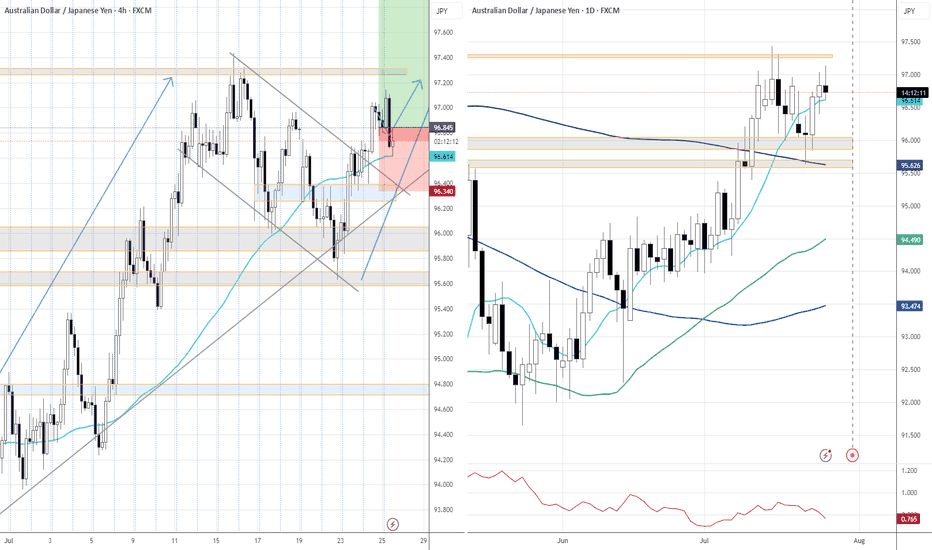

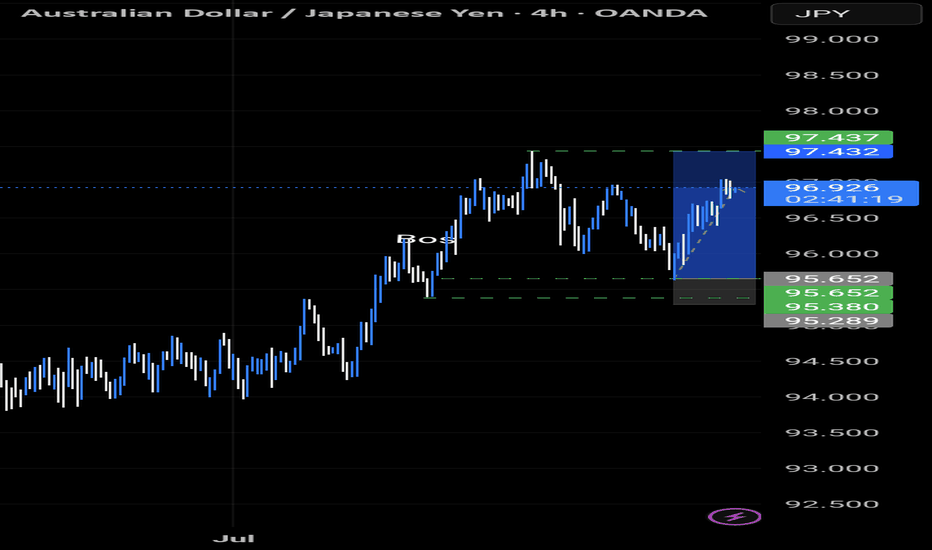

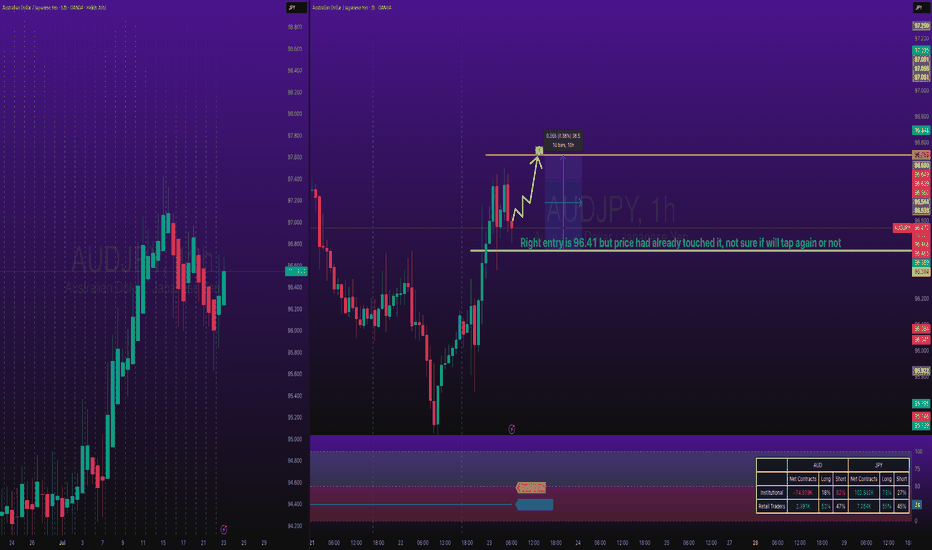

AUD/JPY Long Setup – Anticipating Continuation to Daily ResistanTimeframe: 1H

Bias: Bullish

Entry Zone: ~96.75

SL: Below PDH/POC region

TP1 (1R): 97.36

TP2 (2R): 97.93

Final Target: Daily resistance zone ~98.86

Idea Breakdown:

Price has been forming higher highs and higher lows, respecting both 50EMA and AVWAP on the hourly. After a solid breakout above recent structure and BOS confirmation, I’m looking to buy into a retracement toward the 0.382 fib level and low-volume node (96.70–96.75 region).

