AudJpy Bullish Idea I'm bullish till the previous weekly high 95.305 is taken.

Last week, Price cleared an old weekly low 86.781 closing above it which gives Long Bias. It clears the previous week low as Inducement and that same weekly high as draw on Liquidity 🧲

I would like to see price clears today's low 89.558 before the momentum to the upside.

Sail with me. Kindly boost if you find this insightful 🫴

AUDJPY trade ideas

AUDJPY SELLInitiating a short on AUD/JPY as risk sentiment deteriorates and technicals point to a downside move. The pair has failed to break above and is forming a potential lower high, with momentum indicators showing bearish divergence. A break below adds confirmation to the short setup.

Entry:

Stop Loss:

Take Profit:

Risk/Reward Ratio:

Timeframe:

Rationale: Risk-off environment favoring JPY strength, alongside potential weakness in AUD due to soft commodity prices and/or dovish RBA tone.

AUD/JPY "Aussie vs Yen" Forex Market Heist Plan (Scalping/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the AUD/JPY "Aussie vs Yen" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk MA Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe nearest or swing low or high level for pullback entries.

Stop Loss 🛑:

📍 Thief SL placed at the recent/swing low level Using the 30mins timeframe (88.500) Day trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 92.700 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join Day traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸AUD/JPY "Aussie vs Yen" Forex Market Heist Plan (Scalping/Day) is currently experiencing a bullishness,., driven by several key factors. 👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets and Overall outlook score..., go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Indices GAP UP on Trumps Tariff comments so BUY AUDJPY???All the information you need to find a high probability trade are in front of you on the charts so build your trading decisions on 'the facts' of the chart NOT what you think or what you want to happen or even what you heard will happen. If you have enough facts telling you to trade in a certain direction and therefore enough confluence to take a trade, then this is how you will gain consistency in you trading and build confidence. Check out my trade idea!!

www.tradingview.com

AUDJPY Technical and Order Flow AnalysisOur analysis is based on multi-timeframe top-down analysis & fundamental analysis.

Based on our view the price will rise to the monthly level.

DISCLAIMER: This analysis can change anytime without notice and is only for assisting traders in making independent investment decisions. Please note that this is a prediction, and I have no reason to act on it, and neither should you.

Please support our analysis with a like or comment!

AUDJPY Will Move Higher! Long!

Take a look at our analysis for AUDJPY.

Time Frame: 1D

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is on a crucial zone of demand 90.356.

The oversold market condition in a combination with key structure gives us a relatively strong bullish signal with goal 94.801 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

AUDJPYWe see in Australia against the Japanese yen two scenarios, i.e. the trend is completed to the downside, or if 90.449 is breached, it begins to rise, and we target 93.498 and 92.332, but most likely the scenario is an upward trend that will be activated, i.e. we wait for the taki candle after the breach.

AUDJPY – Buy Limit Setup (Intraday)Published: 11/04/2025 11:26 (BST)

Expires: 11/04/2025 21:00 (BST)

🧠 Trade Summary

Type: Buy Limit

Entry: 88.00

Target: 90.00

Stop Loss: 87.00

Risk/Reward Ratio: 1:2

Duration: Intraday

Confidence Level: 53%

News Sentiment: 47%

📊 Technical View

The recent dip offers a better risk/reward entry compared to current levels.

No signs of exhaustion in the current rally.

A confirmed break above 89.50 would validate bullish momentum.

The measured move target sits at 90.50.

Key support at 88.00, aligning with the Buy Limit order.

🔍 Levels to Watch

Resistance: 89.50 / 90.00 / 90.50

Support: 88.50 / 88.00 / 87.50

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUDJPY Elliott Wave Analysishello friends

In the AUDJPY currency pair, we see the formation of a 5-wave pattern in the dominant wave (B). Before these 5-waves, we see a strong downward movement. which we call wave (A).

These 5 waves have modified the previous powerful movement, and the corrective movements are always more complicated and time-consuming than their previous wave.

Therefore, it is more likely that the price will return to its original movement.

Therefore, with the hypothesis of continued downward movement, we are waiting for the break of the trend line drawn at the 5-wave bottom (wave B) and with the break and pullback, we can enter into a sale transaction.

To support me, I recommend you install Trading View software on your phone and see my analysis and support me with your comments and Boost. Be successful and profitable.

AUDJPY Bearish continuation below 91.85The AUDJPY currency pair remains in a bearish trend, with the recent price action showing signs of an oversold bounce. While a temporary rebound is in play, the broader sentiment remains weak unless a decisive breakout occurs.

Key Levels to Watch:

Resistance Levels: 91.85 (critical level), 92.84, 93.62

Support Levels: 87.87, 86.60, 85.70

Bearish Scenario:

A rejection from the 91.85 resistance level could reaffirm the downside bias, leading to a continuation of the bearish move toward 87.87, with extended declines targeting 86.60 and 85.70 over the longer timeframe.

Bullish Scenario:

A breakout above 91.85 with a daily close above this level would challenge the bearish sentiment, opening the door for further gains toward 92.84, followed by 93.60.

Conclusion:

The market sentiment remains bearish, with 91.85 acting as a critical resistance zone. A rejection from this level could reinforce the downtrend, while a confirmed breakout would shift the outlook to bullish, favouring further upside. Traders should closely monitor price action at this key level for confirmation.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

AUD/JPY SHORT FROM RESISTANCE

Hello, Friends!

We are going short on the AUD/JPY with the target of 85.454 level, because the pair is overbought and will soon hit the resistance line above. We deduced the overbought condition from the price being near to the upper BB band. However, we should use low risk here because the 1W TF is green and gives us a counter-signal.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

AUDJPY to find buyers at previous resistance?AUDJPY - 24h expiry

There is no indication that the rally is coming to an end.

