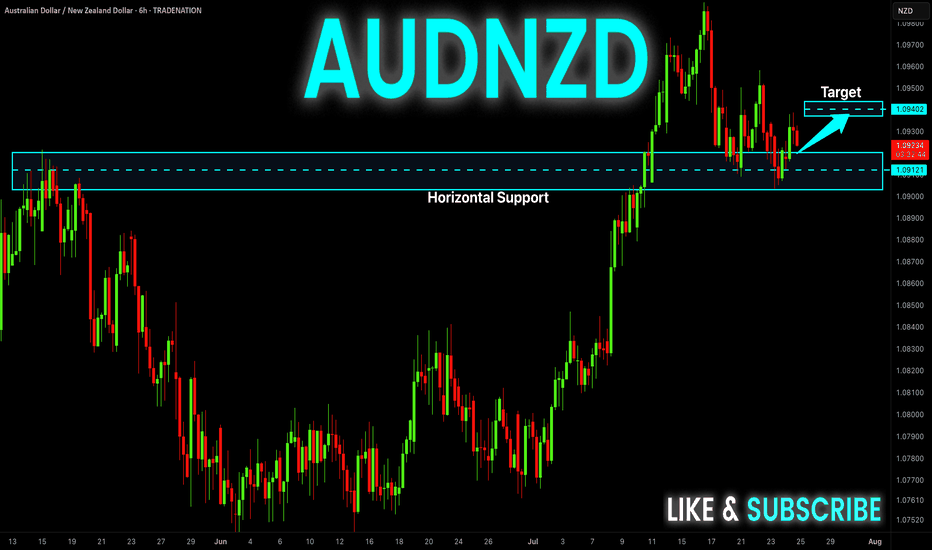

AUD-NZD Local Long! Buy!

Hello,Traders!

AUD-NZD is about to retest

A strong horizontal support

Level of 1.0912 and as we are

Bullish biased we will be expecting

A local bullish rebound

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUDNZD trade ideas

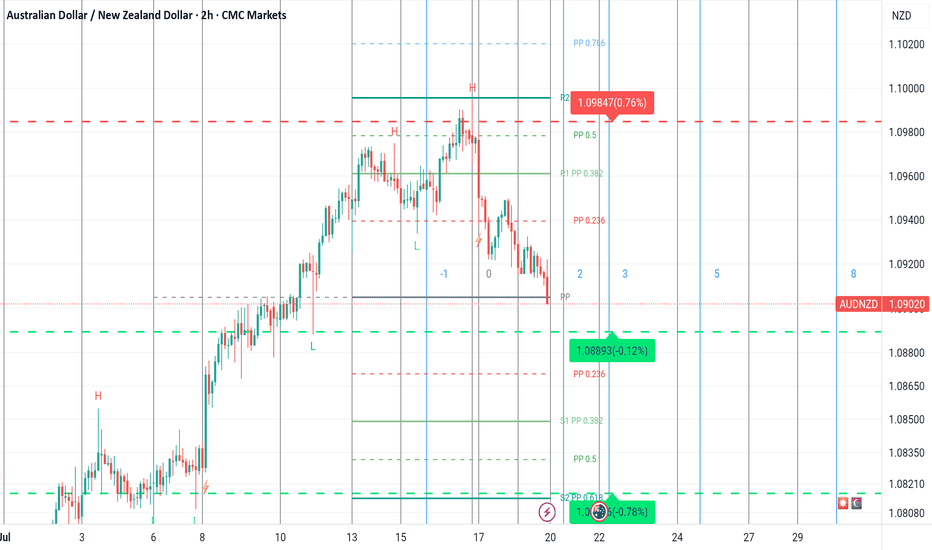

Potential add-on tradeAfter securing a break even trade on this pair, we are at a point where we can risk another one percent for a 2:1 trade. That would bring our trade idea to a 6:1 trade. Minimal risk, great return possibility. This is math and market structure working together to boost an already great trade.