This zone also aligns with:

Previous breakout structure

PDH/PWH region

Value area low

EMA support

If price pulls back into this zone and holds, I expect bullish continuation targeting the next major resistance zones above.

Risk: Entry just above PDH with a stop below PDL and key structure

Reward: Clear path to 2R and higher with limited resistance overhead after breakout

Please note i am a amateur logging my own trades for reference and should not be copied

AUDJPY trade ideas

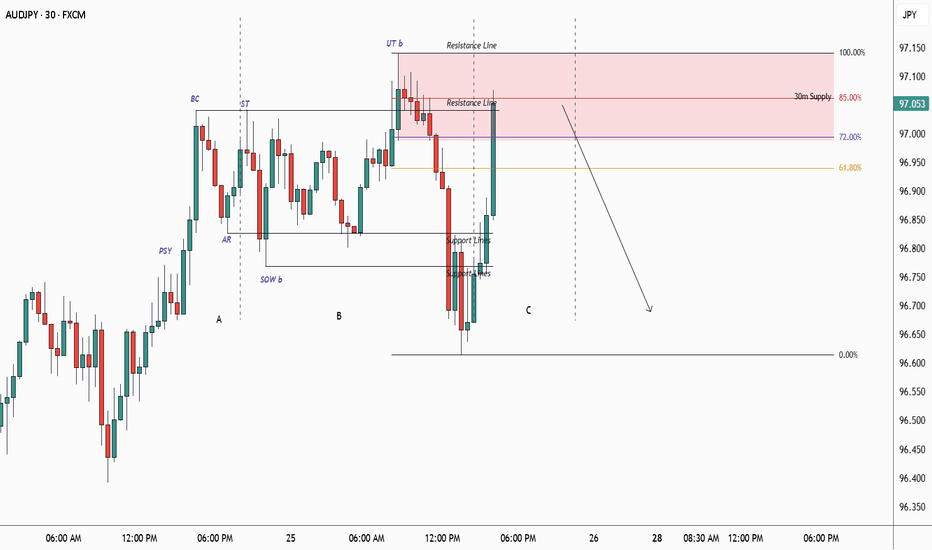

AUDJPY - POTENTIAL?USDJPY is getting super interesting.

If we can get some bearish intent to try and induce the early sellers to the downside creating some buyside liquidity then i will be all over this for a trade.

Lets see how price has moved by the morning as it does need a bit more development before we can consider entering for a short position

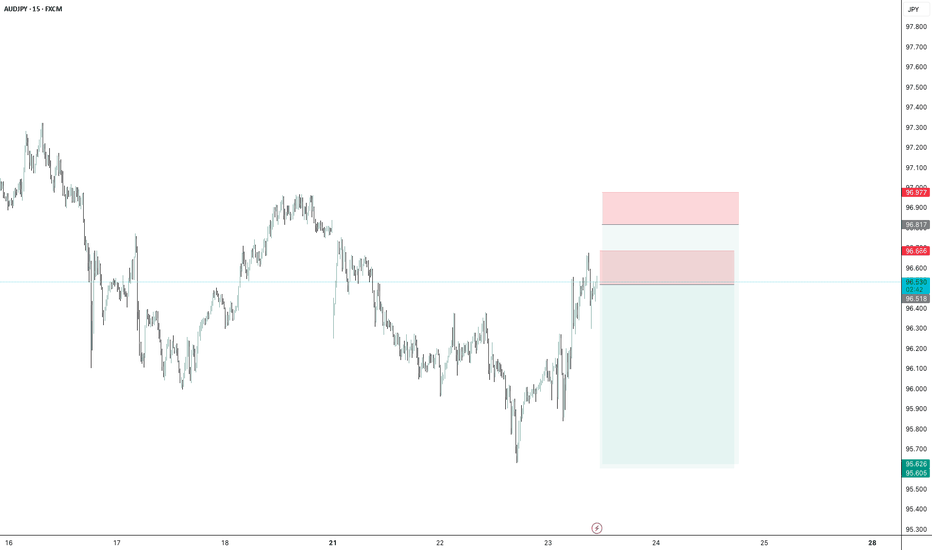

AUDJPY – Waiting for the Long SetupThe price is currently in a corrective move,

and as always, we’ve already marked our key level.

📍 We’re patiently waiting for price to reach our support zone.

If a valid buy signal appears, we’ll take the long position

according to our trading plan.

❌ What if the level breaks?

No worries.

We don’t predict — we follow the market.

We’ll wait for a clean pullback and enter short if confirmed.

