AUDGBP trade ideas

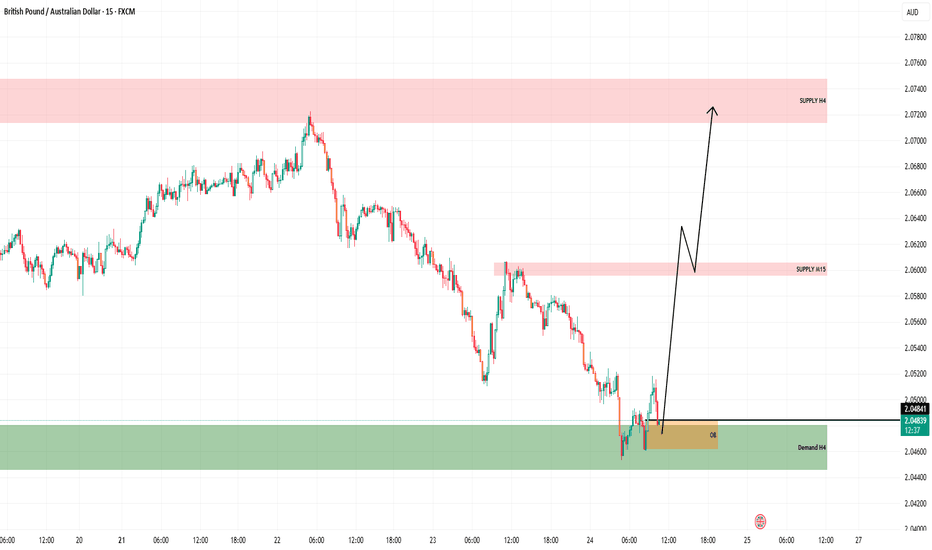

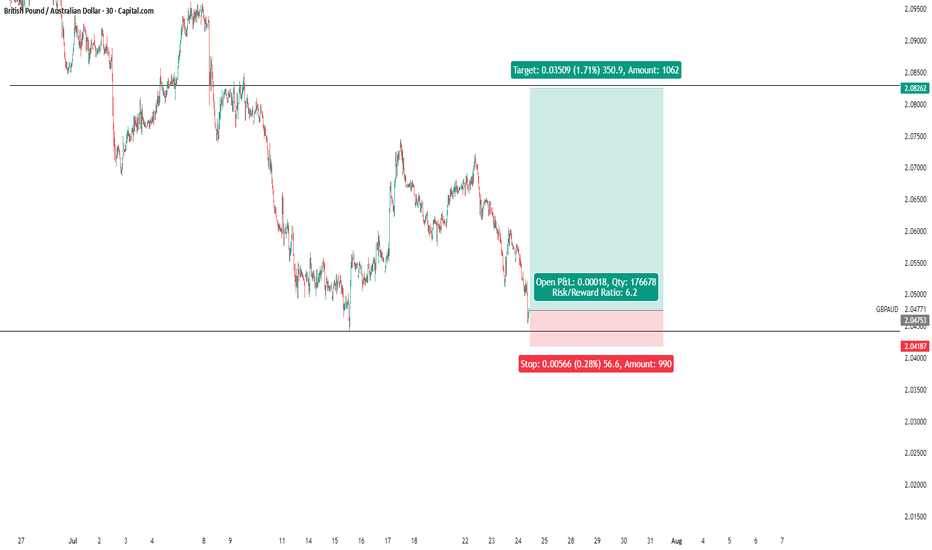

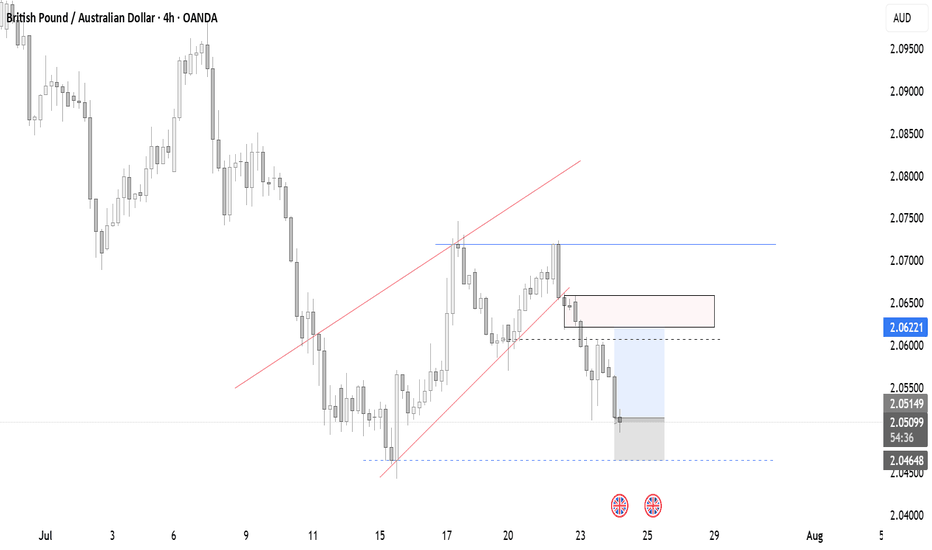

GBPAUD BUY OPPORTUNITY📈 Expected Price Action:

Initial Reaction from Demand H4 & OB:

Bullish rejection confirms buyers stepping in.

Short-Term Target - Supply M15 (Red Zone):

Around 2.0600 – Expect price to react or consolidate here temporarily.

Final Target - Supply H4 Zone:

Around 2.0720–2.0740, where higher-timeframe sellers may step in.

✅ Summary of Bias:

Directional Bias: Bullish

Entry Area: Between OB and Demand H4 zone (2.0450–2.0480)

First Target: 2.0600 (M15 supply)

Final Target: 2.0720+ (H4 supply)

🧠 Notes:

Ensure you monitor price action around the M15 supply for partial profits or re-entry.

A break below the OB and H4 Demand would invalidate the setup.

GBPAUD started an uptrend movement after BOE rate decisionGBPAUD started an uptrend movement after BOE rate decision

Today, the Bank of England cut interest rates by 25 basis points to 4% from 4.25%.

BoE Governor Bailey explained that he has not changed his view on the direction of the interest rate path, the question is the timeframe. The BoE is hinting at prolonged higher rates, weighing on growth, sending an aggressive signal to the market.

GBPAUD strengthened after the rate decision was released and has risen further since then.

GBPAUD broke out of this bullish triangle pattern. The breakout looks strong and the volume that the price has increased was high.

I expect a small pause before GBPAUD moves further to 2.0650 and possibly higher to 2.0700, where it was also rejected several times, but where it was also tested several times.

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

GBPAUD Technical Analysis! SELL!

My dear friends,

Please, find my technical outlook for GBPAUD below:

