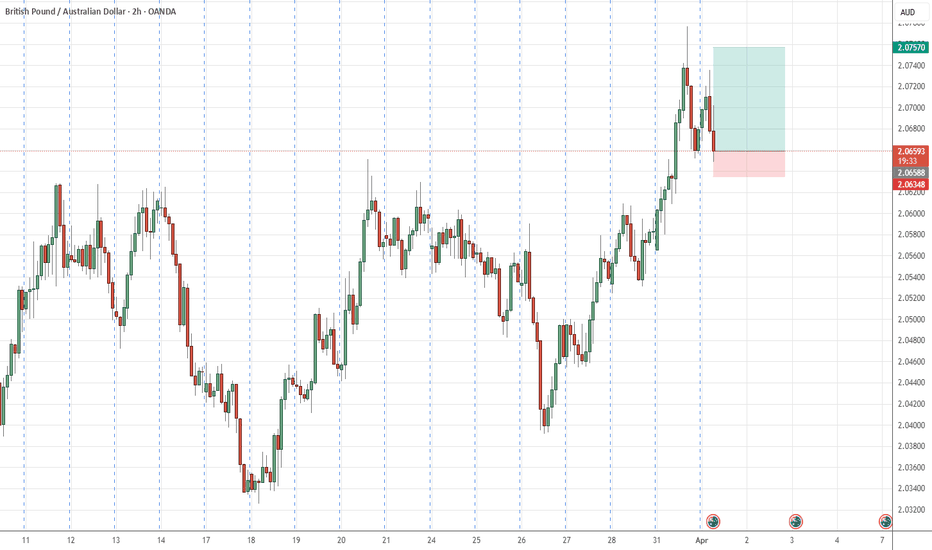

GBPAUD-LONGCash rates came out at 4.10% as expected, causing a small retracement on GA. Im still bullish on GA. Its been consolidating in this zone for a couple of days now and to see price break above confirms bullish momentum and a possible push to our next key level. We will wait for price to reject previous resistance level from our consolidation, and for news that align with our bias before entering buys.

AUDGBP trade ideas

GBPAUD: Important BreakoutThe GBPAUD is currently in a strong bullish trend on a daily basis. Over the past three weeks, the pair has been trading within a horizontal range.

As the market opens after the weekend, the pair is showing strong bullish momentum. Breaking above the resistance line of the range suggests that a bullish accumulation has been completed.

This breach of resistance confirms the strength of buyers and suggests a likely continuation of the bullish trend.

The next resistance level to watch for is at 2.0800.

GBPAUD Bullish breakout supported at 2.0596Trend Overview:

The GBPAUD pair remains in a strong uptrend, with recent price action confirming a breakout above a previous consolidation zone, now acting as a key support level at 2.0596.

Key Levels:

Support: 2.0596 (key level), 2.0530, 2.0440

Resistance: 2.0755, 2.0840, 2.0895

Bullish Scenario:

A pullback to 2.0596, followed by a bullish bounce, would reinforce the support level and signal further upside momentum. A breakout above 2.0755 may extend gains towards 2.0840 and 2.0895 in the longer term.

Bearish Scenario:

A daily close below 2.0596 would weaken the bullish outlook, increasing the likelihood of a retracement towards 2.0530, with 2.0440 as the next downside target.

Conclusion:

GBPAUD remains bullish above 2.0596, with potential upside targets at 2.0755, 2.0840, and 2.0895. However, a break below 2.0596 could shift momentum to the downside, targeting 2.0530 and 2.0440. Traders should monitor price action at 2.0596 for confirmation of the next directional move.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