🎯 Our job isn’t to predict where price will go,

our job is to manage risk and stay aligned with the market.

Price can do anything —

we’re ready for every scenario.

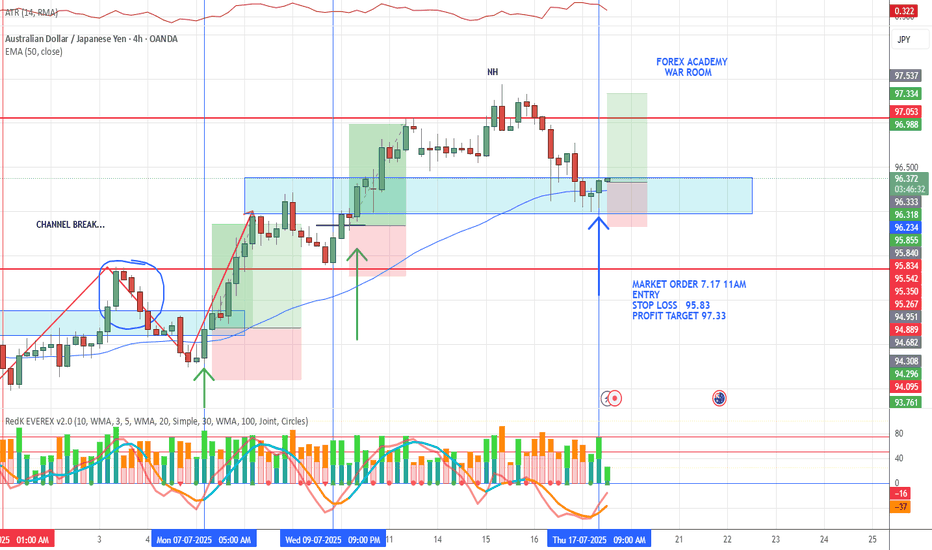

AUDJPY LONG & SHORT – WEEKLY FORECAST Q3 | W29 | Y25💼 AUDJPY LONG & SHORT – WEEKLY FORECAST

Q3 | W29 | Y25

📊 MARKET STRUCTURE SNAPSHOT

AUD JPY is currently reaching for a key higher time frame supply zone, looking for price action to show weakness at premium levels. Structure and momentum are now aligning for a short opportunity backed by multi-timeframe confluence.

🔍 Confluences to Watch 📝

✅ Daily Order Block (OB)

Looking for Strong reaction and early signs of distribution.

✅ 4H Order Block

Break of internal structure (iBoS) confirms a short-term bearish transition.

✅ 1H Order Block

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

🏁 Final Thoughts from FRGNT

📌 The structure is clear.

The confluences are stacked.

Let execution follow discipline, not emotion.