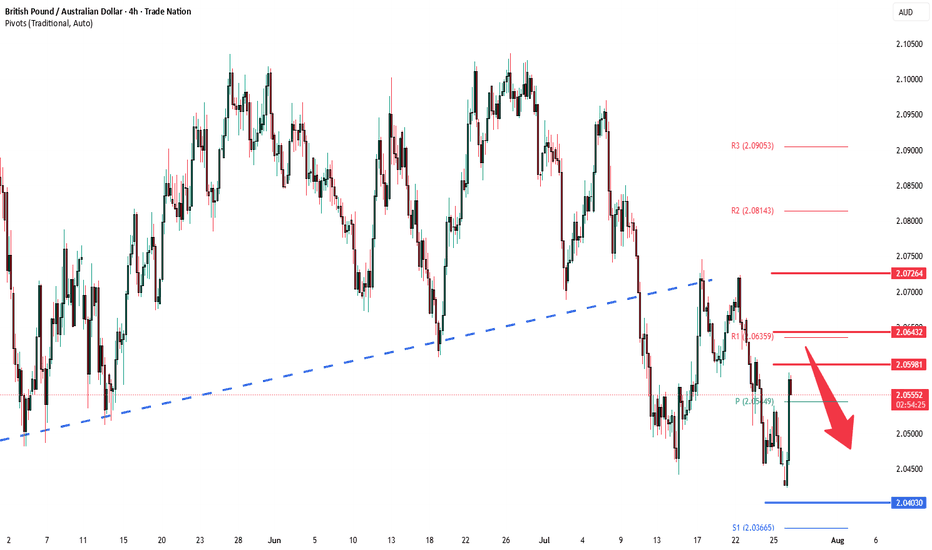

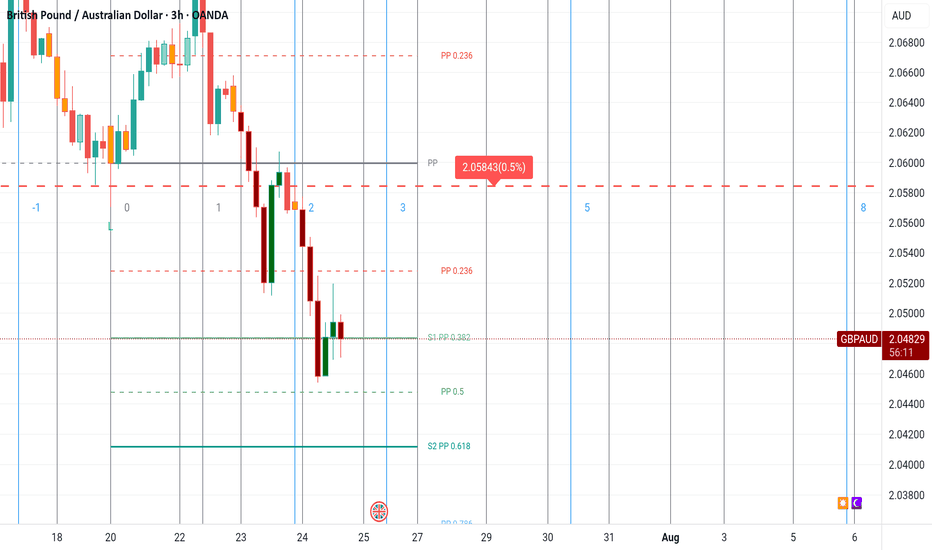

The instrument tests an important psychological level 2.0550

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 2.0522

Recommended Stop Loss - 2.0565

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

GBP/AUD SELLERS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

GBP-AUD uptrend evident from the last 1W green candle makes short trades more risky, but the current set-up targeting 2.049 area still presents a good opportunity for us to sell the pair because the resistance line is nearby and the BB upper band is close which indicates the overbought state of the GBP/AUD pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

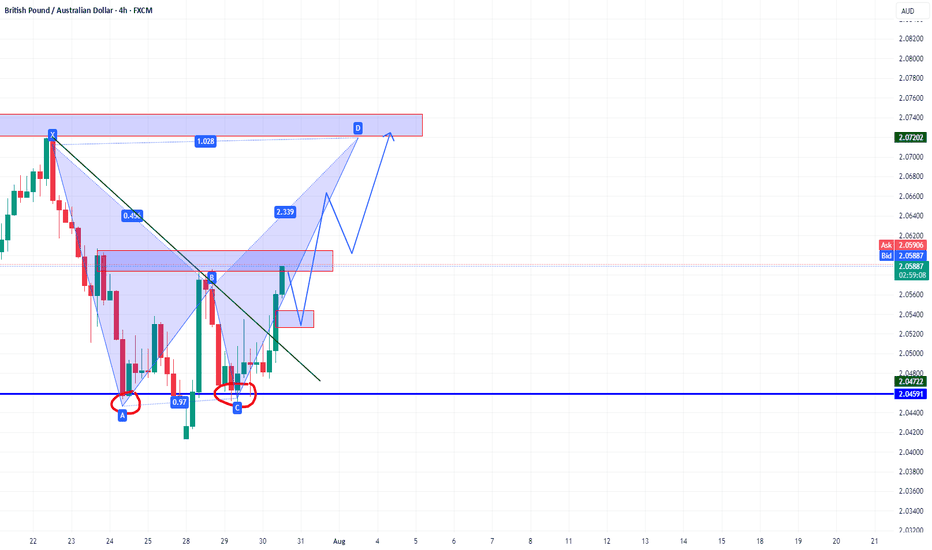

GBPAUD bullish potentialGBPAUD is showing bullish potential after forming a double bottom around the key support zone at 2.0459. A bullish harmonic pattern is unfolding, with a potential move toward the 2.0720–2.0740 resistance zone. The break of the downtrend line adds confirmation, and a pullback to 2.0530–2.0550 could offer a good re-entry area. As long as price stays above 2.0450, the bullish setup remains valid. The key target is the harmonic D completion zone.