Further upside is expected.

Risk/Reward would be poor to call a buy from current levels.

A move through 91.00 will confirm the bullish momentum.

The measured move target is 92.00.

We look to Buy at 89.50 (stop at 88.50)

Our profit targets will be 91.50 and 92.00

Resistance: 91.00 / 91.50 / 92.00

Support: 90.00 / 89.50 / 89.00

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Bullish bounce off pullback support?AUD/JPY is falling towards the pivot which acts as a pullback support and could bounce to the 1st resistance which is an overlap resistance.

Pivot: 89.50

1st Support: 87.82

1st Resistance: 93.06

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Bearish Setup on AUDJPY – Waiting for POI ReactionCurrently bearish on AUDJPY due to higher time frame structure showing signs of weakness. However, I’m exercising patience as I have two key areas of interest (POIs) I’m watching closely:

Primary POI (Point of Interest):

This is a refined supply zone within the premium zone, where I expect price to retrace before giving any bearish confirmation. Ideally, I want to see a clear rejection or distribution pattern here before executing a short position.

Extreme POI (Last Line of Defense):

In case price breaks through the primary POI without a solid rejection, I will wait for price to reach this deeper, more extreme supply zone. This is my most conservative entry area and aligns with higher risk-to-reward expectations.

Trade Plan:

No entry until price pulls back into one of the POIs.

Looking for confirmation (e.g., break of structure, bearish engulfing, supply taking over demand) before executing a sell.

Targeting previous demand levels or liquidity zones below current price.

Stop loss will depend on the POI used, with risk managed accordingly.

Bias: Bearish

Status: Waiting for retracement and confirmation.

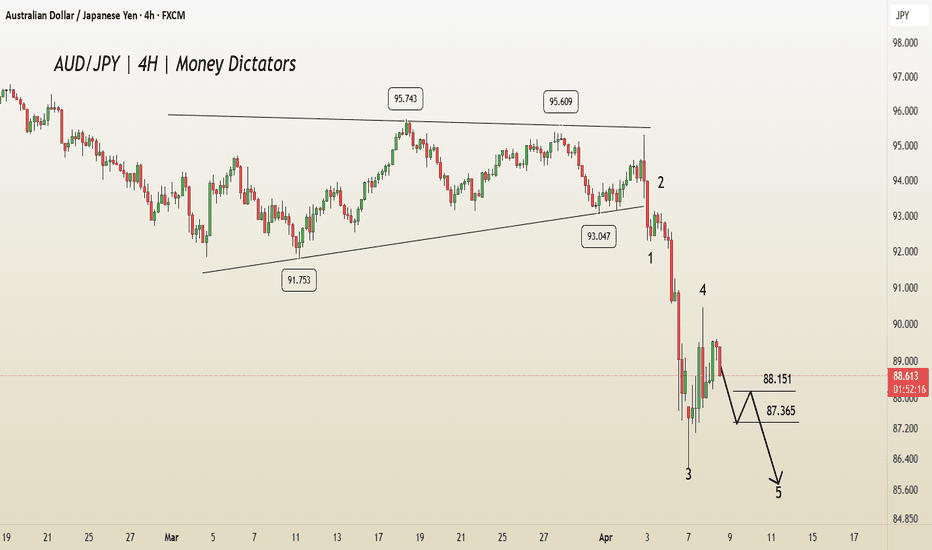

AUD/JPY Technical Outlook: Wave 5 Completion in SightIn AUD/JPY, the 4th wave has been completed, and the 5th wave is in progress. According to Elliott Wave theory, there is a high probability of the market continuing its downward movement.

Regarding potential targets, the price may reach 88.151 and 87.365 on the downside. However, a bullish move could also emerge if the market breaks above 89.645 .

AUDJPY Sell Opportunity: Analyzing Market Trends with EASY TradiBased on the latest EASY Trading AI analysis, AUDJPY presents an attractive selling scenario. The recommended entry is precisely at 87.061, targeting a Take Profit at the 86.05 mark, with a cautious Stop Loss at 88.869.The sell signal arises from reliable indicators showing weakening upward momentum and bearish pressure forming clearly at current resistance levels. EASY Trading AI’s evaluation of recent price action identifies increased selling volume and reduced bullish participation, signaling a likely downward correction.Carefully monitor your risk parameters and follow this clearly defined trading plan for optimal risk-reward management.

AUD/JPY Selloff Keeps RSI in Oversold TerritoryAUD/JPY marks a five-day selloff as it extends the decline from the start of the week, with the recent weakness in the exchange rate keeping the Relative Strength Index (RSI) in oversold territory.

AUD/JPY Outlook

Keep in mind, AUD/JPY cleared the 2024 low (90.40) following the failed attempts to close above the 50-Day SMA (94.38), and the move below 30 in the RSI is likely to be accompanied by a further decline in the exchange rate like the price action from last year.

A move/close below the 0.8660 (78.6% Fibonacci retracement) to 0.8740 (78.6% Fibonacci extension) zone brings the 2023 low (86.06) back on the radar, with the next area of interest coming in around 85.20 (100% Fibonacci extension.

At the same time, lack of momentum to close below the 0.8660 (78.6% Fibonacci retracement) to 0.8740 (78.6% Fibonacci extension) zone may pull the RSI back from overbought territory, with a breach/close above 89.20 (61.8% Fibonacci extension) raising the scope for a move towards 90.50 (61.8% Fibonacci extension).

--- Written by David Song, Senior Strategist at FOREX.com