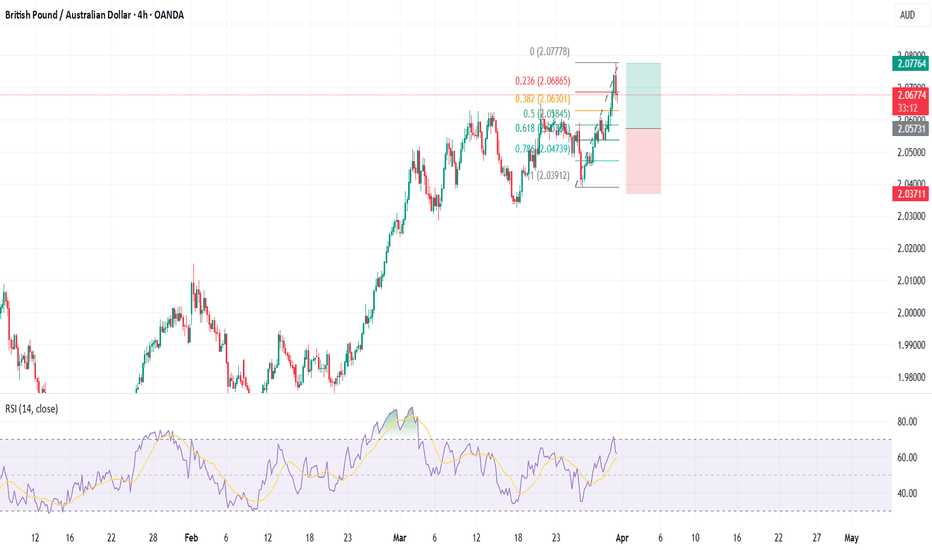

#GBPAUD WAITING FOR CONFIRMATION TO GO SHORT#GBPAUD created a CHOCH move on the 4h chart after bouncing off the weekly resistance zone.

Once GBPAUD enters the pullback area and confirms it's continuation to the downside, I will be looking to enter a short position there with a potential target being the long-term upward trendline.

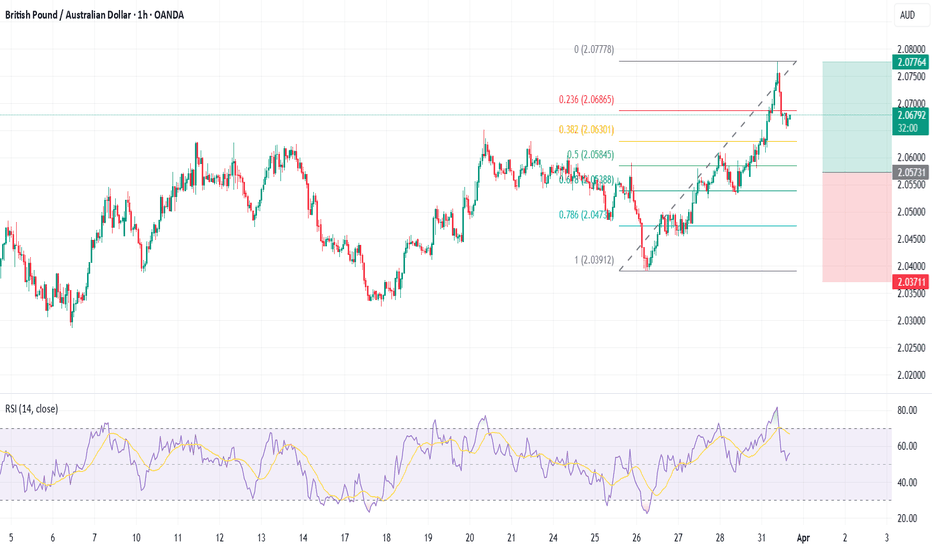

GBP/AUD: Bulls Eye Breakout, But Momentum Signals CautionThursday’s bullish engulfing candle and rising risk aversion have GBP/AUD knocking on the door of a bullish breakout, with the pair testing resistance at 2.0627 in early Asian trade on Monday.

Stepping back, GBP/AUD remains within an ascending triangle pattern, bouncing off uptrend support on four separate occasions this month. While convention suggests traders should watch for a topside break, momentum indicators are less convincing—RSI (14) has been diverging from price in recent weeks, while MACD is easing lower despite staying in positive territory.

The conflicting price and momentum signals reinforce the need for a decisive break above 2.0627 before considering bullish setups. A confirmed break and close above the level could open the door for longs targeting 2.0859, the swing high from March 2020, with a stop beneath to protect against reversal.

A failure at 2.0627 could see the setup flipped, with shorts established beneath the level and a stop above for protection. The initial downside target would be uptrend support, currently around 2.0425.

Good luck!

DS

GBPAUD expecting GBP to start weakening

OANDA:GBPAUD price in channel, its make bullish push in last periods, in week before we are have BOE and some events in last day two like GBP CPI, from events looks like GBP is gather bearish power and technicals on lower TFs are strong bearish.