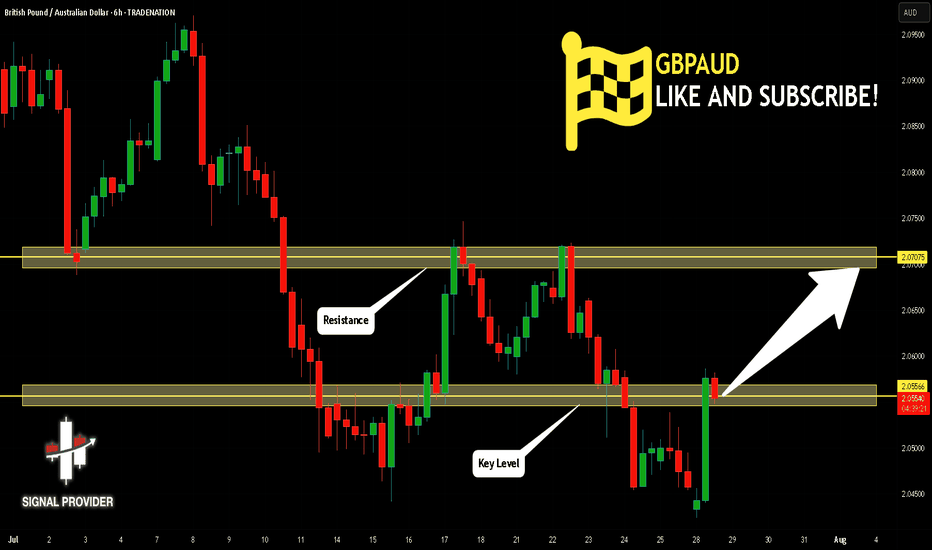

GBPAUD Is Going Up! Long!

Here is our detailed technical review for GBPAUD.

Time Frame: 6h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is on a crucial zone of demand 2.055.

The oversold market condition in a combination with key structure gives us a relatively strong bullish signal with goal 2.070 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

