AUDEUR trade ideas

Bullish reversal?EUR/AUD has bounced off the support level which is an overlap support that aligns with the 61.8% Fibonacci retracement and could rise from this level to our take profit.

Entry: 1.77003

Why we like it:

There is an overlap support level that lines up with the 61.8% Fibonacci retracement.

Stop loss: 1.74799

Why we like it:

There is a pullback support.

Take profit: 1.7974

Why we lik e it:

There is a pullback resistance that lines up with the 61.8% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

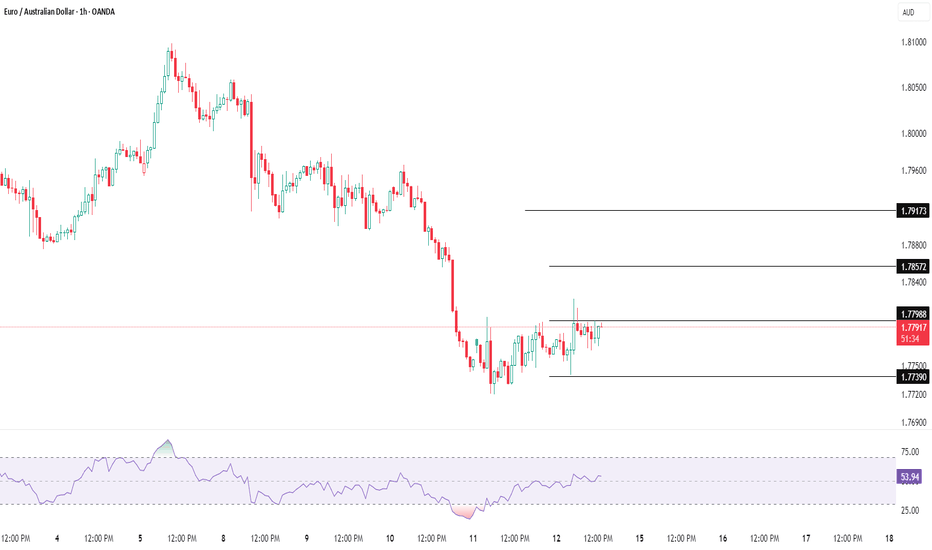

EURAUD – Bearish Flag Breakdown OpportunityThe EURAUD pair is showing signs of trend continuation via a classic bearish flag pattern formation. After a sharp decline, the market has entered into a tight consolidation channel, climbing steadily inside a sloped flag structure. Price is now testing a critical resistance area near 1.7830–1.7840 while hovering just below the 200 EMA.

This setup offers a high-probability sell opportunity — but only after confirmation.

1. Structure Overview

The initial sharp downtrend is followed by a consolidation channel — a textbook bearish flag.

Price is approaching major resistance (1.7830–1.7840) and 200 EMA, acting as a ceiling.

A breakdown from the rising support of the flag is expected to trigger a continuation toward the downside.

2. Trade Plan – Bearish Flag Breakdown

✅ Entry Plan:

Wait for a breakdown of the green support trendline (flag support).

Then, wait for a re-test of the broken support (now resistance).

Enter short only after a bearish candlestick confirmation (e.g., bearish engulfing or rejection wick) on the 15-min or 1-hour chart.

🛡️ Stop Loss:

Place the stop loss just above the major resistance zone, around 1.7835–1.7840.

🎯 Target Zones:

Target 1 (TG1): 1.7755

Target 2 (TG2): 1.7718

Final Target: 1.7632

Risk/Reward Ratio: 1:2, 1:4, 1:9.4+

3. Why This Trade Makes Sense

Bearish Flag is a reliable continuation pattern in strong downtrends.

Price is failing to break above key resistance and 200 EMA.

The flag offers a tight SL and large downside potential — ideal conditions for R:R setups.

Confluence of structure, pattern, and trend all align for short bias.

4. Trade Management Tips

Scale out partial profits at TG1 and TG2, and trail stop for final target.

If breakdown fails, avoid chasing price — re-evaluate bias if price breaks above 1.7840.

5. Final Thoughts

This EURAUD chart is a textbook case of pattern + price action + resistance confluence. The flag structure is well-defined, and the reward-to-risk ratio is significantly favorable if the breakdown confirms.