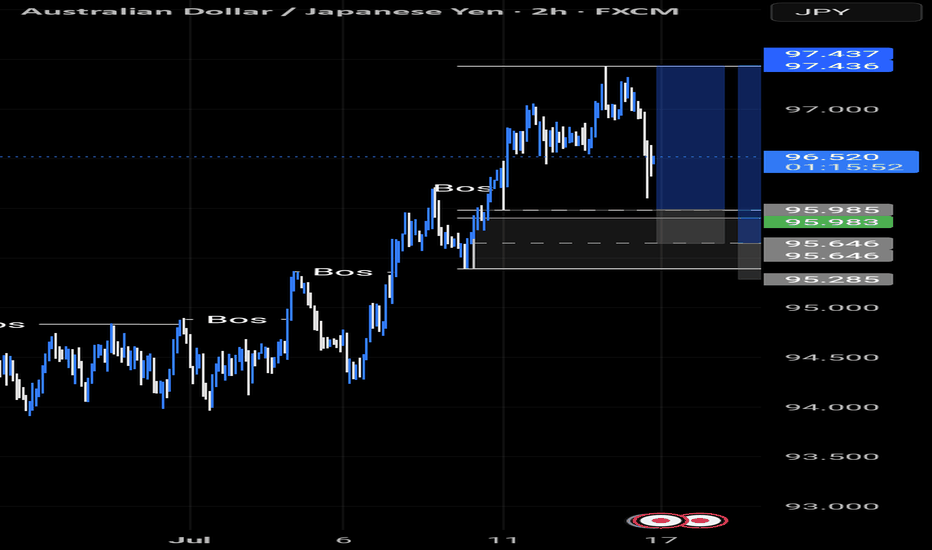

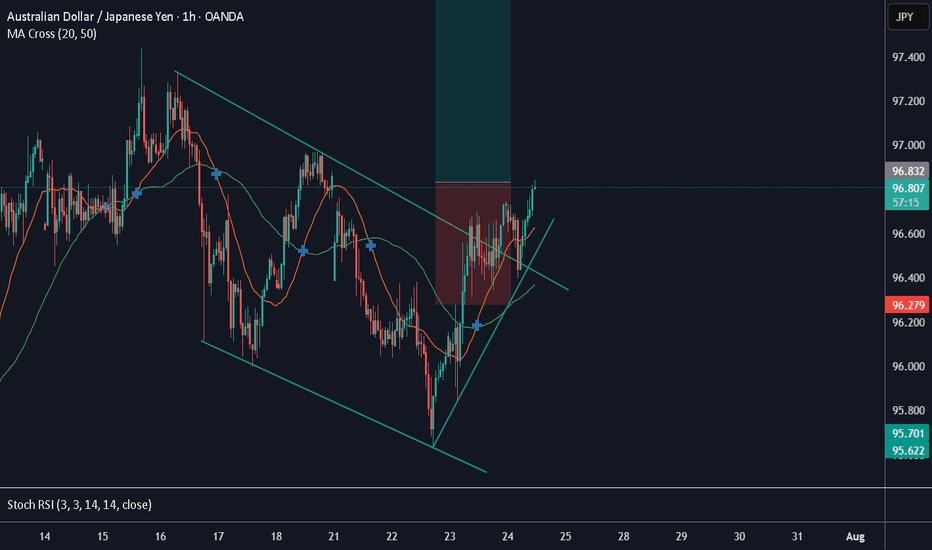

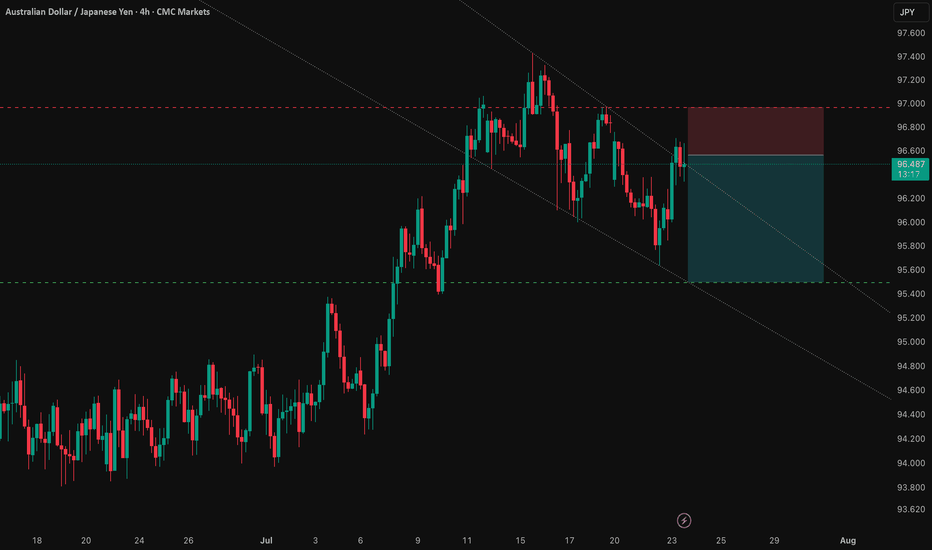

AUDJPY Technical Breakout - Targeting 97.400 Next?TRADENATION:AUDJPY has recently broken decisively above a key resistance zone that had previously capped price for several months. This breakout was preceded by a period of compression and range-bound price action, where bullish momentum steadily built up, indicated by higher lows pressing against the resistance level. This type of structure typically leads to an explosive breakout, which we are now seeing unfold.

After the breakout, price came back for a clean retest of the broken resistance zone, which has now flipped into support. The retest held firmly, suggesting strong buyer interest at this level and confirming the validity of the breakout.

With this structure in place, the bullish momentum is likely to extend further toward the next target zone around 97.400, provided price remains above the current support.

As long as the price holds above the retested zone, the bullish outlook remains intact. A breakdown back below this area, however, would be a warning sign and could open the door to a deeper pullback.

Remember, always wait for confirmation before entering trades, and maintain disciplined risk management.