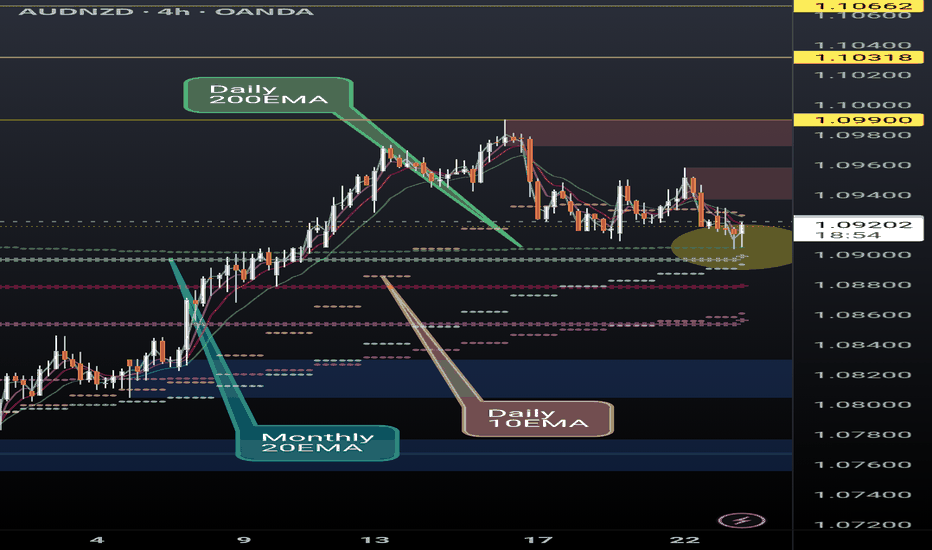

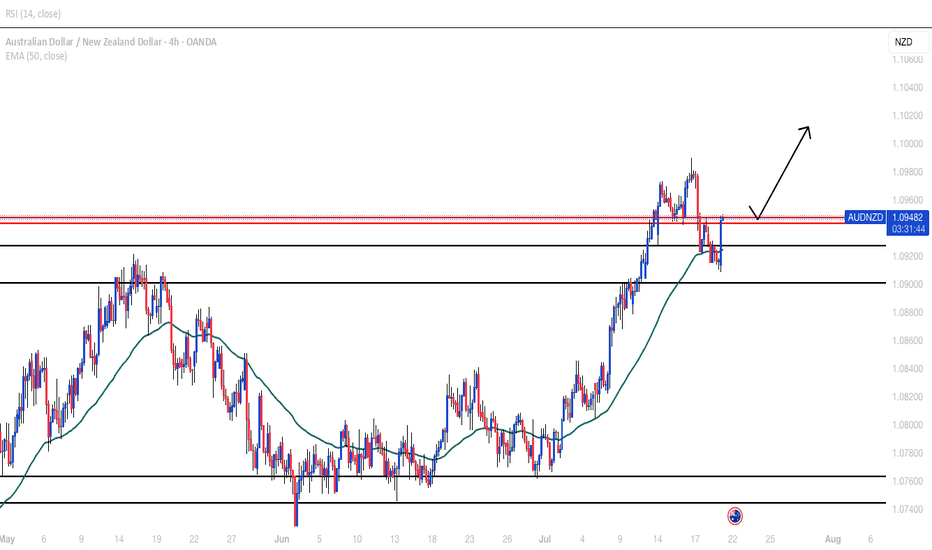

AUDNZD finding support on critical EMAsAUDNZD is finding support at the daily 200EMA (overlayed on 4H chart) and, more significantly, above the monthly 20EMA (overlayed). Break and hold the daily 10EMA (overlayed) will be key.

If the momentum continues we could see a continuation of the ongoing rally however recent AUD monetary policy meeting minutes seemed to lean dovish.

I'm a cat not a financial advisor.

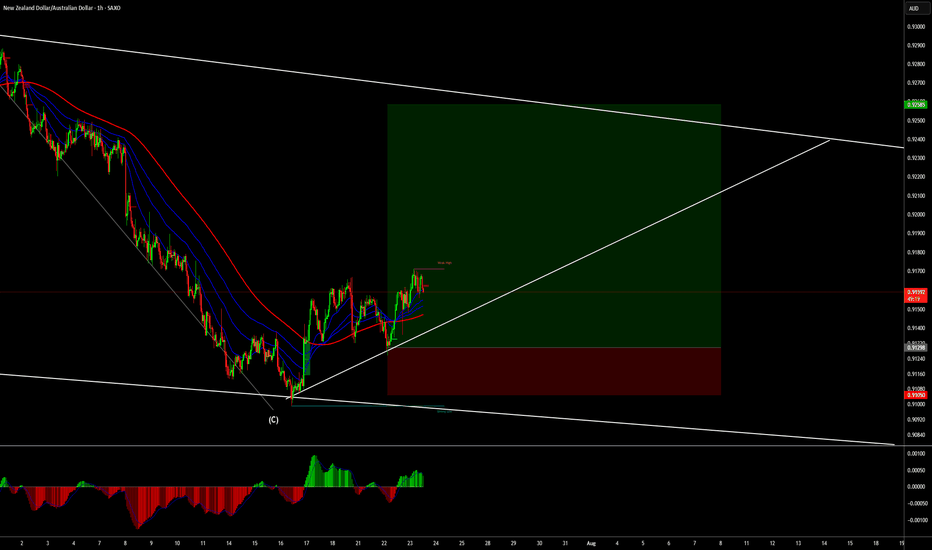

BULLISH BIASPrice previously broke upper structure to form new high before a pullback to support to sweep liquidity.

Right now, support having been touched became a demand zone pushing price up.

Price incidentally came back down to it's present zone to form double bottom which right now is a goid place to enter buy and target new high as take profit.