We are have and TRIPLE TOP apttern, on top of channel.

Here for next periods expecting bearish changes.

SUP zone: 2.06200

RES zone: 2.01500, 2.00600

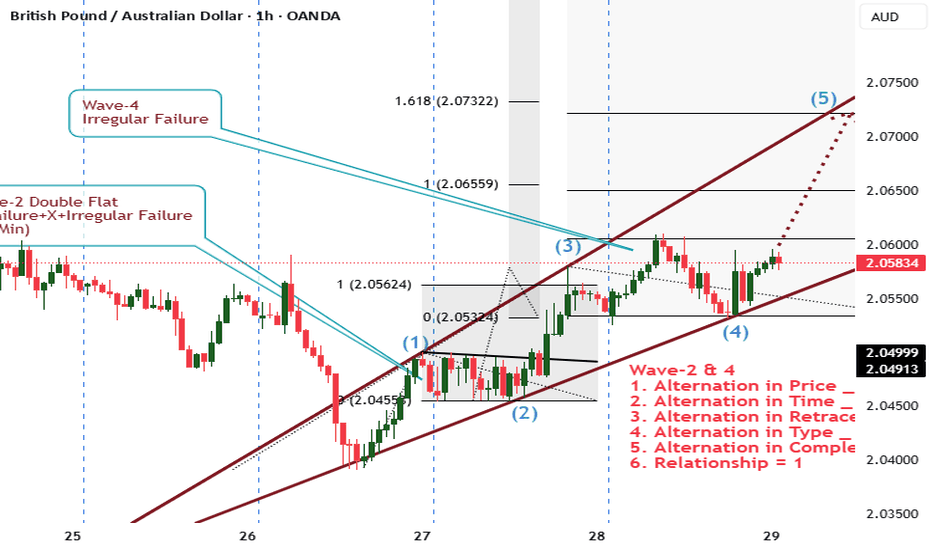

GBPAUD-all Set to Hit 2.07200 Giving R:R=2.6Buy = 2.05800-850

Sell = 2.07200

SL = 2.05325

R:R=2.6

ANALYSIS

After hitting Low at 2.03913 GBPAUD is following Elliott waves principles. It has formed its wave-3 by invoking Rule of Equality that, in turn, makes best case for 5th wave extension. Formation of waves-2 & 4 fulfills the criteria for alternation principle that requires at least one alternation. As per rule, target for 5th wave comes to 2.07200 minimum by taking W5=W0-3. This target is well within the 1.618W3 (2.07322)that gives maximum target of wave-5. Wave-4 has formed correction type Irregular Failure that gives future move equal to at least 1.618 of previous wave, that is again makes a favorable case for 5th wave extension.

GBPAUD appraoching a strong resistance are, short?GBPAUD is approaching a daily higher high of the uptend channel and also a key weekly resistance area price got rejected in 2020. Will this time it reject again from this area ? loook for th reversal pattern. At this moment it looks to be forming a triple top pattern. let us see.