📌 Watch for:

Breakdown of rising support

Retest and bearish candle

Entry only on confirmation

High-probability setups don’t require prediction — they require preparation.

=================================================================

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

=================================================================

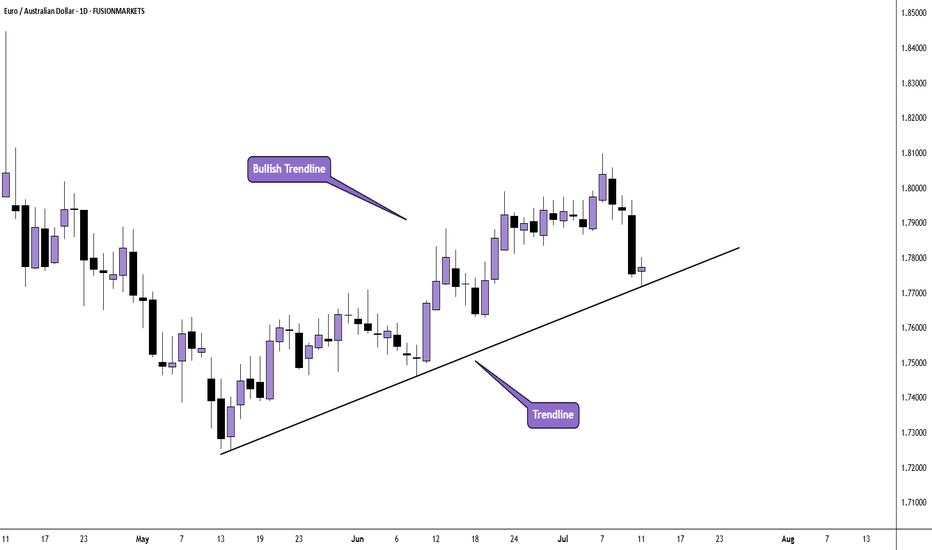

euraud trendline longsSeeing as euraud has well respected the trendlines recently I decided to long eur back into the upper end of previously broken trendline. I am european living in australia, I know first hand how weak aud is agains eur as my salary in australia took a massive hit against euro...

I decided to go all in on this trade with a 2% risk. RR is 1:4 for the final TP, but I do see how trade management is the key for longevity, so I still plan on taking partial profits and moving my stop back to BE as soon as price is hitting 1:1 for BE and 1:2 RR for 50% profit taking.

Let's goo

EURAUD Rebound From 1.77200 is High ProbabilityEURAUD has reached a key support zone near 1.77200, aligning with the ongoing bullish global trend. The current price action appears to be a correction phase, particularly influenced by short-term weakness in the Euro.

According to technical chart conditions, this correction is likely nearing completion. If the 1.77200 support holds, it could serve as a strong buy entry point, then upside target will be 1.79000 and 1.80020

You can see more details in the chart.

if you like this idea if you have on Opinion about this analysis share in comments

EUR/AUD BULLISH BIAS RIGHT NOW| LONG

EUR/AUD SIGNAL

Trade Direction: long

Entry Level: 1.778

Target Level: 1.804

Stop Loss: 1.760

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 8h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EURUAD is in the Buy direction from the Third TouchHello Traders

In This Chart EUR/AUD 4 HOURLY Forex Forecast By FOREX PLANET

today EUR/AUD analysis 👆

🟢This Chart includes_ (EUR/AUD market update)

🟢What is The Next Opportunity on EUR/AUD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

EUR_AUD WILL GO UP|LONG|

✅EUR_AUD is trading in an uptrend

And the bullish bias is confirmed

By the rebound we are seeing

After the pair retested the support

So I think the growth will continue

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURAUD MARKET OVERVIEW - WEEKLY CHART Price’s direction from the weekly perspective looks quite bullish. Technically, we saw how price broke out of the symmetrical triangle pattern and also above the upper resistance of the channel. Therefore, we’re likely to see more bullish growth developments as the upper resistance is currently being retested.

EURAUD Weekly Trade Setup(14 to 18th July 2025) - Head&ShoulderThis week, EURAUD (Euro/Australian Dollar) has entered a critical price zone, providing a textbook technical opportunity for traders. A clear Head & Shoulders pattern has formed on the 4-hour chart, pointing toward a potential trend reversal from bullish to bearish.

Let’s explore how to trade this intelligently from both bullish and bearish perspectives.