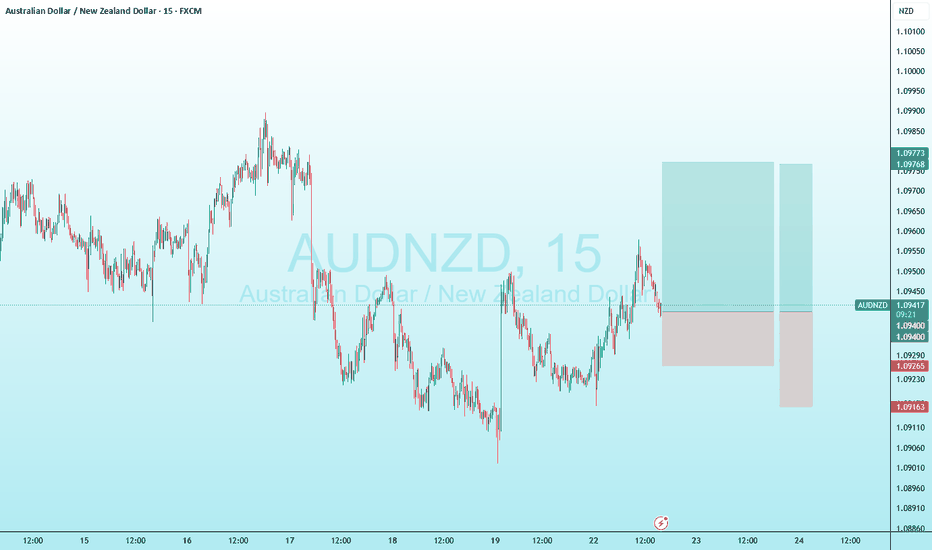

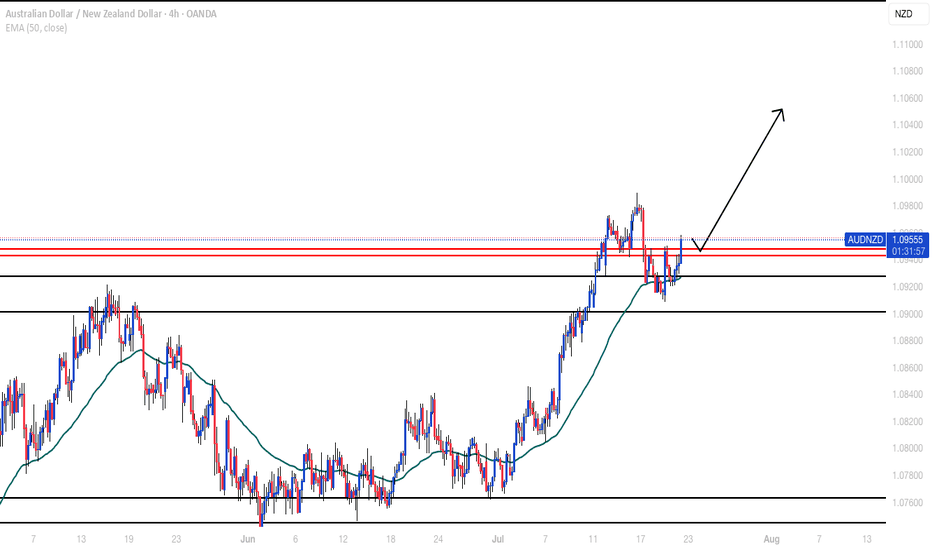

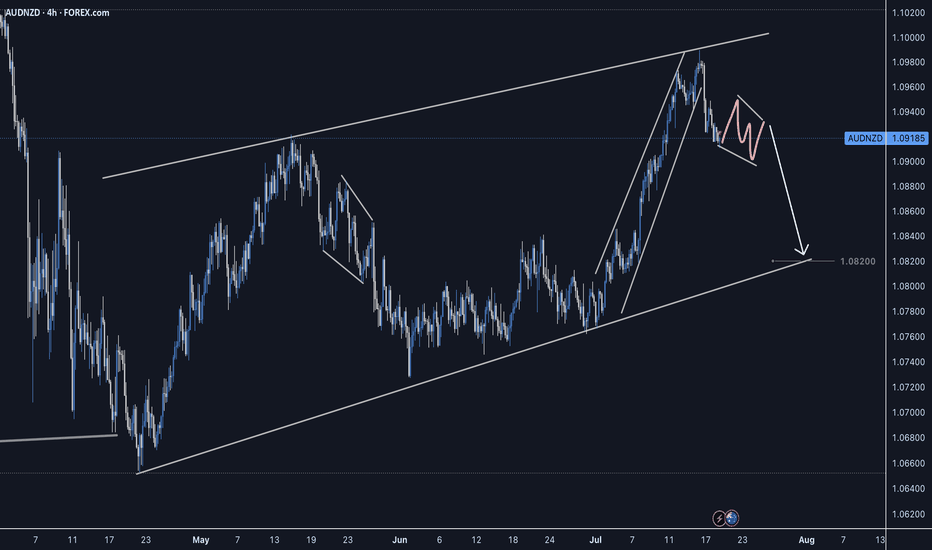

AUDNZD: Bullish Move After Breakout📈AUDNZD has surpassed and closed above a key horizontal daily resistance level.