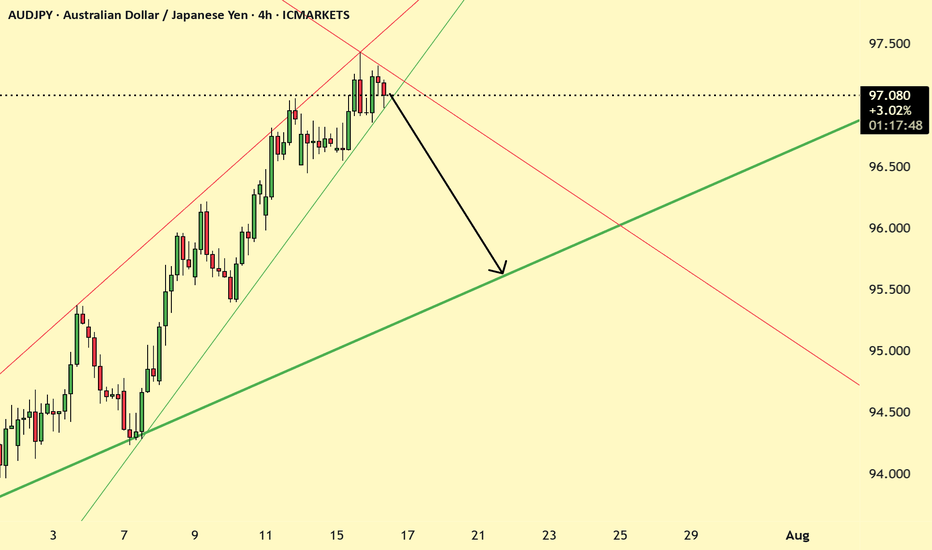

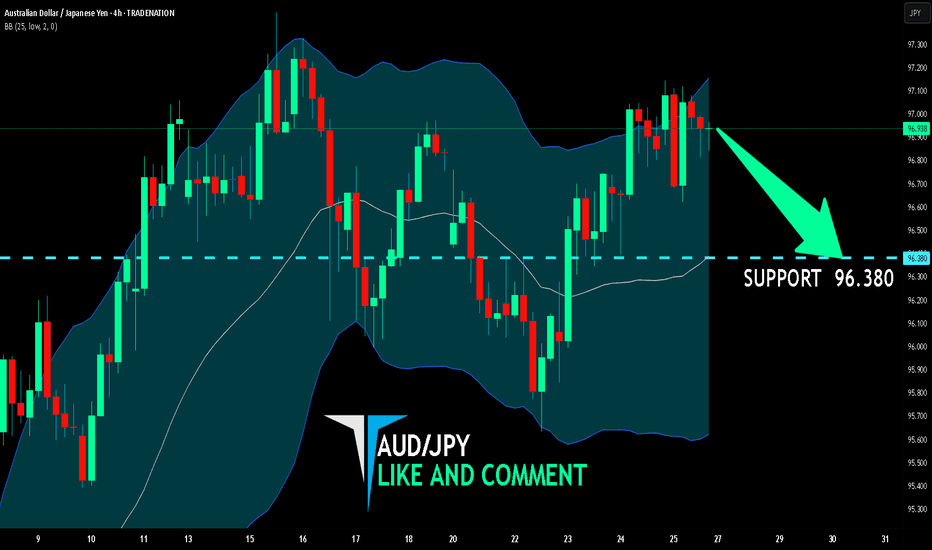

AUD/JPY SENDS CLEAR BEARISH SIGNALS|SHORT

Hello, Friends!

AUD/JPY pair is in the uptrend because previous week’s candle is green, while the price is clearly rising on the 4H timeframe. And after the retest of the resistance line above I believe we will see a move down towards the target below at 96.380 because the pair overbought due to its proximity to the upper BB band and a bearish correction is likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