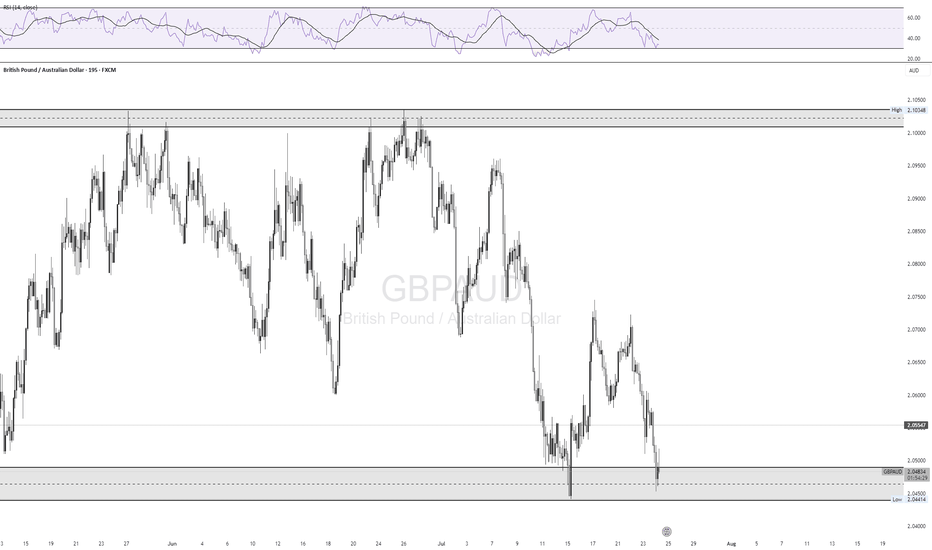

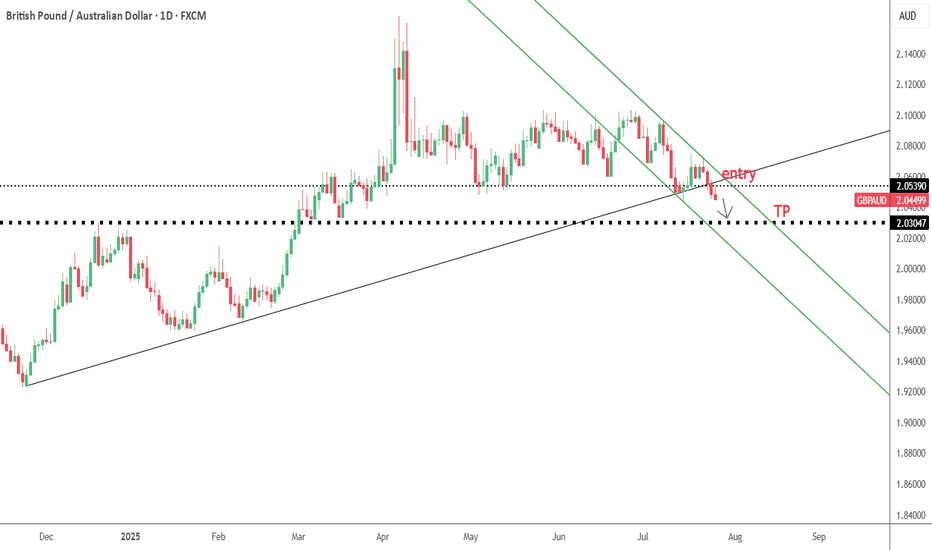

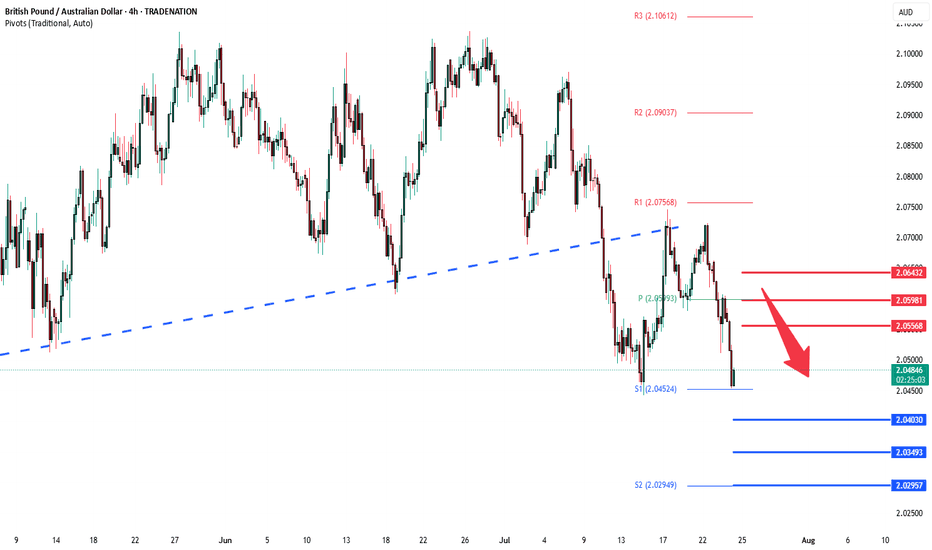

GBPAUD oversold rally capped at 2.0600 resistanceThe GBPAUD pair is currently trading with a bearish bias, aligned with the broader downward trend. Recent price action shows a retest of the resistance, suggesting a temporary relief rally within the downtrend.

Key resistance is located at 2.0600, a prior consolidation zone. This level will be critical in determining the next directional move.

A bearish rejection from 2.0600 could confirm the resumption of the downtrend, targeting the next support levels at 2.0400, followed by 2.0350 and 2.0290 over a longer timeframe.

Conversely, a decisive breakout and daily close above 2.0600 would invalidate the current bearish setup, shifting sentiment to bullish and potentially triggering a move towards 2.0645, then 2.0730.

