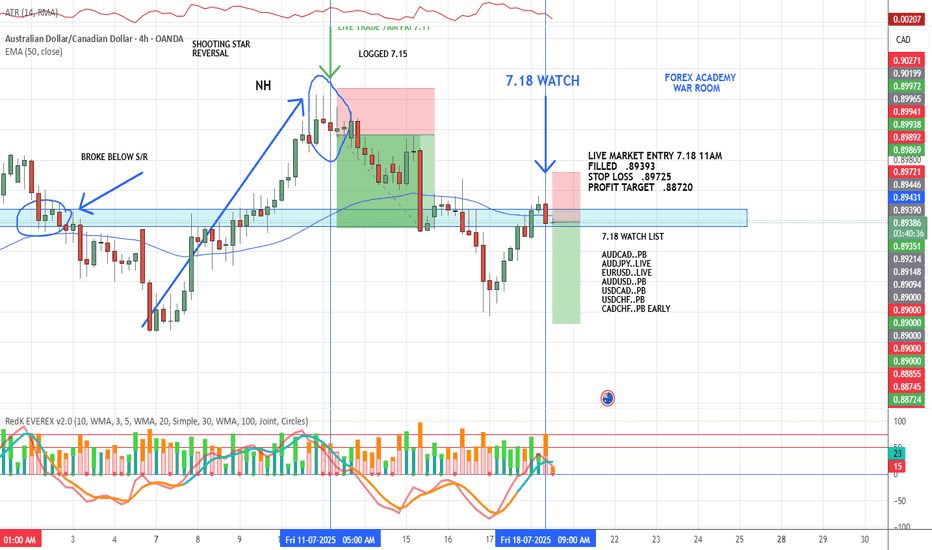

AUD/CAD LIVE TRADE STARTEDAUD/CAD – Short Position Taken

This one was on our watchlist earlier, and it just printed a clean engulfing candle trigger. Here’s what I look for before entering a VMS pullback trade:

A clear new high/low before the pullback

A clean pullback (no choppy mini-pullbacks inside)

Pullback into support/resistance zone

Price action at or near the 50 EMA

Engulfing candle in trend direction

Strong volume (trigger candle should stand out)

Momentum “hooking” in trend direction and below/above 0

We took a short position based on this alignment.

What do you think — continuation or reversal? Up or down from here?

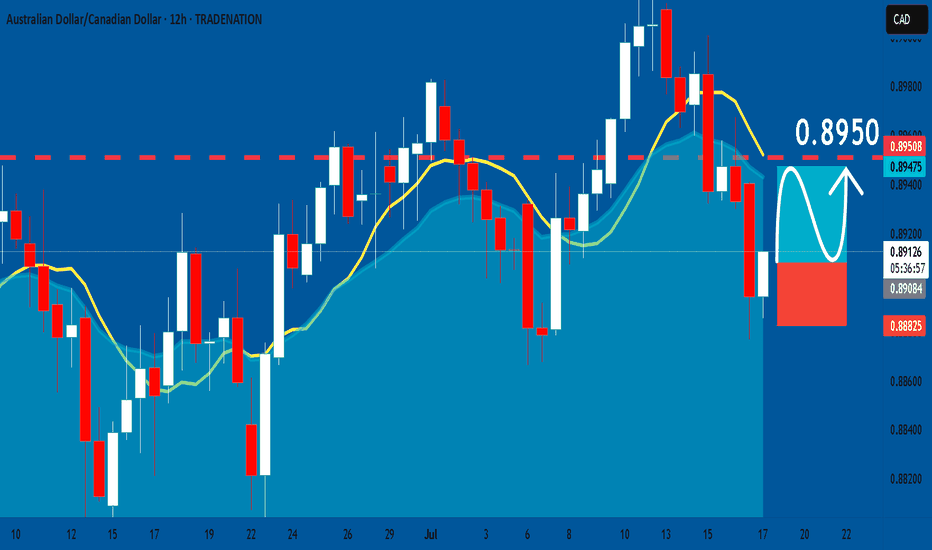

AUDCAD: Long Signal Explained

AUDCAD

- Classic bullish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Long AUDCAD

Entry - 0.8908

Sl - 0.8882

Tp - 0.8950

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️