After retesting this broken structure, the price rebounded and broke above a resistance line of a falling wedge pattern, suggesting a strong likelihood of a bullish trend resumption.

The price is expected to reach the 1.0977 level soon.

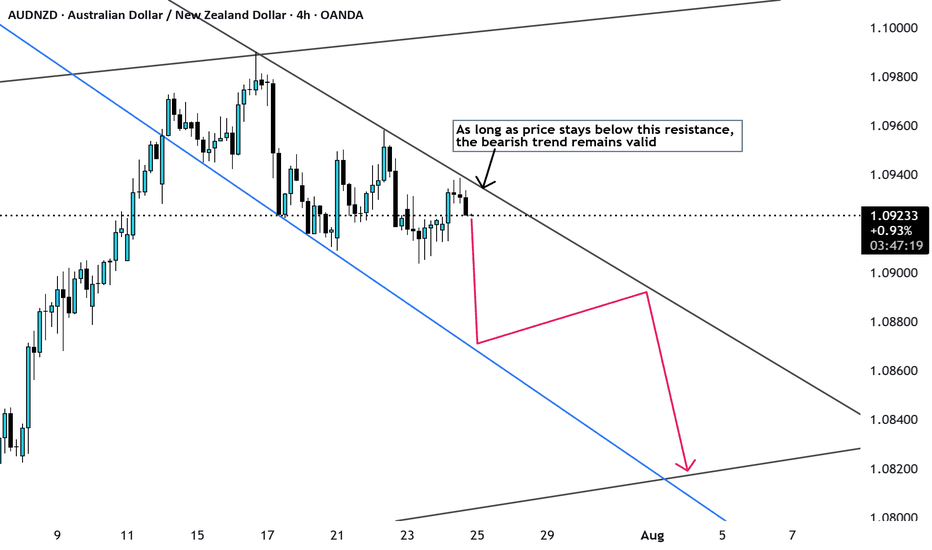

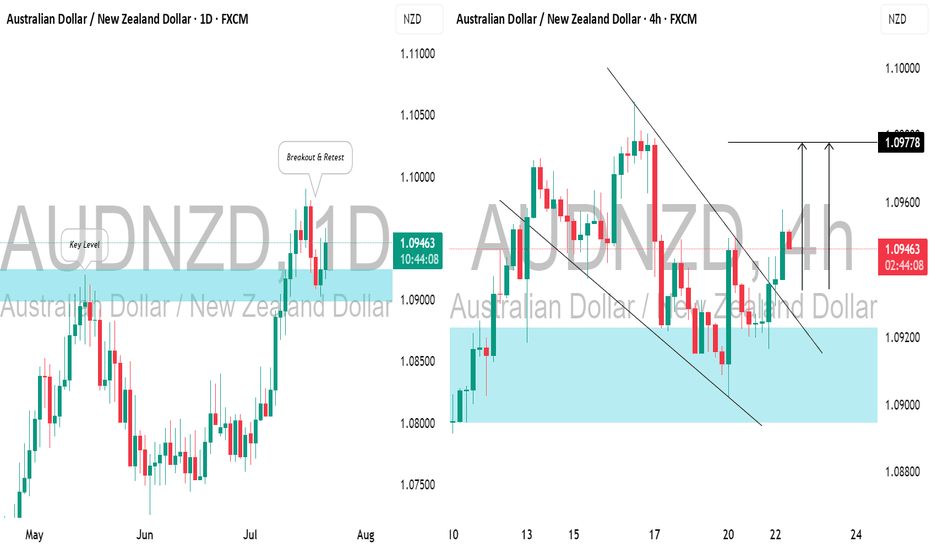

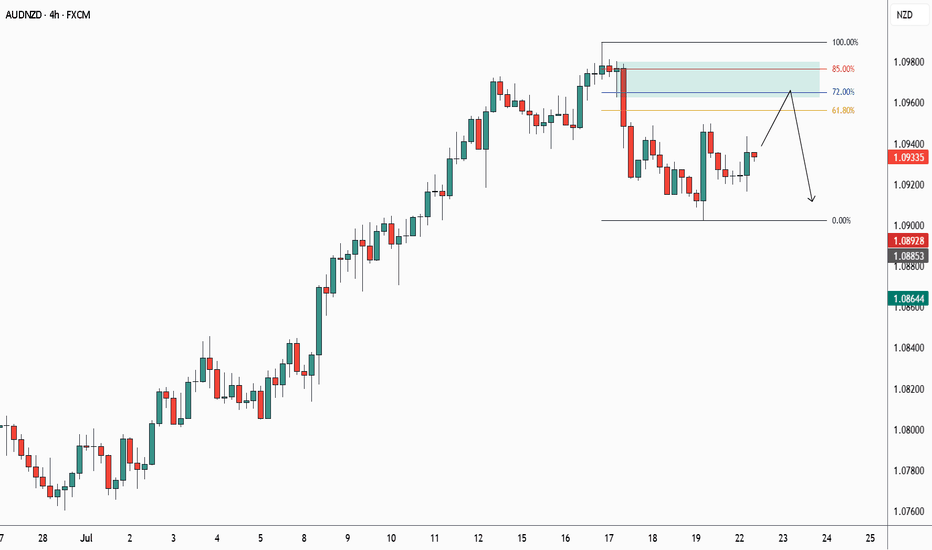

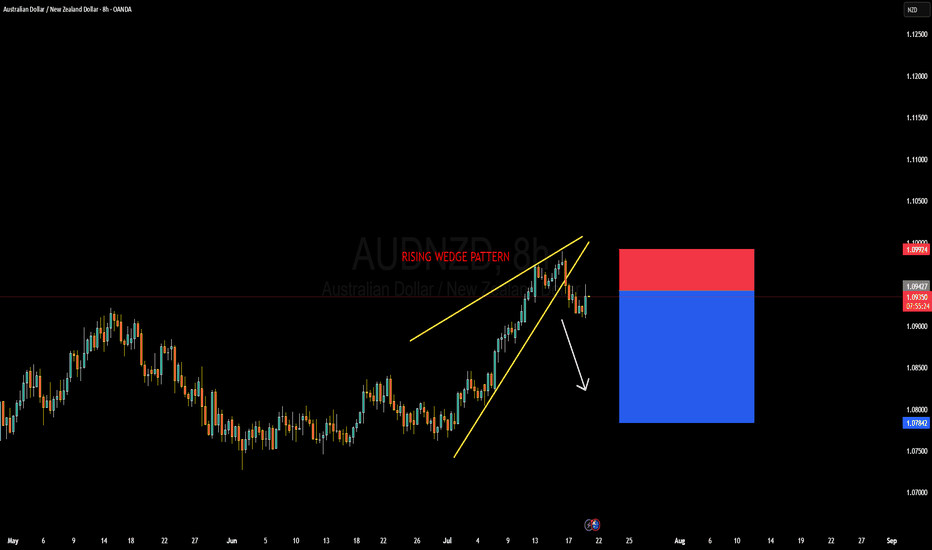

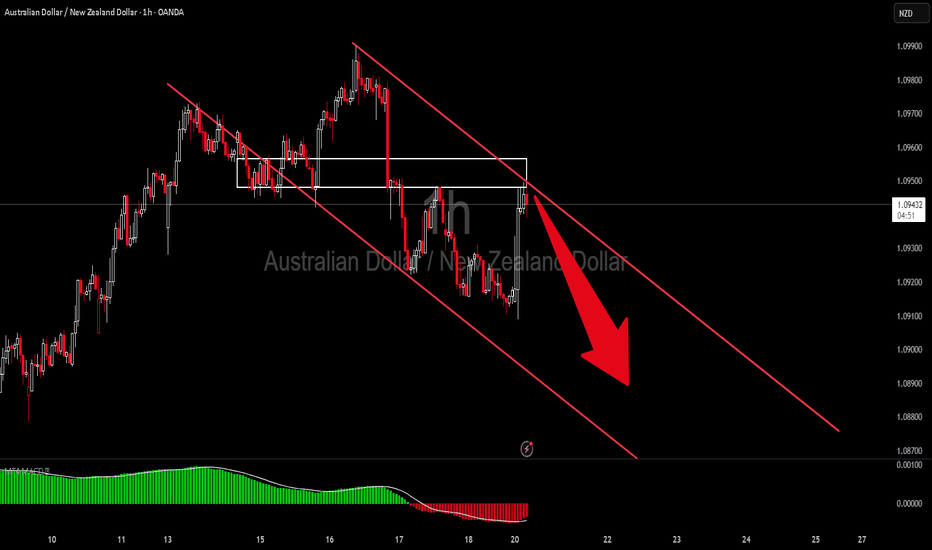

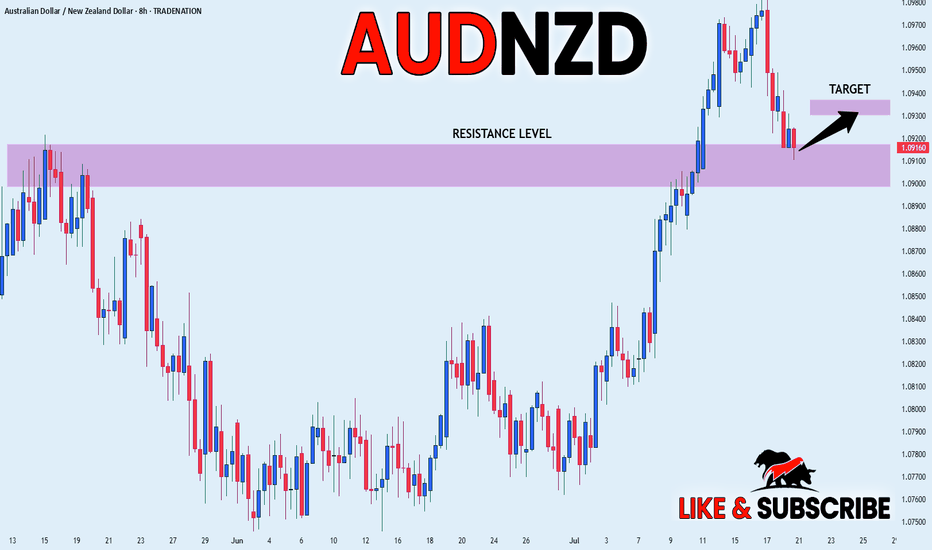

AUDNZD Forming Rising Wedge PatternAUDNZD has formed a textbook rising wedge pattern on the 8H chart and has now broken to the downside, signaling potential bearish continuation. This setup typically indicates a loss of momentum in the prevailing bullish trend, and with the clean structure break now confirmed, the bears seem ready to take control. I’ve already entered short positions from the top edge of the pattern and am currently floating in profit, anticipating further downside toward the 1.0780–1.0800 zone.

From a fundamental perspective, the Australian dollar has been relatively stable but lacks a strong bullish catalyst at this point. The Reserve Bank of Australia is holding a cautious tone amid mixed inflation signals, while New Zealand’s economy is showing signs of potential resilience. The RBNZ remains committed to tighter monetary conditions for longer as inflation continues to hover above their comfort zone, which provides some support to NZD in the near term.

Technically, the break of the lower wedge support is significant. Price failed to sustain higher highs near 1.1000 and quickly retraced, showing bearish rejection. With the RSI diverging and volume fading near the top of the wedge, this was a high-probability reversal zone. As long as price stays below 1.0950, the bias remains bearish, and further sell pressure is expected.

I'm targeting 1.0780 as the next key liquidity level. It aligns with previous structure support and provides a favorable risk-to-reward setup. This setup is a clear example of price-action-driven reversal trading, paired with macroeconomic alignment. I’ll continue to trail stops as price progresses, but so far, AUDNZD is playing out exactly as anticipated.