Conclusion:

The short-term outlook remains bearish unless the pair breaks and holds above 2.0600. Traders should watch for price action signals around this key level to confirm direction. A rejection favours fresh downside continuation, while a breakout signals a potential trend reversal or deeper correction.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

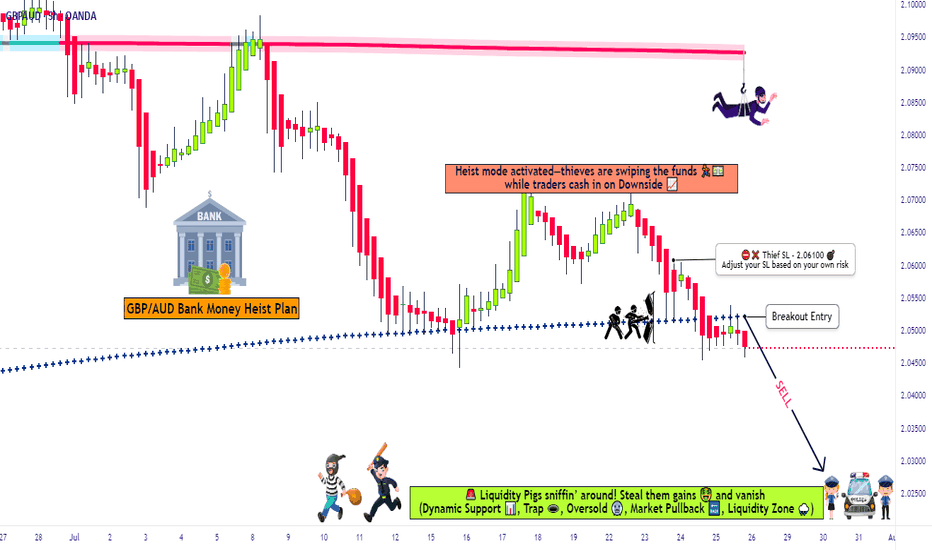

High-Stakes GBP/AUD Short Plan – Grab the Bag & Escape Early!💥🔥GBP/AUD HEIST OPERATION: The Pound vs Aussie Bear Trap Masterplan 🔥💥

(Thief Trader Exclusive TradingView Drop – Smash Boost If You’re Ready To Rob The Market!)

🌍 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌍

Welcome, Money Makers & Market Robbers! 🤑💰✈️

This isn't just analysis — it's a high-stakes forex heist, engineered using Thief Trading Style's elite blend of technical, macro, sentiment, and quantitative insights. We're cracking the GBP/AUD vault with sharp bearish setups targeting a major liquidity zone — aka the Police Barricade Support Area! 🚨🔫

📉 Plan of Attack – Short Entry Setup

This isn’t your typical chart — this is blueprint-grade precision. Here's the GBP/AUD short strategy for Day & Swing Traders:

🚪 ENTRY ZONE

Initiate bearish positions at or near recent highs (wick level).

Use limit orders stacked (layering/DCA style) on the 15m or 30m retest zones for sniper entries.

Look for wicks with rejection — that’s where the fake bullish robbers get trapped!

🛑 STOP LOSS

Place SL just above recent 4H swing highs (2.06100 as a reference).

Adjust according to position size and the number of orders you’re layering.

🎯 TARGET ZONE

Aim for 2.02500, or book partial profits earlier if the heist gets heat.

Escape before the alarms ring! Secure the bag and vanish like a pro.

🔍Fundamental & Sentiment Heist Intel 📚

This bearish pressure on GBP/AUD isn’t random — it’s triggered by a perfect storm:

COT Positioning flips 📊

Aussie strength from commodities & RBA commentary 📈

GBP uncertainty from macro tightening & economic data ⚖️

Sentiment exhaustion at highs + false bullish trap 📉

Consolidation zone breakdown = smart money move! 💼

Wanna go deep? 🧠

Tap into COT, Macro Trends, Intermarket Analysis & Thief’s proprietary scoreboardsss 📡🔗

⚠️ News & Position Management Alert 🚧

📰 Avoid entry around key news drops

🔒 Lock in profits with trailing SL

💼 Secure capital > Chase greed

🔥 SHOW SOME LOVE 🔥

💖 Smash that ❤️ BOOST button — it powers our next big heist!