GBP_AUD SHORT SIGNAL|

✅GBP_AUD keeps growing

In a strong uptrend but

The pair will soon hit a

Horizontal resistance

Of 2.0620 from where

We can enter a counter-trend

(and therefore a riskier) short

Trade with the TP of 2.0532

And the SL of 2.0653

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

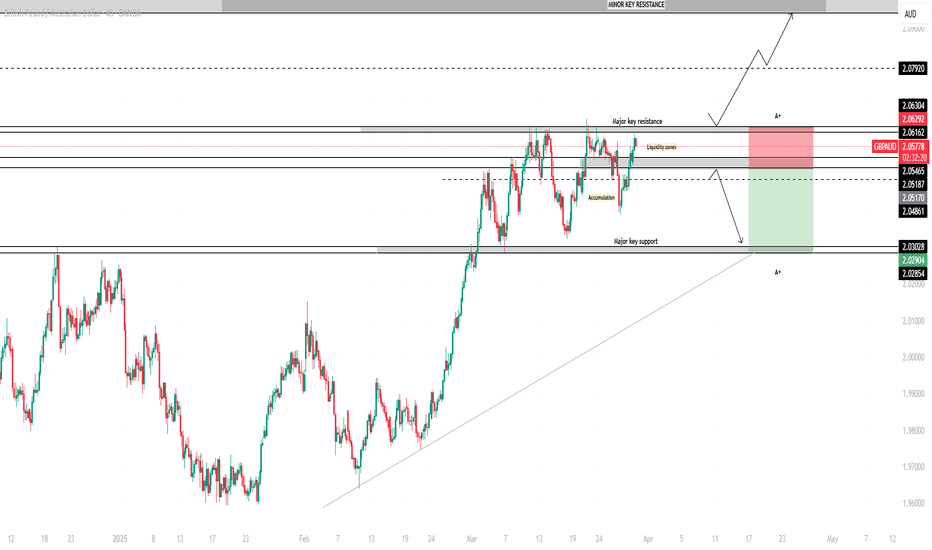

GBP/AUD: Consolidation Breakout Signals Bullish ContinuationThe GBP/AUD market remains in a range-bound structure, fluctuating between the 2.0300 support and 2.0600 resistance levels. Recently, price broke and closed above both a downward trendline and the previous two daily highs, reinforcing a bullish bias.

With strong momentum visible on the daily timeframe, the market appears to be setting up for a consolidation expansion pattern. If the price continues to hold above the trendline and support level, a retest of last week’s high is likely, with further bullish movement possible. The next target is the resistance zone around 2.06490

Lingrid | GBPAUD anticipating POTENTIAL Consolidation-ExpansionFX:GBPAUD market continues to oscillate between the resistance and support levels of 2.0300 and 2.0600. It has broken and closed above the downward trendline and the highs from the last two days. With a bullish outlook on the daily timeframe, we anticipate a classic consolidation expansion move. If the price holds above the support level and trendline, we can expect a retest of at least last week's high and potentially further bullish moves. My goal is resistance zone around 2.06490

Traders, If you liked this educational post🎓, give it a boost 🚀 and drop a comment 📣

GBPAUD what's next ! GBPAUD is trading inside an ascending parallel channel, the price action shows a neutral short term trend, but the major trend is bullish, price is clearly trading above the 200 EMA, my setup is wait for price to touch resistance line of the channel to catch the next correction, let me know in the comments bellow what do you think for this pair, your thoughts is important, if you like my idea don't forget to boost it.

GBP/AUD 4-Hour Timeframe AnalysisGBP/AUD 4-Hour Timeframe Analysis

GBP/AUD has shown signs of losing momentum from its previous bullish trend, with price action consolidating within a range. We have identified key levels to watch, including a major key resistance at 2.06200 and a major key support at 2.03000. Additionally, a minor key support level at 2.05400 serves as a short-term pivot point for potential price movements.

If price breaks above the major resistance at 2.06200, we anticipate a continuation of the bullish trend toward the next minor key resistance at 2.09400. However, if price retraces and breaks below 2.05400, sellers could push the pair lower toward the major key support at 2.03000.

Outlook and Key Technical Levels

🔹 Major Key Resistance: 2.06200 (Breakout level for bullish continuation)

🔹 Minor Key Support: 2.05400 (Break below signals bearish move)

🔹 Major Key Support: 2.03000 (Downside target for sellers)

Fundamental Insight and Market Sentiment

📉 GBP Weakness: he British Pound faces mounting pressure due to weakening fundamentals. UK inflation dropped to 2.8%, fueling speculation of a Bank of England (BoE) rate cut in May. With inflation cooling, the urgency for tighter monetary policy diminishes, making GBP less appealing to investors. Adding to this downside risk, UK Chancellor Rachel Reeves’ Spring Statement introduced public spending cuts, further dampening growth prospects for 2025 and increasing concerns about the UK’s economic trajectory.

📈 AUD Resilience: The Australian dollar initially faced losses due to a lower-than-expected CPI print, raising expectations for an RBA rate cut. However, optimism surrounding Australia's recent budget and positive risk sentiment helped the AUD recover.

Given the technical breakdown and fundamental backdrop, we are monitoring GBP/AUD closely for potential trade opportunities, with a focus on price action near key support and resistance levels.