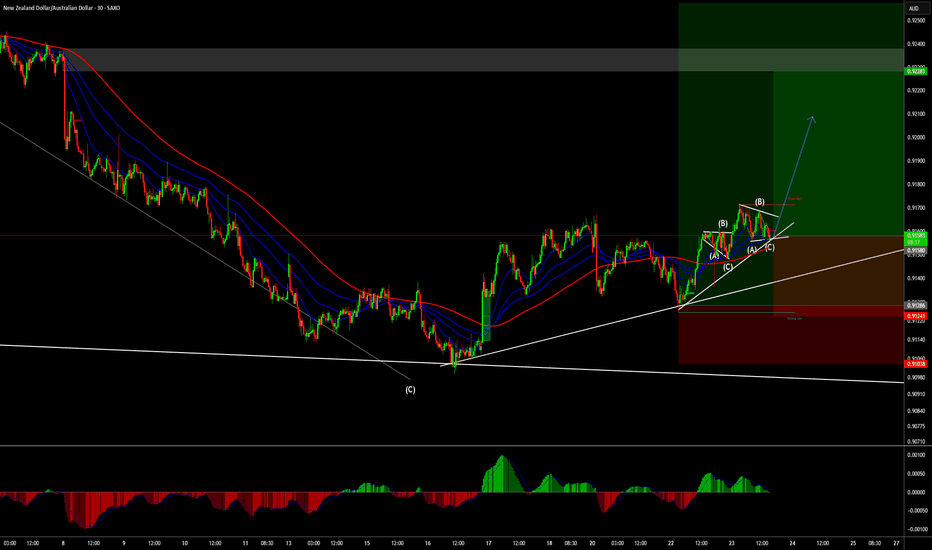

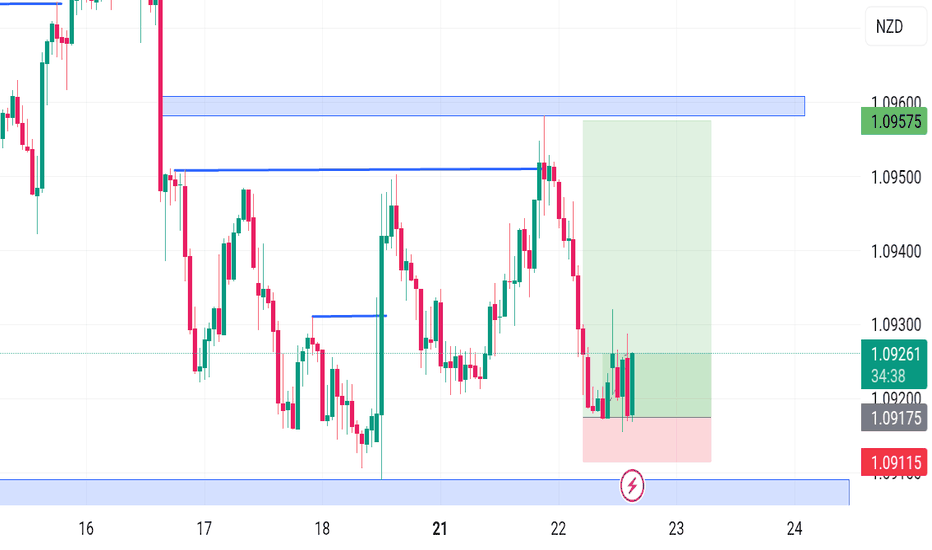

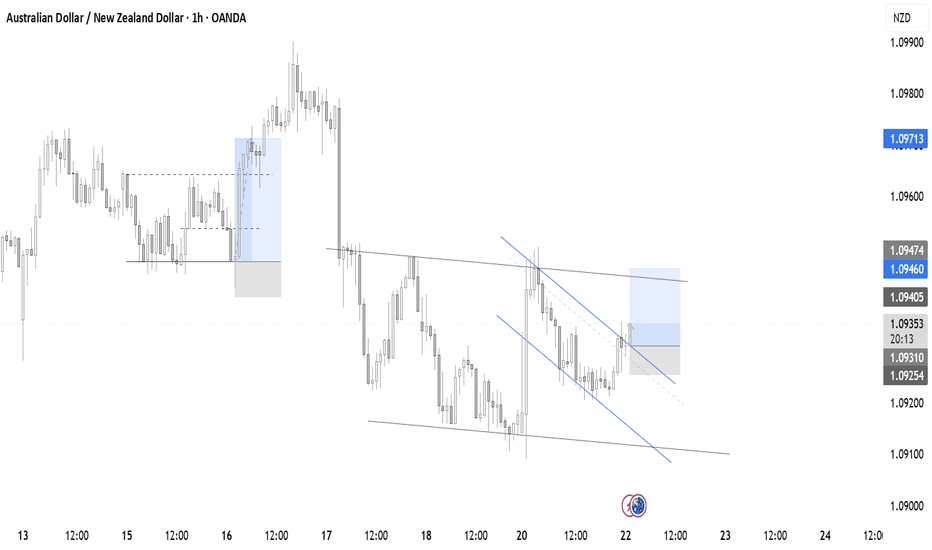

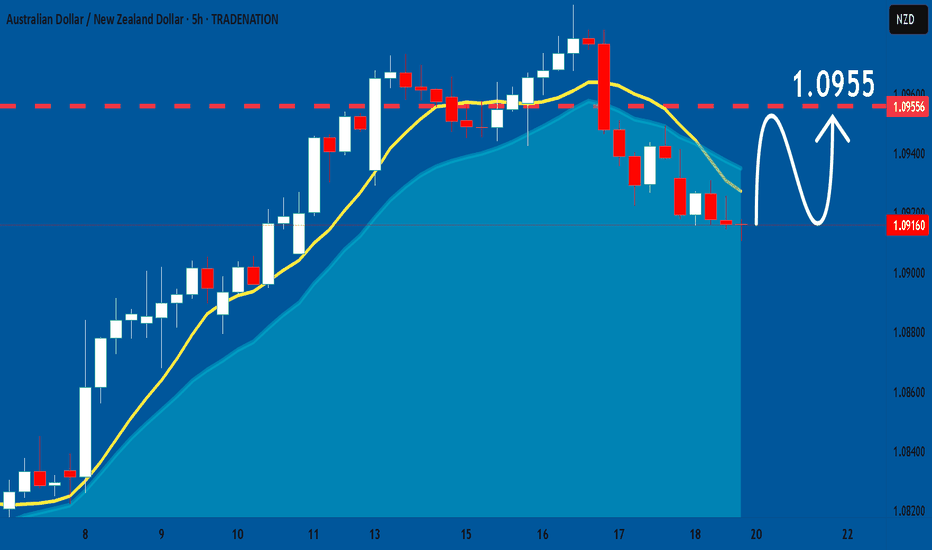

AUD/NZD – Falling Wedge Breakout with Bullish DivergenceAUD/NZD is currently forming a falling wedge pattern on the 1-hour timeframe, a structure typically associated with bullish reversals. Notably, bullish divergence on the RSI is developing while price continues to print lower lows, RSI is making higher lows, indicating weakening selling momentum.