Together, we rob the market with style, skill, and precision.

See you on the next breakout robbery mission, legends!

Stay dangerous. Stay profitable. Stay Thief. 🐱👤💵🚀

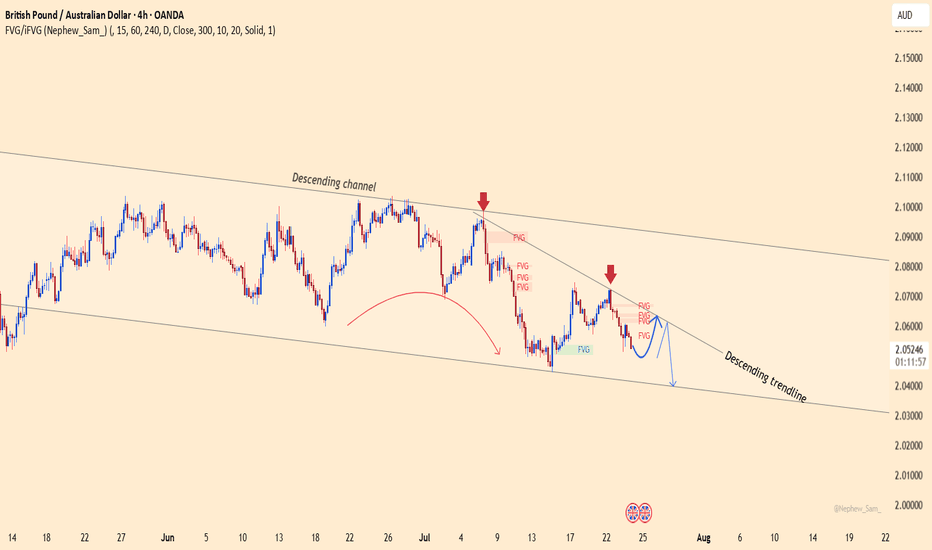

GBPAUD – False breakout or the next sharp drop?The GBPAUD pair continues to trade within a well-defined descending channel, with every bullish attempt being firmly rejected by the descending trendline. Recent candlesticks show a clear sell signal right at the FVG resistance zone.

Market-moving news:

Australia’s manufacturing PMI surprised to the upside → strong support for AUD

GBP remains under pressure after dovish comments from the BoE, diminishing hopes of further rate hikes.

If the price fails to break above the 2.0640 zone — creating yet another fake top — a sharp drop toward 2.0400 is highly likely.

Strategy: Look to SELL near the trendline and FVG zone, targeting 2.0400.

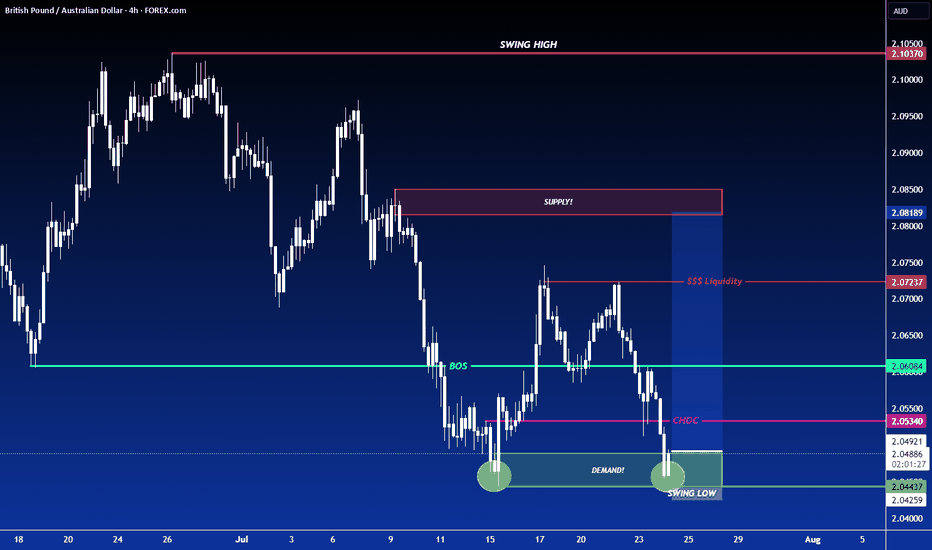

LONG ON GBP/AUDGA has given us a CHOC (change of character) to the upside after making a new low.