1. Bearish Setup – Head & Shoulders Pattern Breakdown

This is the primary trade idea for the week.

✅ Trade Logic:

Price has completed a classic Left Shoulder → Head → Right Shoulder formation.

The neckline (support) will be tested.

The current price is will pulling back to retest the right shoulder resistance zone, offering an ideal short opportunity.

🔻 Entry Plan:

Wait for bearish reversal confirmation (candlestick rejection or bearish engulfing) on the 1H or 4H timeframe.

Enter short once confirmation appears near 1.7850–1.7900.

📉 Stop Loss:

Place SL above the right shoulder high, adjusting for volatility and swing high (around 1.7950).

🎯 Targets:

Target zone: 1.7450–1.7500 (profit booking zone marked on the chart)

Potential Risk/Reward Ratio: 1:2, 1:3, or even 1:4+

2. Alternative Bullish Setup – Reversal at Neckline (High Risk)

This setup is for experienced or aggressive traders who spot early reversals.

✅ Trade Logic:

Price may bounce from the neckline and 200 EMA support area.

If this happens, a temporary bullish reversal may push price back toward the right shoulder zone.

🔺 Entry Plan:

Wait for bullish confirmation (reversal candle) near the neckline and EMA support (around 1.7700).

🚨 Stop Loss:

SL must be below the neckline swing low (around 1.7650).

🎯 Targets:

Resistance zone (right shoulder): 1.7850–1.7900

R:R setups of 1:2 or 1:3 possible

⚠️ This is considered a counter-trend trade and should be traded with caution.

3. Technical Confluence and Indicators

Pattern: Head & Shoulders (bearish reversal)

EMA 200: Price reacting around the long-term trend line

Support/Resistance: Cleanly defined horizontal zones

Reversal zones: Highlighted in red (supply) and green (demand)

4. Final Thoughts

This week’s EURAUD setup is a strong example of structure-based trading. With a well-formed head and shoulders pattern and a clean neckline break, the market signals a shift in momentum.

Safe Approach: Trade the short side after resistance rejection.

Risky Approach: Try a long on neckline bounce with tight SL.

Always confirm with your system and maintain strict risk management. Trade what you see, not what you feel.

Ready to trade? Save this setup, monitor price action, and execute only with confirmation.

=================================================================

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

=================================================================

EUR-AUD Bullish Bias! Buy!

Hello,Traders!

EUR-AUD went down but

A strong horizontal support

Level is below around 1.7690

And as the pair is trading in

An uptrend we will be expecting

A round and a move up

On Monday!

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURAUD Breakdown Incoming? Price + COT + Seasonality🧠 MACRO & INSTITUTIONAL FLOWS (COT)

EURO (EUR)

Strong increase in net long positions by non-commercials: +16,146

Commercials also added long exposure: +25,799

Bias: moderately bullish

AUSTRALIAN DOLLAR (AUD)

Non-commercials remain heavily net short (long/short ratio: 15% vs 63.6%)

Slight increase in commercial longs: +2,629

Bias: still bearish, but showing early signs of positioning exhaustion

COT Conclusion: EUR remains strong, AUD remains weak — but the recent extension calls for caution on fresh EURAUD longs.

📊 SEASONALITY (JULY)

EUR shows historically positive July performance across 2Y, 5Y, and 10Y averages

AUD also shows mild strength, but less consistent

🔎 Net differential: No strong seasonal edge on EURAUD in July

📈 RETAIL SENTIMENT

54% of retail traders are short EURAUD, 46% long

Slight contrarian bullish bias, but not extreme yet → neutral to slightly long

📉 TECHNICAL STRUCTURE – MULTI-TIMEFRAME

1. Weekly Chart

Strong bearish engulfing candle after 4 weeks of upside

RSI dropped below 50 → clear momentum shift

1.7960–1.8100 is now a liquidity zone that’s been tapped

2. Daily Chart

Confirmed break of the ascending channel formed since May

Price reacted from demand zone around 1.7460–1.7720, signaling potential pullback

Watch for rejection around 1.7910 (50% body of the weekly engulfing candle)

3. Entry Setup

Key area for short entries: 1.7910–1.7940

This zone aligns with:

✅ Former support now turned resistance

✅ Inside a valid bearish order block

✅ Ideal retracement level (50% engulfing body)

🎯 OPERATIONAL CONCLUSION

While the macro context still favors a stronger EUR against AUD, price action tells another story.