Trade Setup:

Buy Stop Entry: 1.09309 (above recent Lower High — confirmation of breakout)

Stop Loss: 1.09094 (recent Lower Low )

Take Profit 1 : 1.09520

Take Profit 2 : 1.09740 (full pattern projection target)

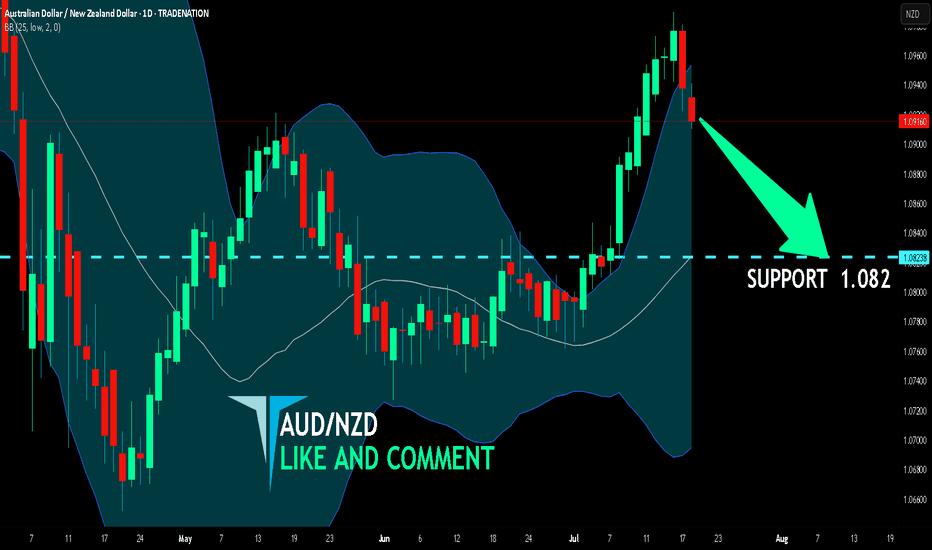

AUD/NZD SHORT FROM RESISTANCE

Hello, Friends!

The BB upper band is nearby so AUD/NZD is in the overbought territory. Thus, despite the uptrend on the 1W timeframe I think that we will see a bearish reaction from the resistance line above and a move down towards the target at around 1.082.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

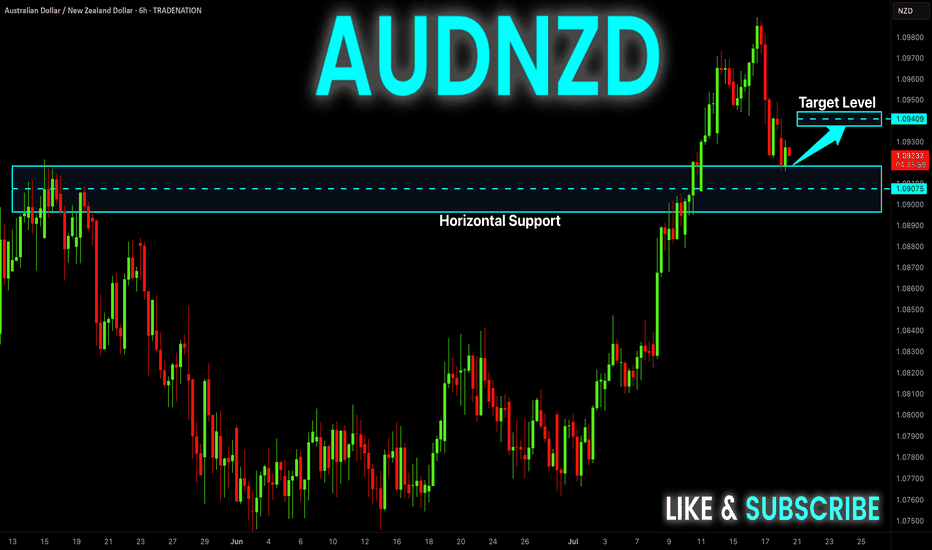

AUD_NZD GROWTH AHEAD|LONG|

✅AUD_NZD fell down sharply

But a strong support level was hit at 1.0910

Thus I am expecting a rebound

And a move up towards the target of 1.0930

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUDNZD: Growth & Bullish Forecast

The analysis of the AUDNZD chart clearly shows us that the pair is finally about to go up due to the rising pressure from the buyers.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

AUD-NZD Rebound Expected! Buy!

Hello,Traders!

AUD-NZD is making a retest

Of the horizontal support

Level of 1.0909 and as the

Pair is trading in an uptrend

We will be expecting a

Local bullish rebound

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Fakeout or Pullback?The only signal that makes me lean more toward a fakeout rather than a clean pullback is the distance between the 100 and 200 moving averages and the current price.

At the moment, price is struggling around the 50 MA, and there’s a clear gap between it and the longer-term averages.

We need to give the market some time and see which direction gains confirmation. Until then, we stay patient and watch for clearer signals.