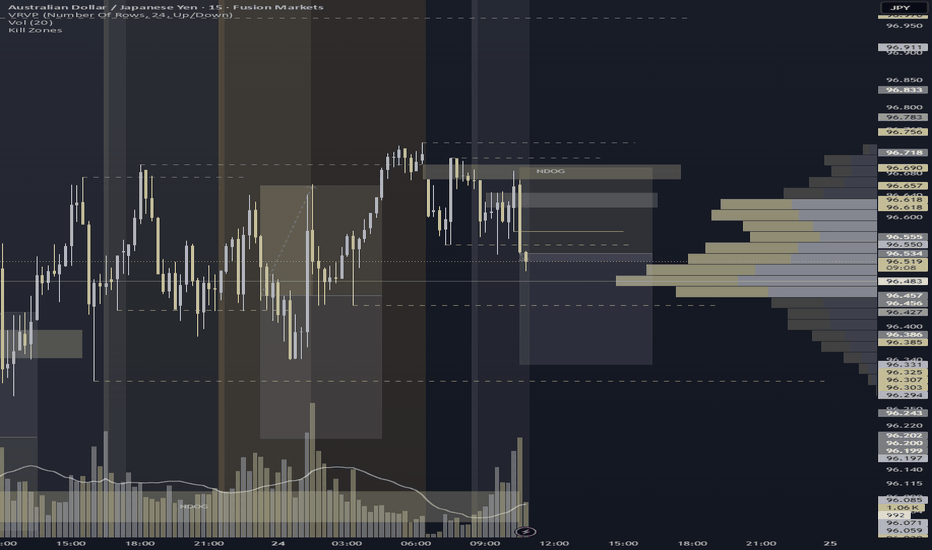

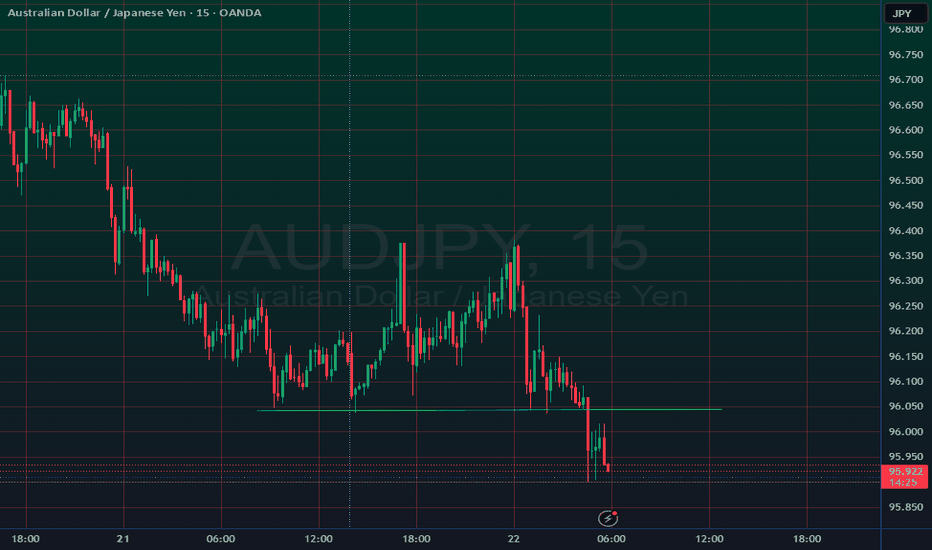

AUDJPY – NDOG & Resistance Zone Campaign

Shorted after clean reaction from NDOG (96.669–96.697) and rejection at my 96.617–96.645 resistance zone. Entered on a strong bearish shift candle with solid volume. TP locked at 96.331, past the 96.439 sellside draw, aiming toward structural liquidity near 96.301. Playbook reminder: structure validated, entry timing needs refinement—early trigger noted. SL hit after engineered volatility, but bias read and magnet zone logic held firm.

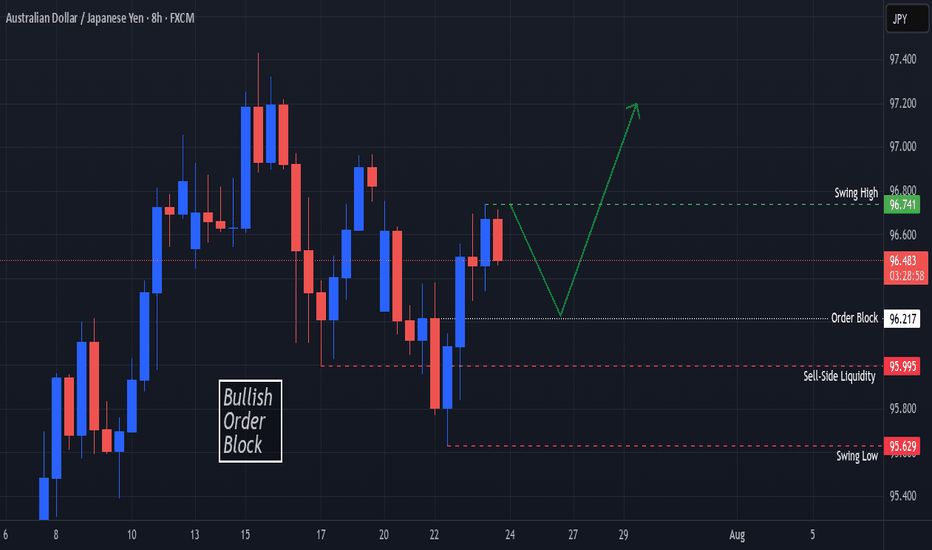

AUDJPY Bullish Order Block In SightOANDA:AUDJPY Price finds Support at the Swing Low @ 95.629 and creates a Swing High @ 96.741!

Based on the ICT Method, the Swing Low broke Sell-Side Liquidity @ 95.995 and opened up a Bullish Order Block Opportunity @ 96.217!

Price is currently working down from 96.49 at the time of publishing but once Price visits the Order Block, this could deliver Long Opportunities!!

AUD/JPY: Capitalizing on the RBA-BoJ Monetary Policy GapThis analysis outlines a compelling short opportunity in AUD/JPY, driven by a powerful confluence of fundamental and technical factors. The trade is strategically positioned ahead of a key catalyst that could unlock significant downside potential.

1️⃣ The Core Thesis: A Clear Policy Divergence

The primary driver behind this trade is the stark and widening gap in monetary policy between the Reserve Bank of Australia (RBA) and the Bank of Japan (BoJ). The RBA is signaling a clear dovish pivot amid a weakening labor market, making an interest rate cut imminent. Conversely, the BoJ is in a tightening phase, creating a fundamental headwind for the AUD relative to the JPY. This divergence underpins the strategic bearish bias.

2️⃣ The Confirmation: Technical Alignment

This fundamental view is supported by a clear technical picture. The pair is in a well-defined downtrend and is currently testing a critical support level. This alignment of fundamental and technical factors presents a clear short opportunity, with the entry positioned for a breakdown below this key juncture.

3️⃣ The Catalyst: The RBA Bulletin

The immediate catalyst for this trade is the upcoming RBA Bulletin on July 24, 2025. Any dovish language from the RBA concerning Australia's economic outlook will likely reinforce expectations for a rate cut and accelerate the downward move in AUD/JPY.

The Trade Setup ✅

Here is the recommended trade setup:

📉 Trade: SHORT AUD/JPY

👉 Entry: 96.56200

⛔️ Stop Loss: 96.96386

🎯 Take Profit: 95.49900

🧠 Risk/Reward Ratio: 2.65

This setup offers a compelling risk-reward profile, capitalizing on a clear and powerful macroeconomic theme. The trade is designed to perform should the expected catalyst confirm the underlying bearish fundamentals.

AUDJPY Long TradeOANDA:AUDJPY Long Trade.

Entry price is already tapped in, I checked chart late, TP is intact, you can take little risk if you can afford.

Note: Manage your risk yourself, its risky trade, see how much your can risk yourself on this trade.