Price has since pulled back to the demand area that created that change leaving us with a possible double bottom forming.

I expect GA to rise to sweep buy side liquidity at the equal highs then reaching the previous supply level / previous High.

Looking to catch 200-300 pips.

GBPAUD oversold rallies capped at 2.0555The GBPAUD pair is currently trading with a bearish bias, aligned with the broader downward trend. Recent price action shows a retest of the resistance, suggesting a temporary relief rally within the downtrend.

Key resistance is located at 2.0555, a prior consolidation zone. This level will be critical in determining the next directional move.

A bearish rejection from 2.0555 could confirm the resumption of the downtrend, targeting the next support levels at 2.0400, followed by 2.0350 and 2.0290 over a longer timeframe.

Conversely, a decisive breakout and daily close above 2.0555 would invalidate the current bearish setup, shifting sentiment to bullish and potentially triggering a move towards 2.0600, then 2.0645.

Conclusion:

The short-term outlook remains bearish unless the pair breaks and holds above 2.0555. Traders should watch for price action signals around this key level to confirm direction. A rejection favours fresh downside continuation, while a breakout signals a potential trend reversal or deeper correction.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

GBPAUD BUY SIGNAL. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

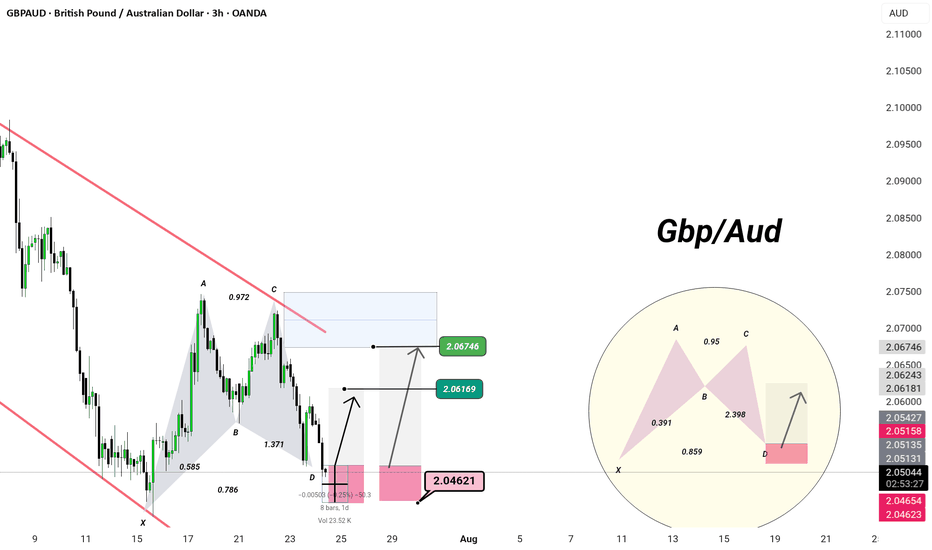

IGBPAUD | 3H Chart | Precision Setup –

🦋 Bullish Harmonic Activation – Deep Zone Precision

When elegance meets geometry — we trade like a Monaco man.

🔺 Pattern: Potential Bullish Bat/Alt Bat

XA → AB → BC → CD

Ideal D-point completion at 2.0462

88.6% XA retracement + 2.0+ BC extension = high-probability reaction zone

🛡️ Demand Zone:

Price is testing the PRZ (Potential Reversal Zone) at 2.0462

Reaction expected → projected targets:

🎯 TP1: 2.0616

🎯 TP2: 2.0674

⚙️ Entry Plan:

Long from 2.0462–2.0465

Invalidation below structure low

Maintain composure. Let the setup mature — precision > prediction

💡 Bias: Tactical long within channel, targeting liquidity above C

🎩