📌 Disclaimer:

This analysis is for informational and educational purposes only and should not be considered financial advice. Trading involves substantial risk, and past performance is not indicative of future results. Always conduct your own research and consult with a financial professional before making any investment decisions.

GBP/AUD Price Action Update📊 GBP/AUD Price Action Update 🎯

🔹 Current Price: 2.05941

🔹 Timeframe: 15M

📌 Key Support Levels (Demand Zones):

🟢 2.05795 – First Support

🟢 2.05327 – Second Support

🟢 2.04939 – Third Support

🟢 2.04012 – Fourth Support

📈 Bullish Scenario:

If price holds above 2.05795, we might see a push towards 2.06663 and beyond.

A breakout above this level could confirm a strong bullish continuation.

📉 Bearish Scenario:

If price breaks below 2.05795, the next supports at 2.05327 and 2.04939 will be key reaction zones.

A break below 2.04012 could signal a deeper retracement.

⚡ Trading Tip:

Look for confirmations before entering buy/sell trades.

Watch for bullish rejection at demand zones for long positions.

Sell near resistance with bearish confirmation.

#GBPAUD #ForexTrading #PriceAction #TechnicalAnalysis #SmartMoney #ForexSignals

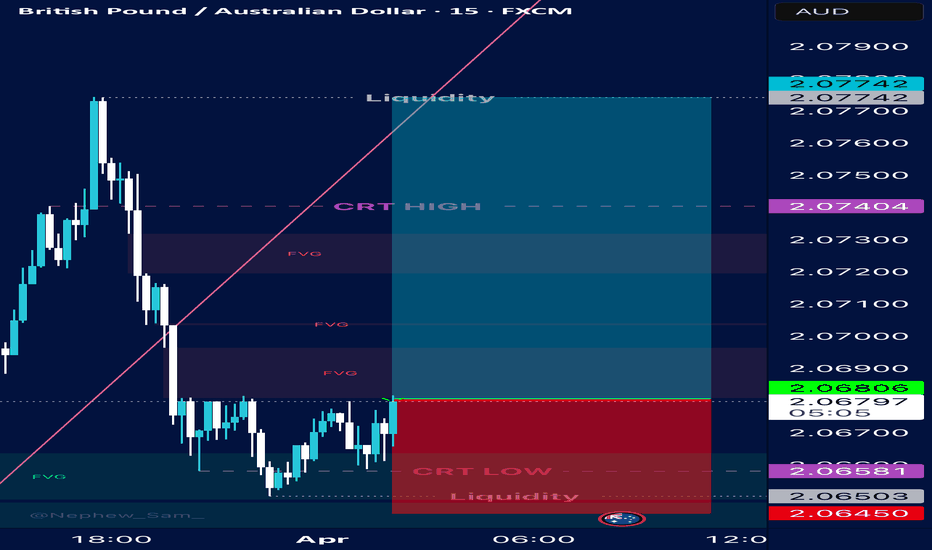

Low timeframe levels exerciseLow timeframe levels, this is an exercise to demonstrate the performance of low timeframe levels. There will be a high success rate in subdued market conditions, and a low success rate during periods of volatility (risk flows). As a trader it's you job to assess market conditions and execute trades that align to market conditions.

GBP/AUD Price Action Update📊 GBP/AUD Price Action Update 🇬🇧🇦🇺

GBP/AUD is currently testing a strong resistance zone (supply area) around 2.0486, marked in red.

📌 Key Insights:

🔴 Supply Zone (Resistance): 2.0486 - 2.0490 📍

This level has been tested multiple times but failed to break convincingly, suggesting a potential reversal or breakout scenario.

📉 Bearish Scenario:

If price rejects this zone, we might see a sell-off towards the 2.0397 support level, as marked on the chart.

📈 Bullish Scenario:

If GBP/AUD breaks and holds above 2.0486, it could trigger a further bullish rally. However, a strong rejection from this level increases the chances of a downward move.

⚡ Trading Tip:

Wait for confirmation candles before entering trades. A strong rejection with bearish momentum could signal a short entry, while a breakout with retest could indicate a buying opportunity.

#fxforever #fxf #GBPAUD #ForexTrading #SmartMoney #TechnicalAnalysis #PriceAction #ForexSignals #DayTrading #MarketAnalysis