Don't be greedy.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

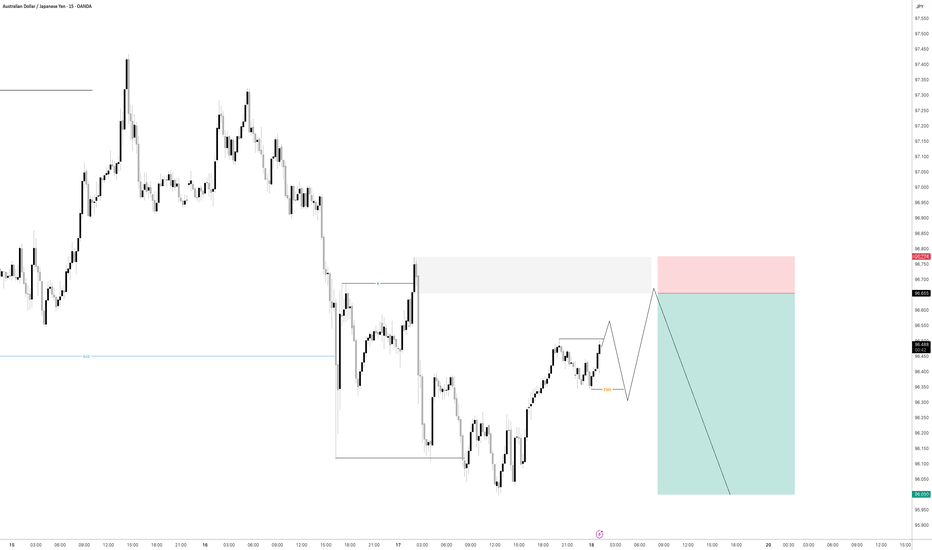

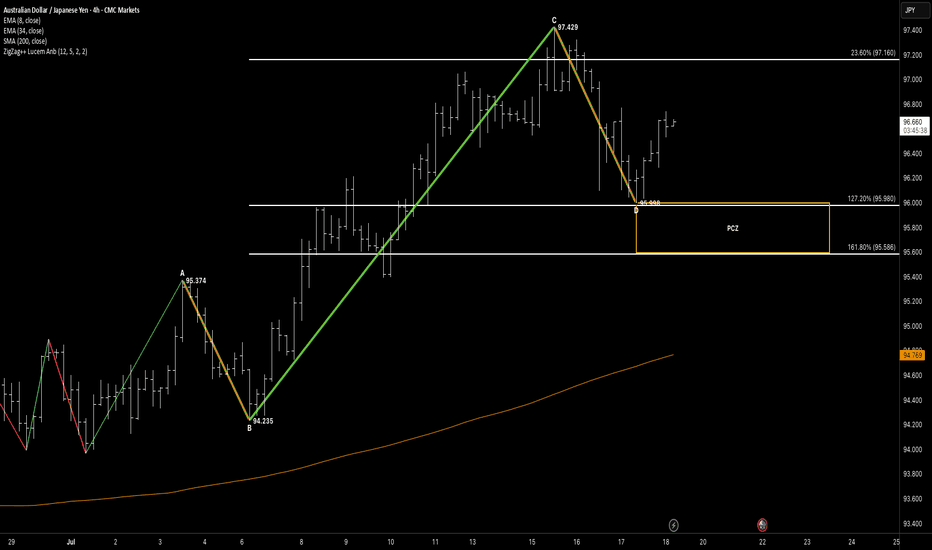

SYMMETRYHello awesome traders! 👋

Hope you’ve managed to grab some solid pips from the markets this week. As we head into the weekend, I’m wrapping things up by dropping a few clean chart setups for you to review and reflect on.

Enjoy the weekend, recharge well — and I’ll see you sharp and ready next week for more structure-led opportunities.

📌 Pattern Breakdown

We had a beautiful AB=CD symmetry setup, with a slight twist:

🔹 AB = CD structure extended slightly beyond traditional symmetry

🔹 CD stretched into the 127.2% fib projection — a known trap zone

🔹 Price tagged 95.980 and reacted with strong bullish momentum from the PCZ (95.98–95.58)

🔹 This zone also aligned with 161.8% fib extension support = strong confluence

🎯 Target Structure

Following the rejection, price is now rotating upward, moving toward:

✅ Target 1:

• 23.6% = 97.16

• 61.8% = 97.972

📍 Partial TP booked at 23.6%

🧭 Watching price behavior here before deciding whether to continue toward…

🔄 Target 2 Zone:

• 78.6% = 98.508

🧠 Key Concepts in Play

✅ AB=CD symmetry extended to 127.2%

✅ Valid PCZ rejection from confluence zone

✅ Partial profit taken at TP1

✅ Measured continuation play in motion

✅ Structure-led management with clear invalidation

🗝 Final Thoughts

AUDJPY gave us a clean extended symmetry rejection — and now we’re in the follow-through phase. The reaction off the 127% extension shows that even stretched patterns can hold when structure aligns.

We’ve locked some gains at the 23.6% zone and will let the rest play out or reassess early next week depending on price behavior around the 61.8% mark.