The weekly engulfing candle is a strong technical reversal signal, and the daily structure confirms the break.

→ Shorting the pullback into 1.7910–1.7940 could offer an excellent R/R trade setup.

Bias: Short-term bearish – Targeting 1.7700, 1.7550, and potentially 1.7315

Invalidation: Daily close above 1.8040

EURAUD The current head of the European Central Bank (ECB) is Christine Lagarde. She has been serving as ECB President since November 2019, Lagarde has emphasized her commitment to steering the ECB through complex economic challenges, including inflation control and adapting monetary policy to evolving global conditions.

the current key interest rates set by the European Central Bank (ECB) are as follows:

Deposit Facility Rate: 2.00%

Main Refinancing Operations Rate: 2.15%

Marginal Lending Facility Rate: 2.40%

These rates were last adjusted on June 11, 2025, when the ECB lowered the key interest rates by 25 basis points (0.25%) to reflect the updated inflation outlook and economic conditions.

Additional Context:

Inflation in the Eurozone is currently around the ECB’s medium-term target of 2%.

The ECB’s Governing Council decided on the rate cut based on a downward revision of inflation projections for 2025 and 2026, partly due to lower energy prices and a stronger euro.

The next ECB interest rate decision is scheduled for July 24, 2025.

ECB Executive Board member Isabel Schnabel recently indicated that the bar for further rate cuts remains “very high” as the economy is holding up well.

Summary Table of ECB Key Rates (as of June 11, 2025)

Rate Type Interest Rate (%)

Deposit Facility Rate 2.00

Main Refinancing Rate 2.15

Marginal Lending Rate 2.40

the Reserve Bank of Australia (RBA) cash rate remains at 3.85%. This decision was made at the RBA’s July 8, 2025 meeting, where the board chose to hold rates steady despite widespread market expectations of a cut to 3.6%

Key Points:

The RBA has signaled that an easing cycle is likely coming, but it wants to wait for the release of the full quarterly inflation data at the end of July to confirm that inflation is on track to decline sustainably toward the target range (2–3%).

Inflation has moderated, with trimmed mean inflation at 2.4% in May, within the target band.

The board was divided: six members voted to hold rates, while three favored a cut.

Market expectations now price in about an 85% chance of a 25 basis point cut to 3.60% at the next meeting on August 12, 2025.

RBA Governor Michele Bullock emphasized that the bank is reacting to domestic inflation and employment data and is prepared to adjust policy as needed, but is not holding rates high “just in case.”

Summary Table

Date Cash Rate (%) Board Decision Next Meeting Expectation

July 8, 2025 3.85 Hold rates steady Likely 0.25% cut at August 12, 2025

Additional Context

The RBA’s cautious approach reflects the need to confirm inflation trends before easing.

The decision surprised markets that had anticipated an immediate cut due to slowing consumer spending and inflation within the target range.

Governor Bullock acknowledged the challenges for borrowers but noted that housing prices, not just interest rates, affect affordability.

EURAUD TRADE MATHE

EU10Y=2.686%

ECB RATE =2.0%

AU10Y= 4.362%

RBA RATE =3.85%

INTEREST RATE DIFFERENTIAL= EUR-AUD=2.0-3.85=-1.85% EURO BASE CURRENCY AND AUD QUOTE. FAVOUR AUD CARRY TRADE.THE TARRIF HAMMER ,AUDSTRALIA AND CHINA TRADE REMAINS A KEY TOOL FOR AUD STRENGTH.

BOND YIELD DIFFERENTIAL= EURO-AUD =2.686%-4.362%=-1.676 FAVOUR AUD .

BUT EURO ZONE ECONOMIC OUTLOOK WILL OFFSET YIELD AND BOND ADVANTAGE AS CHINA AUSTRALIA COMMODITIES MARKET IS DEPENDING MORE ON CHINA ,SO GLOBAL RESTRICTION ON EXPORT WILL GIVE EURAUD LONG POSITION.

#EURAUD

EURAUD: Expecting Bullish Movement! Here is Why:

It is essential that we apply multitimeframe technical analysis and there is no better example of why that is the case than the current EURAUD chart which, if analyzed properly, clearly points in the upward direction.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️