“Even when symmetry stretches — the reaction reveals the conviction.”

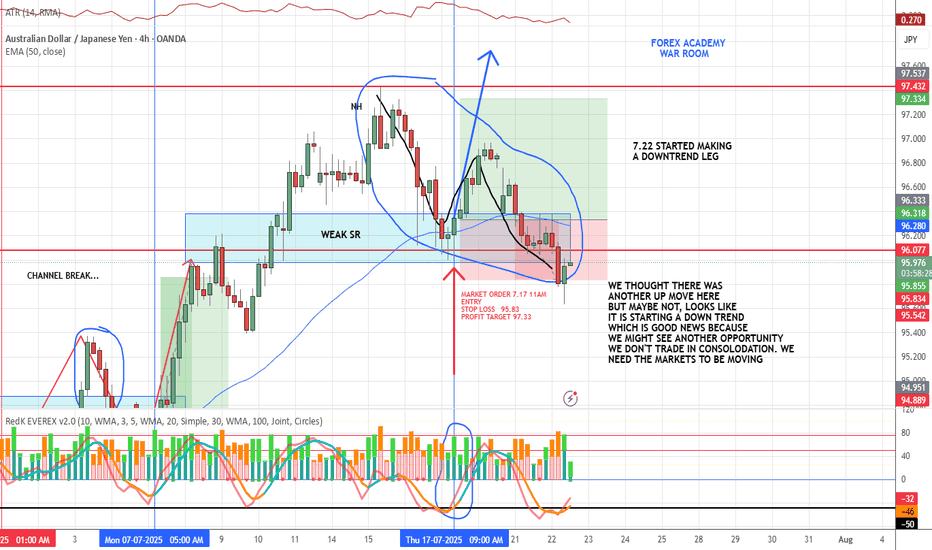

AUD/JPY LOSS❌ AUD/JPY Loss – Market Shifting

We anticipated another move up on AUD/JPY, but price had other plans.

Looks like a new downtrend may be starting—which is actually good news.

We don’t trade in consolidation.

We wait for structure, direction, and alignment.

📌 Movement = opportunity. And we might have a new one setting up soon.

Losses are part of the process. The VMS strategy keeps us focused, patient, and ready for the next valid setup.

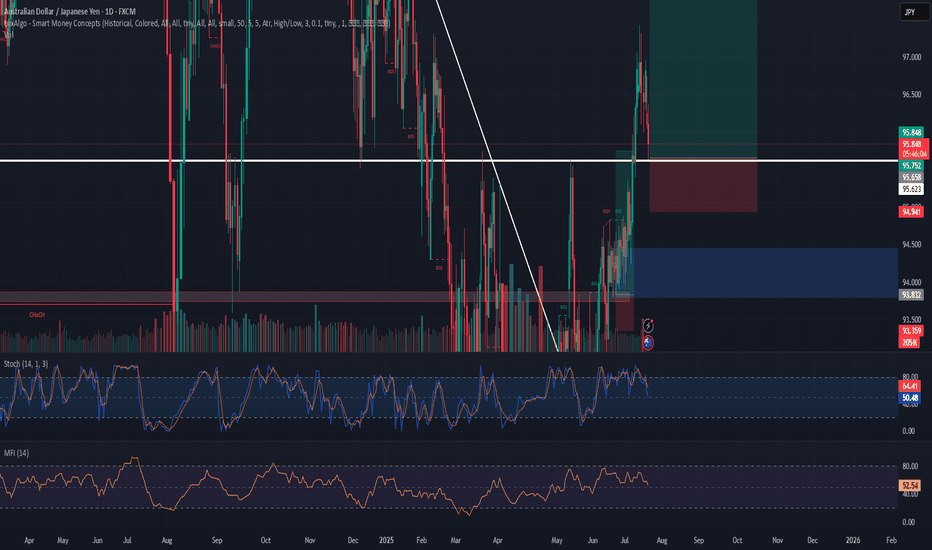

Bullish Momentum Builds: Long Setup on AUD/JPYThe AUD/JPY pair has recently broken out of a long-term descending trendline, signaling a strong shift in market structure. This breakout was supported by multiple bullish BOS (Break of Structure) and ChoCH (Change of Character) signals, indicating institutional buying interest. Price has since retested the breakout zone and is showing signs of continuation, now consolidating just below a key supply zone. With momentum building and previous resistance flipping to support, I’ve entered a long position at 95.65, aiming for a clean push toward the next major resistance at 98.13.

This trade setup aligns with the overall bullish sentiment supported by strong volume during recent rallies and the current market structure. The stop loss is set at 94.94, just below a key demand zone, allowing room for healthy retracement without invalidating the setup. MFI remains neutral, giving the pair more upside potential, while the Stochastic suggests short-term consolidation may be nearing completion. If momentum continues to build, a breakout toward the target is highly probable.

Market analysis 7/22/2025Today we look in to AUD and JPY and discuss their fundamentals and also their relative strength. With strength and activity not matching the fundamentals outlined from this weeks and last weeks.

after review it did not appear that fundamentals were being followed currently. We have to respect this and continue to wait for our opportunity.

Bye for now.